California Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Locating the appropriate legitimate record template can be challenging.

Certainly, there are numerous templates available online, but how can you find the valid form you seek.

Utilize the US Legal Forms website. The service offers thousands of templates, including the California Qualified Written RESPA Request to Dispute or Validate Debt, which you can use for commercial and personal purposes.

If the form does not meet your needs, use the Search field to find the right form. Once you are certain that the form is appropriate, click the Purchase now button to acquire the form. Select the pricing option you desire and input the required information. Create your account and complete a transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, and print, then sign the obtained California Qualified Written RESPA Request to Dispute or Validate Debt. US Legal Forms is the largest repository of legal templates from which you can find various document templates. Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the California Qualified Written RESPA Request to Dispute or Validate Debt.

- Use your account to search through the legal forms you have purchased previously.

- Navigate to the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

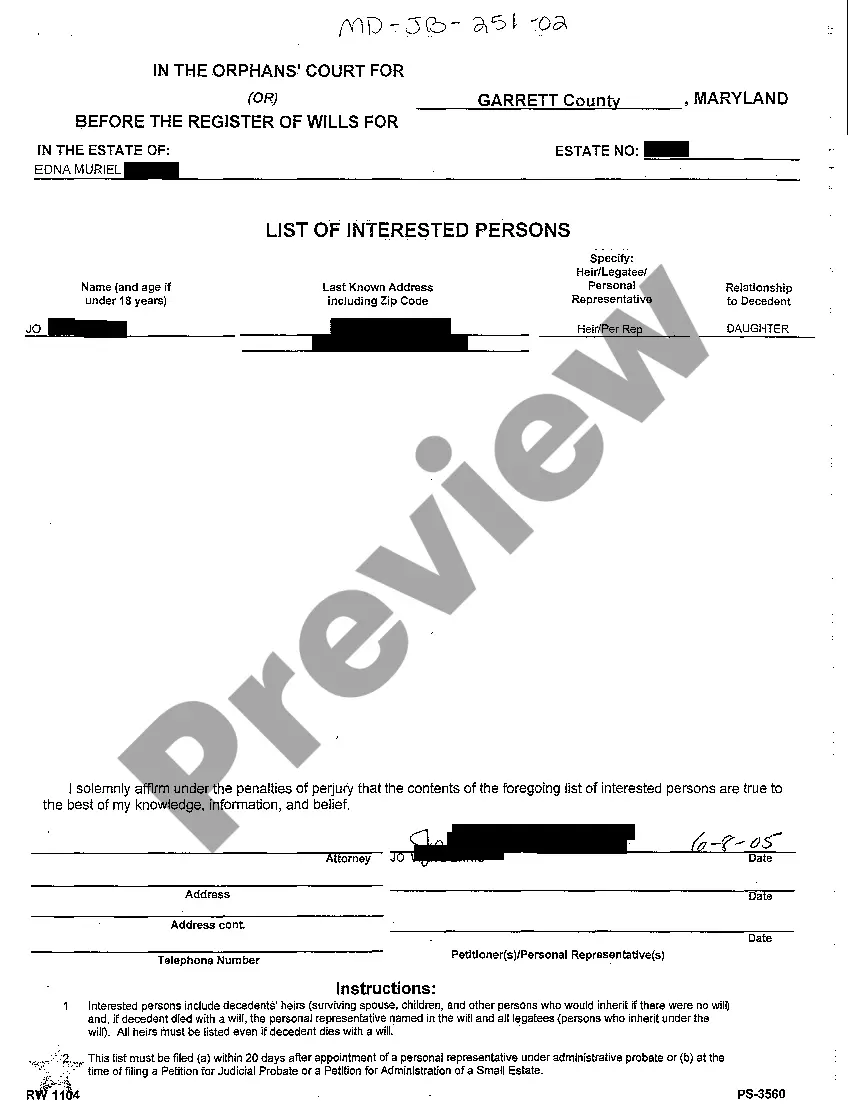

- First, ensure that you have selected the correct form for your region/county. You can review the form using the Review button and examine the form details to confirm it is suitable for you.

Form popularity

FAQ

When writing a dispute letter to a mortgage company, start by clearly identifying your account details and the specific issue you are disputing. Formulate your letter in a straightforward manner, clearly stating the facts and including any supporting documentation. End with a request for action and ensure you keep a copy of the letter for your records. Consider using resources like the uslegalforms platform to streamline this process and create effective documents.

To write a letter disputing a debt, begin by clearly identifying the debt and stating that you are disputing its validity. Use a California Qualified Written RESPA Request to Dispute or Validate Debt template to ensure you include all necessary information. This makes your letter formal and helps establish your rights as a consumer.

The new law for debt collection in California enhances protections for consumers by implementing stricter regulations on how debt collectors must operate. It requires debt collectors to provide more transparency about the debt they are collecting. Understanding the implications of these changes can empower you to use a California Qualified Written RESPA Request to Dispute or Validate Debt effectively.

Yes, you can dispute a valid debt if you believe there are inaccuracies or if you have legitimate reasons to question its validity. Disputing a debt does not necessarily mean it is invalid; rather, it can prompt a thorough review of your claim. Utilizing a California Qualified Written RESPA Request to Dispute or Validate Debt can help clarify your position.

To write a letter disputing the validity of a debt, clearly state your intention to dispute and include relevant details such as account numbers and amounts owed. Use a California Qualified Written RESPA Request to Dispute or Validate Debt format, which helps ensure you cover all necessary legal aspects. Be sure to retain a copy for your records.

When responding to a debt validation letter, first verify the details provided by the creditor. If you believe there are inaccuracies, you should articulate your concerns clearly in your response. You can also reference the California Qualified Written RESPA Request to Dispute or Validate Debt to guide your response and emphasize your position.

To file a debt validation claim, start by sending a California Qualified Written RESPA Request to Dispute or Validate Debt to the creditor or collector. Include your personal information, details of the debt, and request verification. Document your communications, as this will be important if any disputes arise later.

A validation letter for debt in California is a formal request from you to a creditor or collector asking them to validate the debt they claim you owe. This process provides you the legal right to obtain details about the debt, including the original creditor's name and amount owed. Utilizing a California Qualified Written RESPA Request to Dispute or Validate Debt can help you ensure all necessary information is included.

The best sample for a debt validation letter includes clear language requesting verification of the debt, along with a statement of your rights under the Fair Debt Collection Practices Act. You can use a California Qualified Written RESPA Request to Dispute or Validate Debt template for guidance. This ensures your letter is well-structured, which can enhance your chances of a favorable response.

RESPA prohibits kickbacks and referral fees for real estate settlement services, ensuring transparency in the mortgage process. Additionally, it prevents lenders from requiring excessive escrow deposits that are not justifiable. By understanding these prohibitions, you can navigate your mortgage responsibilities effectively, including using a California Qualified Written RESPA Request to Dispute or Validate Debt as needed.