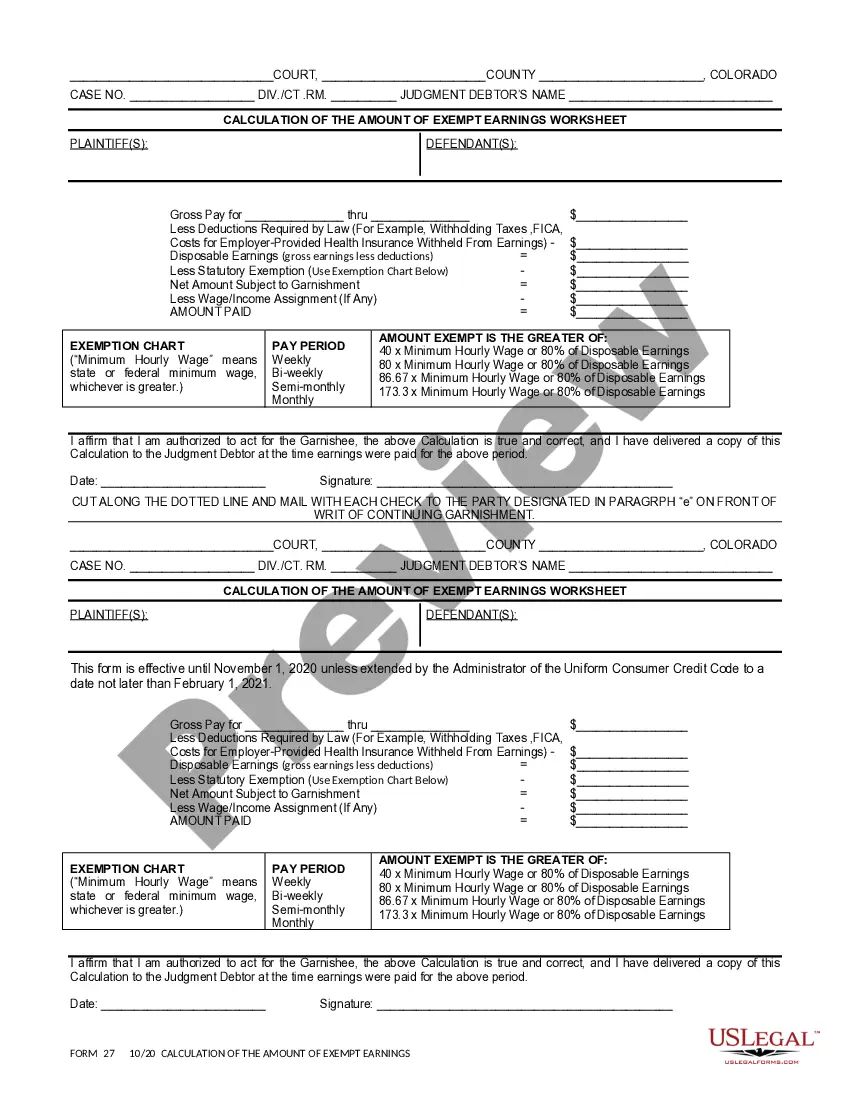

Objection to Calculation of the Amount of Exempt Earnings: This is an official form from the Colorado County Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado County Court forms as is required by Colorado statutes and law.

Colorado Objection to Calculation of the Amount of Exempt Earnings

Description

How to fill out Colorado Objection To Calculation Of The Amount Of Exempt Earnings?

The larger the quantity of documents you need to prepare - the more anxious you are.

You can find a vast array of Colorado Objection to Calculation of the Amount of Exempt Earnings templates online, but you might be unsure which ones to trust.

Eliminate the stress and streamline obtaining samples with US Legal Forms.

