California Self-Employed Independent Welder Services Contract

Description

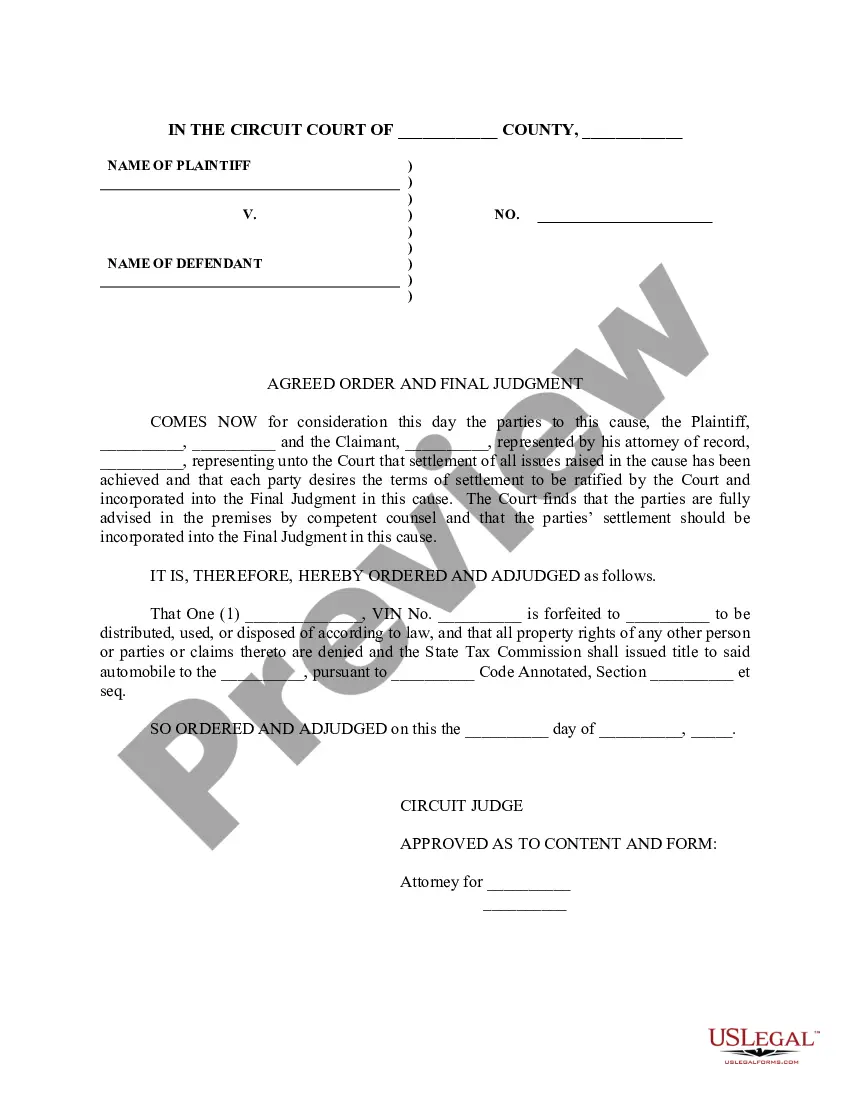

How to fill out Self-Employed Independent Welder Services Contract?

If you need extensive, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to process the transaction.

- Utilize US Legal Forms to acquire the California Self-Employed Independent Welder Services Contract with just a couple of clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click the Acquire button to obtain the California Self-Employed Independent Welder Services Contract.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review feature to verify the contents of the form. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types in that legal form category.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

There may be some factors suggesting a California worker is an employee and others suggesting he or she is an independent contractor. It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

Any business owner must obtain a general business license in the city in which your business is located. Some California cities refer to a business license as a business tax certificate. Businesses that are operated in unincorporated sections of the state must obtain their license or tax certificate on a county basis.

Many California counties require businesses to obtain a business operating license before doing business in the county. This requirement applies to all businesses, including one-person, home-based operations.

An individual is an independent contractor in California only if they meet all three (3) requirements of the test: The worker remains free from managerial direction and control related to the worker's performance. The worker performs duties outside the scope of the company's course of business.

An individual is an independent contractor in California only if they meet all three (3) requirements of the test:The worker remains free from managerial direction and control related to the worker's performance.The worker performs duties outside the scope of the company's course of business.More items...?

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Under the ABC test, a worker is an IC only if he or she meets all of the following: (A) The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.