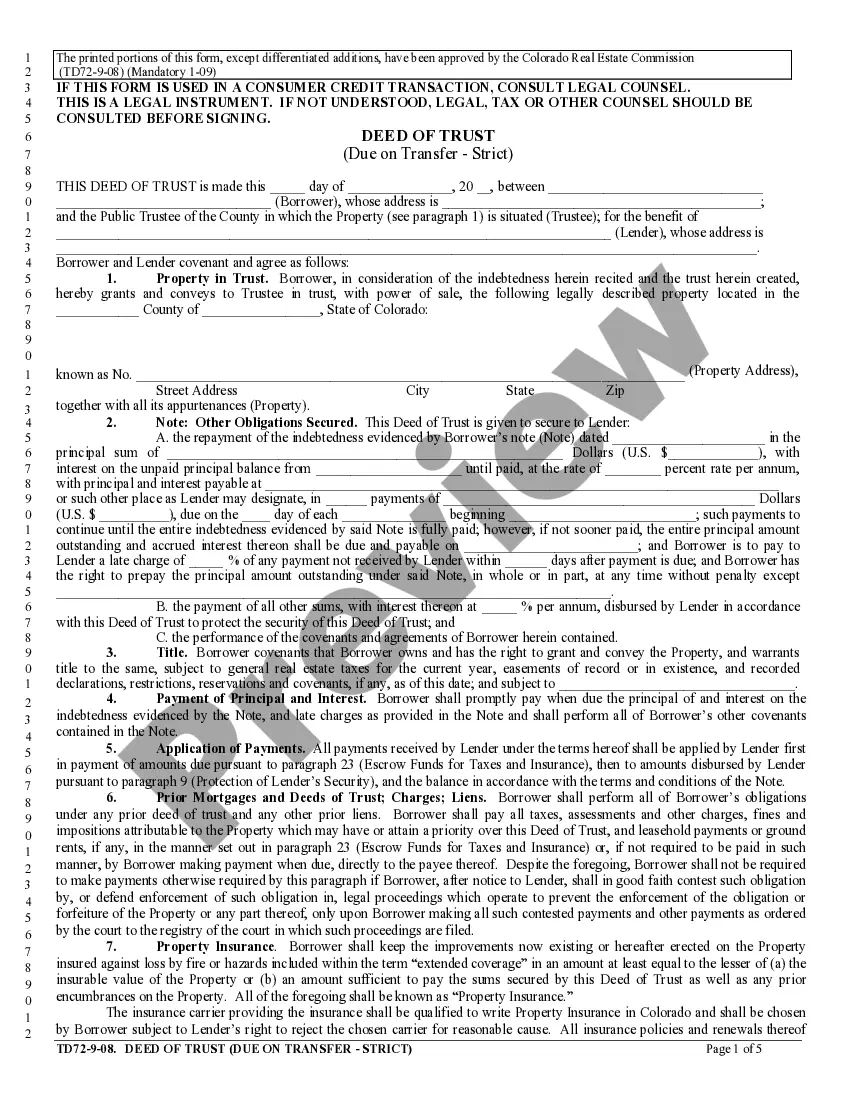

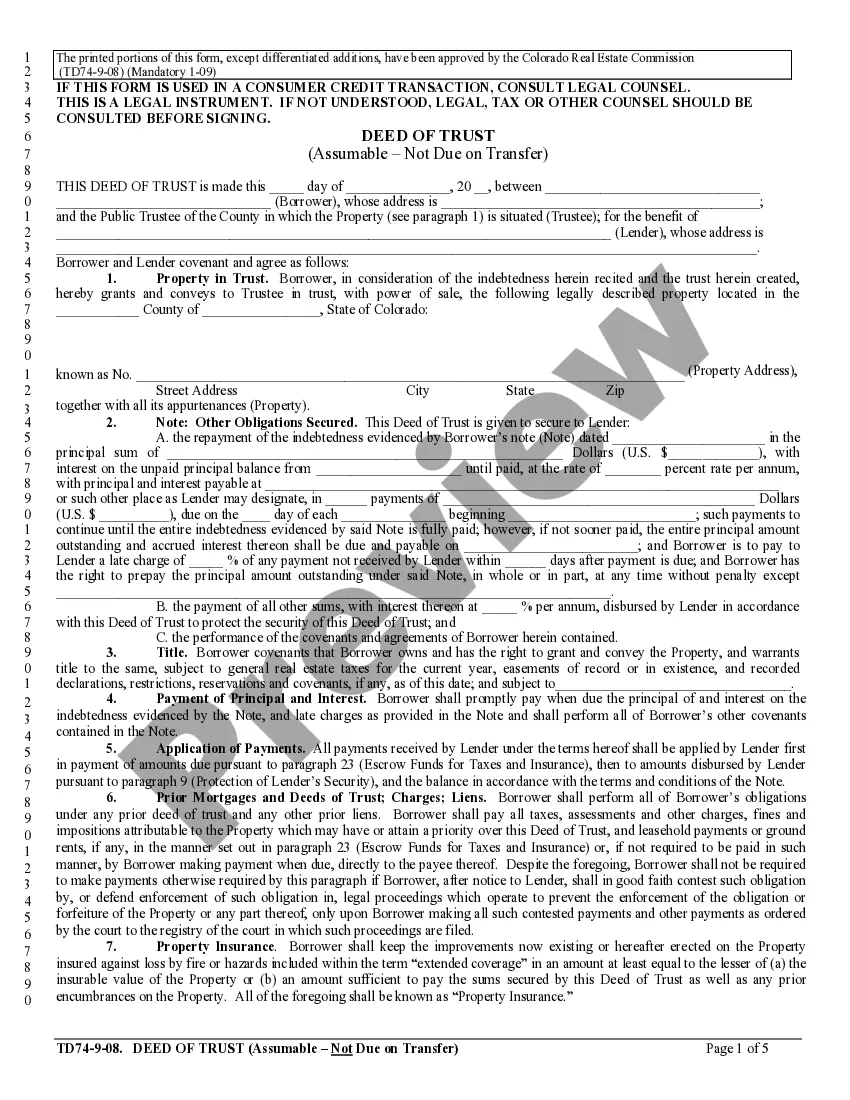

Deed of Trust - Assumable - Not Due on Sale: This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

Colorado Deed of Trust - Assumable - Not Due on Sale

Description

How to fill out Colorado Deed Of Trust - Assumable - Not Due On Sale?

The larger the quantity of documents you need to produce - the more apprehensive you become.

You can discover a vast array of Colorado Deed of Trust - Assumable - Not Due on Sale samples online, yet you may be unsure which ones are reliable.

Eliminate the complications and simplify obtaining templates by utilizing US Legal Forms. Receive expertly crafted documents designed to meet state specifications.

Enter the required information to create your profile and process your order using PayPal or a credit card. Choose a convenient document format and obtain your sample. Access all templates acquired in the My documents section. Simply navigate there to complete a new version of your Colorado Deed of Trust - Assumable - Not Due on Sale. Even when working with expertly crafted templates, it remains crucial to consider consulting a local attorney to verify that your form is accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will see the Download button on the page for the Colorado Deed of Trust - Assumable - Not Due on Sale.

- If you haven't utilized our service previously, complete the registration process by following these steps.

- Ensure that the Colorado Deed of Trust - Assumable - Not Due on Sale is applicable in your residing state.

