The California Minimum Financial Requirements Worksheet is a document used by the California Department of Insurance to determine the financial requirements for insurance companies and producers in the state. This worksheet is used to evaluate the financial resources of the company or producer in order to determine their ability to meet financial obligations and fulfill their contractual obligations. There are three types of California Minimum Financial Requirements Worksheets: 1. The Statement of Financial Responsibility Worksheet (Form A). This form is used to evaluate the financial resources of the company or producer in order to determine their ability to meet financial obligations and fulfill their contractual obligations. 2. The Statement of Financial Condition Worksheet (Form B). This form is used to evaluate the financial resources of the company or producer in order to determine their ability to meet financial obligations and fulfill their contractual obligations. 3. The Organization of Financial Resources Worksheet (Form C). This form is used to evaluate the financial resources of the company or producer in order to determine their ability to meet financial obligations and fulfill their contractual obligations.

California Minimum Financial Requirements Worksheet

Description

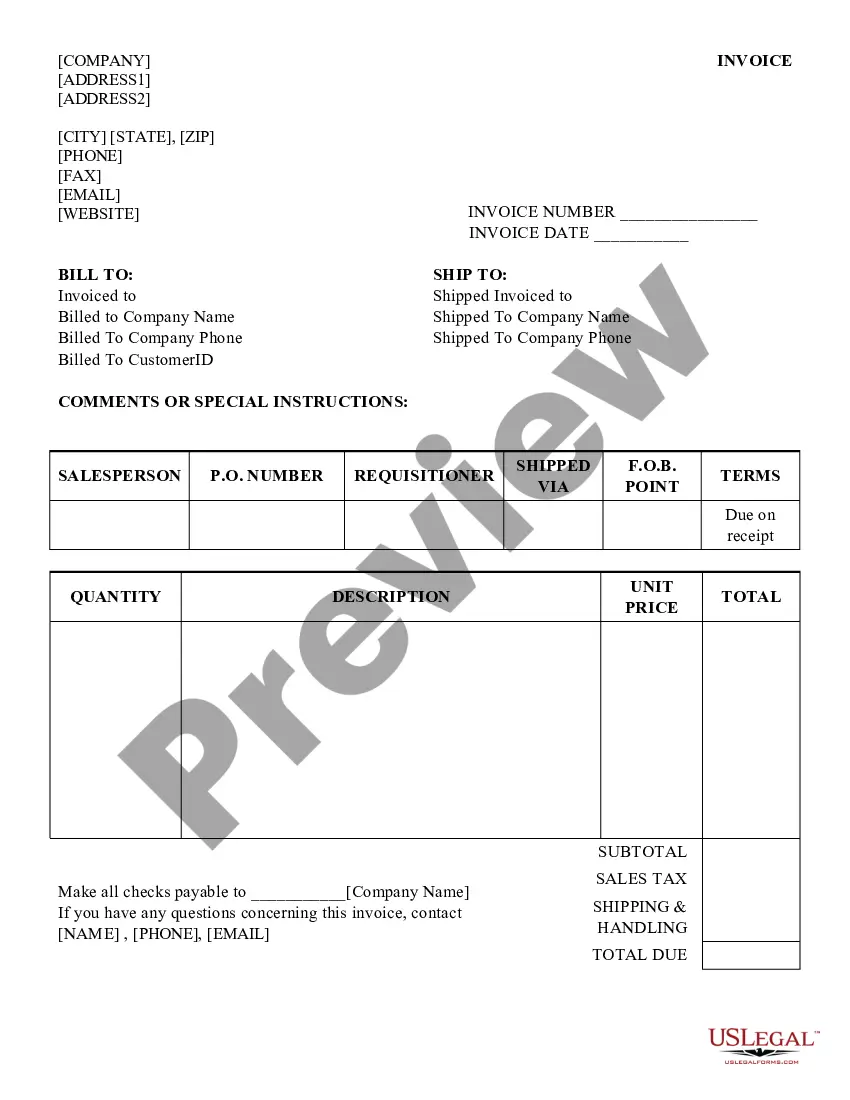

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

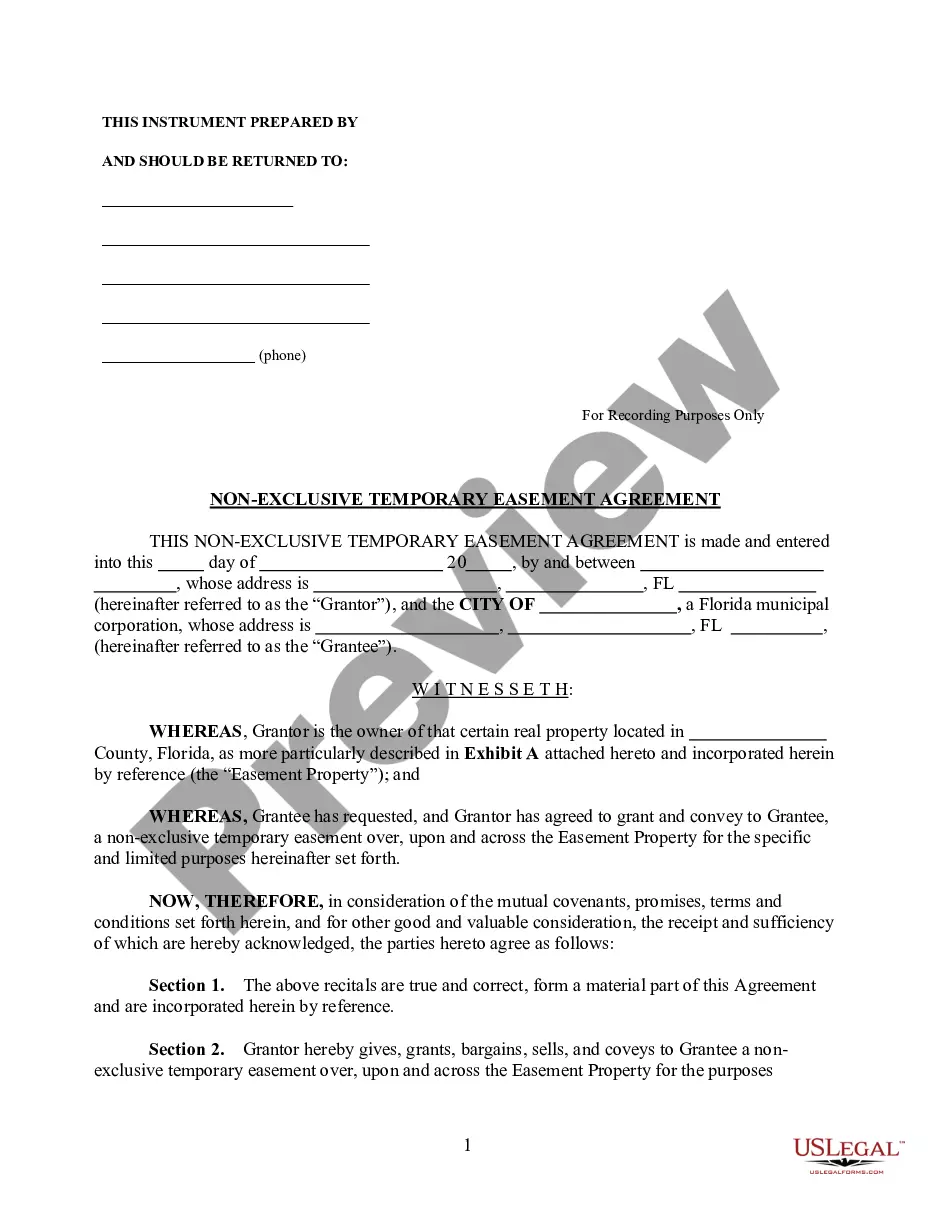

A Minimum Financial Requirements Worksheet is a financial tool used by individuals and organizations in the United States to assess and plan their financial capabilities and prerequisites for particular endeavors or compliance with regulations. It helps in determining the minimal fiscal inputs necessary to initiate or maintain activities without incurring financial risks.

Step-by-Step Guide

- Gather Financial Information: Collect all relevant financial data including income, expenses, assets, and liabilities.

