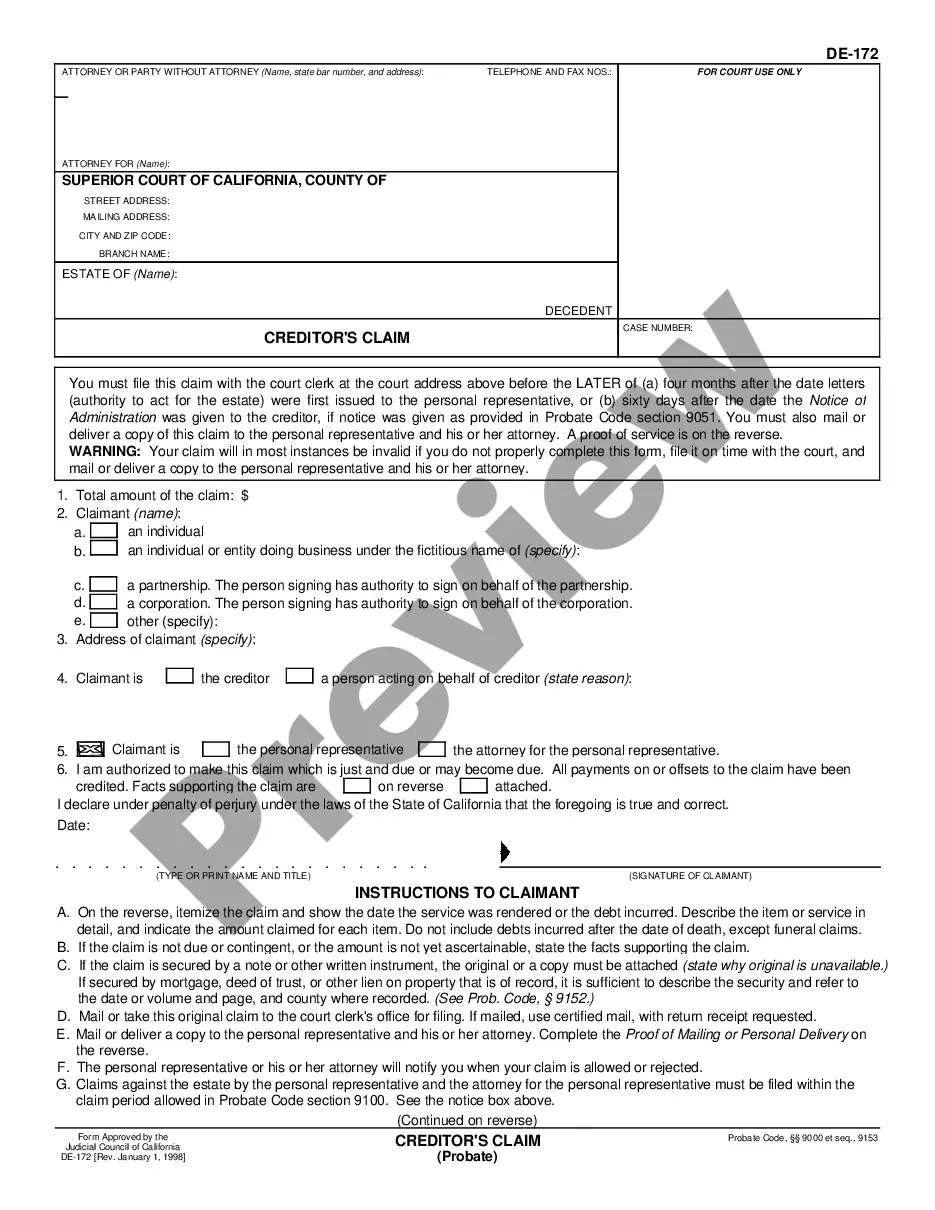

This form, Allowance or Rejection of Creditor's Claim - for estates filed after June 30, 1988, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form sets forth whether a particular creditor's claim(s) is allowed or rejected and includes information such as the name of the creditor, date the claim was filed, date letters were first issued, date of notice of administration, date of decedent's death, estimated value of estate and total amount of claim(s).

California Allowance or Rejection of Creditor's Claim

Description

How to fill out California Allowance Or Rejection Of Creditor's Claim?

If you're looking for precise California Allowance or Rejection of Creditor's Claim replicas, US Legal Forms is what you require; access documents created and reviewed by state-certified lawyers.

Using US Legal Forms not only prevents you from issues related to legal documents; you also conserve effort and time, as well as money!

And that's it. With a few easy steps, you obtain an editable California Allowance or Rejection of Creditor's Claim. After you create your account, all future requests will be processed even more smoothly. When you possess a US Legal Forms subscription, just Log In to your profile and click the Download button visible on the form's page. Then, whenever you need to use this template again, you'll always be able to locate it in the My documents section. Don't waste your time and energy searching through countless forms on various online sources. Obtain precise copies from a single secure service!

- Initiate the signup process by providing your email and setting up a password.

