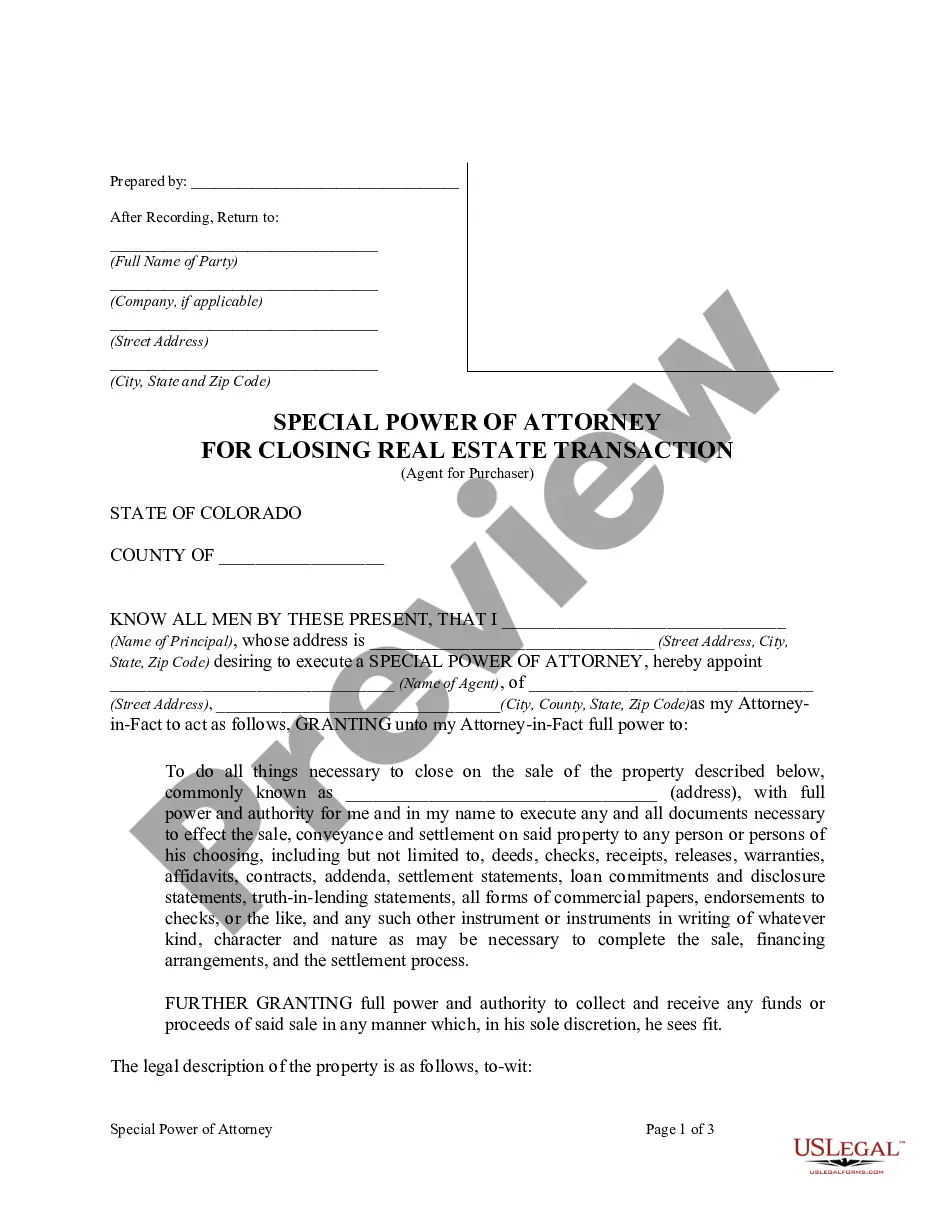

Colorado Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Colorado Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

The higher the number of documents you need to prepare, the more nervous you become.

You can find numerous Colorado Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser templates available online, yet you are unsure which ones to trust.

Eliminate the inconvenience of finding templates by utilizing US Legal Forms for greater ease.

Provide the required information to set up your account and make a payment through PayPal or credit card. Select the desired document type and download your template. Access all documents from the My documents section. Simply navigate there to generate a new version of your Colorado Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser. Even with well-crafted templates, it is still advisable to consult your local attorney to verify that your form is accurately filled out. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, sign in to your account, and you will observe the Download button on the webpage for the Colorado Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser.

- If you have not used our service before, follow these instructions to register.

- Ensure that the Colorado Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is valid in your state.

- Re-evaluate your selection by reviewing the description or utilizing the Preview feature if available for the selected file.