- Identify Financial Goals: Specify the primary objectives related to your anticipated expenditure or investments, such as startup costs for a business or capital for an investment.

- Calculate Minimum Requirements: Use the worksheet to determine the amount of capital needed to safely meet the goals without overextending financially.

- Assess Risk: Evaluate potential financial risks and consider alternative solutions or safeguards.

- Plan for Contingencies: Create a contingency plan based on the results from the worksheet to manage unexpected financial issues.

- Regular Updates: Regularly review and update the worksheet to reflect changes in financial situation or objectives.

Risk Analysis

Risks Involved in Inadequate Planning: Failing to accurately complete a Minimum Financial Requirements Worksheet can lead to underestimating necessary capital, resulting in financial strain or business failure. Proper risk management strategies are essential to mitigate such outcomes.

Common Mistakes & How to Avoid Them

- Underestimating Expenses: Always include unexpected or irregular expenses to prevent shortfalls.

- Overestimating Revenue: Be conservative with income projections to avoid financial overcommitment.

- Neglecting Regular Revisions: Financial landscapes change; regularly update your worksheet to stay relevant.

Key Takeaways

Importance of Precision: Accurately filling out a Minimum Financial Requirements Worksheet ensures better financial planning and risk management. It is a critical tool for both personal and business financial health in the United States.

How to fill out California Minimum Financial Requirements Worksheet?

US Legal Forms is the simplest and most economical method to locate appropriate formal templates.

It represents the largest online collection of business and personal legal documents crafted and verified by lawyers.

Here, you can discover printable and fillable forms that adhere to federal and local standards - similar to your California Minimum Financial Requirements Worksheet.

Once you save a template, you can revisit it whenever needed - simply locate it in your profile, re-download it for printing and manual filling or upload it to an online editor for more efficient completion and signing.

Utilize US Legal Forms, your reliable partner in acquiring the necessary formal documentation. Give it a shot!

- Examine the form details or preview the document to ensure you’ve found one that suits your needs, or find another using the search bar above.

- Click Buy now once you are confident about its suitability for all your specifications, and select the subscription plan that appeals to you the most.

- Establish an account with our service, Log In, and purchase your subscription using PayPal or your credit card.

- Choose your desired file format for your California Minimum Financial Requirements Worksheet and download it onto your device using the designated button.

