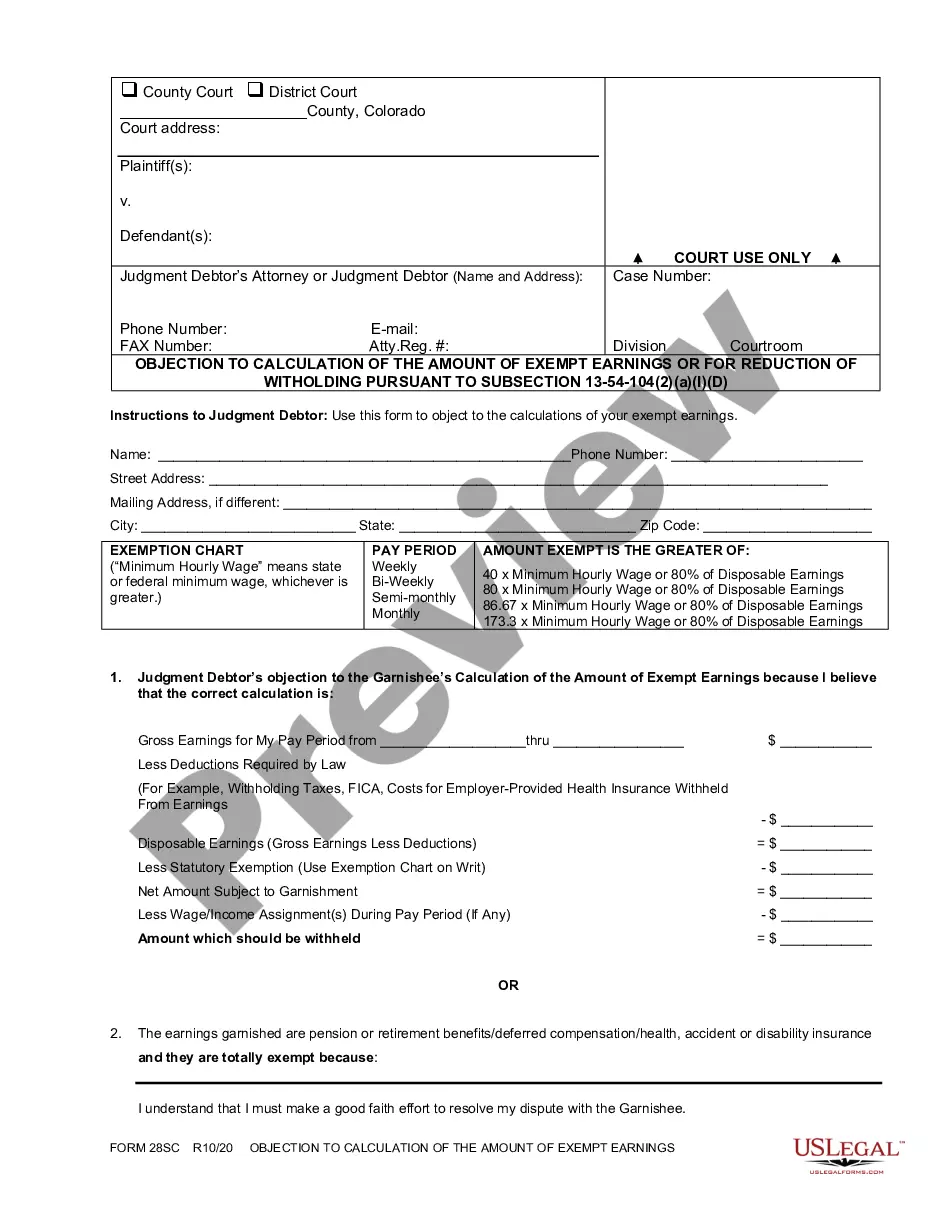

Calculation of the Amount of Exempt Earnings: This is an official form from the Colorado County Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado County Court forms as is required by Colorado statutes and law.

Colorado Calculation of the Amount of Exempt Earnings

Description

How to fill out Colorado Calculation Of The Amount Of Exempt Earnings?

The greater the number of documents you need to prepare - the more anxious you become.

You can access a vast array of Colorado Calculation of the Amount of Exempt Earnings templates online, yet you remain unsure which ones to trust.

Eliminate the stress to make acquiring samples significantly easier with US Legal Forms.

