California Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

US Legal Forms - one of the greatest libraries of legal forms in the United States - delivers a wide array of legal file themes you are able to down load or produce. While using website, you can get 1000s of forms for enterprise and personal functions, categorized by categories, says, or key phrases.You will find the newest versions of forms such as the California Complex Will - Credit Shelter Marital Trust for Spouse in seconds.

If you already have a membership, log in and down load California Complex Will - Credit Shelter Marital Trust for Spouse from your US Legal Forms collection. The Obtain switch will appear on each and every develop you look at. You have access to all earlier delivered electronically forms inside the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, allow me to share straightforward directions to get you began:

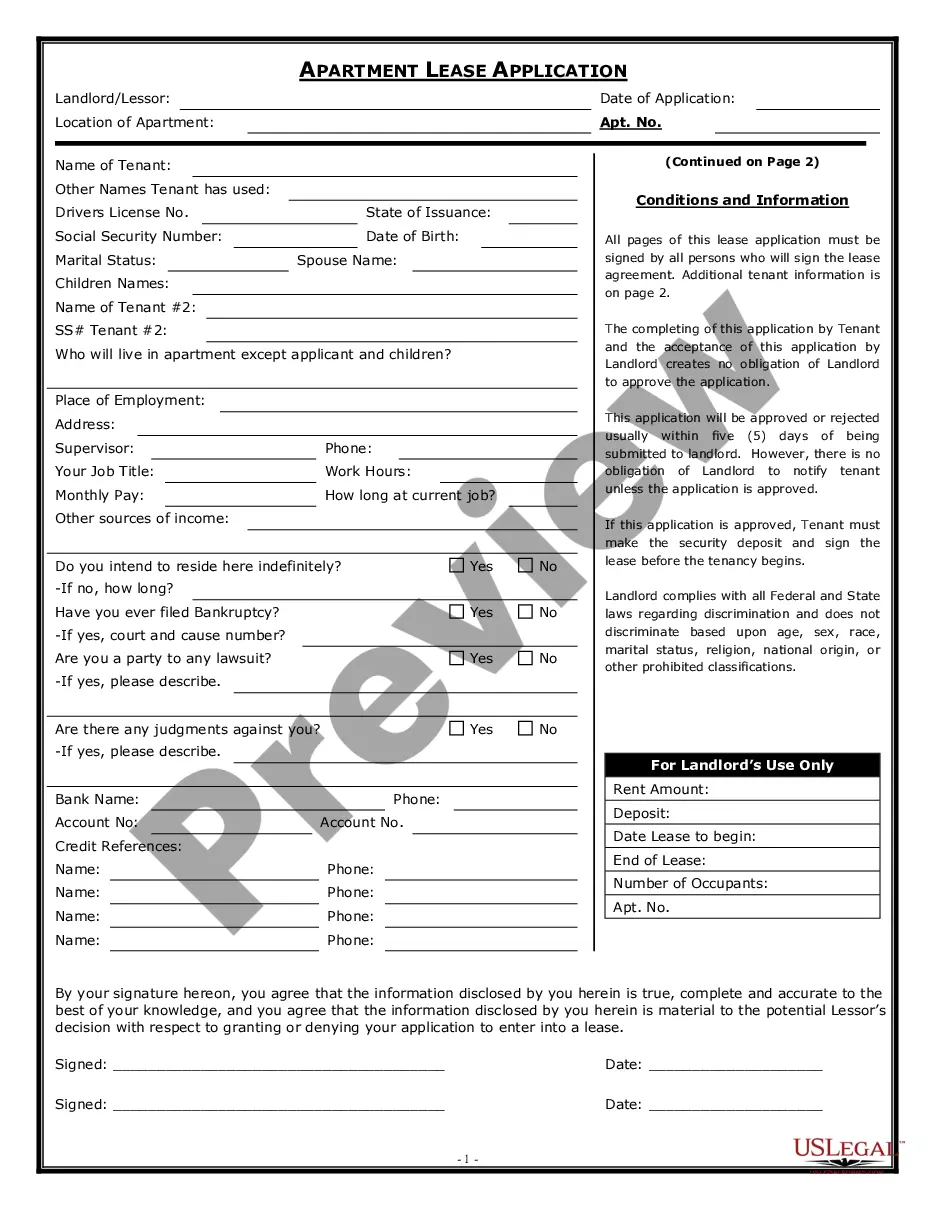

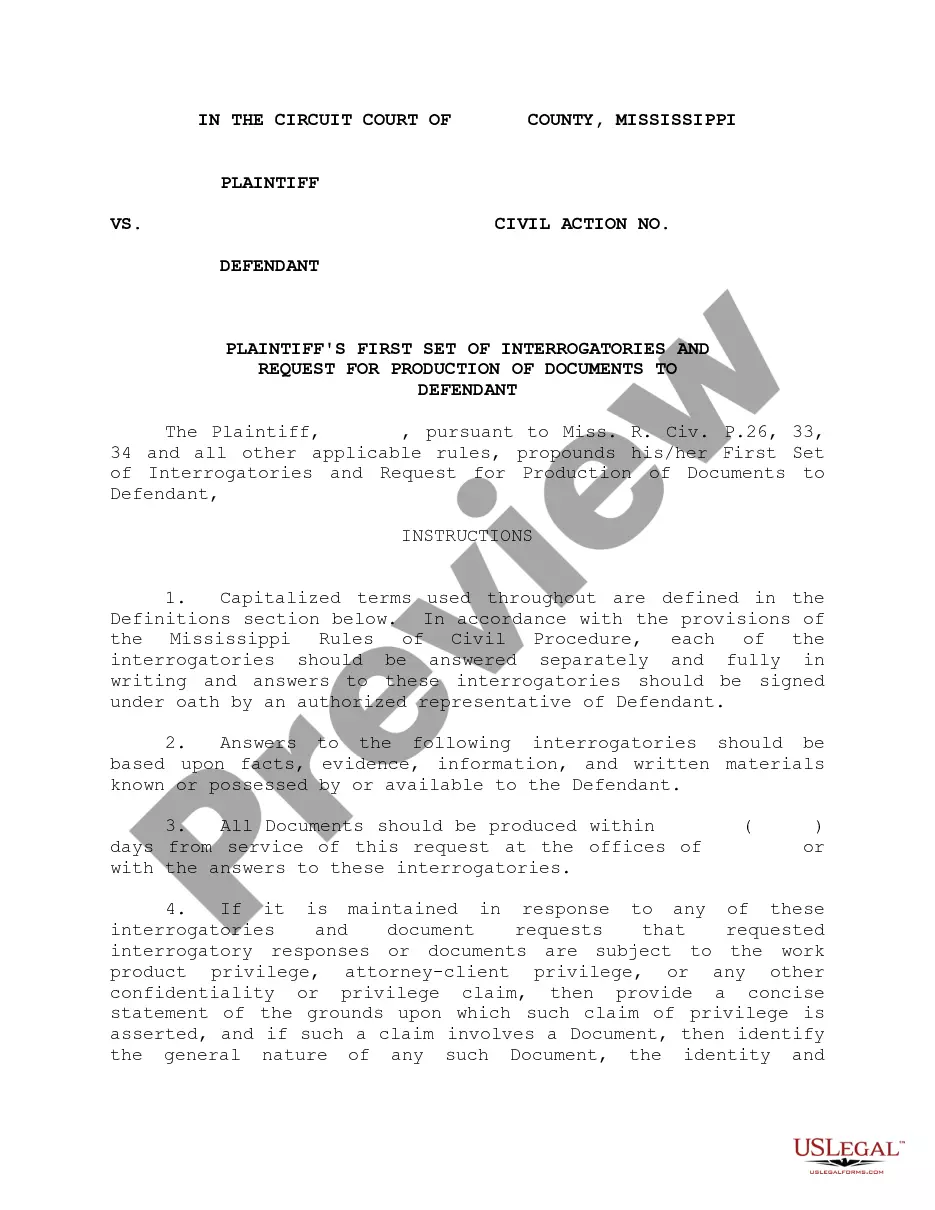

- Ensure you have chosen the best develop for your city/area. Click the Preview switch to examine the form`s content. See the develop description to actually have chosen the right develop.

- In case the develop does not satisfy your needs, utilize the Research discipline near the top of the display screen to discover the the one that does.

- If you are happy with the shape, verify your decision by clicking on the Purchase now switch. Then, pick the prices prepare you favor and supply your accreditations to register to have an bank account.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to perform the financial transaction.

- Find the format and down load the shape on your own system.

- Make changes. Complete, revise and produce and signal the delivered electronically California Complex Will - Credit Shelter Marital Trust for Spouse.

