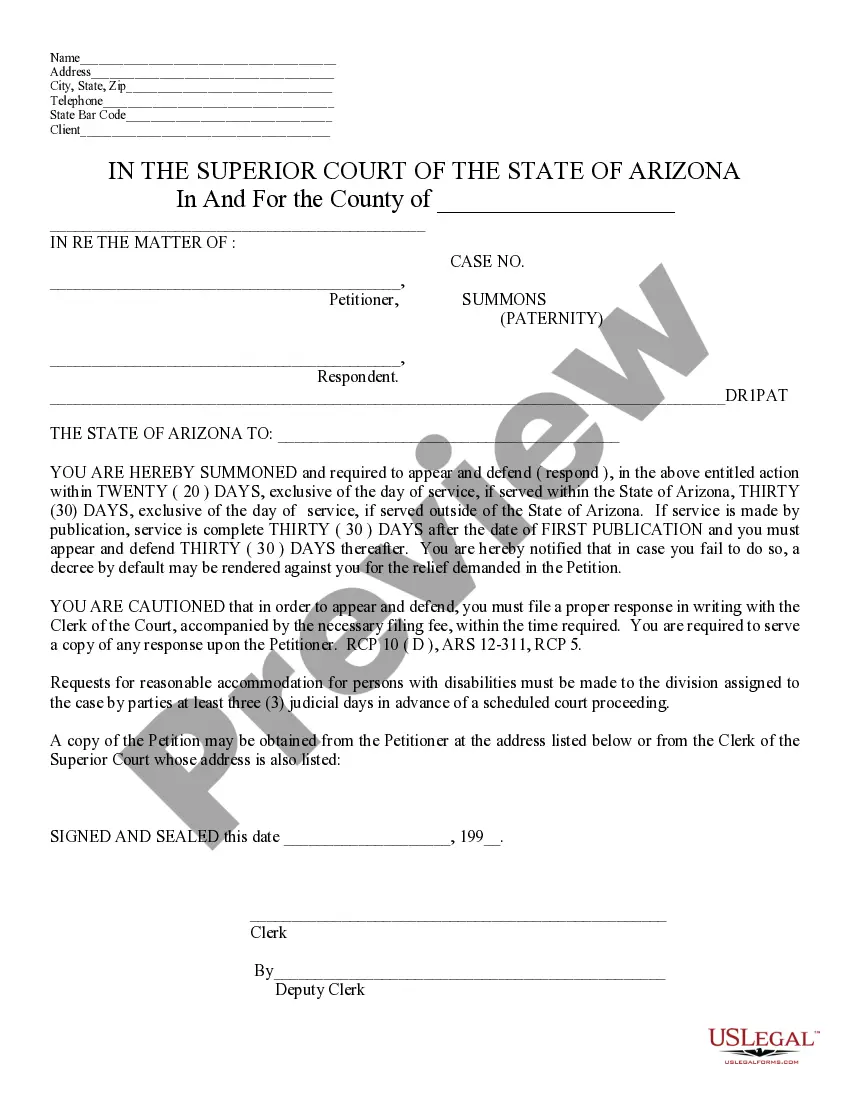

This form is a sample business credit application that can be used to take information from a business seeking a loan.

California Business Credit Application

Description

How to fill out Business Credit Application?

Are you currently inside a situation where you will need documents for both enterprise or person functions nearly every day? There are plenty of lawful papers templates accessible on the Internet, but locating types you can depend on isn`t straightforward. US Legal Forms gives a large number of type templates, just like the California Business Credit Application, that happen to be written to fulfill federal and state requirements.

Should you be presently familiar with US Legal Forms site and get a merchant account, simply log in. Next, you can download the California Business Credit Application template.

Unless you provide an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the type you want and make sure it is for the correct metropolis/state.

- Utilize the Review key to examine the shape.

- Browse the description to ensure that you have chosen the appropriate type.

- In case the type isn`t what you are searching for, make use of the Lookup field to obtain the type that fits your needs and requirements.

- Whenever you discover the correct type, simply click Get now.

- Choose the rates plan you want, fill out the desired information and facts to create your money, and pay for an order using your PayPal or charge card.

- Choose a hassle-free paper file format and download your duplicate.

Get each of the papers templates you possess purchased in the My Forms food list. You can get a further duplicate of California Business Credit Application anytime, if needed. Just go through the necessary type to download or print the papers template.

Use US Legal Forms, one of the most extensive selection of lawful kinds, in order to save some time and avoid errors. The support gives professionally made lawful papers templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

The California Competes Tax Credit (CCTC) is an income tax credit available to businesses that want to locate in California or stay and grow in California. Businesses of any industry, size, or location compete for over $180 million available in tax credits by applying in one of the three application periods each year.

