California Log of Records Retention Requirements

Description

How to fill out Log Of Records Retention Requirements?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse range of legal document templates you can access or create.

By using the website, you can acquire thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can obtain the latest versions of forms such as the California Log of Records Retention Requirements in minutes.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

When you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account.

- If you hold a subscription, Log In and retrieve the California Log of Records Retention Requirements from the US Legal Forms library.

- The Obtain button will appear on every form you view.

- You have access to all previously saved forms from the My documents section of your account.

- To begin using US Legal Forms for the first time, here are simple instructions to help you start.

- Ensure you have selected the correct form for your city/county.

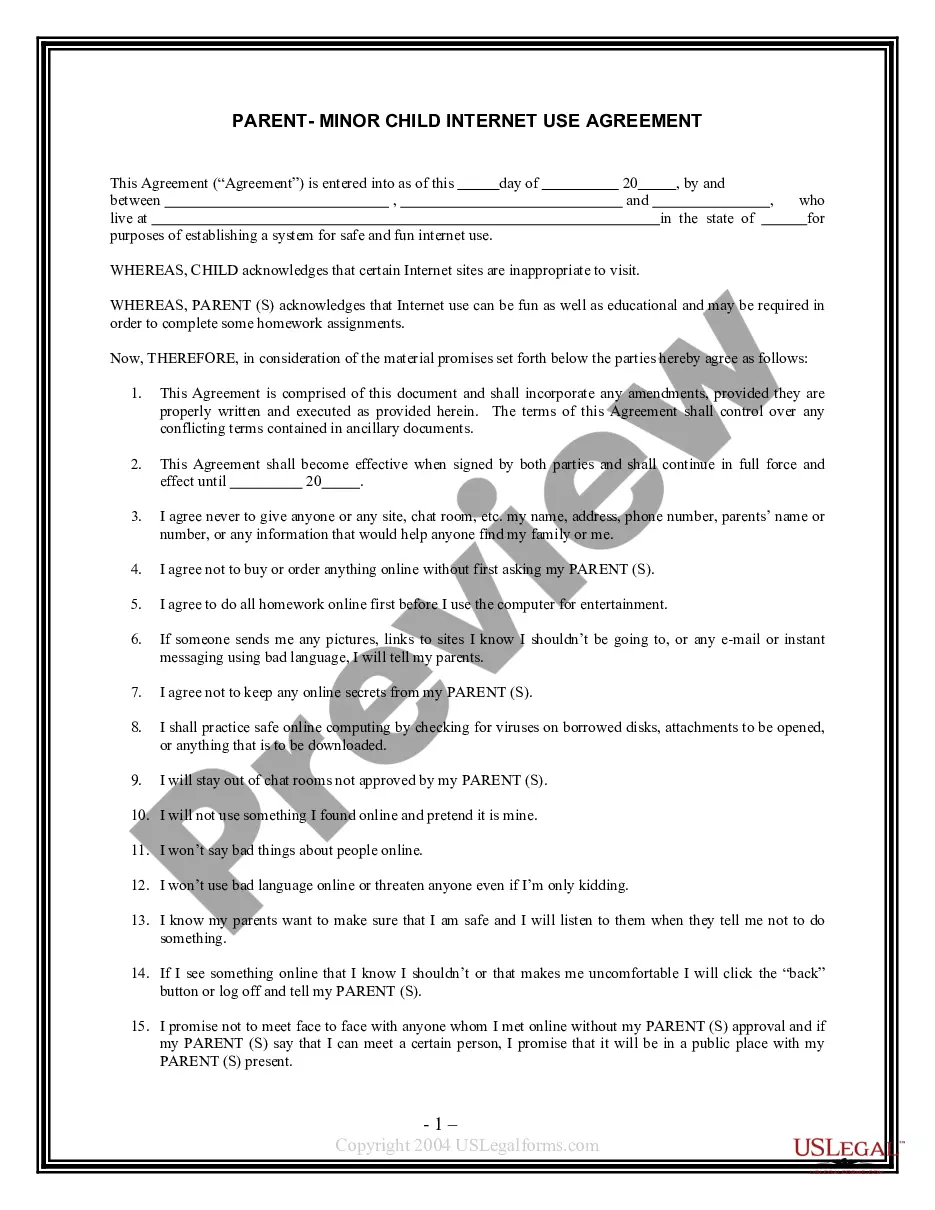