- Click Buy Now to initiate the registration process and choose a payment plan that suits your needs.

Form popularity

FAQ

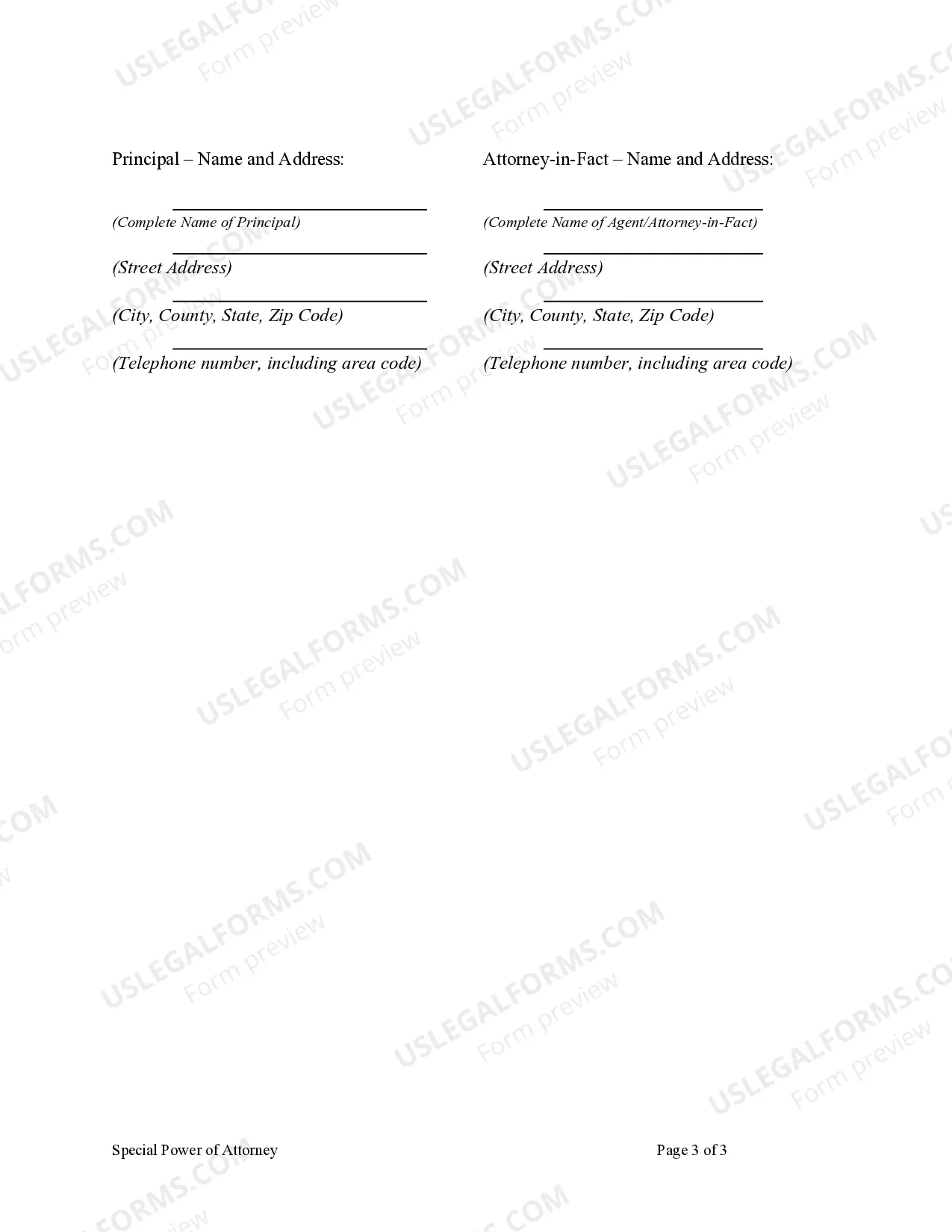

Filling out a limited power of attorney form begins with providing the principal's and agent's details, including names and addresses. Clearly state the specific powers granted, particularly those related to real estate transactions. After filling in the necessary information, the principal must sign the form to validate it. Using platforms like USLegalForms can streamline this process with user-friendly resources and templates tailored to your needs.

In Colorado, a medical power of attorney does not necessarily need to be notarized but must be signed by the principal and witnessed by two individuals or a notary. While it’s advisable to have the document notarized for additional legal security, notarization is not a strict requirement for validity. It’s essential to ensure proper execution to avoid future complications. Consider using a template from USLegalForms to ensure compliance with all necessary requirements.

