The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

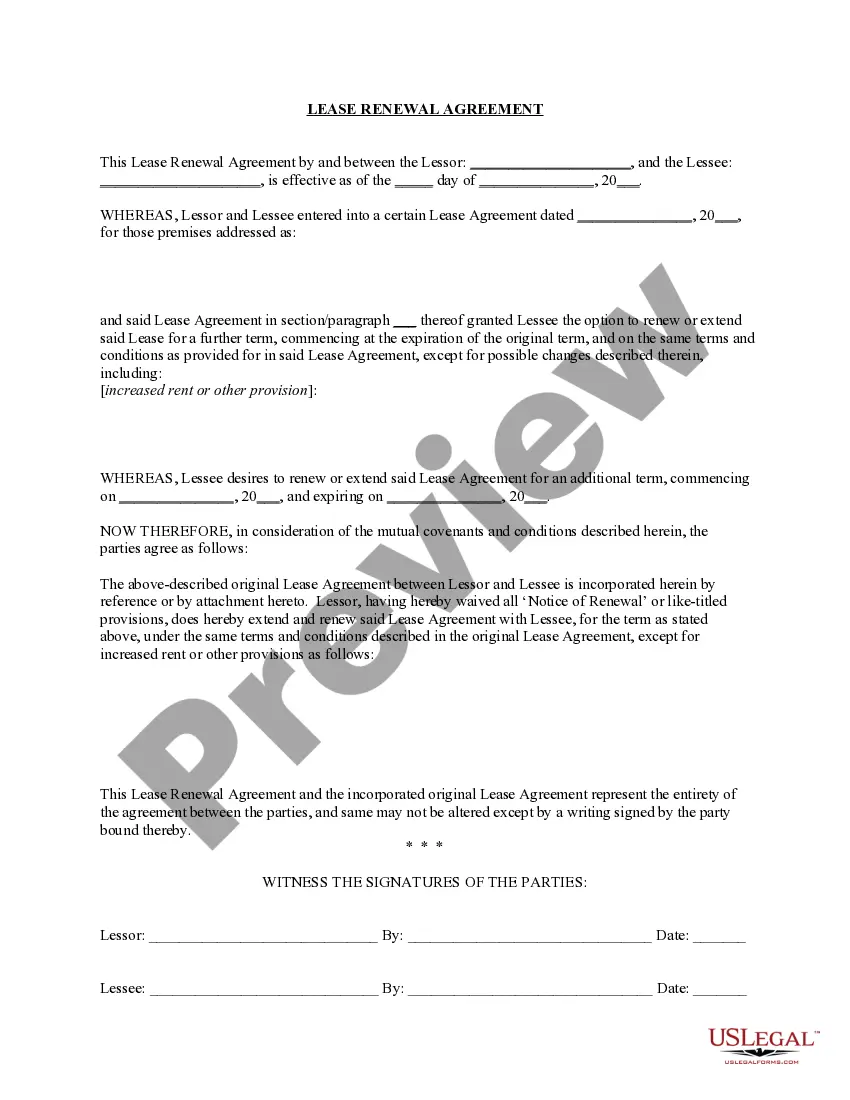

Colorado Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

You are able to devote several hours on the Internet searching for the lawful document design which fits the state and federal specifications you want. US Legal Forms supplies a large number of lawful kinds that happen to be examined by specialists. You can actually obtain or print out the Colorado Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from your service.

If you have a US Legal Forms account, you may log in and then click the Obtain key. Next, you may total, change, print out, or indication the Colorado Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Each lawful document design you acquire is yours eternally. To acquire another version for any bought type, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms website the very first time, keep to the easy guidelines below:

- Initially, be sure that you have selected the proper document design for your county/city that you pick. See the type explanation to make sure you have chosen the appropriate type. If readily available, make use of the Preview key to look from the document design also.

- If you would like locate another variation in the type, make use of the Lookup area to discover the design that meets your needs and specifications.

- When you have discovered the design you desire, click on Acquire now to carry on.

- Pick the pricing plan you desire, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal account to purchase the lawful type.

- Pick the structure in the document and obtain it in your gadget.