Form popularity

FAQ

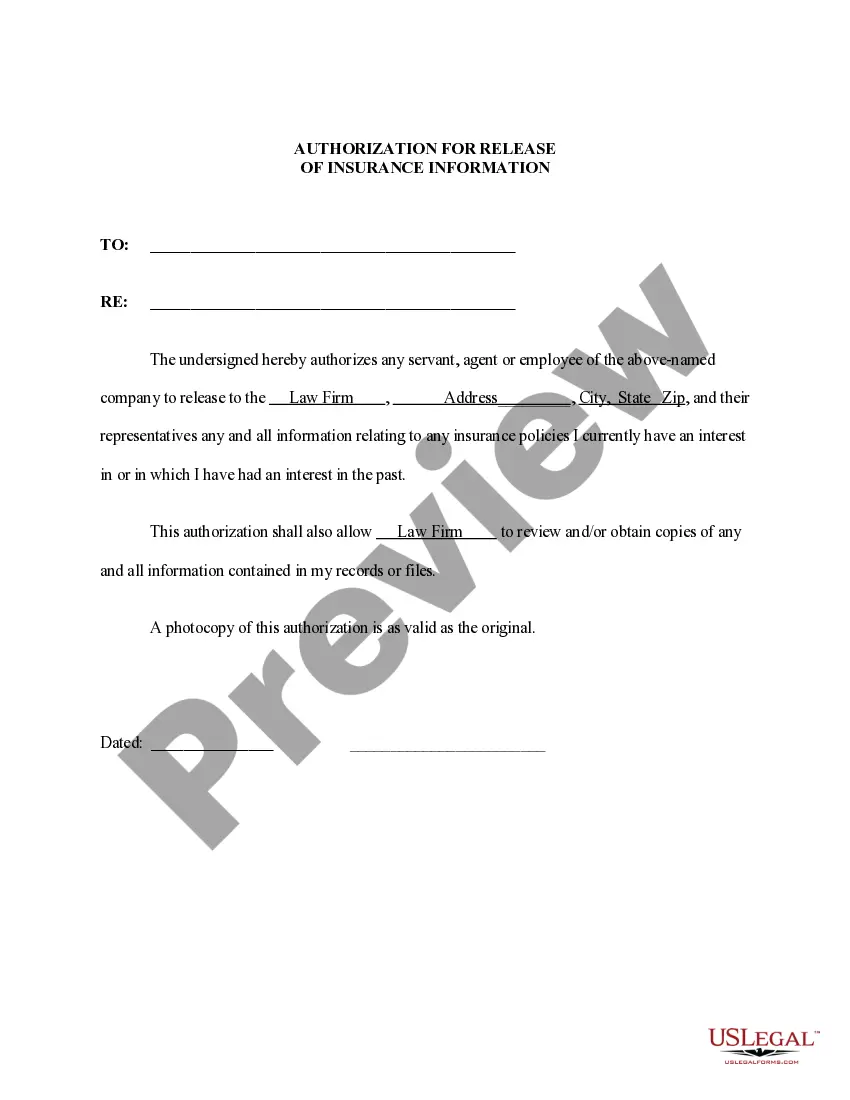

To become an IAR, you typically need to have a combination of relevant education, professional experience, and the completion of the required exams. Additionally, meeting the financial obligations established by California law is essential. The California Minimum Financial Requirements Worksheet can assist you in ensuring that you meet all necessary qualifications while pursuing your career.

The requirements for IAR registration in California include obtaining the necessary credentials, passing relevant exams, and adhering to financial guidelines set forth by the state. Moreover, advisors must maintain a certain level of net worth and comply with regulatory expectations, which can be navigated using the California Minimum Financial Requirements Worksheet.

In California, Investment Adviser Representatives (IARs) must complete continuing education (CE) requirements periodically. The specific hours required may vary, but they are typically designed to keep you updated on financial regulations and best practices. Using the California Minimum Financial Requirements Worksheet can help you track your compliance with these continuing education obligations.

To become an Investment Adviser Representative (IAR) in California, you need to pass the necessary exams, such as the Series 65 or Series 7 and 66. Afterward, you can apply for registration through the state’s regulatory body. Completing the California Minimum Financial Requirements Worksheet will guide you through the specific financial benchmarks needed for your application.

The requirements for admission to the California Institute of Technology include a strong academic record, standardized test scores, and a well-rounded application showcasing relevant extracurricular activities. Additionally, you may need to submit letters of recommendation and a personal statement. If you are interested in economics or financial regulations, understanding the California Minimum Financial Requirements Worksheet could be beneficial for your studies.

Section 260.236 of the California Code of Regulations addresses the financial requirements for investment advisors in California. It outlines the minimum standards an advisor must meet, covering aspects like net capital and liquid assets. By consulting the California Minimum Financial Requirements Worksheet, you can gain clarity on how this section directly impacts your financial practices and requirements.

To become a California registered investment advisor, you must first meet the educational requirements and pass the Series 65 exam. Afterward, you can submit your application to the California Department of Financial Protection and Innovation. Completing the California Minimum Financial Requirements Worksheet will help you ensure that you meet the necessary financial standards to be granted registration.

In California, financial advisors are primarily regulated by the California Department of Financial Protection and Innovation. This department oversees the practices and operations of financial advisors, ensuring they adhere to state laws and regulations. The balancing act between protecting clients and empowering advisors is crucial in maintaining a healthy financial advisory landscape. You can learn more about compliance requirements through the California Minimum Financial Requirements Worksheet.