Provide the necessary details to create your profile and pay for the order using PayPal or a credit card. Choose a seamless document format and obtain your copy. You can find every document you receive in the My documents section. Just visit there to create a new copy of the Colorado Calculation of the Amount of Exempt Earnings. Even with professionally prepared templates, it is essential to consider consulting a local attorney to verify that your form is accurately completed. Achieve more while spending less with US Legal Forms!

- If you currently have a US Legal Forms subscription, Log In to your account, and you will find the Download option on the Colorado Calculation of the Amount of Exempt Earnings’s page.

- If you haven't used our platform before, follow these instructions to complete the sign-up process.

- Verify that the Colorado Calculation of the Amount of Exempt Earnings is valid in your state.

- Review your selection by reading the description or utilizing the Preview mode if available for the selected document.

- Click Buy Now to initiate the sign-up process and choose a pricing plan that suits your needs.

Form popularity

FAQ

To calculate a garnishment in Colorado, start by determining your disposable earnings, which is your total income minus any mandatory deductions. Then, apply the Colorado Calculation of the Amount of Exempt Earnings to protect a portion of your income based on state guidelines. Once you know the exempt amount, you can subtract it from your disposable earnings to find out what portion may be garnished. This process ensures you comply with the law while safeguarding essential funds.

The formula for garnishment typically involves determining a portion of your earnings that is subject to withholding. In Colorado, the Colorado Calculation of the Amount of Exempt Earnings is crucial, as it allows you to identify the minimum amount that must be protected from garnishment. Generally, creditors can garnish a percentage of wages after this exempt amount is deducted. Understanding this formula helps you maintain your financial stability.

When referring to 25 percent of garnishment, this typically means that creditors can take up to 25% of your disposable income for most debts. However, the actual amount taken depends on your total earnings and any applicable exemptions. The Colorado Calculation of the Amount of Exempt Earnings helps clarify how much of your income remains safe from garnishment. Being informed about this calculation assists you in budgeting effectively.

Determining the amount of a garnishment involves looking at your disposable income and applying the appropriate legal percentage. The Colorado Calculation of the Amount of Exempt Earnings plays an essential role, as it shows what income is exempt from garnishment. By knowing how to calculate this, you can better manage your financial situation. If you have questions, consider checking out resources available on uslegalforms for clarity.

To calculate wage garnishment in Colorado, first identify your gross wages and then subtract mandatory deductions to find your disposable earnings. Next, apply the appropriate percentage that creditors can legally garnish. Utilizing the Colorado Calculation of the Amount of Exempt Earnings can help you determine your exempt amount, ensuring that you maintain the minimum necessary for living expenses. Always stay informed about these calculations to protect your income.

The garnishment percentage allowed in Colorado generally follows federal guidelines. For most debts, creditors can garnish up to 25% of your disposable earnings. However, the Colorado Calculation of the Amount of Exempt Earnings ensures you keep a portion of your income safe. It's crucial to know your rights regarding garnishment percentages to manage your budget efficiently.

In Colorado, the amount they can garnish from your wages depends on your earnings and the type of debt. Typically, creditors can garnish a portion of your disposable income, which is your income after mandatory deductions. The Colorado Calculation of the Amount of Exempt Earnings helps determine the exact amount that remains untouchable. Understanding this calculation can protect your finances, so familiarize yourself with the guidelines.

In Colorado, you can generally have multiple garnishments at once, but they are subject to limits. The total amount garnished cannot exceed 25% of your disposable earnings, or the amount by which your earnings exceed 30 times the federal minimum wage. It’s essential to understand how the Colorado Calculation of the Amount of Exempt Earnings applies to your situation. Consulting with legal advice or using platforms like US Legal Forms can provide valuable clarity.

To stop wage garnishment in Colorado, you can take several actions. First, you may file an objection to the garnishment with the court if you believe your exempt earnings are being improperly targeted. Additionally, negotiating payment plans or settlements with creditors can lead to a cessation of garnishment. Utilizing tools that outline the Colorado Calculation of the Amount of Exempt Earnings can be valuable in this process, helping you protect your income.

The new garnishment law in Colorado, effective as of 2022, aims to provide greater protections to debtors. The law increases the exemptions available and alters the maximum amounts that can be garnished from wages and bank accounts. Staying informed about these changes and understanding the Colorado Calculation of the Amount of Exempt Earnings can empower you when confronting debt. This knowledge can help you effectively manage your financial situation.