Colorado Sales Order Form

Description

How to fill out Sales Order Form?

If you desire to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Make use of the site’s user-friendly and convenient search to find the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to secure the Colorado Sales Order Form in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you have saved in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Colorado Sales Order Form with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to acquire the Colorado Sales Order Form.

- You may also retrieve documents you previously stored from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific area/region.

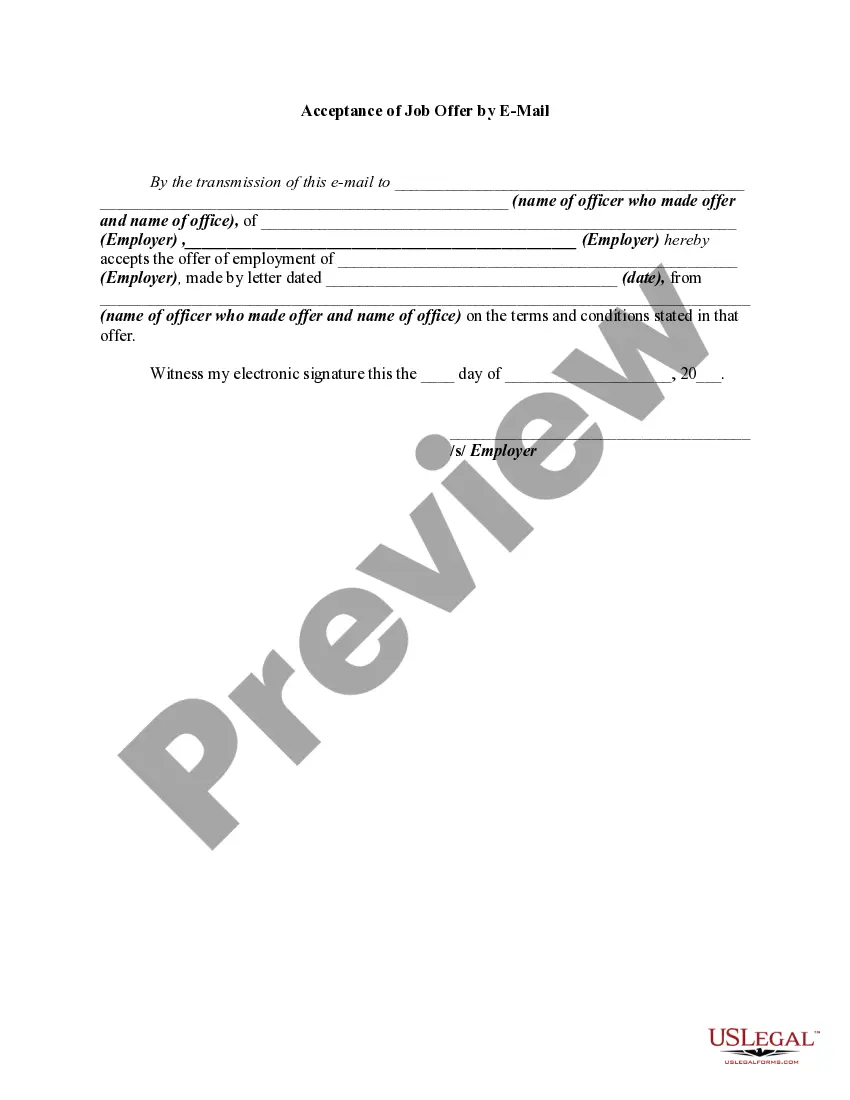

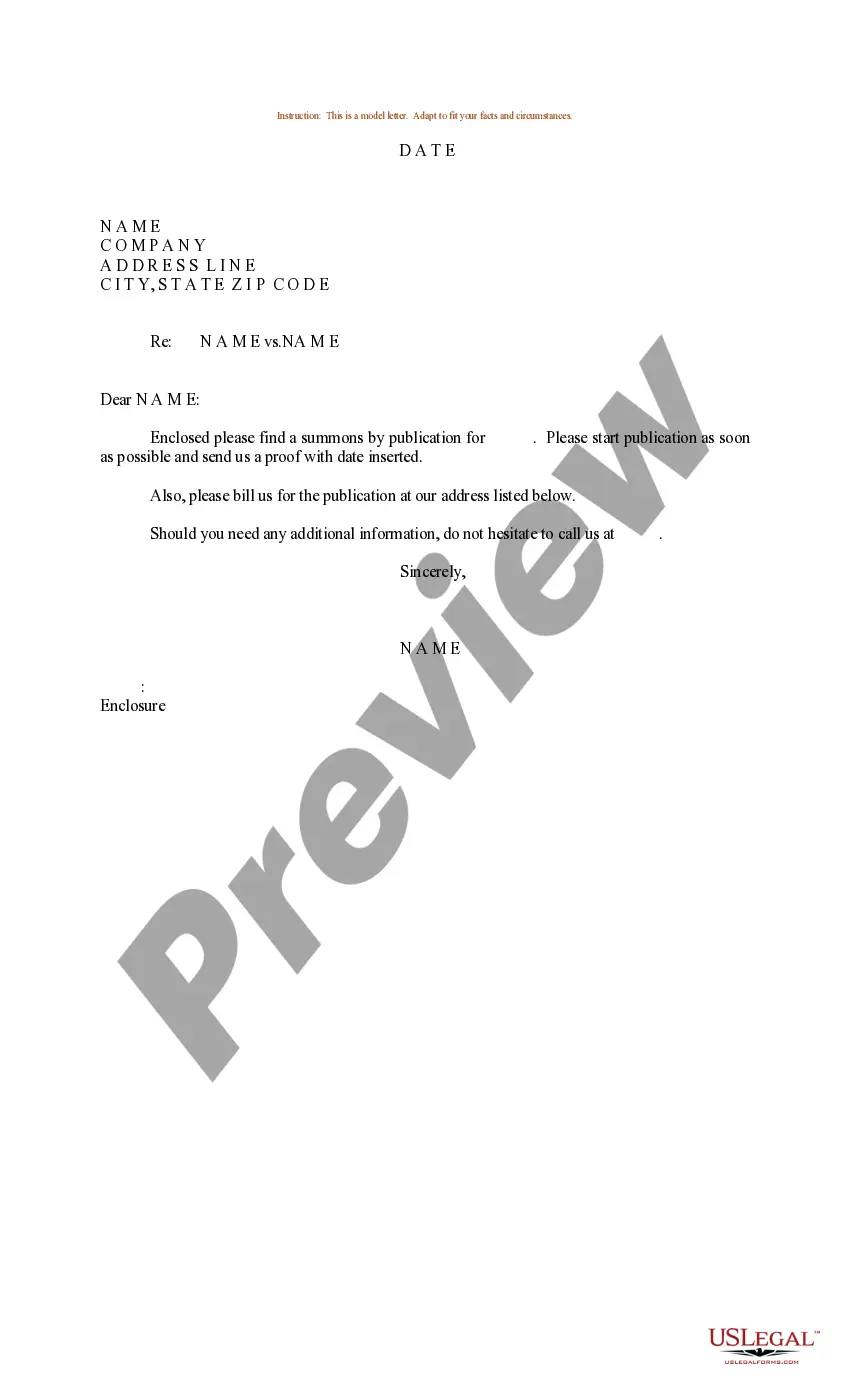

- Step 2. Use the Preview option to examine the contents of the form. Remember to review the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Colorado Sales Order Form.

Form popularity

FAQ

Your Colorado Sales Tax Filing Requirements Colorado recommends that all retailers use the online Colorado Revenue Online web portal to make their sales tax payments. Using this online portal, you can file Form DR 0100 - the Colorado Retail Sales Tax Return.

No Login RequiredVerify a Colorado sales tax license (Instructions below)Check county and city sales tax rates (Instructions below)Verify the sales tax rates at a specific location(s)Obtain a rate chart for a specific tax percentage.Find tax rates by address.Make a payment.More items...

What Is Colorado's New Online Sales Tax Rule, and When Does It Take Effect? Beginning December 1, 2018, the Colorado Department of Revenue will require all businesses who sell goods to customers in their state to assess sales tax based on the customer's address, not the location of the business.

If you are an online retailer who ONLY sells on approved marketplaces (such as Amazon, eBay, etc), Colorado sales tax will be remitted by the marketplace and you do not need to get a sales tax permit based on the physical location of your inventory.

If you sell, rent or lease tangible personal property in Colorado, you must obtain a sales tax license. The type of license you need and the amount of tax you are required to collect depends upon who you are selling to and where and how you are doing business.

Go to Colorado.gov/RevenueOnline. In the Sales and Use Tax menu panel, click on File a Consumer Use Tax Return Using the drop-down, indicate the time frame when the last purchase being filed for occurred.

How to fill out the Colorado Sales Tax Exemption CertificateStep 1 Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563.Step 2 Identify the business name and business address of the seller.Step 3 Identify the name and business address of the buyer.More items...?19-Apr-2022

How to File a Monthly Sales Tax Return?The first is to visit the official website of FBR which is fbr.gov.pk.The second step is to put the user id and password of a company.After login, the windows open which shows the profile of a company in which their previously return files are visible.More items...?

You may electronically file your return by either of the following methods:My Tax Account. The department's online filing and payment system. You will need a username and password. See: Using My Tax Account.Telefile. The department's telephone filing and payment system. Call (608) 261-5340 or (414) 227-3895.