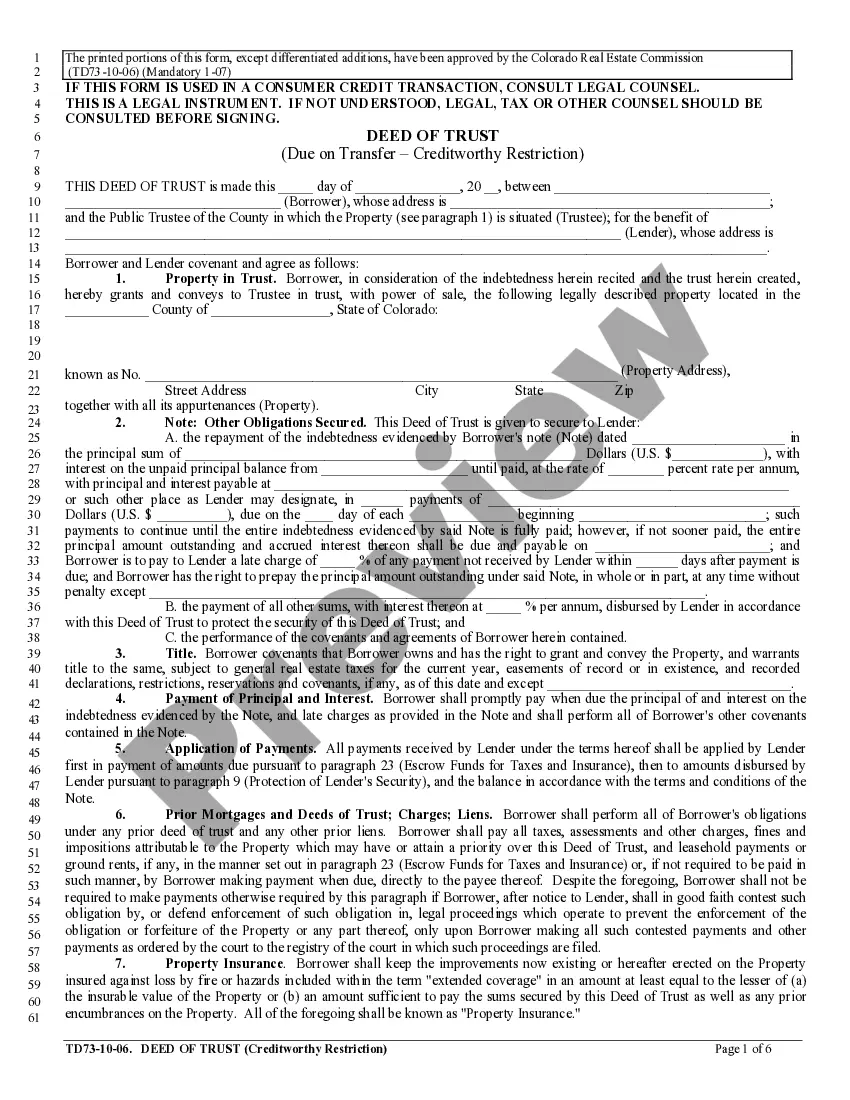

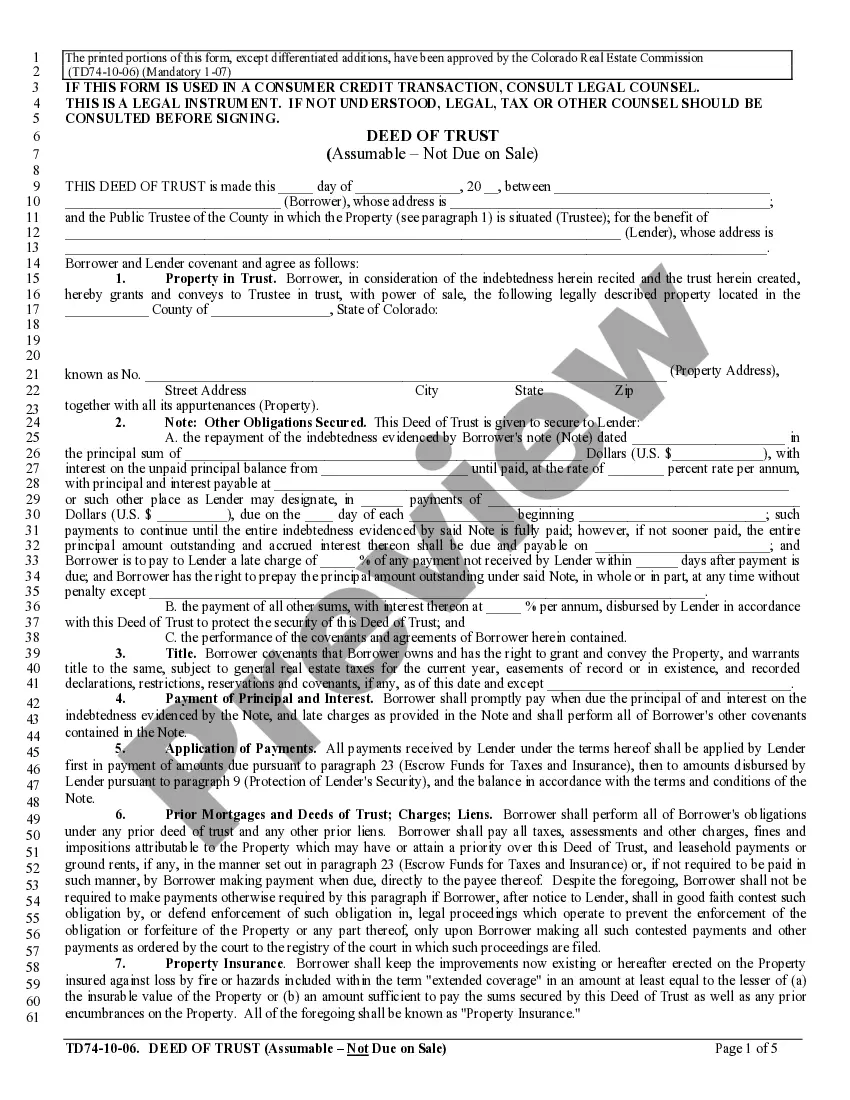

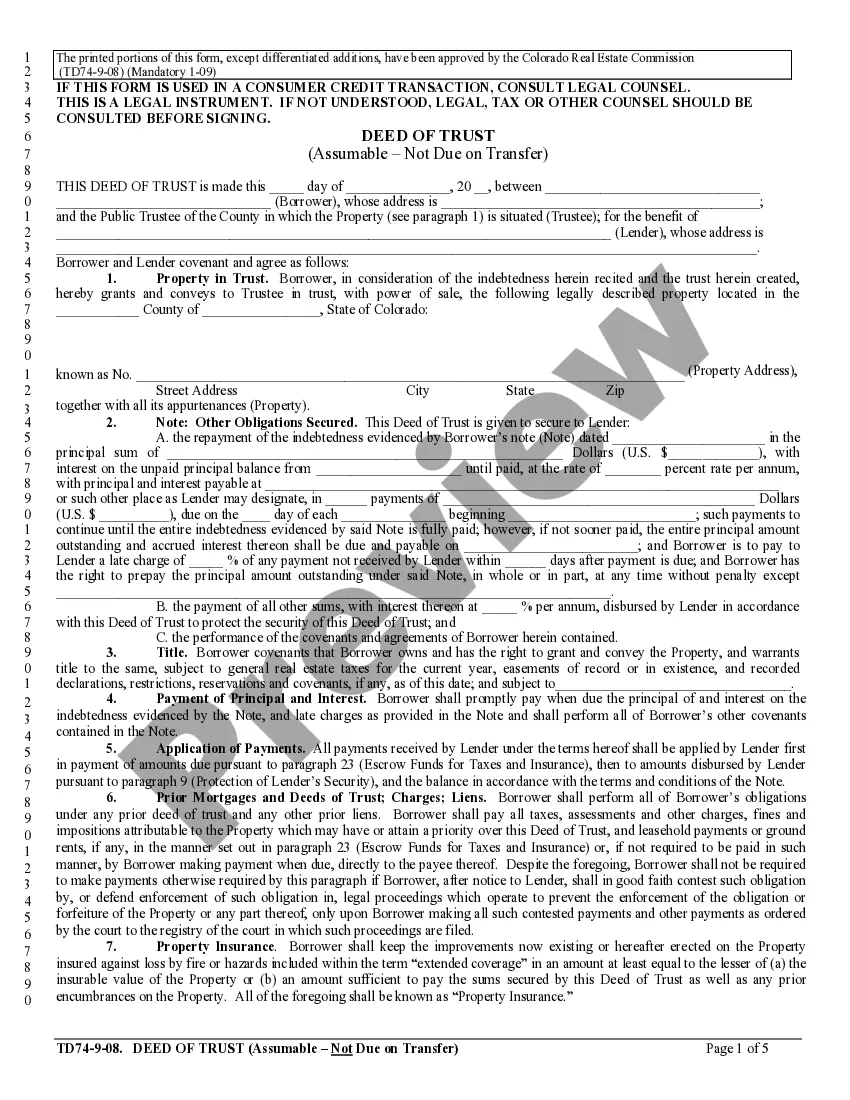

Deed of Trust - Due on Transfer - Strict: This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

Colorado Deed of Trust - Due on Transfer - Strict

Description

How to fill out Colorado Deed Of Trust - Due On Transfer - Strict?

The larger the quantity of documents you must prepare, the more anxious you become.

You can discover a vast selection of Colorado Deed of Trust - Due on Transfer - Strict templates online, yet you're unsure which ones to trust.

Eliminate the inconvenience and simplify the process of obtaining samples by using US Legal Forms.

Proceed by clicking Buy Now to initiate the registration process and select a pricing plan that meets your needs.

- Obtain professionally constructed documents that are crafted to comply with state regulations.

- If you possess a subscription with US Legal Forms, Log In to your account, and you'll see the Download option on the page for the Colorado Deed of Trust - Due on Transfer - Strict.

- If you haven't used our service before, follow these instructions to complete the sign-up process.

- Confirm that the Colorado Deed of Trust - Due on Transfer - Strict is applicable in your residing state.

