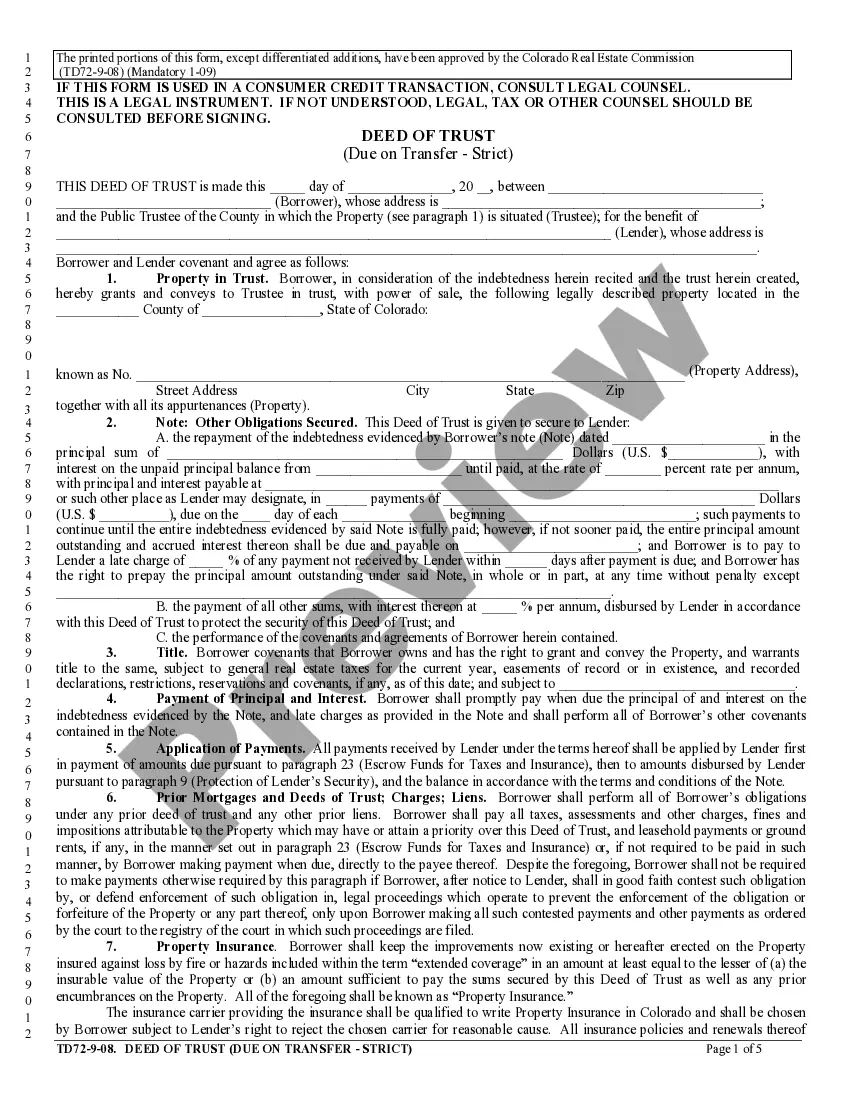

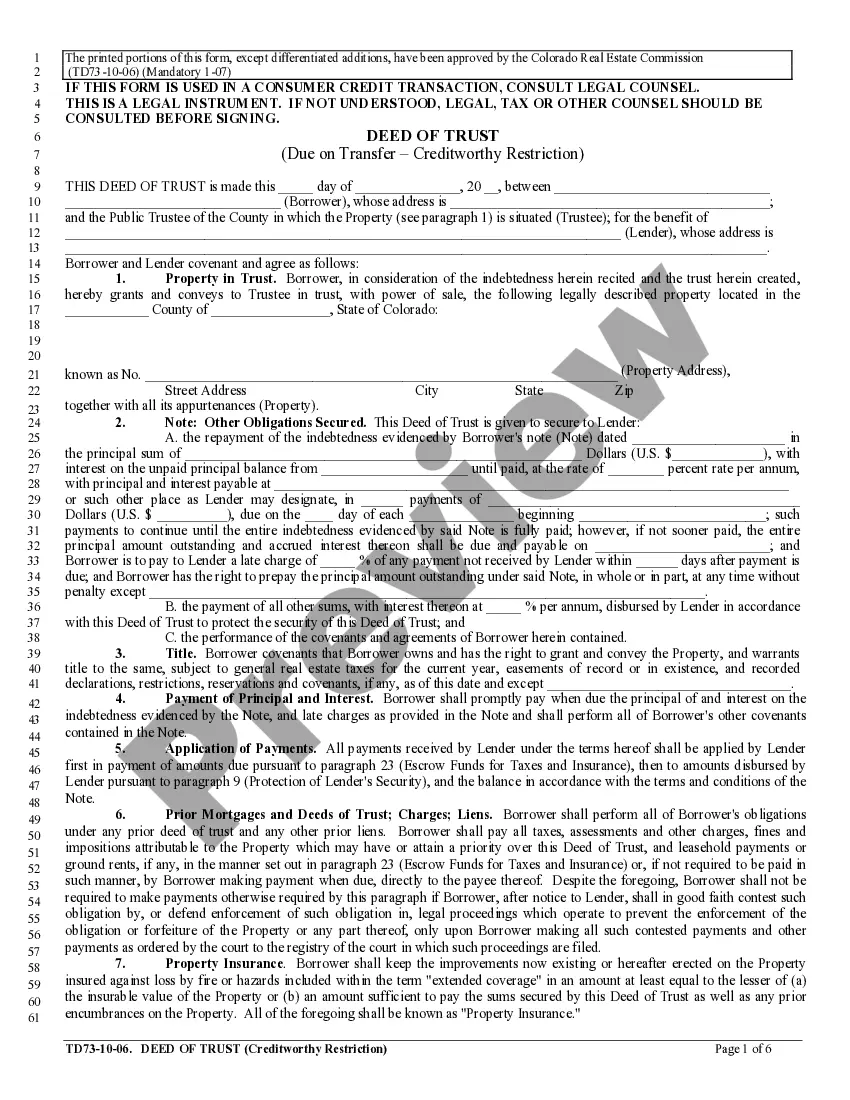