- Follow the instructions below to register and locate the California Allowance or Rejection of Creditor's Claim form to meet your requirements.

- Utilize the Preview feature or check the document description (if available) to confirm that the form is suitable for you.

- Verify its relevance in your jurisdiction.

- Click Buy Now to place your order.

- Select a preferred pricing option.

- Create an account and pay using your credit card or PayPal.

Form popularity

FAQ

A creditor claim must be filed with the California Probate court. A copy of the creditor claim must be served on the personal representative within the later of 30 days of the filing of the claim or 4 months after letters are issued to a personal representative with general powers.

You can get a creditor's claim form at the Forms Window in Room 112 on the first floor of the Los Angeles Superior Court at 111 North Hill Street, or any other Superior Court location. The form is also available at the Judicial Council website: http://www.courtinfo.ca.gov/forms/. It is form number DE-172.

Is there a time limit for a claim against a deceased estate? Yes, there is. You have only 6 months from the date of the grant of probate to make a claim. In some very limited circumstances, an extension of this time frame may be granted.

What Is The Statute Of Limitations To File A Claim Against A Decedent? One year. Upon a person's death, California Code of Civil Procedure section 366.2 provides for an outside time limit of one year for filing any type of claim against a decedent.

The statute of limitations for filing a claim against an estate is a strict one year from the date of the debtor's death (pursuant to California Code of Civil Procedure Section 366.2). This limitation period applies regardless of whether the judgment creditor knew the judgment debtor had died!

Generally, in California creditors of a decedent's estate have up to one year (365 days) from the decedent's death to file a timely creditor claim.Also, in the case of small estates, i.e., a total gross value under $150,000, a creditor may consider opening a probate matter within 40 days of the decedent's death.

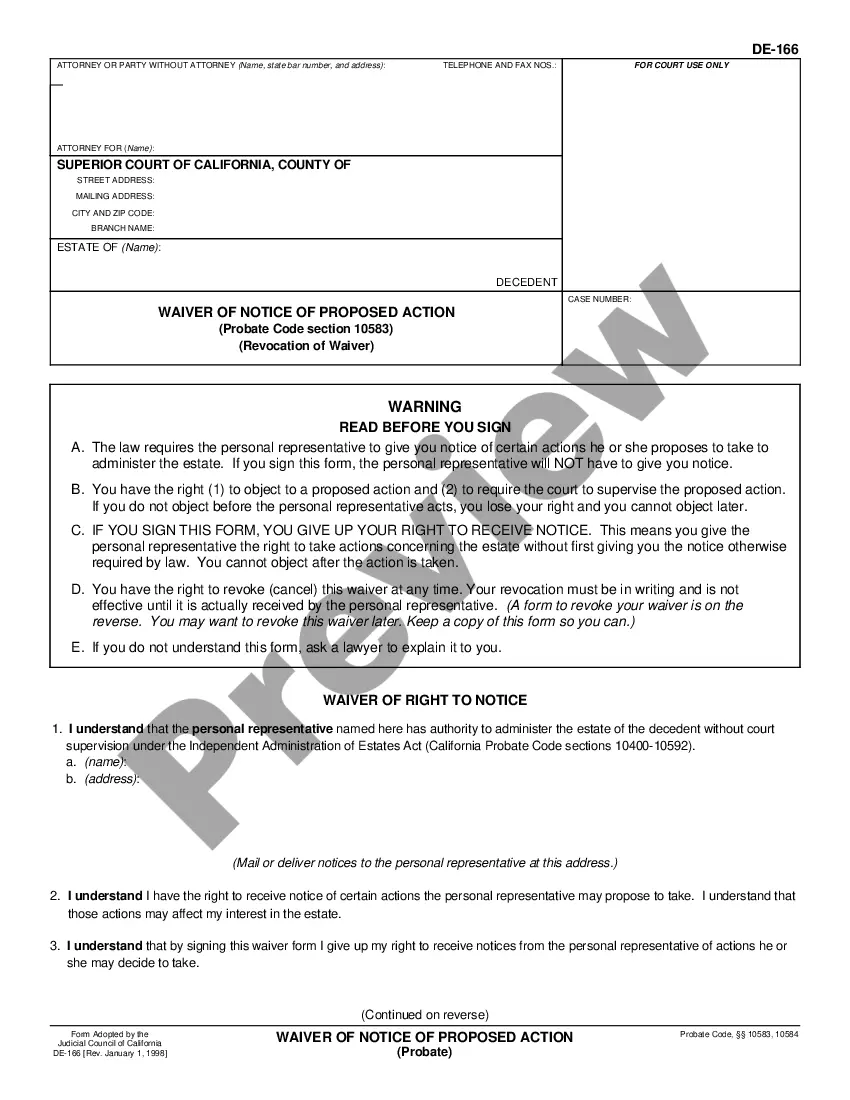

1) A written claim filed in federal bankruptcy court by a person or entity owed money by a debtor who has filed for bankruptcy.If the executor or administrator in charge of the probate denies the claim, the creditor can request a court hearing.