- Verify your selection by reviewing the description or employing the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration procedure and select a pricing plan that suits your preferences.

Form popularity

FAQ

Yes, you can modify a deed of trust, but certain conditions may apply. It is essential to review the terms of your existing Colorado Deed of Trust - Assumable - Not Due on Sale to understand the modification process. Generally, both the lender and borrower must agree to the changes, which should be documented formally. If you seek assistance throughout this process, US Legal Forms offers tools and resources to help you navigate modifications effectively.

One primary disadvantage of a Colorado Deed of Trust - Assumable - Not Due on Sale is the potential for foreclosure. If the borrower defaults, the lender can initiate foreclosure without going through court, which can lead to a quicker loss of property. Additionally, the terms tied to these deeds can limit refinancing options and impose restrictions on the seller's ability to transfer the property. As you consider the implications, using a platform like UsLegalForms can help you navigate these concerns effectively.

A land trust generally does not trigger the due-on-sale clause in a Colorado Deed of Trust - Assumable - Not Due on Sale. This means that when you transfer the property into a land trust, you typically retain the beneficial interest, which allows your mortgage to remain in place without triggering the clause. However, it's essential to review your specific trust agreement and consult with a legal expert to ensure compliance. Tools like USLegalForms can provide helpful resources for understanding your options.