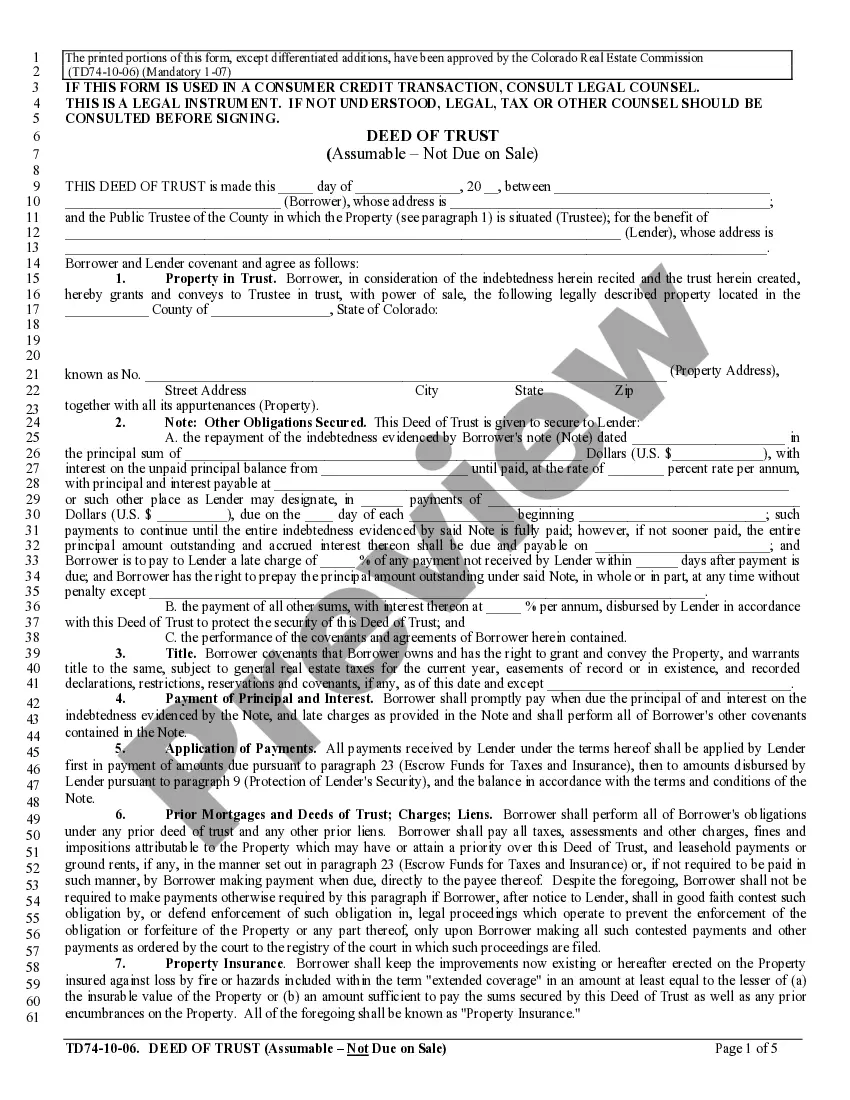

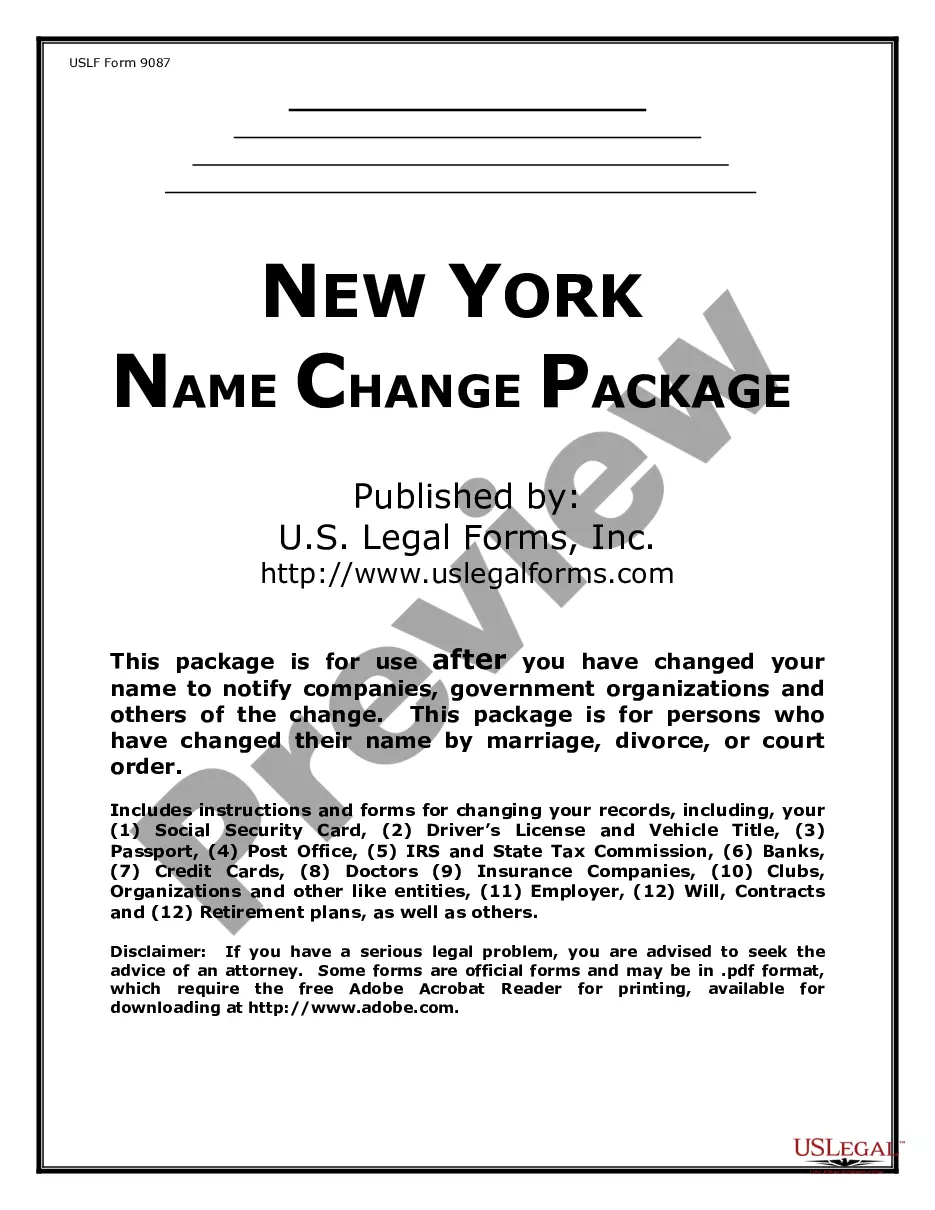

Deed of Trust - Assumable - Not Due on Transfer: This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

