Colorado Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

If you desire to be thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest assortment of valid forms that are accessible online.

Employ the site`s straightforward and user-friendly search to locate the documents you require.

Diverse templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have identified the necessary form, click the Buy now button. Select your preferred pricing plan and provide your details to register for the account.

Step 5. Complete the payment transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Colorado Owner Financing Agreement for Home in just a few clicks.

- If you are already a US Legal Forms subscriber, sign in to your account and click the Download button to access the Colorado Owner Financing Agreement for Home.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If this is your first experience with US Legal Forms, adhere to the following steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

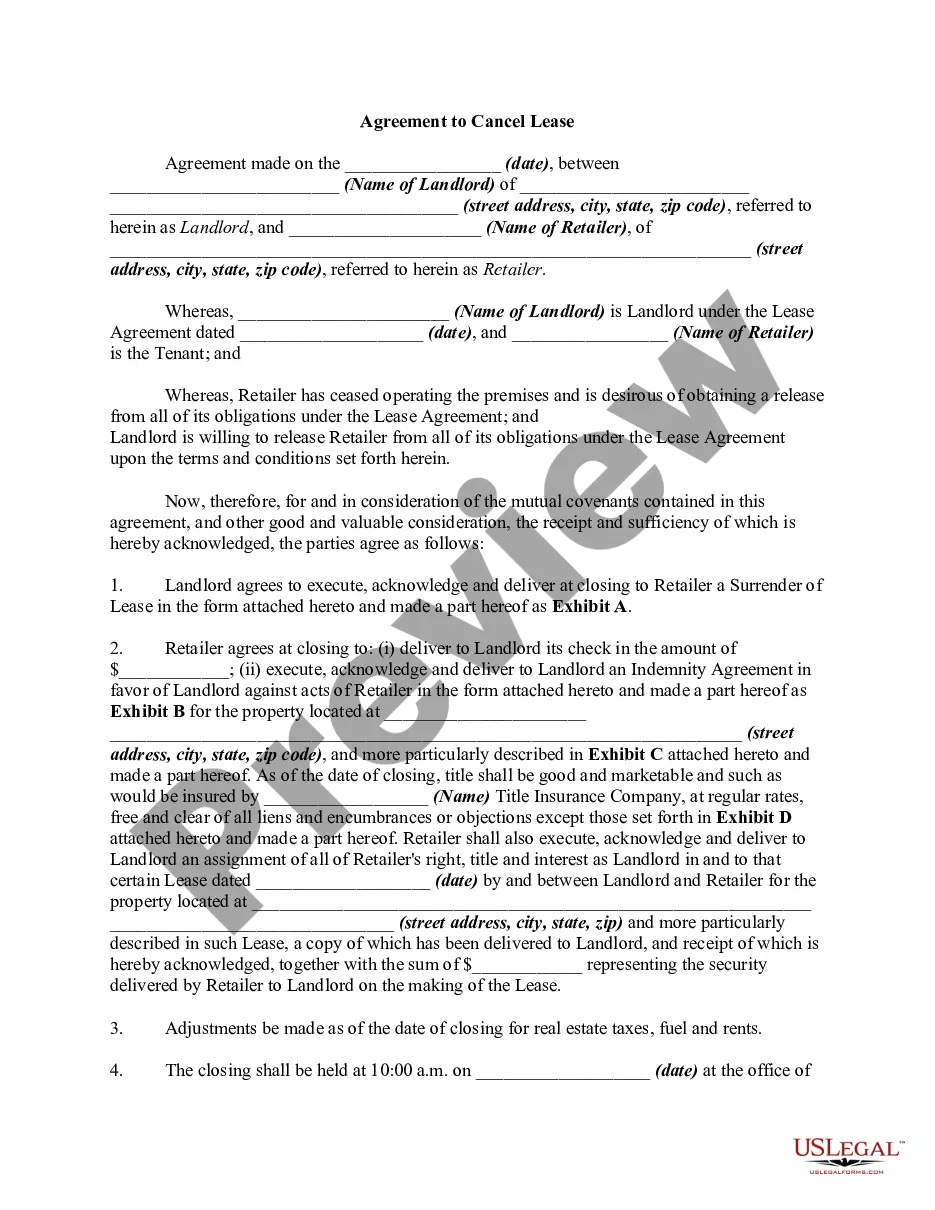

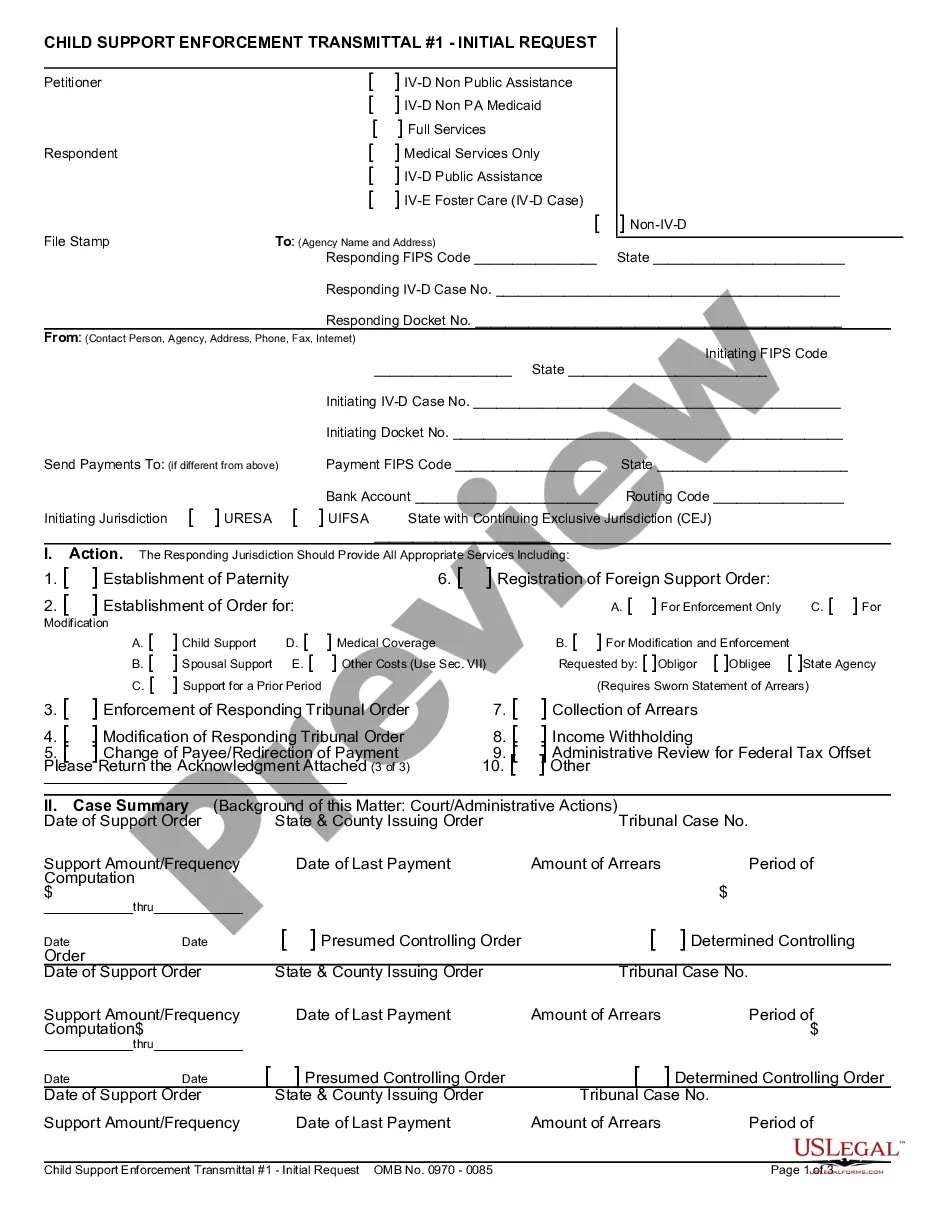

- Step 2. Use the Review feature to inspect the details of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the page to find alternative types of your valid form format.

Form popularity

FAQ

Setting up an owner financing contract involves drafting a clear agreement outlining the terms, payment schedule, and other essential details. Using platforms like USLegalForms can simplify this process, providing templates tailored for a Colorado Owner Financing Contract for Home. Make sure to consult with legal professionals to ensure compliance with state laws.

During seller financing, the seller retains ownership of the deed until all terms of the agreement are met. This means the buyer occupies the home under the terms of the Colorado Owner Financing Contract for Home but does not hold the title. Once the contract terms are satisfied, ownership is officially transferred to the buyer.

In a typical owner financing scenario, the seller retains the deed until the buyer fulfills the payment obligations outlined in the Colorado Owner Financing Contract for Home. This method protects the seller while providing the buyer access to the property. Once the buyer completes their payments, the seller transfers the deed.

