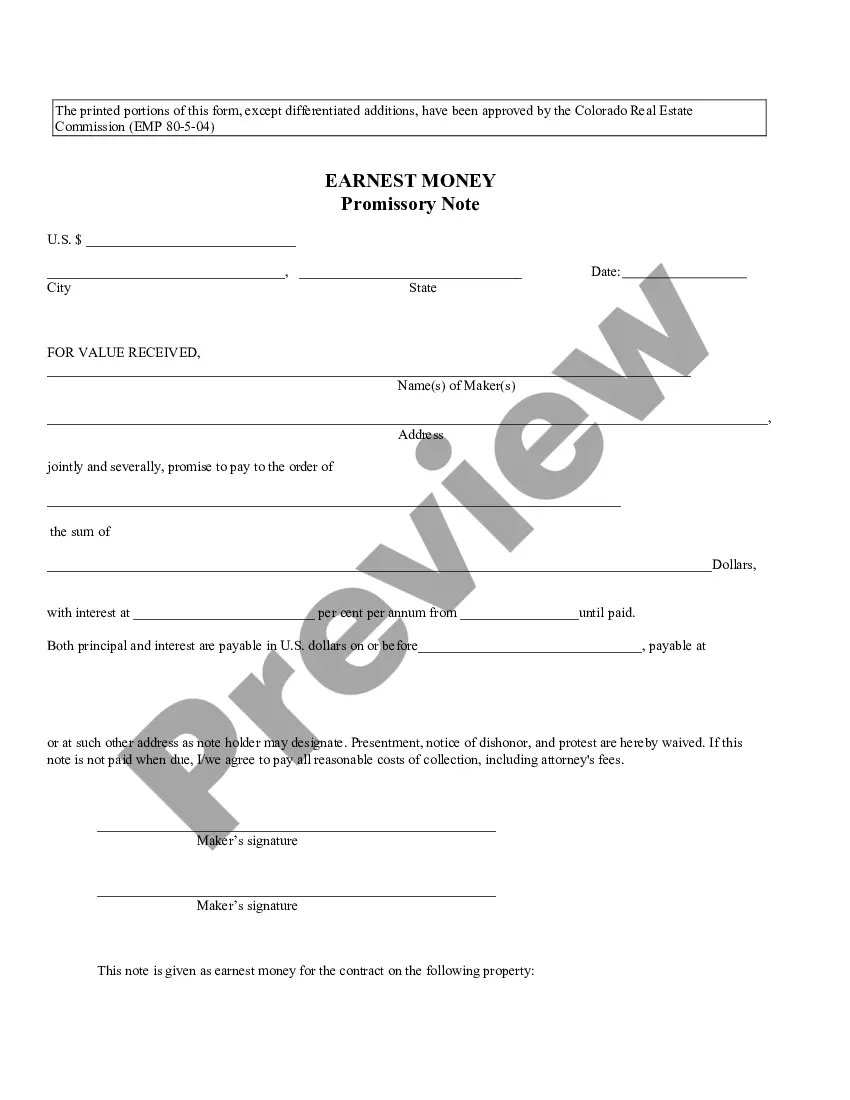

Earnest Money Release: This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and laws.

Colorado Earnest Money Release

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Earnest Money Release: This refers to the process where the earnest money held in an escrow account is released back to the buyer or transferred to the seller under the terms agreed upon in a real estate contract. Earnest Money is a deposit made to a seller showing the buyer's good faith in a transaction. Escrow Account: An account where funds are held in trust whilst two or more parties complete a transaction.

Step-by-Step Guide on How to Release Earnest Money

- Contact Estate Agents: Initiate the process by consulting with skilled real estate agents to guide you through the terms of the contract.

- Home Sale Contingency: Review whether a home sale contingency applies, which might impact the release conditions.

- Property Inspection Deadline: Verify that all property inspections are completed before the deadline. This can influence the earnest money release conditions.

