California Self-Employed Steel Services Contract

Description

How to fill out Self-Employed Steel Services Contract?

US Legal Forms - one of the largest collections of legal documents in the country - provides a variety of legal form templates that you can obtain or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the California Self-Employed Steel Services Contract in mere seconds.

If you already have a membership, Log In and obtain the California Self-Employed Steel Services Contract from the US Legal Forms catalog. The Download option will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

To utilize US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/state. Use the Preview option to review the form's content. Check the form description to confirm you have selected the right one. If the form does not meet your needs, use the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get Now button. Then, select your preferred pricing plan and provide your details to register for an account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved California Self-Employed Steel Services Contract. Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you desire.

US Legal Forms is your go-to resource for all legal document needs, providing a comprehensive selection of templates tailored to various requirements.

By following the outlined steps, you can effortlessly navigate the platform to find and manage your legal documents effectively.

- Gain access to the California Self-Employed Steel Services Contract with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- Explore a vast library of legal forms.

- Find the latest updates on various forms.

- Enjoy a user-friendly interface for easy navigation.

- Experience secure transactions with various payment options.

Form popularity

FAQ

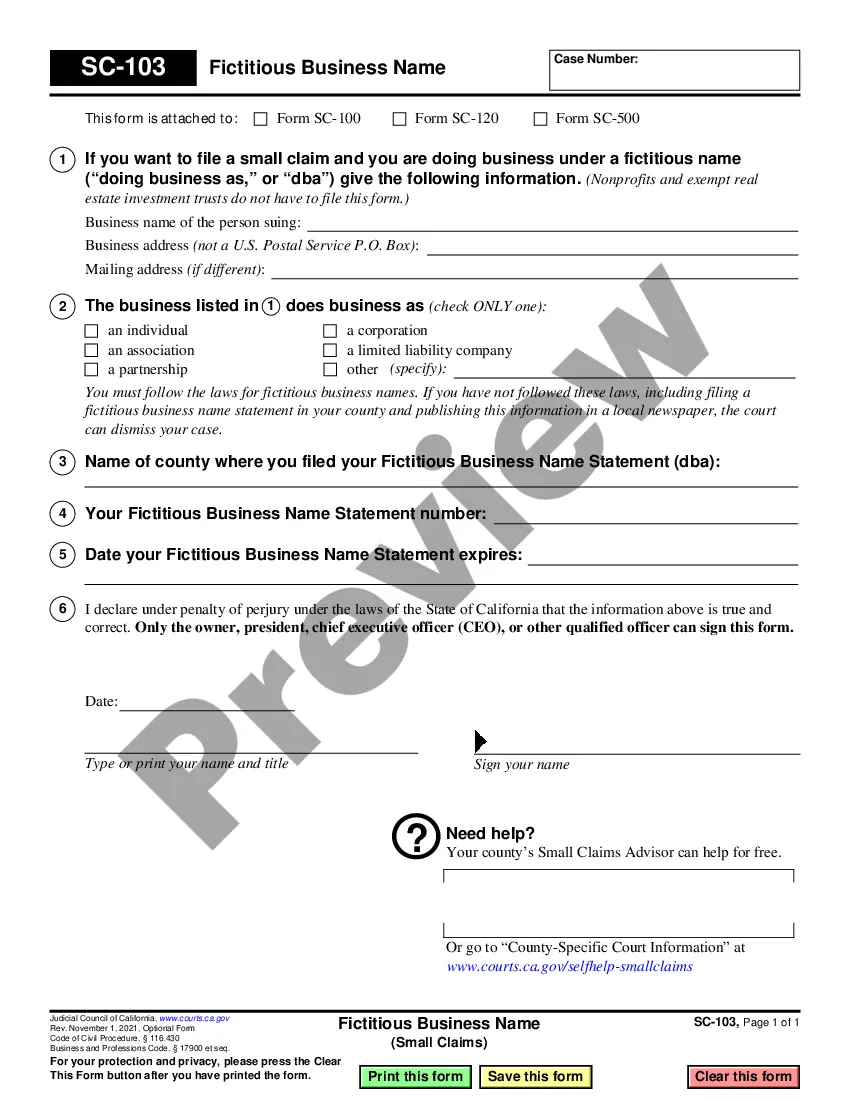

Establishing yourself as an independent contractor involves several key steps. First, you should choose a specialization, such as steel services, and create a business plan. Next, obtain any required licenses and permits, and set up your business structure. Finally, utilize platforms like ours to create a California Self-Employed Steel Services Contract, ensuring you have the necessary documentation to attract clients and succeed in your venture.

While some independent contractors may operate without a license, it is not advisable, especially in the steel services industry. Operating without a license can lead to legal issues and fines. Furthermore, clients often prefer working with licensed professionals for peace of mind. To avoid these pitfalls, consider using our resources to secure a California Self-Employed Steel Services Contract that includes necessary licensing information.

In California, you do need a license to operate as an independent contractor in many fields, including steel services. Specifically, if your services are part of a construction project, you must obtain the appropriate contractor's license. This ensures that you meet state standards for qualifications and insurance. Our platform can help guide you through the licensing process efficiently.

Yes, independent contractors in California generally need a business license, especially if they operate under a business name. This applies to those providing services like steel work. Obtaining a business license not only legitimizes your work but also helps you comply with local regulations. Consider using our platform to simplify the process of acquiring necessary licenses and permits.

To create a valid California Self-Employed Steel Services Contract, you must adhere to the requirements set by the Contractors State License Board (CSLB). This typically includes being licensed if your work exceeds a certain monetary limit. Additionally, your contract should clearly outline the scope of work, payment terms, and timelines. Ensuring compliance with CSLB guidelines protects both you and your clients.

The 72-hour rule in California refers to the requirement for employers to provide advance notice of work schedules to employees. While this rule primarily targets employees, it highlights the importance of clear communication and agreements in contracts. For independent contractors, reviewing your California Self-Employed Steel Services Contract can ensure that both parties understand work expectations and timelines.

The new federal rule aims to make it easier for workers to classify themselves as independent contractors. This rule is part of a broader effort to simplify the landscape for gig economy workers. If you're working under a California Self-Employed Steel Services Contract, it's important to stay informed about these changes and how they affect your status.

The new freelance law set to take effect in 2025 aims to clarify payment structures and protections for freelancers. It will require companies to provide written contracts for freelance work over a certain amount. Utilizing a California Self-Employed Steel Services Contract can help you establish clear terms and protect your rights as a freelancer.

An independent contractor must earn at least $600 during a calendar year from a single client to receive a 1099 form. This threshold ensures that income is reported to the IRS. If you work under a California Self-Employed Steel Services Contract, keeping track of earnings will help you meet this requirement.

The new law, known as AB 5, impacts how workers are classified in California. It establishes stricter criteria for determining whether a worker is an independent contractor or an employee. To navigate these changes effectively, consulting your California Self-Employed Steel Services Contract can help clarify your status and responsibilities.