- Verify your selection by reviewing the description or utilizing the Preview feature if available for the selected document.

Form popularity

FAQ

Transferring property into a trust in Colorado involves preparing a trust document and executing a deed to transfer ownership. When using a Colorado Deed of Trust - Due on Transfer - Strict, ensure that all legal requirements are met to avoid complications. It is advisable to follow the correct procedures and keep records of the transfer process. For detailed steps and assistance, consider utilizing the services offered by USLegalForms.

Yes, you can sell a house with a Colorado Deed of Trust - Due on Transfer - Strict, but it involves specific steps. You must ensure that the buyer is aware of the deed of trust, as it may have implications on the sale. Additionally, you may need to seek consent from the lender if the trust document contains due-on-transfer clauses. For assistance in navigating this process, USLegalForms provides valuable resources.

A Colorado Deed of Trust - Due on Transfer - Strict offers several advantages, such as simplifying the foreclosure process and providing a clear title transfer method. However, there are drawbacks, including potential restrictions on transferring property without consent from the lender. It's essential to weigh these factors when deciding to use a trust deed. For more guidance, USLegalForms can help you understand the nuances of trust deeds.

One significant disadvantage of a deed of trust is the potential for a faster foreclosure process compared to traditional mortgages. This strict method may place homeowners at risk if they encounter financial difficulties. Understanding the implications of a Colorado Deed of Trust - Due on Transfer - Strict is essential before signing. Using resources like UsLegalForms can help you navigate these challenges effectively.

In Colorado, a deed of trust must include specific elements such as the names of the parties, a clear description of the property, and the terms of repayment. It also needs to outline the rights and duties of all parties involved. Completing these requirements accurately is crucial for the validity of the Colorado Deed of Trust - Due on Transfer - Strict. UsLegalForms provides templates that ensure compliance with all legal standards.

A deed of trust is a legal document among three parties: the borrower, the beneficiary and the trustee who holds the legal title to the property.Once the modification has been filed, it replaces any conflicting information in the original deed of trust.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.