- Provide Earnest Money: Ensure earnest money has been correctly deposited into an escrow account set up for the transaction.

- Release Earnest Deposit: Request the release of the deposit via written notice to all stakeholders, providing necessary documentation of fulfilled conditions or contingencies.

- Closing Real Estate Deal: Complete all remaining steps for closing, ensuring that the release of the earnest money is part of the finalization steps.

Risk Analysis of Earnest Money Release

- Failed Transactions: If the sale does not close, determining who keeps the earnest money can lead to disputes.

- Legal Risks: Failing to adhere to the terms set out in the real estate contract can result in legal repercussions.

- Timeline Delays: Delays in meeting contingencies such as property inspections can delay the process of releasing earnest money.

Best Practices

- Create a Thorough Contract: Include clear terms for the release of earnest money to avoid misunderstandings.

- Regular Communication: Maintain open lines of communication between the buyer, seller, and real estate agents to ensure all parties are aligned.

- Timely Fulfillment of Contingencies: Meet all deadlines for contingencies like home inspections and appraisal reviews to avoid delays in the earnest money release.

Key Takeaways

- Understanding the contract terms is crucial for the smooth release of earnest money.

- Engage competent real estate agents when trying to sell home fast and manage earnest money effectively.

- Meticulous documentation and adherence to agreed timelines facilitate the release process and prevent disputes.

How to fill out Colorado Earnest Money Release?

The larger quantity of documents you must produce - the more stressed you become.

You can discover countless Colorado Earnest Money Release templates online, yet you may not know which to depend on.

Remove the frustration to make locating samples simpler with US Legal Forms. Obtain professionally prepared papers that are crafted to comply with state standards.

Locate each template you receive in the My documents section. Simply navigate there to create a new copy of your Colorado Earnest Money Release. Even when preparing properly drafted templates, it remains essential to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Verify if the Colorado Earnest Money Release is applicable in your state.

- Reconfirm your choice by reviewing the description or utilizing the Preview feature if available for the chosen document.

- Select Buy Now to commence the registration process and choose a pricing plan that suits your requirements.

- Provide the required information to set up your account and pay for the order using PayPal or credit card.

- Choose a convenient file format and receive your copy.

Form popularity

FAQ

Go to the Banking menu and click Transfer Funds. In the Transfer Funds window, select the account from which you want to transfer the funds. Select the account to which you want to transfer the funds. Enter the amount that you want to transfer. Save the transaction.

The release of earnest money form is a waiver that is to be signed by both the buyer and seller before an earnest money deposit towards a property may be released.

According to the court, the earnest money paid by a prospective purchaser of a property can be forfeited by the seller in case the buyer fails to pay the remaining sum as per the agreement.The Court ruled that earnest money is given to bind a contract.

Does the Seller Ever Keep the Earnest Money? Yes, the seller has the right to keep the money under certain circumstances. If the buyer decides to cancel the sale without a valid reason or doesn't stick to an agreed timeline, the seller gets to keep the money.

Assuming the seller does not contest to you getting your earnest money back, then you should both sign release forms. This says that you both agree that the earnest money will be returned to you. Make sure to contact your realtor or lawyer to find out about any other forms you need to sign.

In Colorado real estate, when using a Realtor® or licensed agent, if anyone acts in bad faith, the main recourse is that the party who was wronged gets to keep the earnest money deposit. Either the buyer gets it back, if, for example, a seller decides they no longer want to sell and terminate the contract.

The earnest money can be held in escrow during the contract period by a title company, lawyer, bank, or brokerwhatever is specified in the contract. Most U.S. jurisdictions require that when a buyer timely and properly drops out of a contract, the money be returned within a brief period of time, say, 48 hours.

Buyers stand to lose their earnest money if they jump ship on a real estate transaction.But, if a buyer decides to cancel the contract for a reason not covered by a contract contingency, earnest money is generally forfeited to the seller.