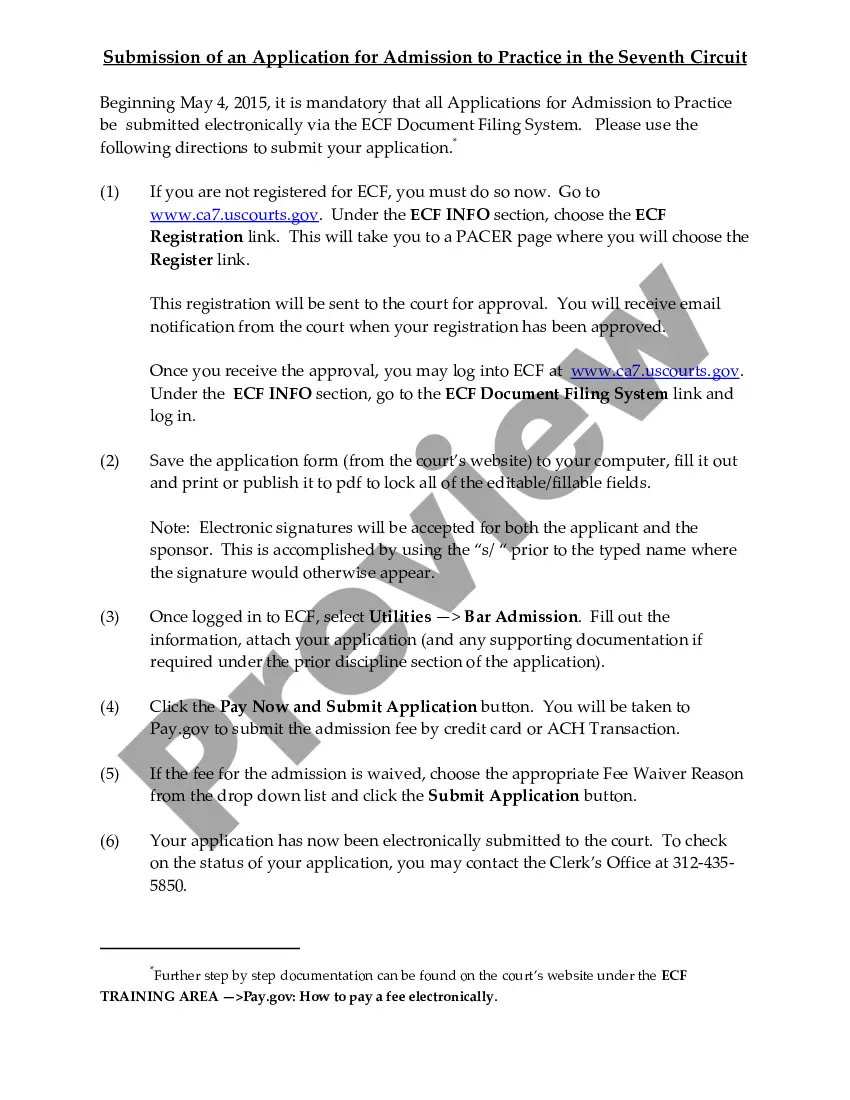

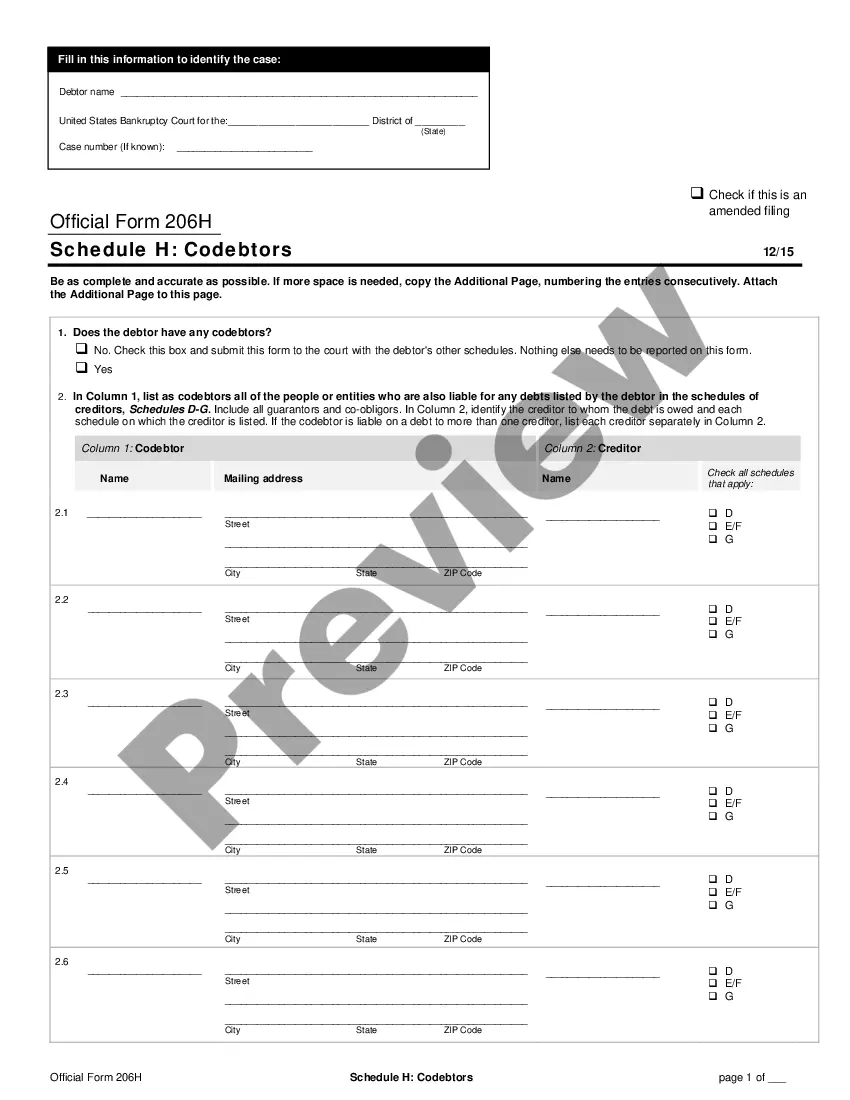

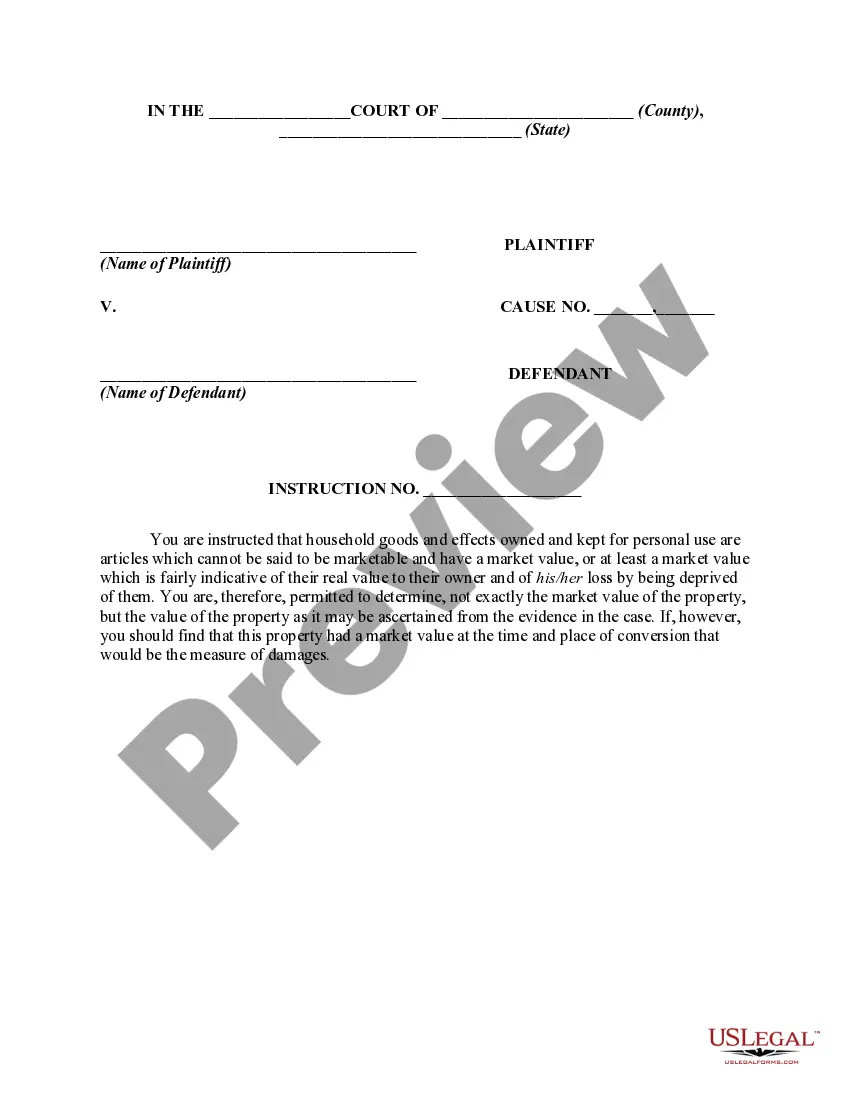

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Maintain a copy of each employee's personnel records for no less than 3 years. Make a current employee's personnel records available, and if requested by the employee or representative, provide a copy at the place where the employee reports to work or at another location agreeable to the employer and the requester.

The following documents must be retained for 3 years: Employee personnel files (3 years after termination of employment) Recruitment and hiring records.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Among new laws taking effect this coming year is Senate Bill 807, signed by Governor Newsom in September. Beginning on January 1, 2022, employers will be required to retain personnel records for applicants and employees for a minimum of four years (up from the previous requirement of three years).

California Labor Code section 1174 requires that all payroll records showing employees' daily hours worked and the wages paid to them be kept in the State of California. And these records must be kept for three years.

While required retention periods of no more than three years are most common, California law imposes requirements of as long as eight years for certain employment records and six years for certain tax and corporate records.

Permanent or 5 years after closing of the office in India. Registered documents of companies which have been fully wound up and finally dissolved together with correspondence relating to such companies. Permanent or the last change of situation of the registered office.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

Maintain a copy of each employee's personnel records for no less than 3 years. Make a current employee's personnel records available, and if requested by the employee or representative, provide a copy at the place where the employee reports to work or at another location agreeable to the employer and the requester.