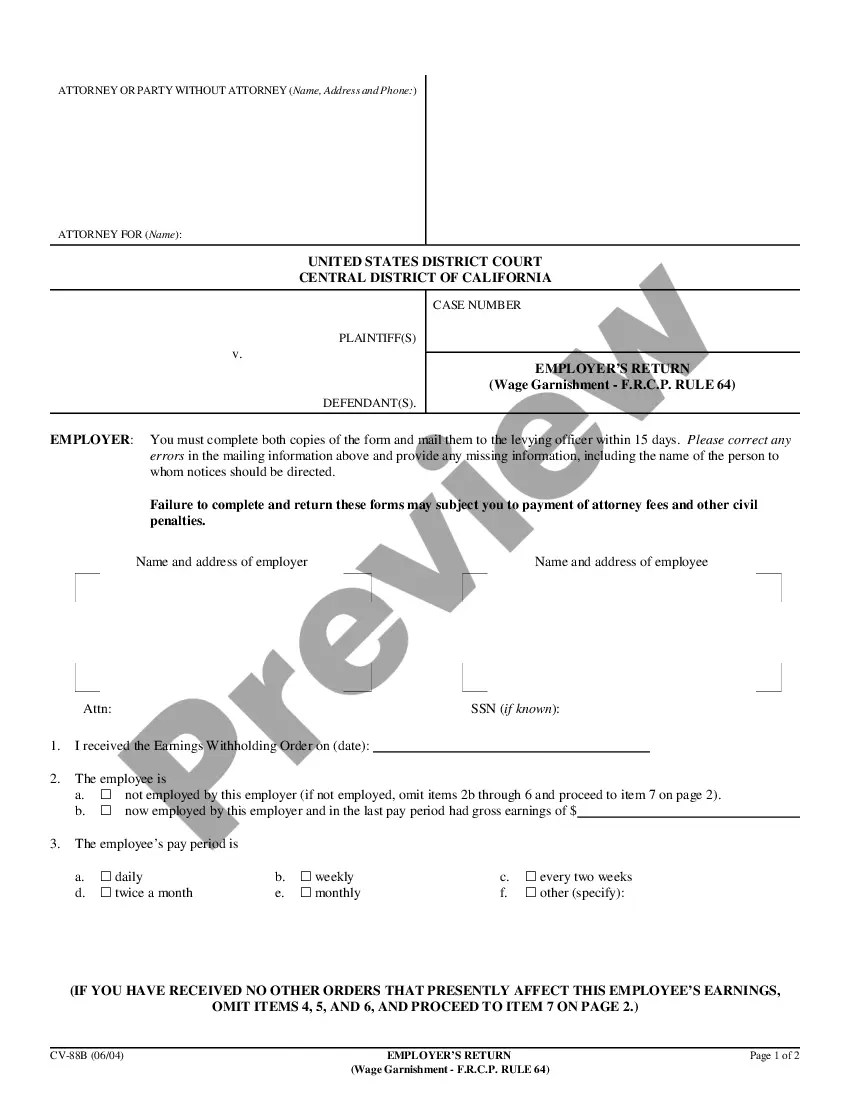

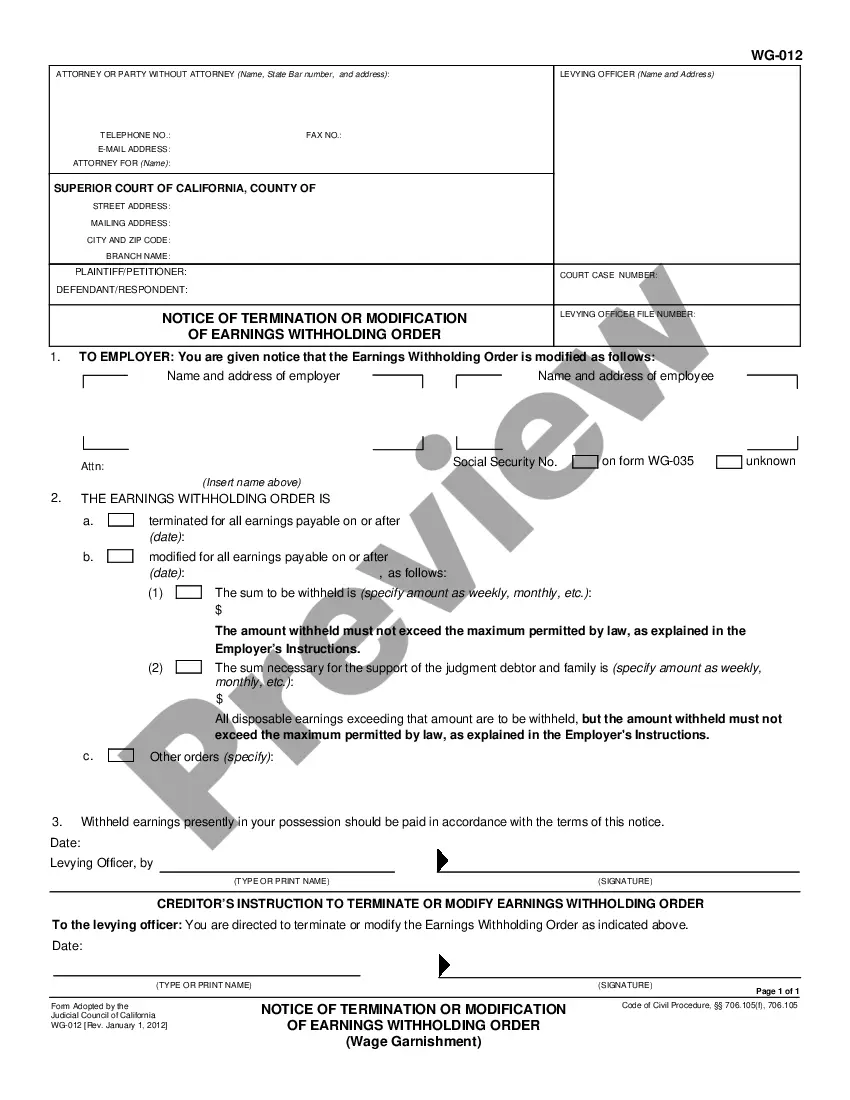

The California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishement-FRCP Rule 64) is a document issued by a court in California that terminates or modifies an existing wage garnishment order, also known as an earnings withholding order. This notice informs the employer of the court's order and requires the employer to comply with the new terms of the garnishment. There are two types of notices: one for employers who are subject to the Federal Rules of Civil Procedure (FRC) Rule 64 and one for employers who are subject to California law. The FRC notice of termination of modification of earning withholding order (wage garnishement-FRCP Rule 64) informs employers of the court's order to terminate or modify the wage garnishment and requires the employer to comply with the new terms. The California law notice of termination of modification of earning withholding order (wage garnishment) informs employers of the court's order to terminate or modify the wage garnishment and requires the employer to comply with the new terms.

California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishement-FRCP Rule 64)

Description

How to fill out California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishement-FRCP Rule 64)?

Handling official documentation necessitates focus, precision, and utilizing correctly-prepared forms. US Legal Forms has been assisting individuals across the country with this for 25 years, so when you select your California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) template from our platform, you can be assured it complies with federal and state laws.

Using our service is straightforward and swift. To obtain the necessary documents, all you need is an account with an active subscription. Here’s a brief guide for you to acquire your California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) in just minutes.

All documents are designed for multiple uses, like the California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) displayed on this page. If you require them again, you can fill them out without another payment - just access the My documents tab in your profile and finalize your document as needed. Try US Legal Forms and prepare your business and personal paperwork efficiently and in full legal adherence!

- Ensure to thoroughly review the document content and its alignment with general and legal standards by previewing it or reading its description.

- Search for an alternative official template if the one you previously opened doesn’t match your circumstances or state legislation (the option for this is in the top corner of the page).

- Sign in to your account and download the California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) in your desired format. If it’s your initial experience with our service, click Buy now to proceed.

- Create an account, select your subscription plan, and complete your payment with a credit card or PayPal account.

- Decide in which format you want to save your form and click Download. Print the document or upload it to a professional PDF editor for electronic preparation.

Form popularity

FAQ

To stop wage garnishment, you should draft a letter that clearly states your intent to invoke the California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64). Ensure you include your personal information, details about the garnishment, and a request for termination or modification. It is also wise to mention any relevant circumstances that support your request, such as financial hardship. If you need assistance, consider using US Legal Forms to access templates and guidance tailored to your situation.

