California Revocable Living Trust for Unmarried Couples

Description

How to fill out Revocable Living Trust For Unmarried Couples?

Are you presently in a situation where you require paperwork for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding versions you can trust is not simple.

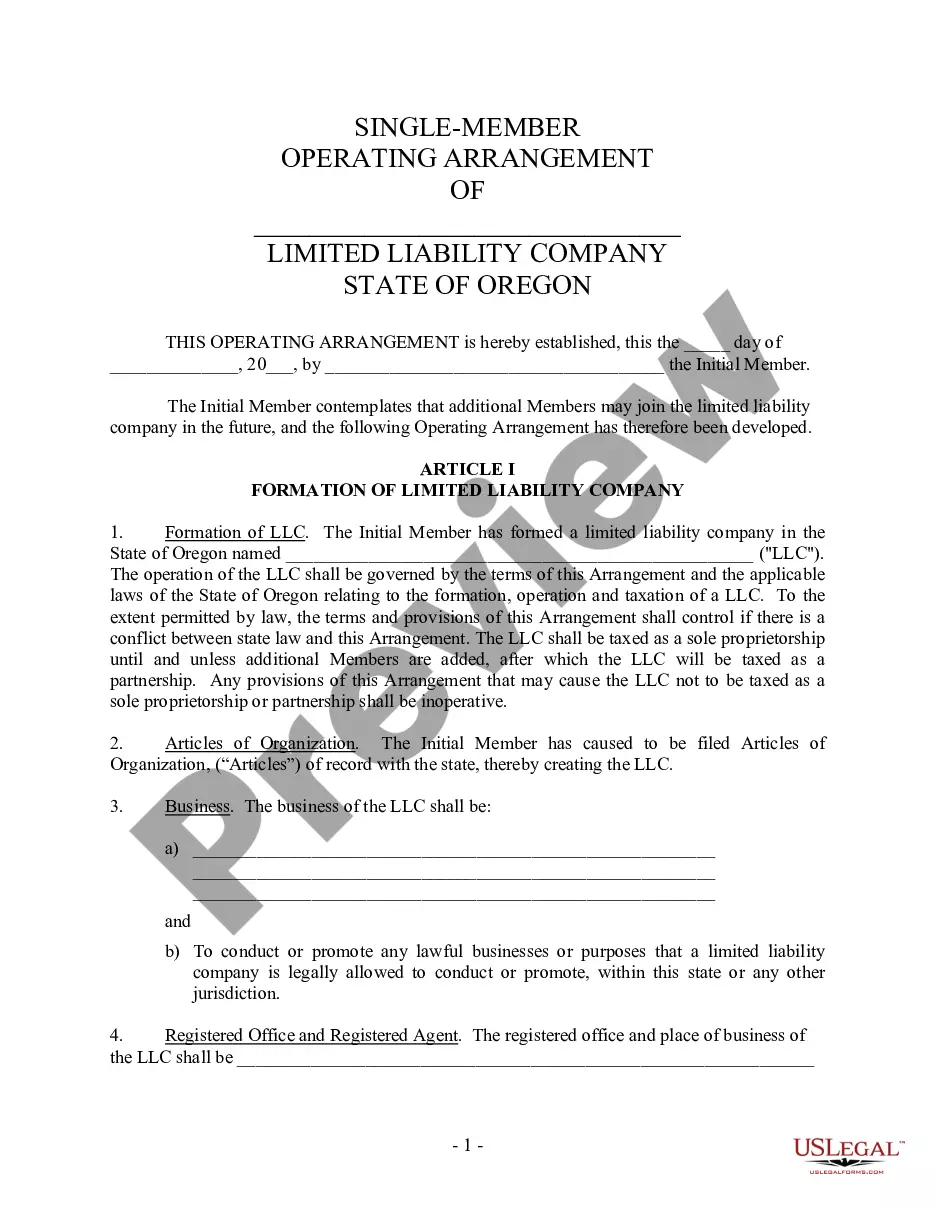

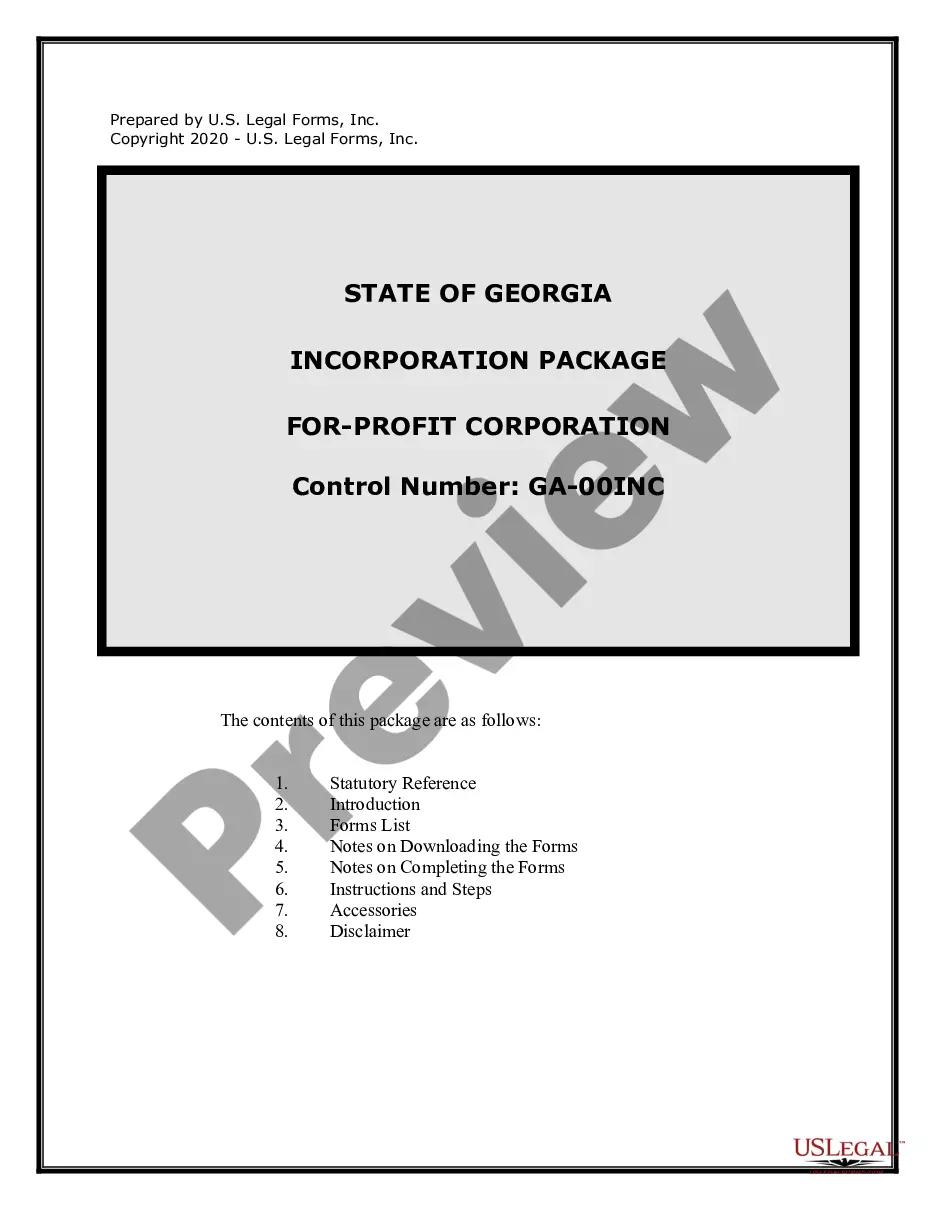

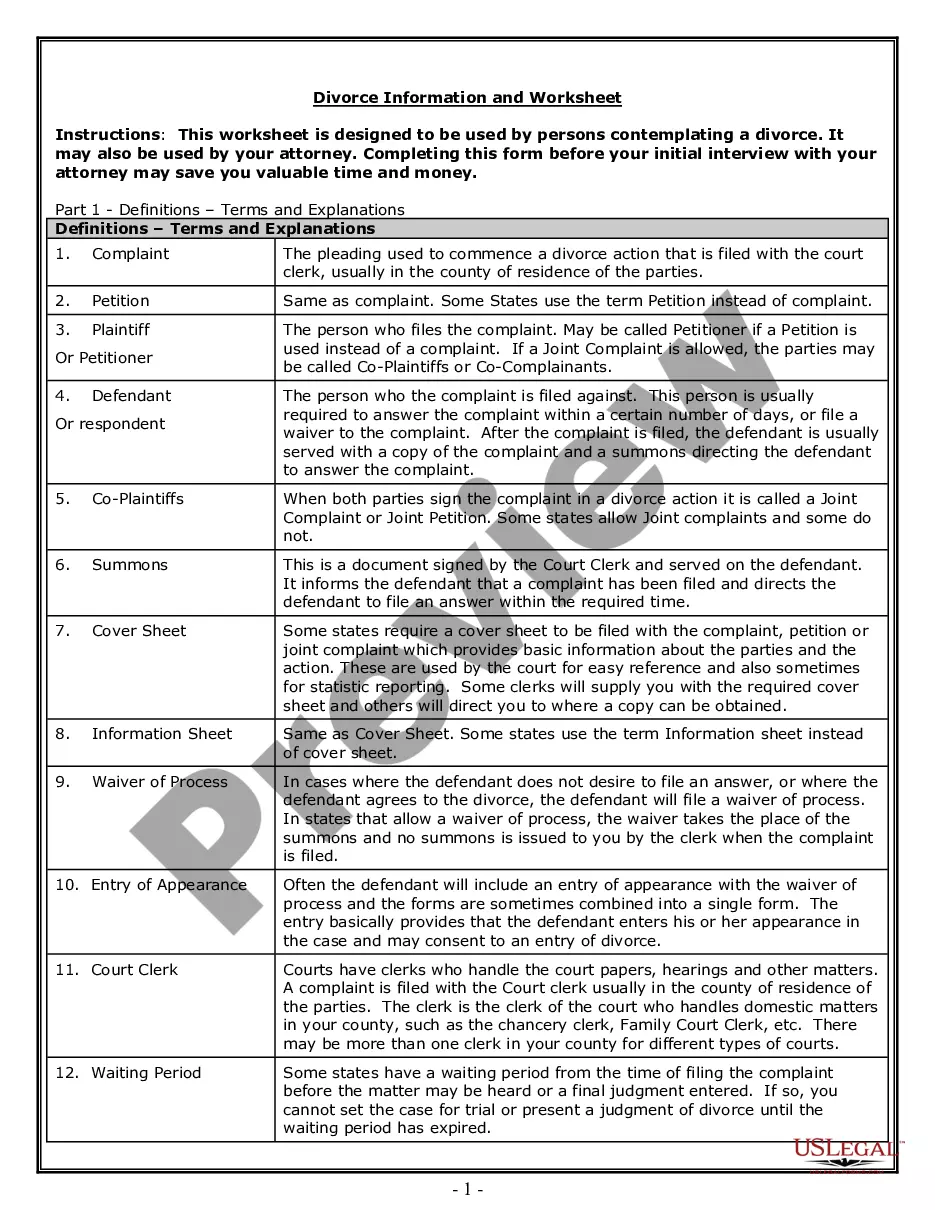

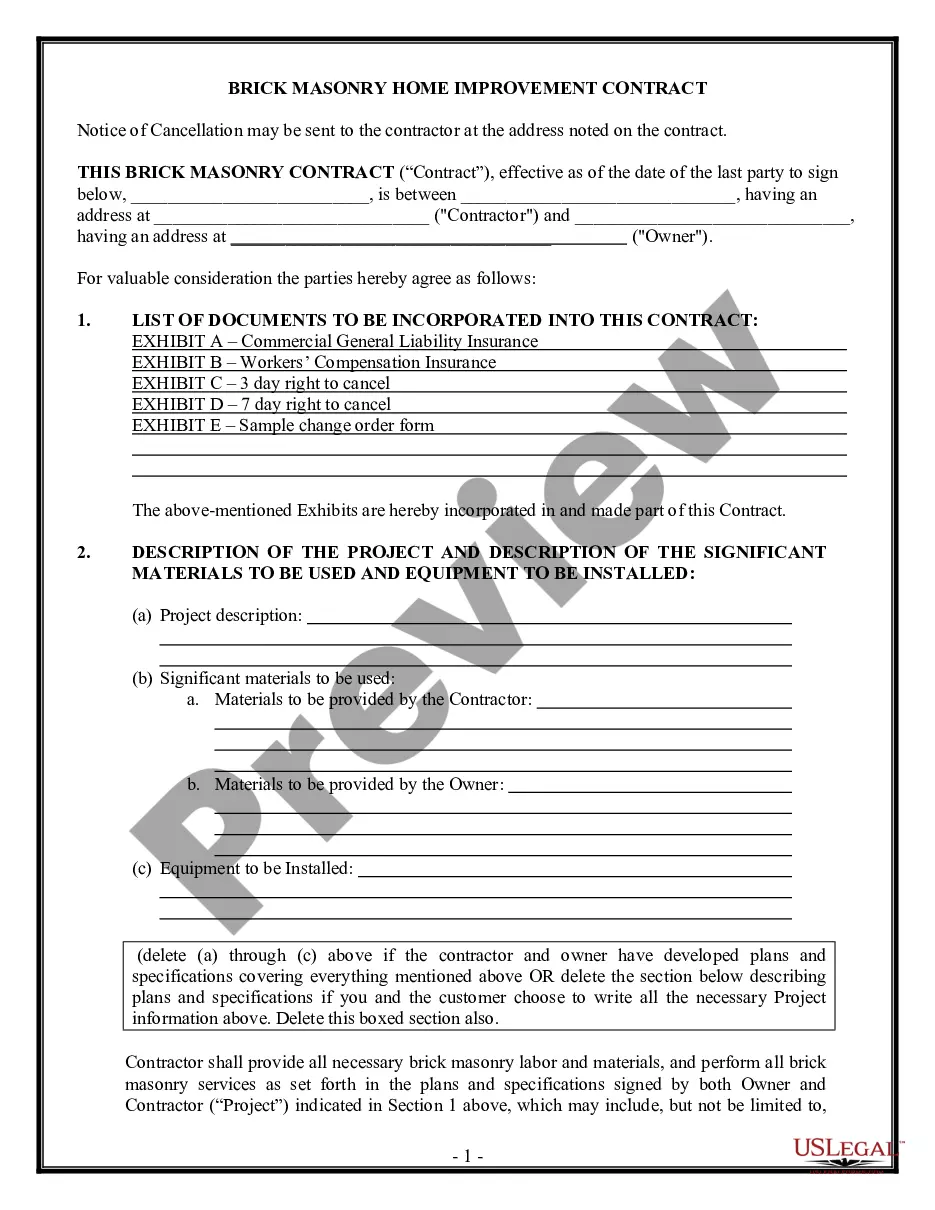

US Legal Forms offers thousands of form templates, including the California Revocable Living Trust for Unmarried Couples, that comply with federal and state requirements.

If you locate the correct form, click Buy now.

Select the pricing plan you desire, fill in the required details to create your account, and purchase your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the California Revocable Living Trust for Unmarried Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/state.

- Use the Preview button to review the form.

- Read the summary to confirm that you selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the form that fits your needs.

Form popularity

FAQ