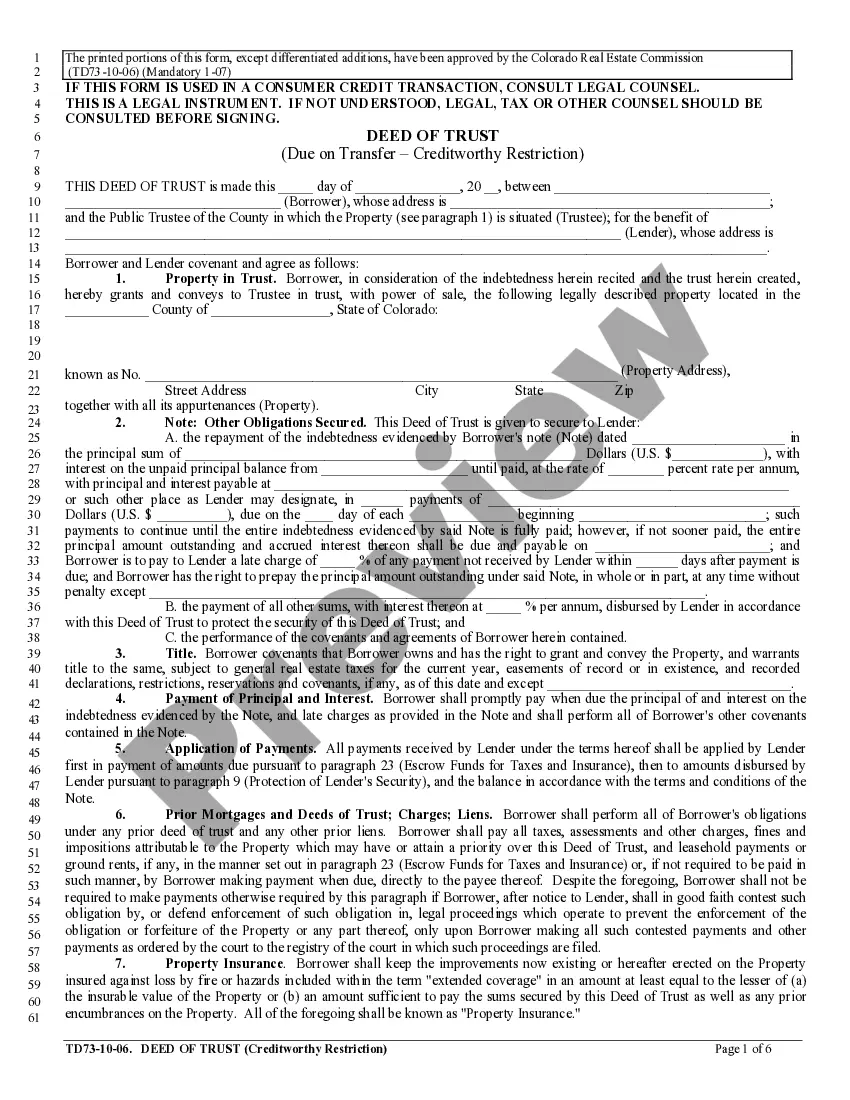

In Colorado, a deed of trust must include specific elements to be valid, such as the names of the parties involved, a legal description of the property, and the signature of the borrower. Additionally, it is crucial to state whether the deed of trust is assumable or has a due on sale clause. Having a Colorado Deed of Trust - Assumable - Not Due on Sale can simplify the transfer process. Utilizing US Legal Forms can ensure you meet all legal requirements when drafting your deed.

Yes, you can sell a house with a deed of trust. However, it is important to consider the specific terms of the deed of trust, especially if it includes a due on sale clause. If the deed is assumable, the buyer may take over the existing mortgage, which can make the sale process smoother. Using a platform like US Legal Forms can help you understand the steps involved in selling a home encumbered by a Colorado Deed of Trust - Assumable - Not Due on Sale.

What Is a Due-on-Sale Clause? A due-on-sale clause is a provision in a mortgage contract that requires the mortgage to be repaid in full upon a sale or conveyance of partial or full interest in the property that secures the mortgage. This provision as also sometimes referred to as an acceleration clause.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A power of sale provision is a clause in the deed of trust or mortgage in which the borrower pre-authorizes the sale of property by way of a nonjudicial foreclosure to pay off the balance of the loan in the event of a default. With a power of sale foreclosure, the lender can foreclose without court oversight.

There are some types of mortgage loans that do not have a due-on-sale clause. Government-backed loans, like FHA loans, VA loans, and USDA loans, are notable exceptions. These are all assumable mortgages. Assumable conventional mortgages, which aren't backed by the federal government, rarely exist anymore.