California Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

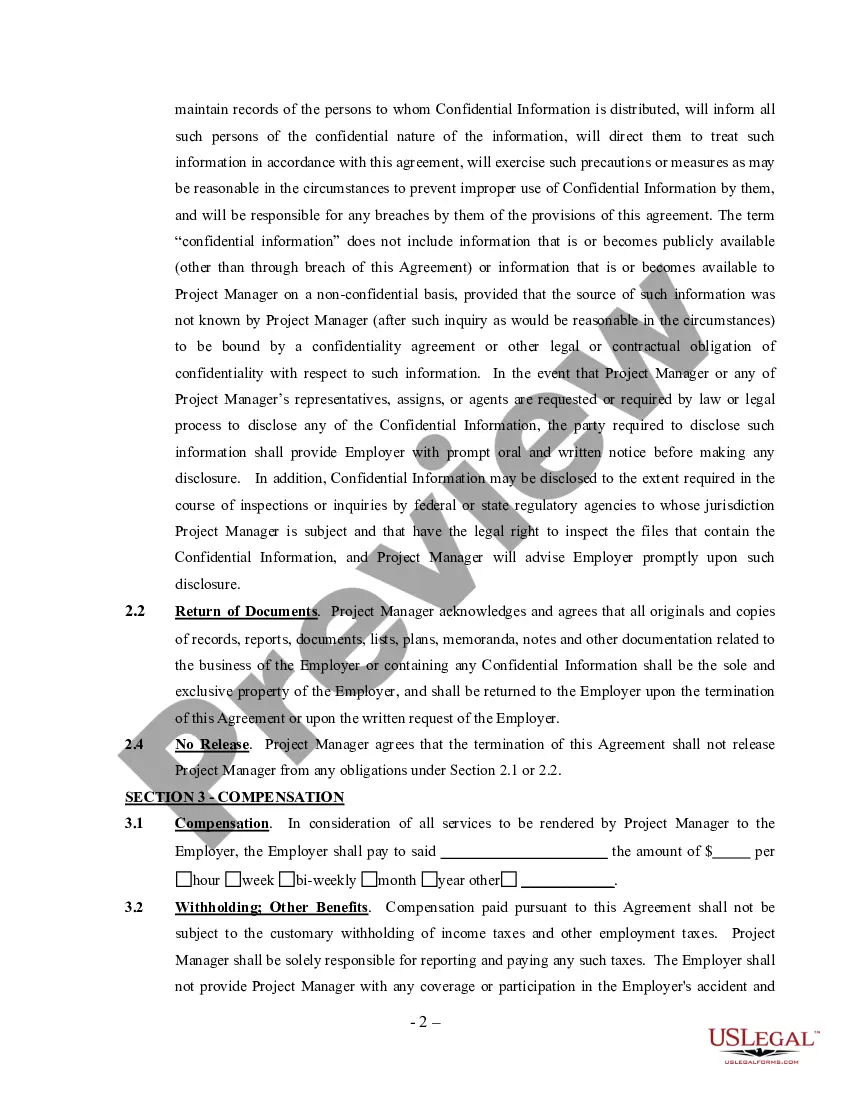

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

If you need to finish, obtain, or produce sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Take advantage of the site’s simple and straightforward search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or phrases. Use US Legal Forms to find the California Outside Project Manager Agreement - Self-Employed Independent Contractor within just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the California Outside Project Manager Agreement - Self-Employed Independent Contractor. You can also access forms you have previously acquired in the My documents tab of your account.

Every legal document template you purchase is yours permanently. You can access every form you have acquired in your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the California Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative models in the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the California Outside Project Manager Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Writing an independent contractor agreement involves several key steps. Begin by introducing the parties involved, then list out the project specifics, including deliverables and timelines. Make sure to indicate it as a California Outside Project Manager Agreement for self-employed independent contractors to comply with state regulations. You can also use US Legal Forms to access templates that simplify this process, ensuring you cover all necessary aspects.

To fill out an independent contractor agreement, start by gathering essential information such as the names and addresses of both parties. Next, clearly outline project details, including scope, payment terms, deadlines, and responsibilities. It is crucial to specify that this is a California Outside Project Manager Agreement for a self-employed independent contractor to avoid any confusion. Finally, ensure both parties review and sign the document to formalize the agreement.