Select Buy Now to initiate the registration process and choose a pricing plan that fits your needs. Fill in the required details to create your account and complete your order payment with PayPal or a credit card. Choose a preferred document format and download your example. Access all samples you download in the My documents section. Simply navigate there to fill in a new version of the Colorado Objection to Calculation of the Amount of Exempt Earnings. Even though you are using professionally prepared templates, it is still advisable to consult a local legal expert to ensure that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain expertly crafted documents that comply with state regulations.

- If you already have a US Legal Forms subscription, Log In to your account, and you'll find the Download option on the Colorado Objection to Calculation of the Amount of Exempt Earnings page.

- If you are new to our platform, complete the sign-up process by following these steps.

- Verify if the Colorado Objection to Calculation of the Amount of Exempt Earnings is applicable in your state.

- Double-check your choice by reviewing the description or using the Preview mode if it's available for the selected document.

Form popularity

FAQ

To fight a garnishment in Colorado, you should consider filing a formal objection in court. This allows you to present evidence and arguments against the garnishment. You can also raise a Colorado Objection to Calculation of the Amount of Exempt Earnings to safeguard your earnings. Engaging a legal professional can offer valuable support and clarity during this procedure.

In Colorado, the amount of your paycheck that can be garnished is typically limited to 25% of your disposable earnings. However, certain exemptions may apply that can reduce this amount further. Understanding these exemptions is crucial, especially when considering a Colorado Objection to Calculation of the Amount of Exempt Earnings. Consulting a professional can help you navigate the specifics.

Yes, you can negotiate with your creditor even after a wage garnishment begins. Engaging in this process allows you to discuss and potentially modify the terms of your repayment. This can include addressing the Colorado Objection to Calculation of the Amount of Exempt Earnings. By seeking expert assistance, you can find ways to protect your income.

Interrogatories for garnishment in Colorado are written questions that the court may ask a debtor to gather information about their financial situation. These questions help ensure accurate and fair assessment regarding the garnishment process. If you receive such a request, understanding the implications of your responses is crucial, especially in the context of a Colorado Objection to Calculation of the Amount of Exempt Earnings.

The rules for garnishment in Colorado require creditors to follow specific legal procedures, including obtaining a court order. Colorado law protects a portion of your income, making it essential to know your rights. If you find yourself questioning the amounts taken from your paycheck, a Colorado Objection to Calculation of the Amount of Exempt Earnings may be a course of action worth exploring.

Garnishments in Colorado involve a legal process where a creditor can claim a portion of your wages to settle a debt. Once a court issues a garnishment order, your employer must withhold a specified amount from your paycheck. Navigating this process may lead you to consider a Colorado Objection to Calculation of the Amount of Exempt Earnings if you believe the garnishment is excessive.

In Colorado, the maximum amount that can be garnished from your paycheck is usually set at either 25% of your disposable earnings or the amount that your earnings exceed 30 times the federal minimum wage, whichever is lesser. This regulation helps protect a portion of your income from creditors. If you're facing challenges with a Colorado Objection to Calculation of the Amount of Exempt Earnings, consider reviewing your situation with a legal expert.

To calculate garnishment in Colorado, you need to determine your disposable income, which is your total earnings minus mandatory deductions like taxes. The laws limit the amount that can be garnished based on your income level. Importantly, when you're considering a Colorado Objection to Calculation of the Amount of Exempt Earnings, you should understand what qualifies as exempt income, as this can affect your calculation.

After a writ of garnishment is filed, your employer is required to withhold the specified amount from your wages and send it to the creditor. You will receive a notice informing you about the garnishment and your rights. If you feel your exempt earnings have been incorrectly calculated, you can file a Colorado Objection to Calculation of the Amount of Exempt Earnings to contest the garnishment.

A writ of garnishment in Colorado is a legal order that directs your employer to withhold a portion of your wages to satisfy a debt owed to a creditor. This process must comply with Colorado's garnishment laws, which outline how much can be deducted from your earnings. If you think this garnishment is improperly calculated, you may file a Colorado Objection to Calculation of the Amount of Exempt Earnings.