- Make changes in your document if required. You are able to total, change and indication and print out Colorado Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Obtain and print out a large number of document layouts making use of the US Legal Forms site, which offers the most important selection of lawful kinds. Use specialist and status-certain layouts to tackle your company or specific demands.

Form popularity

FAQ

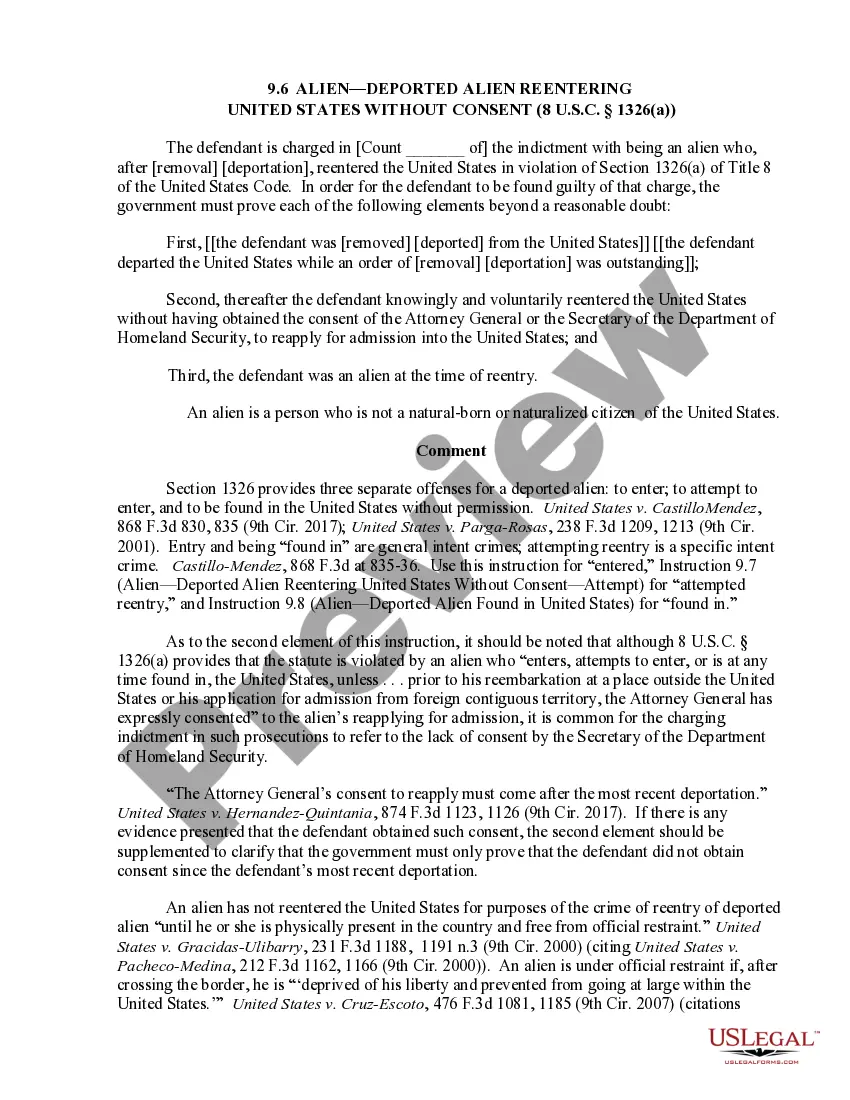

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit reporting. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number.

Under Colorado law, a consumer reporting agency shall, upon written or verbal request and proper identification of any consumer, clearly, accurately, and in a manner that is understandable to the consumer, disclose to the consumer, in writing, all information in its files at the time of the request pertaining to the ...

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer.

Any person who obtains a consumer report from a consumer reporting agency under false pretenses or knowingly without a permissible purpose shall be liable to the consumer reporting agency for actual damages sustained by the consumer reporting agency or $1,000, whichever is greater.

Section 628 - Properly dispose of consumer information to protect the confidentiality of the information -- go to Section 628. Section 629 - Prevents consumer reporting agencies from circumventing the law -- Section 629.

Section 603(d) defines consumer report to mean ''any written, oral, or other commu- nication of any information by a consumer reporting agency bearing on a consumer's credit worthiness, credit standing, credit ca- pacity, character, general reputation, per- sonal characteristics, or mode of living which is used or ...