California Self-Employed Special Events Driver Services Contract

Description

How to fill out Self-Employed Special Events Driver Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

By using the site, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly locate the latest versions of forms such as the California Self-Employed Special Events Driver Services Agreement within moments.

If you have a subscription, Log In and retrieve the California Self-Employed Special Events Driver Services Agreement from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously saved forms in the My documents section of your account.

Select your payment plan and provide your information to create an account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved California Self-Employed Special Events Driver Services Agreement. Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the California Self-Employed Special Events Driver Services Agreement with US Legal Forms, the most comprehensive library of legal form templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are new to US Legal Forms, here are simple steps to help you get started:

- Ensure you have selected the correct form for your city/state.

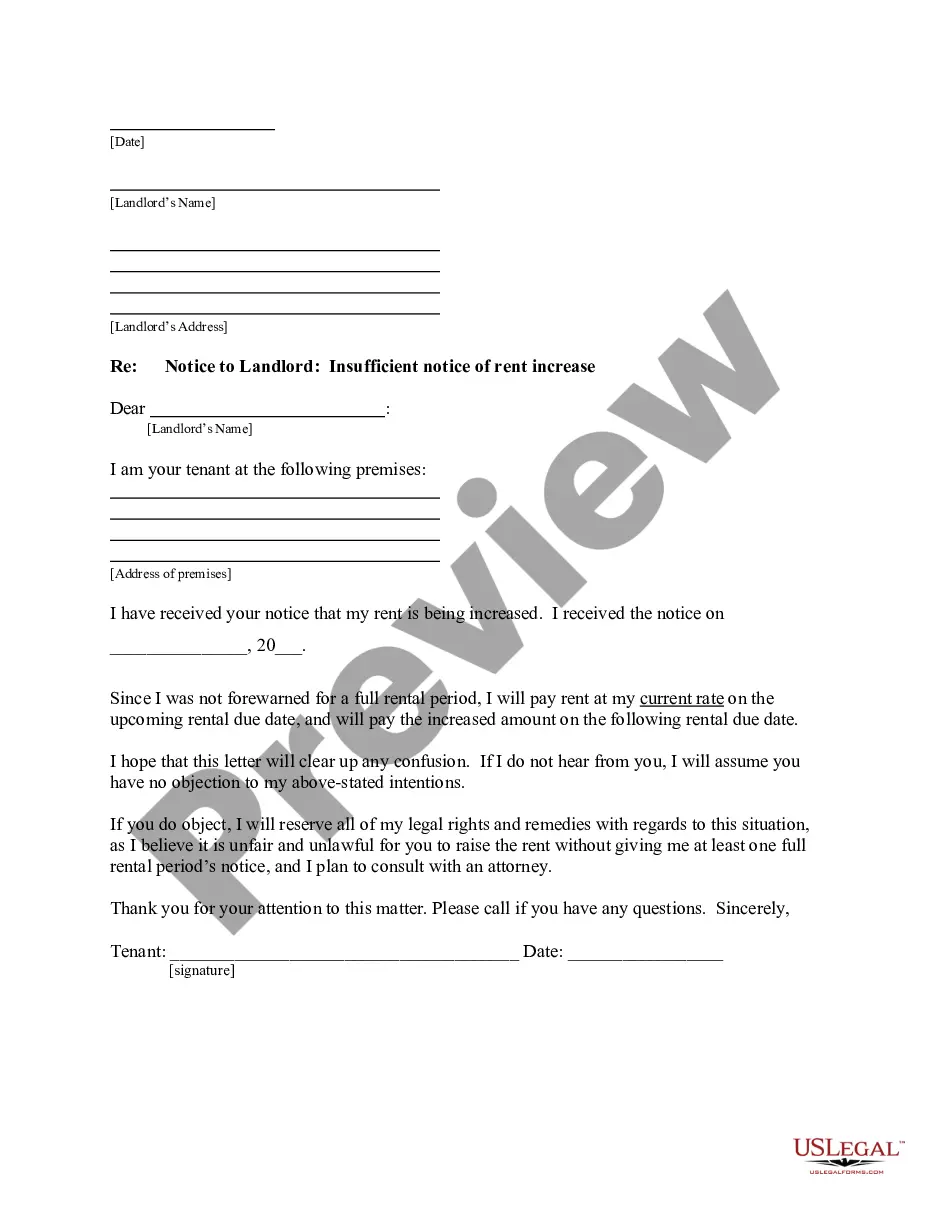

- Click the Preview button to review the content of the form.

- Examine the form summary to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

Form popularity

FAQ

Yes, having a contract as a self-employed individual is highly recommended. A California Self-Employed Special Events Driver Services Contract outlines your rights, responsibilities, and payment terms, providing security for both you and your clients. This written agreement helps prevent misunderstandings and establishes a clear framework for your work. By securing a contract, you can focus on delivering quality services without worry.

Being employed without a contract can lead to uncertainties regarding your job responsibilities and payment. In the absence of a California Self-Employed Special Events Driver Services Contract, you may find it challenging to enforce your rights or clarify expectations. This lack of clarity can result in disputes, which may negatively impact your freelance career. It is wise to formalize your agreements with a written contract.

The DE 542 form is a report used in California to notify the Employment Development Department (EDD) that you are performing services as an independent contractor. This form is essential for tax reporting and helps establish your status as a self-employed individual. Incorporating a California Self-Employed Special Events Driver Services Contract can complement the DE 542 by clearly defining the nature of your services, ensuring that you meet all necessary compliance requirements.

To be authorized as an independent contractor in the US, you need to register your business according to state regulations. Additionally, obtaining an Employer Identification Number (EIN) is typically necessary for tax purposes. Utilizing a California Self-Employed Special Events Driver Services Contract can clarify your role and responsibilities, helping you comply with regulations. This contract serves as a foundation for your independent work.

Working without a signed contract is legal; however, it poses risks. A California Self-Employed Special Events Driver Services Contract helps prevent potential conflicts and misunderstandings. Without this formal agreement, you may face challenges in enforcing payment terms or project specifications. It is always better to have a written contract to safeguard your interests.

To be legally recognized as self-employed, you must obtain the appropriate licenses and permits for your business in California. Additionally, maintaining accurate financial records and paying self-employment taxes are crucial. A California Self-Employed Special Events Driver Services Contract can help outline your business structure and responsibilities, ensuring compliance with local laws. By following these guidelines, you can operate your freelance business effectively.

While you can technically freelance without a contract, it is not advisable. A California Self-Employed Special Events Driver Services Contract provides clarity and protection for both you and your clients. Without a contract, misunderstandings can occur, leading to disputes regarding payment and project expectations. Therefore, securing a written agreement is always a smart move.

The new law in California regarding independent contractors emphasizes stricter regulations on worker classification. It aims to protect workers' rights while also clarifying the conditions under which someone can be classified as an independent contractor. If you provide services under a California Self-Employed Special Events Driver Services Contract, understanding this law is crucial for your business.

An independent contractor must earn at least $600 in a tax year from a single client to receive a 1099 form. This threshold applies to various industries, including those providing specialized services under a California Self-Employed Special Events Driver Services Contract. Keeping track of your earnings is essential for accurate tax reporting.

In California, a contractor can work for the same company indefinitely as long as they maintain their independent contractor status. However, if the relationship resembles that of an employee, it may lead to reclassification. It is wise to review your California Self-Employed Special Events Driver Services Contract to ensure compliance with state regulations.