Colorado Owner Financing Contract for Car

Description

How to fill out Owner Financing Contract For Car?

Are you situated in an environment where you need documentation for potential business or personal reasons nearly every time.

There are numerous legitimate document templates accessible online, but finding versions you can rely on isn't simple.

US Legal Forms offers thousands of form templates, such as the Colorado Owner Financing Agreement for Vehicle, crafted to comply with state and federal regulations.

When you find the right document, just click Purchase now.

Select the payment plan you desire, fill in the required details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Colorado Owner Financing Agreement for Vehicle template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Identify the document you need and ensure it is for your specific city/state.

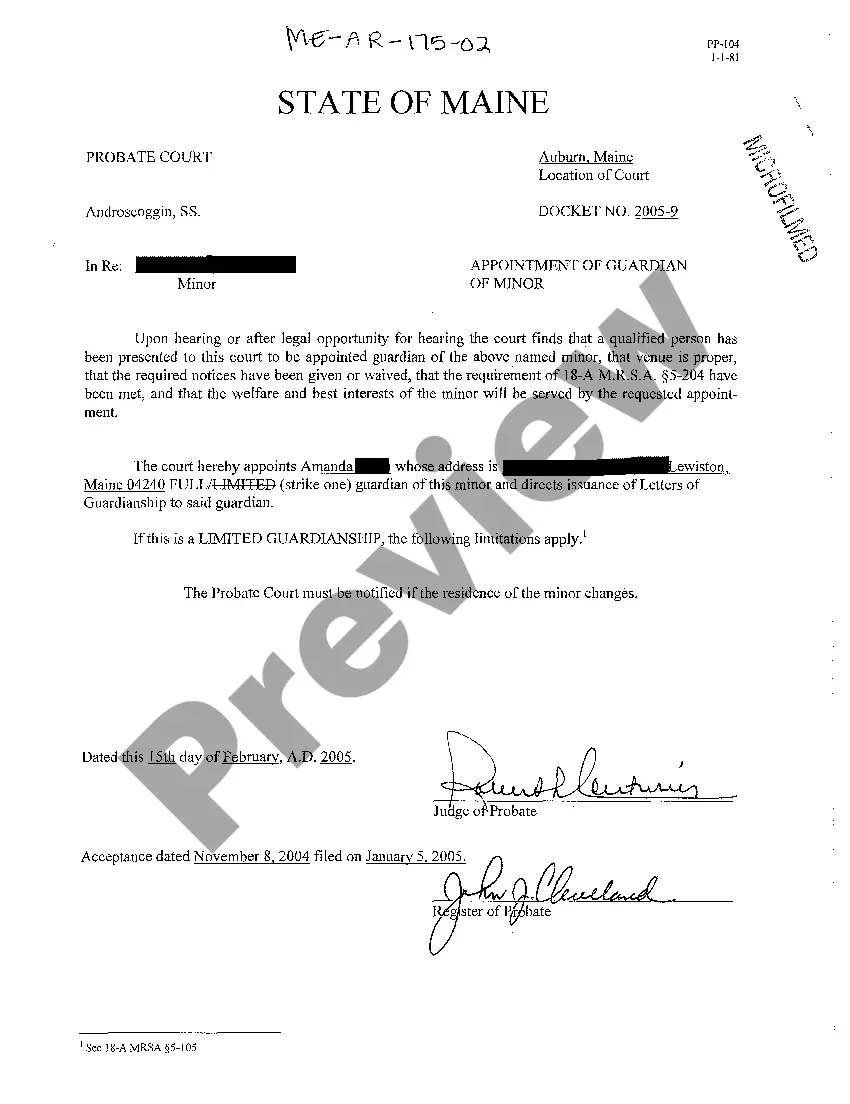

- Utilize the Preview button to view the form.

- Review the information to confirm you have selected the correct document.

- In case the document isn't what you require, make use of the Search box to find the form that fits your needs and specifications.

Form popularity

FAQ

To protect yourself in a seller financing situation, ensure that your contract is detailed, covering payment methods, default conditions, and repossession rights. Using a Colorado Owner Financing Contract for Car template from US Legal Forms can provide essential safeguards. Additionally, performing due diligence on your buyer’s financial situation can help mitigate risks.

In an owner financing scenario, the seller typically holds the deed until the buyer pays off the agreed-upon amount in full. This arrangement is crucial in a Colorado Owner Financing Contract for Car because it provides the seller with security while allowing the buyer to use and enjoy the vehicle. It's important for both parties to clearly define this structure in their agreement.

Several issues can arise with seller financing, including potential buyer defaults, disagreements over contract terms, and falling property values. In a Colorado Owner Financing Contract for Car, it’s essential to have a clear agreement and ongoing communication between both parties. Taking the time to draft comprehensive contracts can help alleviate many common pitfalls.

If a buyer defaults on seller financing, the seller retains the right to repossess the property as outlined in the Colorado Owner Financing Contract for Car. This process typically involves legal action, which can be both time-consuming and costly. To minimize risks, sellers should conduct thorough screenings of potential buyers and consider including protective clauses in their contracts.

Yes, seller financing is legal in Colorado. Buyers and sellers can agree to terms directly, which can simplify transactions, especially in a Colorado Owner Financing Contract for Car. However, both parties should ensure that the terms comply with state laws and regulations to avoid legal issues down the line.

To set up an owner financing contract, start by gathering all necessary information about the buyer and seller, as well as the car in question. Clearly outline the payment terms and responsibilities in a written document. Finally, consider using a Colorado Owner Financing Contract for Car from US Legal Forms, which provides a reliable framework to ensure all legal requirements are satisfied.

To obtain financing for a car, consider a Colorado Owner Financing Contract for Car. Begin by assessing your budget and your credit situation to understand your financial capacity. Next, research different owner financing options, which typically offer more flexibility than traditional loans. After finding a suitable option, review the terms carefully and ensure you understand your repayment obligations.

Individuals may choose owner financing to facilitate a sale that may be challenging through traditional methods. It allows buyers with limited credit history or funds to acquire a vehicle while offering sellers a steady income stream. Using a Colorado Owner Financing Contract for Car, both parties can create a beneficial arrangement tailored to their needs.

The down payment for owner financing can vary significantly based on the sale amount and seller preferences, typically ranging from 10% to 30%. A larger down payment may strengthen the buyer's position and decrease the financed amount. When drafting a Colorado Owner Financing Contract for Car, it’s beneficial to agree upon a down payment that reflects both the buyer's capabilities and the seller's expectations.

An owner financing offer might involve a car priced at $15,000, with the seller proposing a $3,000 down payment and a repayment plan for the remaining $12,000 spread across 24 months. Additionally, the seller might briefly outline the interest rate and monthly payments in the offer. Such details can easily be included in a Colorado Owner Financing Contract for Car to formalize the agreement.