This contract deals specifically with construction cranes, but could be used in preparation of most any heavy equipment maintenance agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment

Description

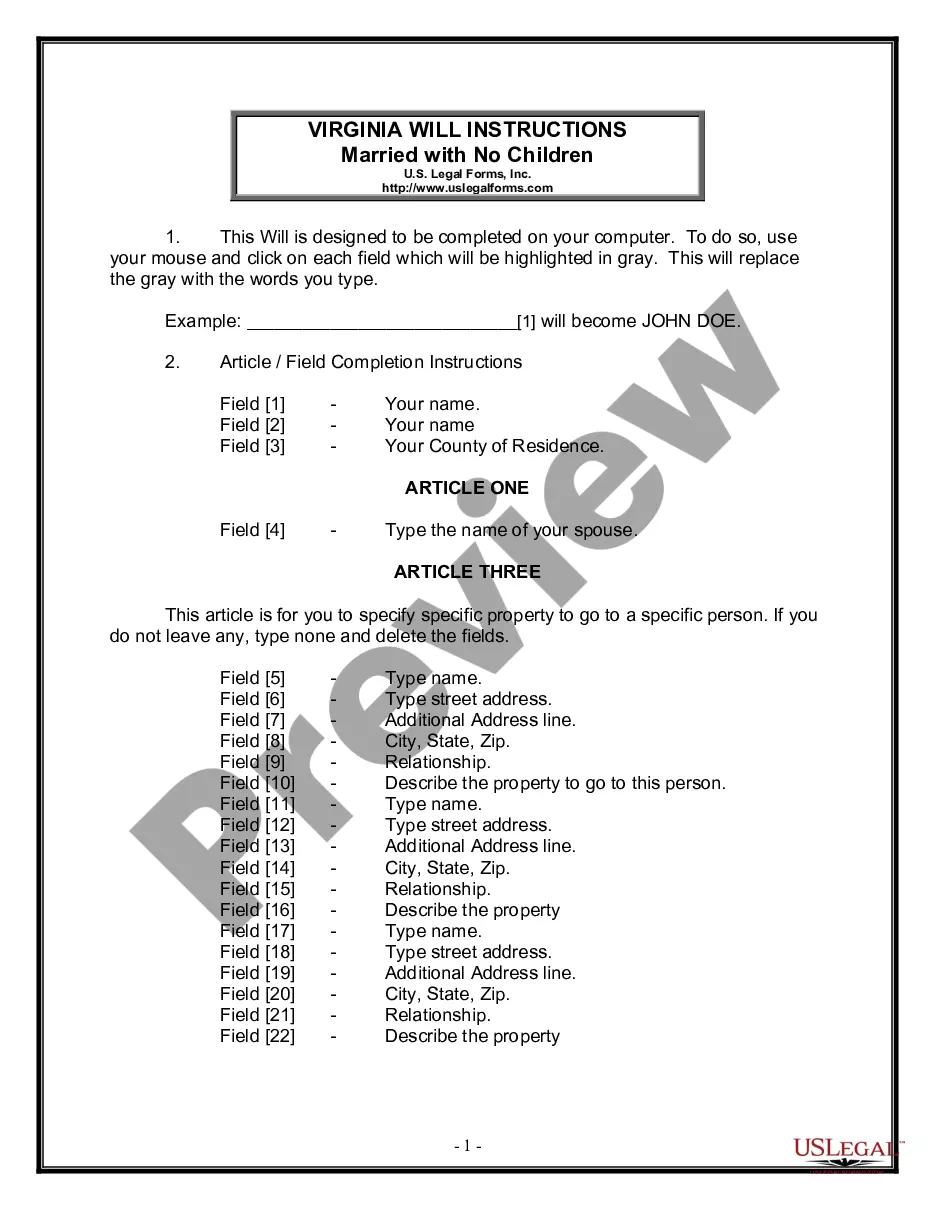

How to fill out Contract With Self-Employed Independent Contractor For Maintenance Of Heavy Equipment?

You can spend numerous hours online trying to locate the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast collection of legal forms that can be reviewed by experts.

You can easily download or print the California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment from my service.

If you wish to locate another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

- Every legal document template you acquire is yours permanently.

- To retrieve an additional copy of any purchased form, navigate to the My documents section and click the corresponding option.

- If you're using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the proper document template for the state/city of your choice. Review the form details to confirm that you have chosen the correct form.

- If available, utilize the Preview feature to review the document template as well.

Form popularity

FAQ

To write a contract for an independent contractor, start by clearly defining the scope of work, payment terms, and project deadlines. Include clauses for confidentiality, liability, and termination to protect both parties. For assistance in drafting a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, consider using the templates available from USLegalForms, which make the process straightforward and efficient.

employed general contractor manages construction projects from start to finish, ensuring they meet client specifications, budgets, and deadlines. This role involves coordinating subcontractors, securing permits, and supervising the worksite. When establishing a California Contract with SelfEmployed Independent Contractor for Maintenance of Heavy Equipment, a clear scope of work is crucial to set expectations and responsibilities.

While the terms self-employed and independent contractor often overlap, they are not precisely the same. Self-employed individuals manage their own business and may have various income streams, whereas independent contractors typically work on specific projects or contracts. If you're considering a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, recognize these distinctions to ensure clarity in your agreements.

The IRS defines a self-employed individual as someone who conducts business as a sole proprietor or as an independent contractor. Self-employed individuals earn income directly from their own businesses, unlike employees who receive a paycheck from an employer. For those engaging in a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, understanding this definition is essential for compliance and tax obligations.

An independent contractor needs to fill out a W9 form and possibly additional tax documents depending on their business setup. They also need to complete any specific agreements that detail the services provided and payment conditions. Keeping meticulous records of all paperwork ensures compliance with legal requirements under a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. A reliable platform like uslegalforms can help guide you through these processes.

Filling out an independent contractor agreement involves clearly defining the scope of work, payment terms, and deadlines. Start by including names and contact information for both parties. Next, outline specific tasks the contractor will perform along with payment details. Finally, ensure that both parties sign the agreement to formalize the California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

Independent contractors typically receive a 1099-NEC form, which specifically reports non-employee compensation. Since 2020, the IRS has required clients to use this form to report payments to contractors who earn over $600 annually. Prior to this, the 1099-MISC was more commonly used. Understanding the correct form helps ensure compliance while working under a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

A self contractor and an independent contractor often refer to the same type of working arrangement. Both terms describe individuals who provide services on a contract basis rather than as employees. However, 'self contractor' may sometimes imply a broader range of self-employment. Regardless of the term used, understanding your California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment is crucial for clarity.

To hire an independent contractor, you usually need a signed independent contractor agreement outlining project terms. Additionally, collecting a completed W9 form is essential for tax reporting and compliance. You may also want to gather any relevant business licenses or insurance documentation. All these elements support a smooth collaboration under a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

An independent contractor should primarily fill out the W9 form to share their Tax ID or Social Security number. Depending on the type of work, they might also need to fill out contracts detailing the scope of work or payment details. For revenue reporting, the contractor may receive a 1099-MISC or 1099-NEC form from clients. This ensures proper documentation under a California Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.