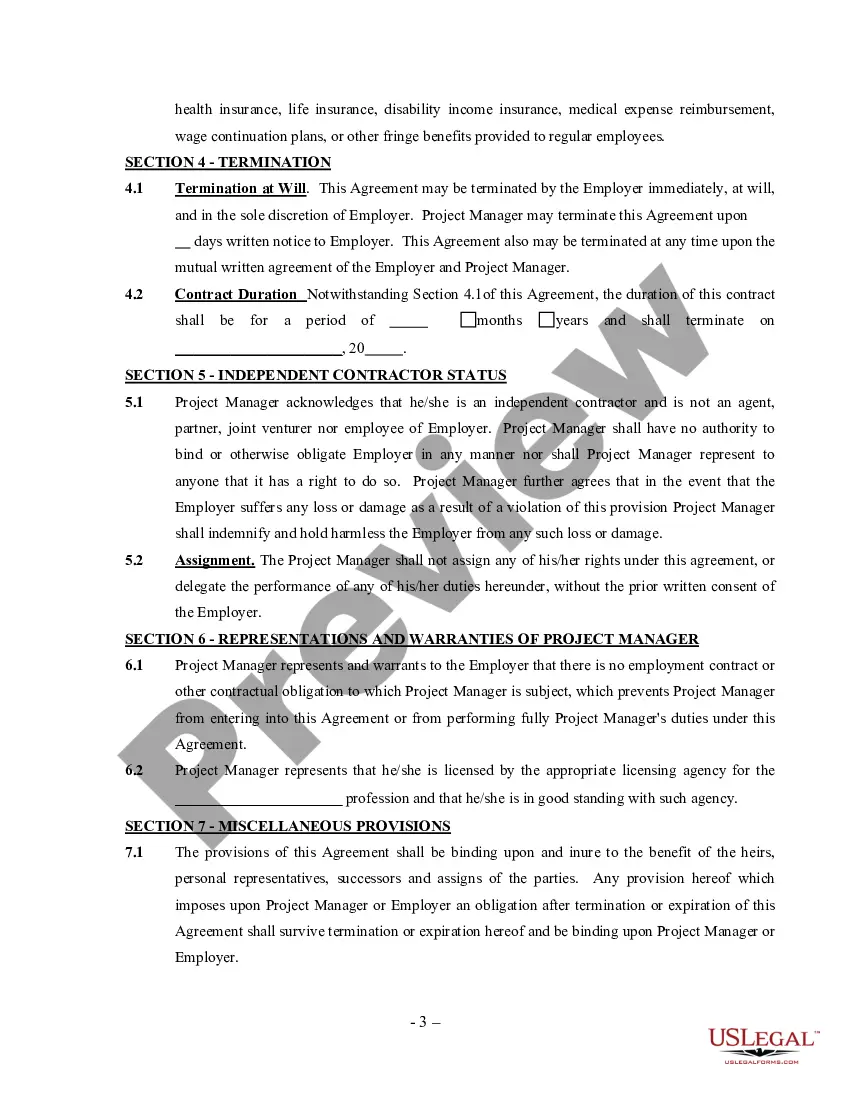

A 1099 employee typically cannot be bound by a non-compete agreement in California. The law views these types of agreements as restrictive and limits their enforceability. If you're working under a California Outside Project Manager Agreement - Self-Employed Independent Contractor, it's vital to understand your rights. Our platform can assist you with resources to navigate your contract obligations effectively.

Non-compete agreements are generally not enforceable in California for independent contractors. This principle applies widely across numerous professions, protecting individual rights to pursue their careers. If you are entering a California Outside Project Manager Agreement - Self-Employed Independent Contractor, be cautious of any non-compete clauses. For more insights, consider exploring the legal tools available through our platform.

The new law in California, known as AB 5, significantly impacts how independent contractors are classified. It establishes stricter criteria for determining independent contractor status, further safeguarding workers’ rights. If you work under a California Outside Project Manager Agreement - Self-Employed Independent Contractor, ensure you meet the guidelines set forth in AB 5. For further details, our platform provides extensive legal resources for independent contractors.

In California, non-compete agreements typically do not hold up against independent contractors. The California Business and Professions Code restricts such clauses, as they may hinder an individual's ability to work freely. Understanding the implications of a California Outside Project Manager Agreement - Self-Employed Independent Contractor is essential for anyone in this role. If you seek specific guidance, our platform offers comprehensive resources.

The law applies only to workers in Californiaregardless of where the employer is based. It does not apply to workers outside of California even if the employer is based in California.

In California, most businesses need to obtain a business license at the county or city level for tax purposes. An exception to this is some unincorporated areas of counties. In addition, you may need other licenses or permits from your local government depending on your business activity or location.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.

Many California counties require businesses to obtain a business operating license before doing business in the county. This requirement applies to all businesses, including one-person, home-based operations.