Every template you added to your bank account does not have an expiry particular date which is your own property eternally. So, in order to down load or produce one more duplicate, just proceed to the My Forms portion and then click around the develop you require.

Obtain access to the California Complex Will - Credit Shelter Marital Trust for Spouse with US Legal Forms, one of the most comprehensive collection of legal file themes. Use 1000s of specialist and express-distinct themes that meet your organization or personal requires and needs.

Form popularity

FAQ

Once the court orders a property division between the two former spouses, the trust no longer has assets in it and it evaporates as a matter of law. As soon as that divorce is finalized, that Living Trust blinks out of existence.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

Sometimes trusts can give assets to the beneficiaries and protect those assets from the beneficiaries' creditors. But a Living Trust does not shelter the settlor from creditors. A creditor of the settlor has the same right to go after the trust property as if the settlor still owned the assets in his or her own name.

Community and Separate Property Principles California is a community property state, so any property acquired during the marriage is generally subject to equal distribution between the spouses in the event of divorce. In California, trusts established before marriage are generally considered separate property.

If the beneficiary of a testamentary trust chooses to keep the assets in the trust and does not use them to purchase family assets (such as a family home), the assets are not generally subject to division in the event of relationship breakdown.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

The trustee is the person (or people) who holds legal title to the property that is in the trust. The trustee's job is to manage the property in the trust for the benefit of the beneficiaries in the way the settlor has asked.