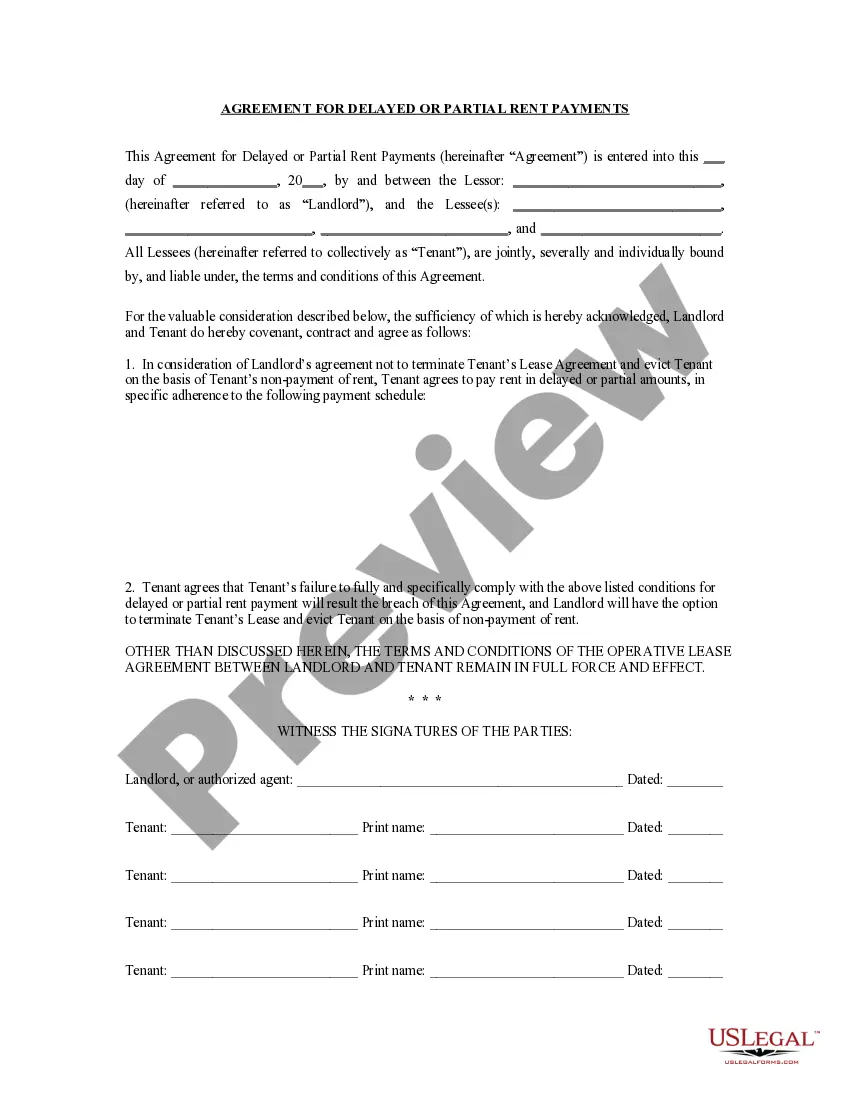

A business credit application can make it easy to collect all the information you need to properly gauge the risk a specific customer poses. It can also help you determine how much credit is appropriate at that time.

The New Employment Credit is a CA income tax credit for businesses located in former enterprise zones, as well as areas with high unemployment or poverty. It excludes temporary help agencies, retailers, and food services, unless those businesses have less than $2 million in gross receipts (small businesses).

The California Competes Tax Credit (CCTC) provides tax credits to businesses who are looking to grow across the state, relocate to California from a different state, or stay in the state. For more information about the program's eligibility, guidelines and application periods please click here.

You must have earned income from employment, self-employment, or employer-paid disability benefits received prior to retirement. You must have a Social Security Number valid for employment. You cannot file your taxes as ?married filing separately.? If you're married, you must file a joint tax return.

California Competes Tax Credit (?Cal Competes?): This discretionary program was re-authorized through fiscal year 2022-2023 and makes available an annual total of $180 million of corporate income tax credits (plus any additional amounts made available via recapture), to businesses that create new jobs and make capital ...

Have an Adjusted Gross Income (AGI) on your 2020 CA tax return, that is: If filing as Head of household, qualifying widow(er), Married/Registered Domestic Partner (RDP) filing jointly: $500,000 or less. If filing as Single or Married/Registered Domestic Partner (RDP) filing separately: $250,000 or less.