California Self-Employed Tour Guide Services Contract

Description

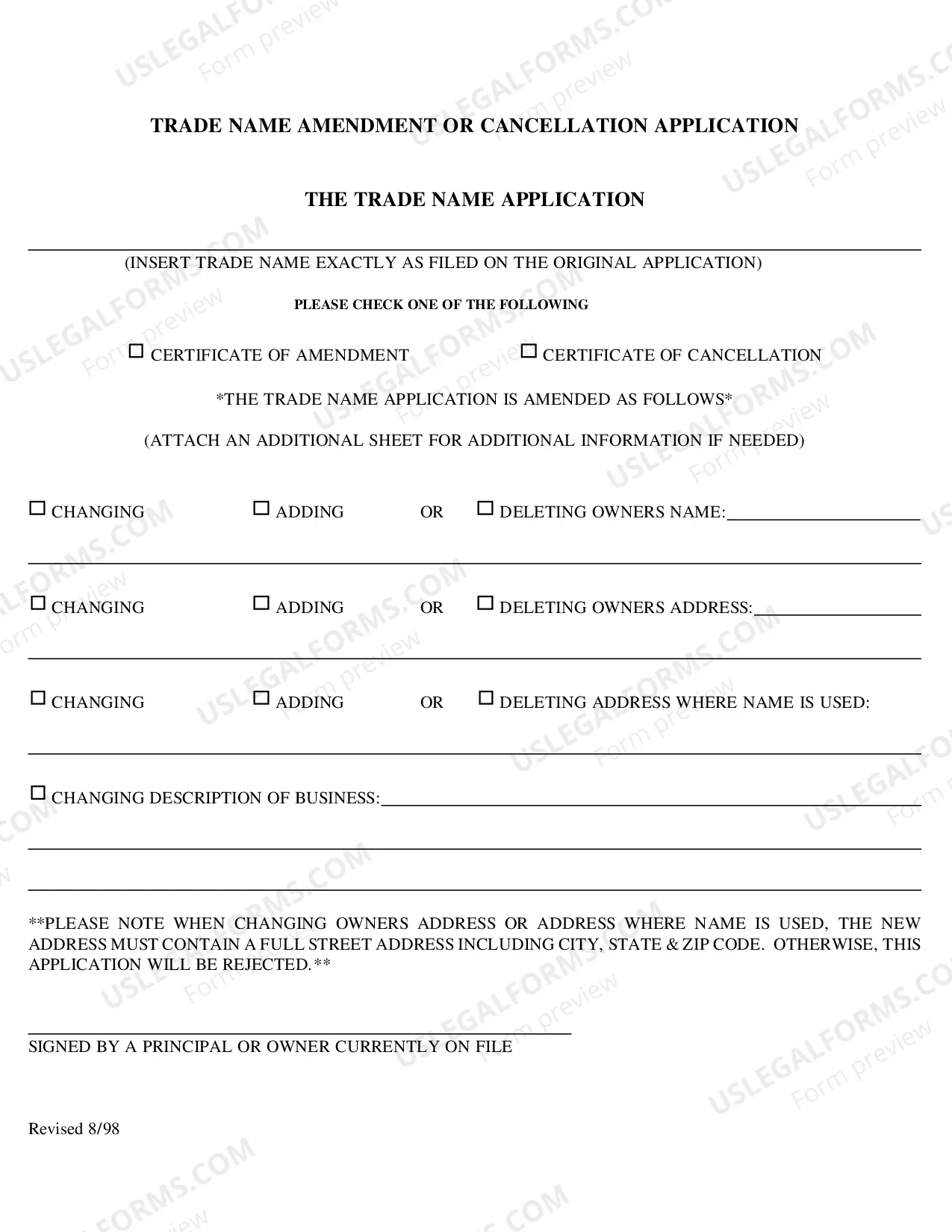

How to fill out Self-Employed Tour Guide Services Contract?

US Legal Forms - one of the largest collections of legal templates in America - provides a variety of legal document formats that you can download or print.

By using the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the California Self-Employed Tour Guide Services Agreement within moments.

If you already have a membership, Log In and obtain the California Self-Employed Tour Guide Services Agreement from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved templates in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finish the transaction.

Select the format and download the form to your device. Make modifications. Fill out, modify, print, and sign the saved California Self-Employed Tour Guide Services Agreement. Each document you added to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the California Self-Employed Tour Guide Services Agreement with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you wish to utilize US Legal Forms for the first time, here are straightforward instructions to help you begin.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Examine the form description to ensure you have picked the accurate form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

In California, you typically do not need to register specifically as an independent contractor; however, you must operate under the legal requirements of your business. Using a California Self-Employed Tour Guide Services Contract can help you define your business structure and ensure compliance with state laws. It's wise to consult with a legal professional to understand your responsibilities fully.

Generally, an independent contractor must earn at least $600 in a calendar year to receive a 1099 form from a client. This applies to self-employed tour guides in California as well. Having a California Self-Employed Tour Guide Services Contract can help you track your earnings and ensure proper documentation for tax purposes.

Self-employed individuals must adhere to various legal requirements, including obtaining necessary permits and licenses. Additionally, a California Self-Employed Tour Guide Services Contract is vital for establishing clear agreements with clients. This contract not only outlines your services but also helps you comply with local regulations.

California's new law, known as AB 5, requires many independent contractors to qualify as employees unless they meet specific criteria. Understanding this law is crucial for self-employed tour guides. A California Self-Employed Tour Guide Services Contract can help clarify your status and ensure compliance with legal standards.

If you work without a contract, you may face uncertainty regarding your payment and responsibilities. A California Self-Employed Tour Guide Services Contract clarifies these aspects, helping you manage expectations with your clients. Without it, you lack legal leverage in case of disputes.

It is legal to work without a signed contract, but it can be risky. A California Self-Employed Tour Guide Services Contract creates a formal understanding of the terms of your service. This contract can be vital if any legal issues arise, protecting your interests as a self-employed tour guide.

While you can technically freelance without a contract, it is not advisable. A California Self-Employed Tour Guide Services Contract protects your rights and defines your responsibilities. Without a contract, you may face challenges in enforcing payment or addressing client expectations.

Yes, having a contract is essential for self-employed individuals, including tour guides in California. A California Self-Employed Tour Guide Services Contract outlines the terms of your agreement with clients, ensuring clarity and protection for both parties. It helps avoid misunderstandings and provides a legal framework if disputes arise.

To become a self-employed tour guide, start by gaining experience and knowledge about the area you wish to cover. Develop a business plan, market your services, and create a detailed California Self-Employed Tour Guide Services Contract to define your terms and protect your interests. Consider using platforms like uslegalforms to access customizable contracts tailored for tour guiding services.

In California, you do not need a specific license to work as an independent contractor, including as a tour guide. However, you must comply with local business regulations and tax requirements. Using a comprehensive California Self-Employed Tour Guide Services Contract can help you navigate these legal aspects effectively.