Arizona Tax Release Authorization

Description

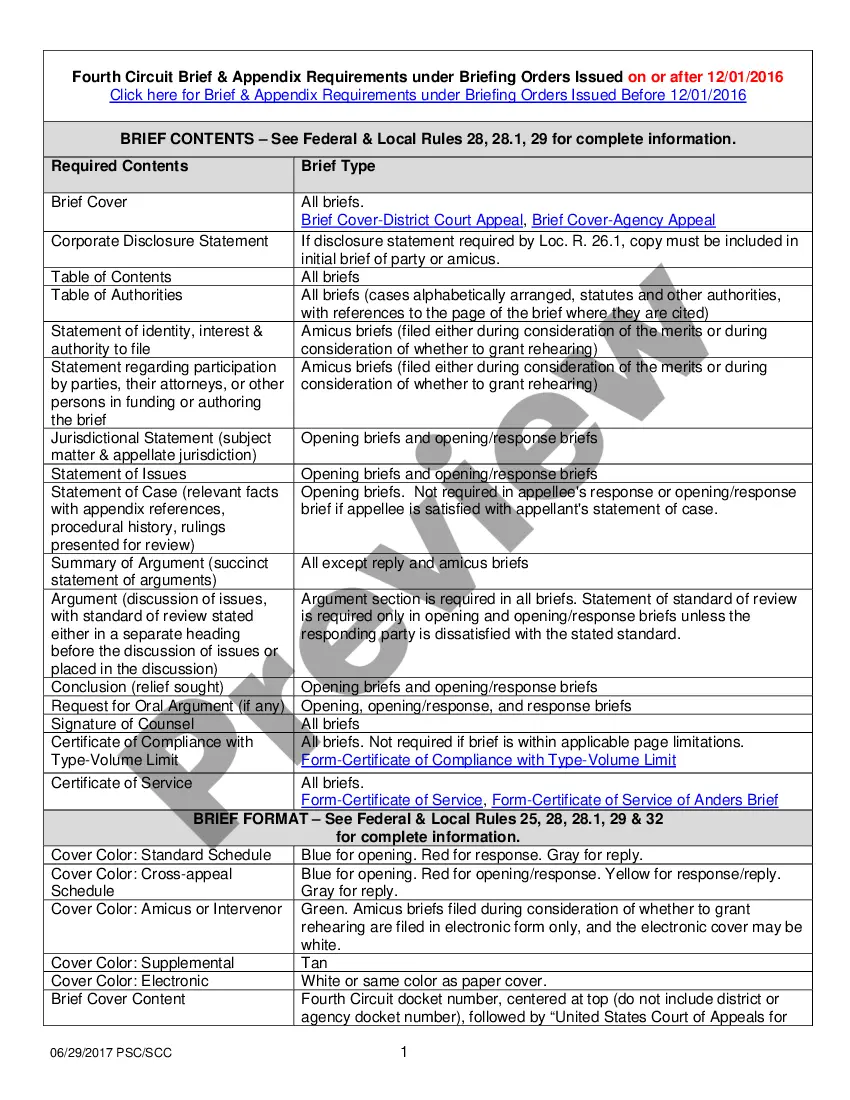

How to fill out Tax Release Authorization?

If you have to full, down load, or print authorized document templates, use US Legal Forms, the biggest variety of authorized types, which can be found on the web. Make use of the site`s basic and hassle-free look for to discover the paperwork you want. Numerous templates for enterprise and specific functions are sorted by categories and states, or keywords. Use US Legal Forms to discover the Arizona Tax Release Authorization in a few click throughs.

If you are already a US Legal Forms consumer, log in to your accounts and click on the Down load button to find the Arizona Tax Release Authorization. Also you can entry types you formerly acquired in the My Forms tab of your respective accounts.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for that correct area/land.

- Step 2. Use the Preview method to examine the form`s information. Don`t neglect to see the description.

- Step 3. If you are unhappy together with the develop, use the Research field near the top of the screen to get other types of your authorized develop design.

- Step 4. Once you have located the shape you want, click the Get now button. Select the rates strategy you favor and put your qualifications to sign up on an accounts.

- Step 5. Process the transaction. You should use your charge card or PayPal accounts to complete the transaction.

- Step 6. Select the file format of your authorized develop and down load it on your own system.

- Step 7. Full, modify and print or sign the Arizona Tax Release Authorization.

Every authorized document design you acquire is your own for a long time. You possess acces to each and every develop you acquired inside your acccount. Go through the My Forms section and choose a develop to print or down load once again.

Remain competitive and down load, and print the Arizona Tax Release Authorization with US Legal Forms. There are millions of skilled and status-distinct types you can use for the enterprise or specific requires.

Form popularity

FAQ

For individuals needing to authorize the Department to release confidential information to the taxpayer's Appointee or file a power of attorney on behalf of another taxpayer, Arizona will accept the Federal Power of Attorney (POA) Form 2848 provided certain changes are made.

Common Arizona Income Tax Forms & Instructions The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

A taxpayer may use Arizona Form 285 to authorize the department to release confidential information to the taxpayer's Appointee.

An Arizona tax power of attorney (Form 285-I) allows a principal to give agent-specific tax-related power of attorney in the event they find themselves unable to work directly with the state Department of Finance.

Electronic filing options for withholding tax and transaction privilege tax are available through AZTaxes.gov.

A taxpayer may use Form 285 to authorize the department to release confidential information to the taxpayer's Appointee. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the Appointee.

Arizona Form 8879 - Electronic Signature Authorization This form is incorportated within the taxpayer's e-filed return package when using a software vendors, and not to be used by a tax preparer when filing paper. This form can only be obtained when e-filing a return through a software vendor.

For proper application of payment and to avoid delays, corporations must submit payments together with the completed Arizona Form 120EXT. The department will also accept a valid federal extension for the same period of time covered by the federal extension.