To write a power of attorney letter for property transactions, start with a clear title stating it is a power of attorney document. Include the principal's name, address, and an affirmation that they are granting authority to the agent for specific transactions, such as those involving real estate. The letter should also detail the scope of the authority and include a signature from the principal. Utilizing a structured template from USLegalForms can help simplify this process and ensure all necessary elements are included.

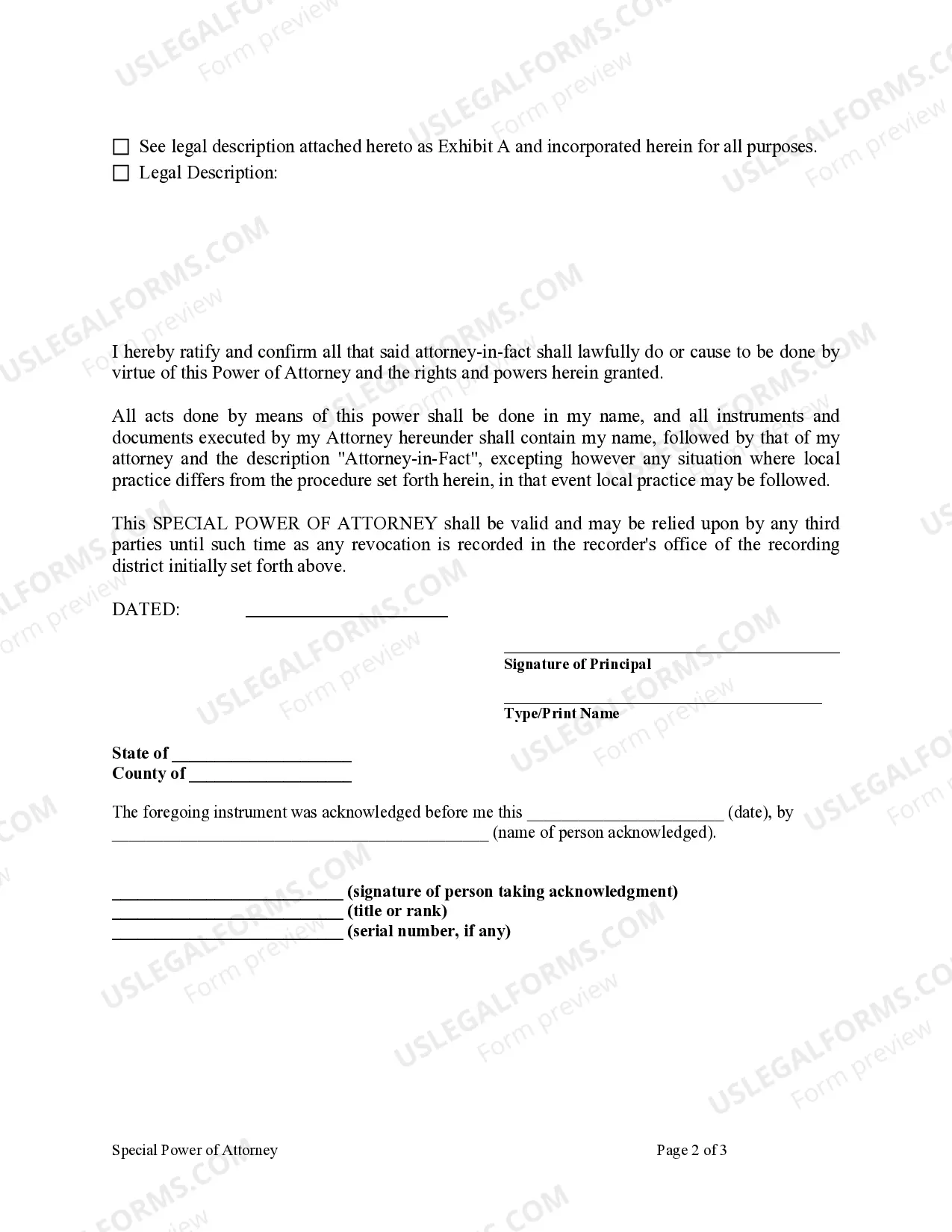

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

An agent is a fiduciary, which means that he or she must act with the highest degree of good faith. The agent must keep records of their actions if those actions need to be reviewed.

First, the legal answer is however long you set it up to last. If you set a date for a power of attorney to lapse, then it will last until that date. If you create a general power of attorney and set no date for which it will expire, it will last until you die or become incapacitated.

What Is a Special Power of Attorney?Also known as a limited power of attorney (LPOA), a special power of attorney allows an individual to give another person the ability to make certain legal or financial decisions on their behalf.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

The short answer is YES, you may send someone in your place to close for you. A closing is essentially a signing of documents, documents drafted by both the closing attorney and your lender.