California Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

If you require extensive, download, or printing legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for professional and personal purposes are categorized by types and indicates, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Step 4. Once you have found the form you need, click on the Get now button. Select the pricing plan you prefer and add your details to register for an account.

- To obtain the California Personnel Status Change Worksheet with just a few clicks, use US Legal Forms.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the California Personnel Status Change Worksheet.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read all the information.

Form popularity

FAQ

A change of status occurs when an employee will change from full-time to part-time, part-time to full-time, or will otherwise have a change is the number of hours regularly worked per week.

Use Worksheet B to determine whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances.

A status change allows you to change from one medical insurance plan to another if the coverage category is changing. For example, current coverage category is "employee only". Due to the status change the coverage category is now "employee + family".

Employment Status in the United States In general, U.S. organizations use employment status to refer to the type of implied or written contract between the employer and employee, e.g., full-time employment, part-time employment, temporary or contract employment, or an internship or apprenticeship.

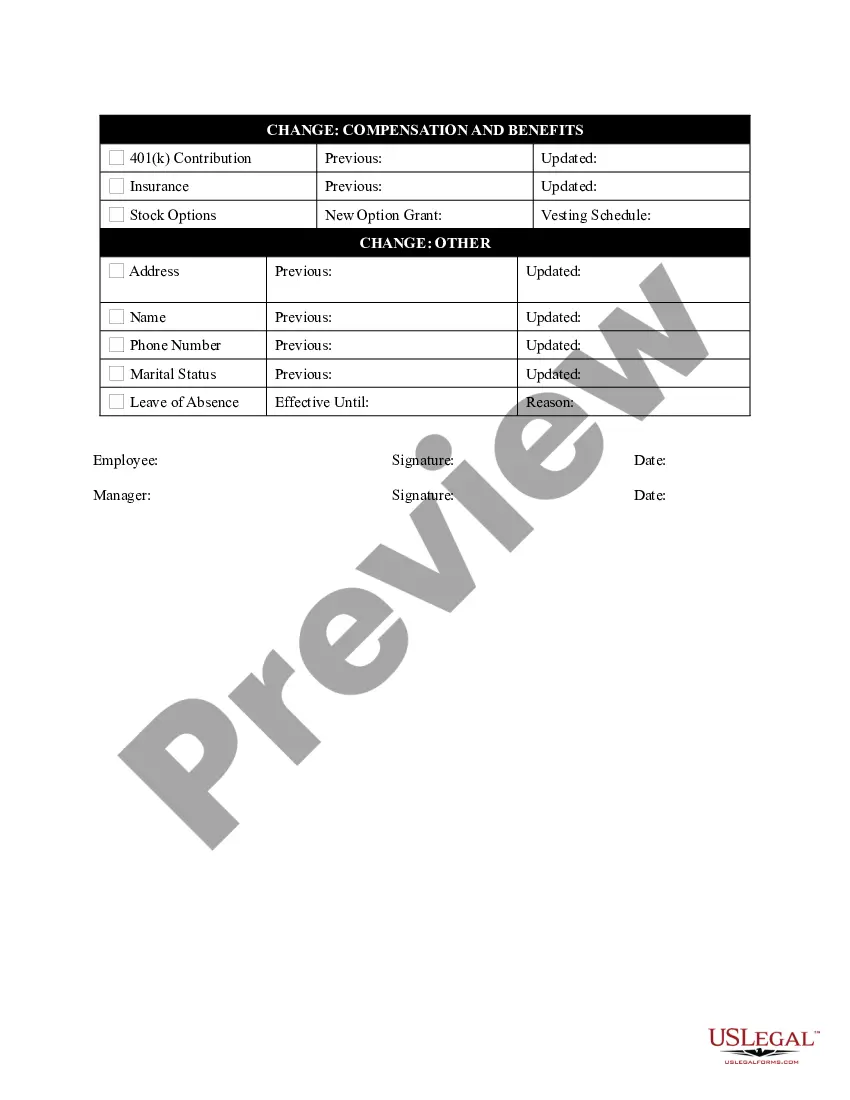

The purpose of the Employee Change of Status Form is to collect historical documentation and communication information. All Employee Change of Status Forms must include the employee's name, department if applicable, job title, effective date, date it was prepared and signed, and the change of status.

Change in Employment Status You experience a Change in Employment Status when the number of hours You are expected to provide on an ongoing basis either increases from less than 30 hours per week to 30 or more hours per week or decreases from 30 or more hours per week to less than 30 hours per week.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck.

The low income exemption amount for Single, and Married with 0 or 1 allowance has increased from $14,573 to $15,042. The low income exemption amount for Married with 2 or more allowances, and Head of Household has increased from $29,146 to $30,083.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.