The best trust for a single person often depends on their individual needs and circumstances. A California Revocable Living Trust for Unmarried Couples may still be beneficial even if you are single, as it allows for precise control over your assets. This type of trust can help you avoid probate, manage your estate, and designate how and when your assets are distributed. Utilizing a trust gives you peace of mind regarding your financial legacy.

The most popular form of marital trust is the A/B trust, which allocates assets to ensure the surviving partner maintains control. However, for unmarried couples, a California Revocable Living Trust for Unmarried Couples can often serve a similar purpose. This structure allows couples to specify how their assets should be managed during their lifetime and distributed after death. By addressing your unique situation, you can better protect both partners’ interests.

Choosing between a single trust and a joint trust depends on your financial situation and goals. A California Revocable Living Trust for Unmarried Couples allows both partners to share assets while maintaining individual control. If you want flexibility and ease of management, a joint trust can simplify the process. However, if you prefer to keep your assets separate, a single trust might be more suitable.

For unmarried couples, joint tenancy with right of survivorship is often the best option. This arrangement ensures that if one partner passes away, their share automatically transfers to the surviving partner. A California Revocable Living Trust for Unmarried Couples can also help facilitate the transfer of assets and provide additional protection for both partners. By setting up a trust, you can clarify your wishes and streamline asset management.

A California Revocable Living Trust for Unmarried Couples has notable advantages, such as avoiding probate and simplifying the transfer of assets upon death. However, it may also bring complexities in its setup and maintenance, along with the potential need for additional legal guidance. Understanding both sides can help you make an informed decision.

For unmarried couples looking to protect their property, a California Revocable Living Trust is often the best option. This type of trust allows for seamless management and transfer of real estate while offering flexibility to make changes over time. Depending on individual circumstances, consulting uslegalforms could help clarify which trust best fits your needs.

A California Revocable Living Trust for Unmarried Couples has some disadvantages, such as the complexity of initial setup and the ongoing administrative requirements. Although it avoids probate, it does not protect assets from creditors or lawsuits. Moreover, changes in life circumstances could necessitate a complete revision of the trust document.

In a California Revocable Living Trust for Unmarried Couples, the trust itself technically owns the property. However, the individuals who created the trust are considered the beneficiaries and retain control over the assets. This allows them to manage or amend the trust during their lifetime, ensuring they have the flexibility they need.

Yes, you can create a California Revocable Living Trust for Unmarried Couples independently of your partner. This type of trust allows you to allocate your assets according to your wishes, especially if your partner is not a spouse. It's important to keep your partner informed and aligned with estate planning, ensuring that both of your interests are protected.

In California, a California Revocable Living Trust for Unmarried Couples does not require court filing. This allows for confidentiality and flexibility, as the assets in a trust transfer directly to beneficiaries without the probate process. However, certain legal documents may be beneficial to support the trust’s structure, so consulting with a legal expert is advisable.