To reverse a wage garnishment order, you must file a motion with the court that issued the original order. In your motion, you should provide evidence showing why the garnishment should be modified or terminated. A California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) can be particularly useful in this situation. Seeking assistance from legal professionals or platforms like US Legal Forms can help streamline this process.

In New Jersey, wage garnishment follows strict guidelines to protect individuals from excessive deductions. Generally, creditors can garnish up to 10% of your gross income, unless a different amount is specifically approved. It's essential to understand the legal limits and procedures involved, as they provide significant protections. If you seek to modify or terminate the garnishment, consider consulting a legal expert to navigate these rules effectively.

To write a letter to stop wage garnishment, you should clearly state your request to terminate or modify the garnishment, citing the California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) in your letter. Provide your personal information, the case number, and a brief explanation for your request, such as financial hardship. It's wise to attach any relevant documents that support your case. If you need templates or further assistance, US Legal Forms can offer you valuable resources.

To prevent tax garnishment, you should first contact the tax agency that's garnishing your wages and request a payment arrangement. If you file a California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64), you might halt the garnishment if you can prove you’re facing financial difficulty. Additionally, you can consider filing for tax relief or appeal your case if you believe the garnishment is unjust. Using platforms like US Legal Forms can provide you with the necessary forms and guidance.

To file a claim of exemption for wage garnishment in California, you should complete and submit a Claim of Exemption form to the court that issued the garnishment. This claim must show that your income or financial situation qualifies you for protection under state laws, including relevant provisions in the California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64). Be sure to gather supporting documents that verify your financial position. Consulting with legal resources like US Legal Forms can simplify this process for you.

To stop a wage garnishment in California, you can file a California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64). This process allows you to modify or terminate the garnishment if you can demonstrate financial hardship or a valid reason. It's important to act quickly, as assuming the garnishment will end on its own may not be accurate. Seeking assistance from a legal professional or using resources like US Legal Forms can help guide you through this process.

Yes, someone can garnish your wages without your prior knowledge, typically through a legal process initiated by a creditor. However, they must provide you with notice in most cases, which allows you an opportunity to contest the garnishment. Being informed about your rights and the garnishment process can help you take appropriate actions when necessary.

In California, the maximum amount that can be garnished from your paycheck is generally 25% of your disposable earnings. However, if your disposable income is less than the federal minimum wage, a lower percentage applies. Understanding these limits is vital for protecting your income while managing any legal financial obligations.

To get out of a wage garnishment in California, you can negotiate a settlement with your creditor or contest the garnishment through legal channels. Filing a California Notice Of Termination Of Modification Of Earning Withholding Order (Wage Garnishment-FRCP Rule 64) is an essential step toward stopping the garnishment. Consulting with professionals or using platforms like uslegalforms can help you navigate the necessary processes.