California Invoice Template for Sole Trader

Description

How to fill out Invoice Template For Sole Trader?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the California Invoice Template for Sole Trader in just moments.

If you already have a subscription, Log In and download the California Invoice Template for Sole Trader from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents tab of your account.

If you are new to US Legal Forms, here are simple steps to help you get started.

Process the payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your city/state.

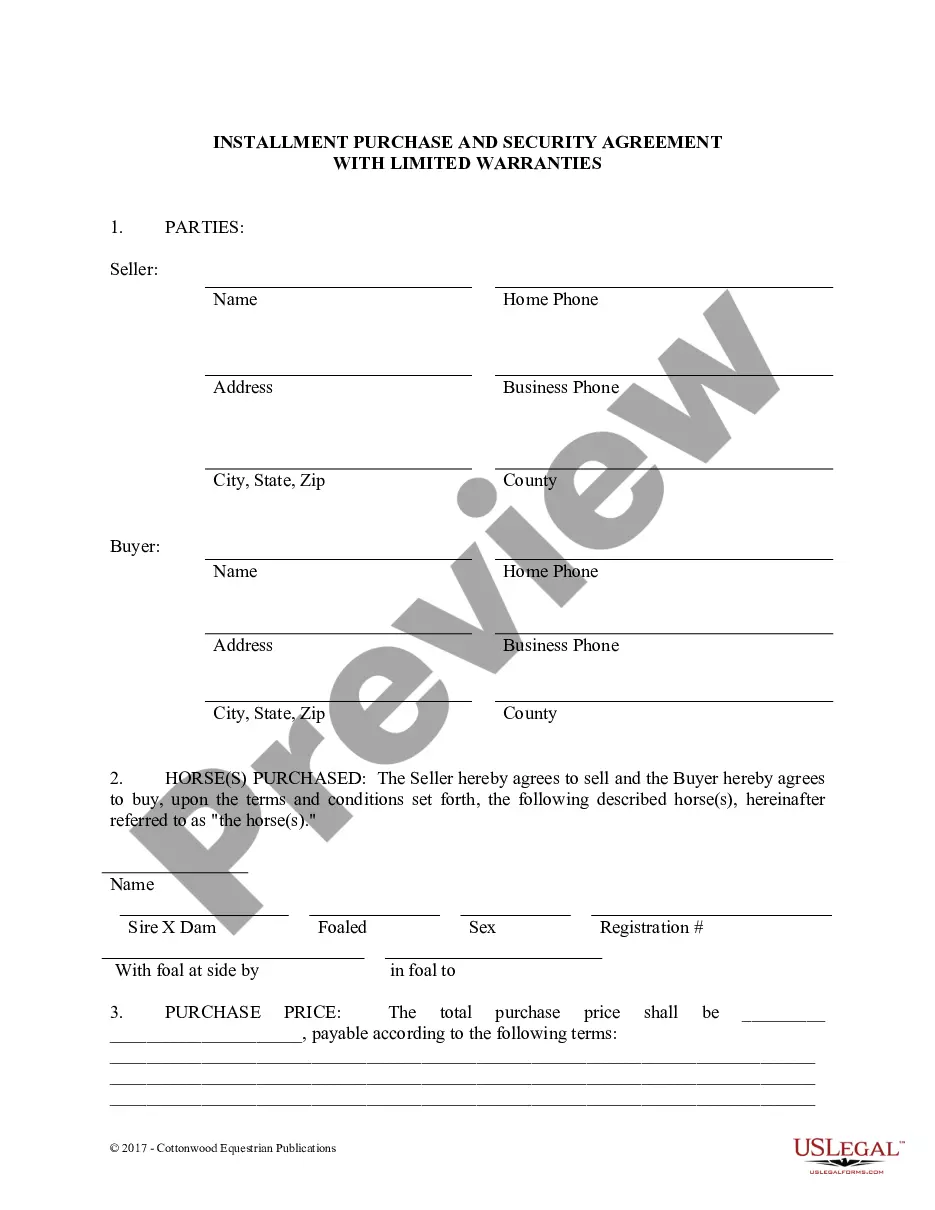

- Click the Preview button to examine the form's details.

- Review the form information to make sure you have chosen the appropriate form.

- If the form does not fulfill your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

Invoicing as a sole trader involves using a California Invoice Template for Sole Trader to ensure your documentation is accurate. Begin with your personal information, list the services provided, and be sure to include payment details. This format not only simplifies your invoicing process but also reinforces your professionalism as a sole trader.

To invoice using a sole trader template, start by utilizing a California Invoice Template for Sole Trader available on platforms like uslegalforms. You can enter your personal and business information, itemize your services, and set clear payment instructions. This ensures that your invoice is professional and legally compliant.

Invoicing without a company is straightforward when you use a California Invoice Template for Sole Trader. You simply need to enter your name and personal details as the service provider. Customize the template with your client's information and specify the services provided to create a valid invoice.

To make an invoice as a sole proprietor, start with a California Invoice Template for Sole Trader. Fill in your business name, contact information, and details of the services rendered. Include payment terms and ensure that all relevant information is clear and concise, which enhances credibility and professionalism.

Yes, you can invoice without an LLC. As a sole trader, you can create invoices for your services using a California Invoice Template for Sole Trader. This template allows you to include all necessary details, such as your name, address, and services provided, ensuring you meet basic legal and professional standards.

Creating an invoice as an independent contractor involves a few key steps. First, gather all relevant information such as your legal name, business information, and the services you've provided. A California Invoice Template for Sole Trader is an excellent resource, as it ensures you include all necessary components like itemized services and payment instructions, making the invoicing process seamless and efficient.

For a beginner, invoicing can feel overwhelming, but it doesn't have to be. Start by gathering all necessary information, including client details and services offered. Utilizing a California Invoice Template for Sole Trader streamlines the process, guiding you through the required elements and ensuring that your invoices look professional and are easy to understand.

To generate an invoice as a sole trader, you can use a template specifically designed for your business needs. A California Invoice Template for Sole Trader provides a structured format that includes essential details like your business name, services rendered, and payment terms. By filling out the template, you can create appealing invoices that help organize your financial records easily.

Yes, it is legal to invoice yourself as a sole trader in California. When you provide services or products, issuing an invoice helps you keep track of your income and ensures proper record-keeping for tax purposes. Using a California Invoice Template for Sole Trader simplifies the process, making it easier to generate professional invoices that reflect your business accurately.

When making an invoice as a self-employed individual, include your business contact information and a clear breakdown of services rendered. Specify the payment due date and total amount at the end to avoid confusion. A California Invoice Template for Sole Trader can streamline this process, ensuring you have all necessary elements covered without hassle.