Colorado Amendment of terms of Class B preferred stock

Description

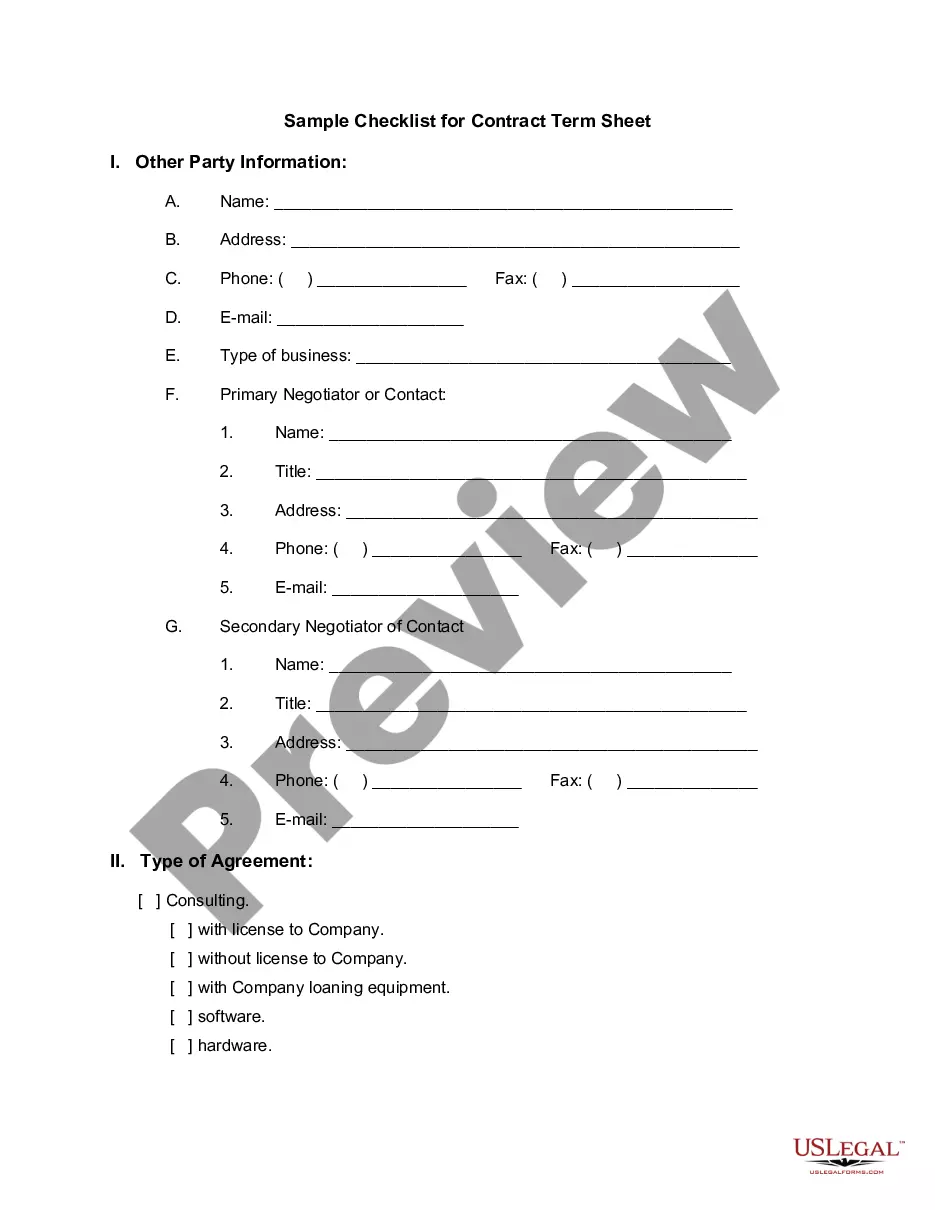

How to fill out Amendment Of Terms Of Class B Preferred Stock?

Finding the right authorized document design can be a have a problem. Naturally, there are tons of layouts accessible on the Internet, but how do you get the authorized form you require? Make use of the US Legal Forms internet site. The services delivers 1000s of layouts, like the Colorado Amendment of terms of Class B preferred stock, that can be used for business and private demands. All of the kinds are checked by specialists and satisfy federal and state specifications.

If you are presently signed up, log in in your bank account and then click the Obtain switch to have the Colorado Amendment of terms of Class B preferred stock. Make use of your bank account to appear through the authorized kinds you might have ordered formerly. Go to the My Forms tab of your bank account and have yet another copy of the document you require.

If you are a fresh consumer of US Legal Forms, allow me to share straightforward recommendations that you can comply with:

- Initially, ensure you have selected the right form for your personal metropolis/county. You are able to look over the form while using Review switch and browse the form explanation to ensure it is the right one for you.

- In the event the form will not satisfy your expectations, utilize the Seach discipline to obtain the correct form.

- Once you are certain that the form would work, select the Buy now switch to have the form.

- Pick the prices program you desire and enter the essential information and facts. Design your bank account and pay money for the order making use of your PayPal bank account or charge card.

- Select the data file format and acquire the authorized document design in your system.

- Full, revise and print and sign the attained Colorado Amendment of terms of Class B preferred stock.

US Legal Forms will be the greatest library of authorized kinds for which you can discover a variety of document layouts. Make use of the company to acquire expertly-made paperwork that comply with express specifications.

Form popularity

FAQ

When a private company acquires a public company, the stock of the publicly-traded target company tends to rise due to the premium paid on the acquisition. After the deal closure, shareholders receive cash for their existing shares.

Preferred stock is also like long-term debt in that it does not give the holder voting rights in the firm. Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments. Failure to make payments does not set off corporate bankruptcy.

Secured position in case of the company's liquidation: Investors with preferred stock are in a more secure position relative to common shareholders in the event of liquidation, because they have a priority in claiming the company's assets.

Preferred shares typically get converted to common shares when a start-up has an IPO or when another company acquires the start-up. So there should be enough common shares available to allow the preferred shareholders to convert their shares.

Typically, company founders and employees receive common stock, while venture capital investors receive preferred shares, often with a liquidation preference. The preferred shares are typically converted to common shares with the completion of an initial public offering or acquisition.

An investor owning a callable preferred stock has the benefits of a steady return. However, if the preferred issue is called by the issuer, the investor will most likely be faced with the prospect of reinvesting the proceeds at a lower dividend or interest rate.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options. The cost of preferred stock is also used to calculate the Weighted Average Cost of Capital.

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.