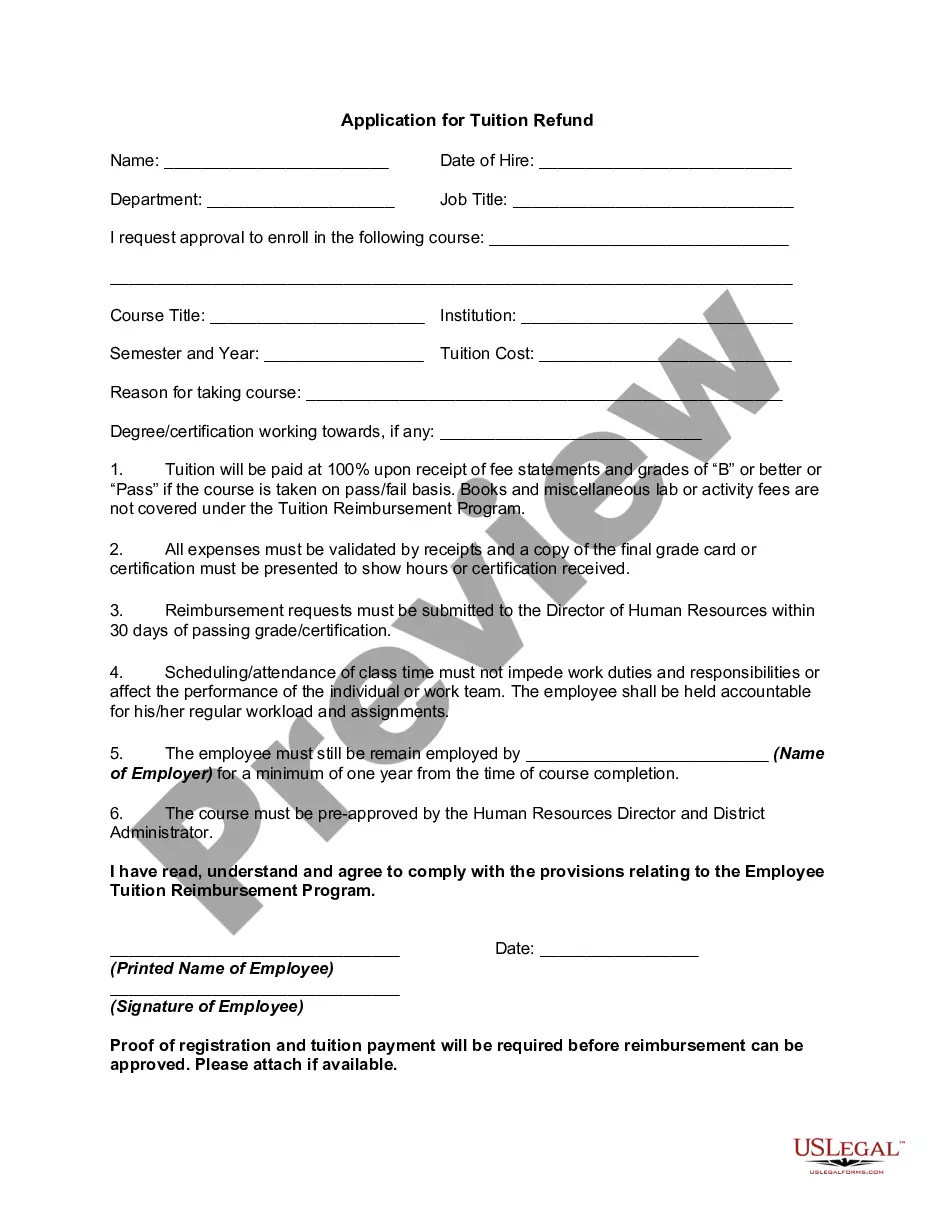

Starting in 2025, California will increase its minimum liability limits, ensuring better financial protection for accident victims. The new requirements will substantially raise the figures, adjusting to the rising costs of medical care and vehicle repairs. These changes reflect the state's commitment to enhancing driver accountability and safety on the roads. For a detailed understanding of how these adjustments affect you, refer to the California Minimum Financial Requirements Worksheet.

The 15/30/5 rule refers to California's minimum required liability insurance coverage. Specifically, it indicates that a driver must carry at least $15,000 for bodily injury per person, $30,000 for total bodily injury per accident, and $5,000 for property damage. This structure helps ensure that victims receive necessary financial support following an accident. Utilizing the California Minimum Financial Requirements Worksheet can aid you in understanding and meeting these requirements effectively.