California Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

If you need to total, obtain, or produce valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Step 4. Once you have identified the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the California Revocable Living Trust for Married Couple with just a few clicks.

- If you are currently a US Legal Forms client, Log In to your account and click the Download button to obtain the California Revocable Living Trust for Married Couple.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/country.

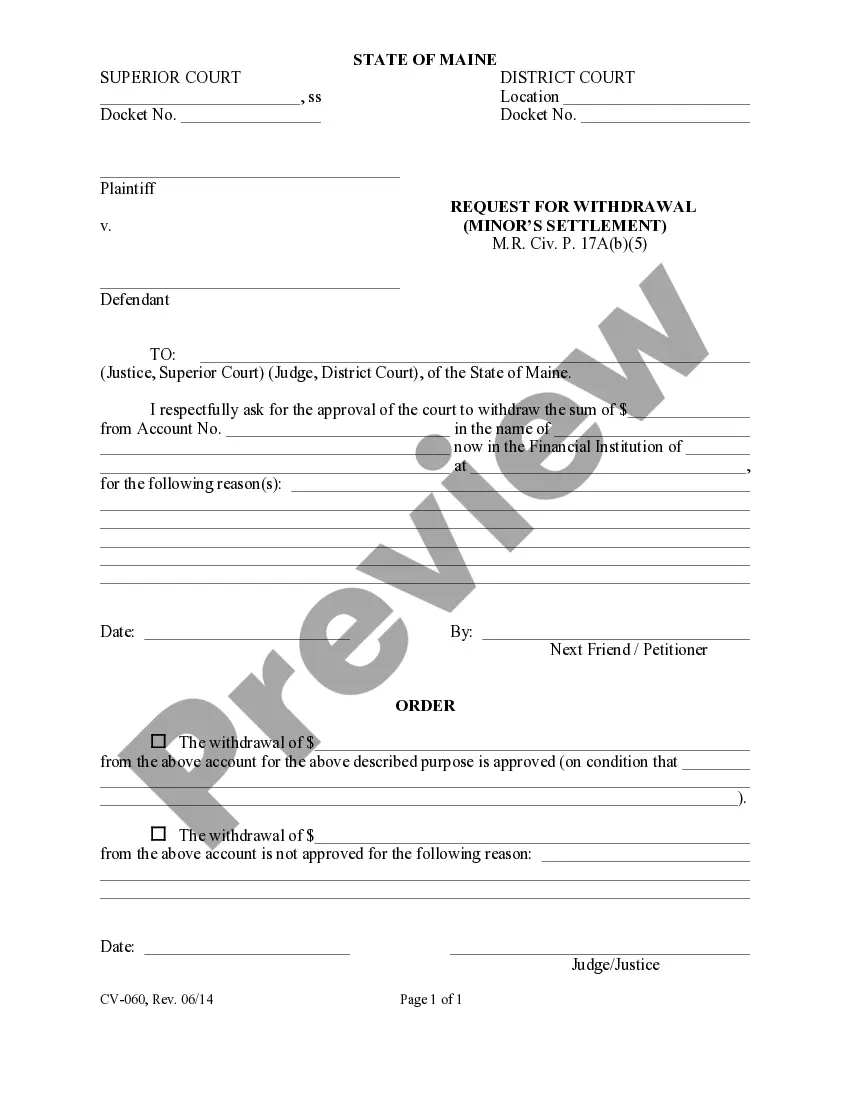

- Step 2. Use the Preview feature to review the form's details. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the page to find other versions of the valid form template.

Form popularity

FAQ

While a California Revocable Living Trust for Married Couple offers many benefits, it also has some disadvantages. One limitation is that assets placed in the trust may not provide creditor protection. Additionally, establishing a trust requires time and costs for legal assistance, which may deter some couples. Evaluating these factors can help you make the best decision for your family's financial future.

In California, marriage does not automatically override a trust, including a California Revocable Living Trust for Married Couple. However, if you created a trust before marriage, it is wise to review it after the wedding. This can help ensure that your spouse's interests are adequately addressed. Integrating your trust with your marital plans can provide peace of mind and clarity.

The best trust for a married couple often is the California Revocable Living Trust for Married Couple. This trust provides unparalleled flexibility and control, allowing each spouse to manage their assets while designating how they wish those assets to be handled after death. It prepares the couple for life changes, enabling them to adjust the trust accordingly as their needs evolve. Utilizing U.S. Legal Forms will further simplify the process, offering easy access to templates and guidance tailored to their specific situation.

Certainly, a married couple can establish one California Revocable Living Trust for Married Couple to encompass all their combined assets. This approach not only simplifies management but also clarifies their intentions regarding how assets will be allocated after their deaths. By working together in a single trust, they streamline the process of asset distribution, making it easier for their heirs to navigate. Furthermore, it can provide significant tax advantages, which may be beneficial for the couple's overall financial strategy.

Yes, a married couple can create a single California Revocable Living Trust for Married Couple to manage their shared assets. This unified trust simplifies estate planning and reduces paperwork, making it easier to handle their combined estate. With this structure, both individuals can specify their desires for asset distribution, providing clarity and coherence for their beneficiaries. Additionally, it allows for streamlined management of resources, ensuring both partners can access and control their assets as needed.

A California Revocable Living Trust for Married Couple allows both partners to manage and control their assets during their lifetime. Essentially, the trust holds the couple's property, enabling them to designate how their assets should be distributed upon their passing. This arrangement simplifies the transfer of assets to heirs, avoiding the lengthy probate process. Furthermore, it provides flexibility, as either spouse can alter or revoke the trust when needed.

A California Revocable Living Trust for Married Couple is an ideal choice for most married couples. This type of trust offers flexibility, allowing you to change terms as needed during your lifetime. It also facilitates the smooth transfer of assets without going through probate, ensuring peace of mind for both partners. To explore options, you might find uslegalforms to be a valuable resource for creating an appropriate trust.

Yes, a married couple can create a joint revocable trust, known as a California Revocable Living Trust for Married Couple. This arrangement allows both partners to manage the trust together, promoting collaboration in asset management. A joint trust can simplify the process of transferring assets upon one spouse's death and avoid complicated legal matters. It's advisable to discuss this option with a legal professional for personalized guidance.

In California, a California Revocable Living Trust for Married Couple does not need to be filed with the Court unless a dispute arises. This feature helps maintain confidentiality and simplifies the management of assets. However, it is crucial to ensure the trust is properly funded to enjoy its full benefits. If you need assistance, uslegalforms can provide comprehensive resources to navigate this process.

The best choice for a married couple often involves a California Revocable Living Trust for Married Couple. This type of trust allows both partners to manage their shared assets seamlessly. It presents a flexible approach, enabling couples to adjust terms as their needs evolve. We suggest consulting a legal expert to tailor the trust to your specific circumstances.