Colorado Deed of Trust - Assumable - Not Due on Transfer

Description

How to fill out Colorado Deed Of Trust - Assumable - Not Due On Transfer?

The greater the number of papers you require to produce - the more anxious you become.

You can obtain a vast array of Colorado Deed of Trust - Assumable - Not Due on Transfer templates online; however, you are uncertain which of them to rely on.

Remove the inconvenience to simplify the search for samples using US Legal Forms. Acquire precisely formulated documents that are designed to fulfill state regulations.

Provide the required information to create your account and pay for the order using your PayPal or credit card. Choose a convenient document format and receive your template. Access each document you obtain in the My documents section. Simply navigate there to create a new version of your Colorado Deed of Trust - Assumable - Not Due on Transfer. Even when utilizing expertly crafted forms, it’s still crucial that you consider consulting a local attorney to review the completed form to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently have a US Legal Forms subscription, Log In to your account, and you will find the Download button on the webpage for the Colorado Deed of Trust - Assumable - Not Due on Transfer.

- If you have yet to utilize our platform, follow the sign-up process with these instructions.

- Verify if the Colorado Deed of Trust - Assumable - Not Due on Transfer is applicable in your state.

- Double-check your choice by reviewing the description or using the Preview option if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

Lenders often prefer a Colorado Deed of Trust - Assumable - Not Due on Transfer because it offers them more security. In a deed of trust, the property serves as collateral, which allows the lender to initiate a non-judicial foreclosure in case of default. This process is typically faster and less costly compared to judicial foreclosures associated with traditional mortgages. Therefore, lenders can maintain a more streamlined process, benefiting both themselves and borrowers.

Yes, you can modify a deed of trust in Colorado under certain conditions. This typically involves creating a written agreement that specifies the changes and obtaining approval from all parties involved. When dealing with a Colorado Deed of Trust - Assumable - Not Due on Transfer, it’s essential to ensure that these modifications comply with all state laws. Consider reaching out to USLegalForms for professional assistance to navigate any complexities in the modification process.

To make changes to a trust deed in Colorado, you need to draft an amendment that outlines the modifications you wish to implement. This document must be signed by the parties involved and then recorded with the county clerk where the original deed is filed. Be sure to reference the Colorado Deed of Trust - Assumable - Not Due on Transfer, as this will clarify the nature of the agreement. Using a service like USLegalForms can simplify this process and ensure everything is completed correctly.

Writing a trust deed involves clearly outlining the agreement between the borrower and the lender while including all necessary details. Start by identifying all parties involved and describe the specific property being secured. Make sure to incorporate the Colorado Deed of Trust - Assumable - Not Due on Transfer conditions and any legal stipulations. For convenience and accuracy, using Uslegalforms can streamline the process of drafting a trust deed.

One drawback of a trust deed is the foreclosure process, which can be faster compared to traditional mortgages. If the borrower defaults, the lender may proceed with foreclosure without going through court. This aspect can create anxiety for borrowers who are concerned about losing their home. Additionally, a Colorado Deed of Trust - Assumable - Not Due on Transfer may limit flexibility in transferring the property under certain conditions.

Commission Rule F, established by the Colorado Real Estate Commission, governs the use of deeds of trust in real estate transactions. This rule ensures that certain requirements are met to protect both lenders and borrowers. Specifically, it provides guidelines on how the Colorado Deed of Trust - Assumable - Not Due on Transfer should be structured to comply with state regulations. Understanding Rule F is essential for anyone involved in real estate transactions in Colorado.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed conveys ownership; a deed of trust secures a loan.

Transferring a Property Subject to a Due-on-Sale Clause Perhaps the best way to avoid triggering a due-on-sale clause in a real estate deal is to obtain the lender's consent for a transfer.