When taking an owner's draw, you do not report it as income since it’s viewed as a withdrawal of your own equity. However, maintaining good records is crucial, particularly with a Colorado Owner Financing Contract for Home. Understanding the nuances between draws and salary can help you optimize your tax situation.

You will report owner financing income on your federal tax return, typically using Form 1040 and Schedule B. Ensure you also keep detailed records of the financing arrangement included in your Colorado Owner Financing Contract for Home. This helps streamline the reporting process and supports any deductions you might claim.

The IRS has specific rules for reporting and taxing income received from owner financing. According to their guidelines, interest payments must be reported, and any associated expenses can be deducted. Understanding these rules will help you avoid unexpected tax liabilities.

You report owner financing income on your tax return as ordinary income. This includes any interest collected as part of your Colorado Owner Financing Contract for Home. Be sure to complete Schedule C or Schedule E, depending on whether you are operating a business or renting property.

In a Colorado Owner Financing Contract for Home, sellers must report the interest received as income on Schedule B of Form 1040. This form tracks interest and dividends for tax purposes. It’s essential to keep accurate records of transactions to ensure compliance with IRS regulations.

Yes, seller financing is legal in Colorado, provided that all parties adhere to local laws and regulations. It is crucial to ensure that the financing terms are clearly defined and documented. A well-crafted Colorado Owner Financing Contract for Home can help make the process smooth and compliant.

Typical terms for owner financing might involve a 10-20% down payment, a fixed interest rate, and a repayment period ranging from five to 30 years. These terms can vary widely based on the market and individual agreements. Ensure your Colorado Owner Financing Contract for Home captures these specifics to avoid future disputes.