Arizona Stock Option and Award Plan

Description

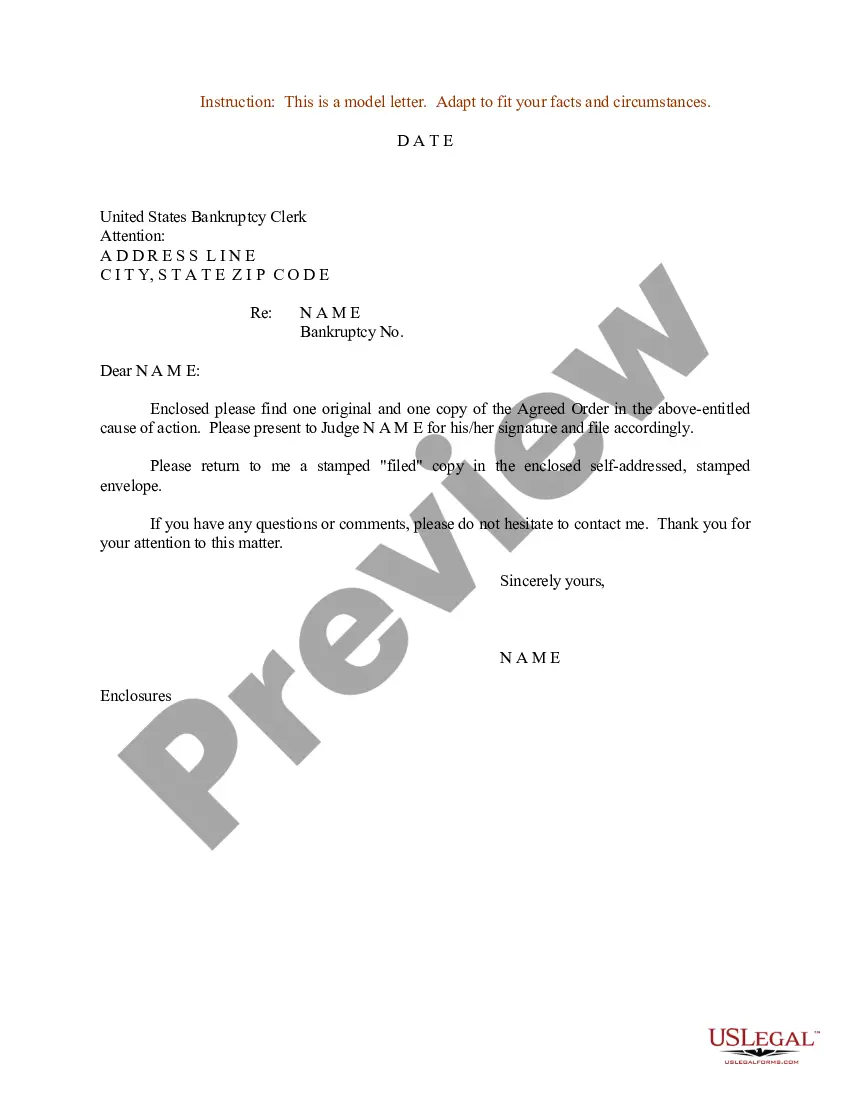

How to fill out Stock Option And Award Plan?

You might spend hours on the Internet searching for the official document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that are evaluated by experts.

You can download or print the Arizona Stock Option and Award Plan from my service.

If available, utilize the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Arizona Stock Option and Award Plan.

- Each legal document template you receive is yours permanently.

- To obtain an additional copy of any purchased document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure you have selected the correct document template for your region/city of choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

To access your stock options under the Arizona Stock Option and Award Plan, you typically need to follow the guidelines set by your employer. This often involves exercising your options through a designated process, which may include filling out forms or accessing a specific online platform. Using a reliable platform, like uslegalforms, can simplify this process by providing legal documentation and guidance tailored to your needs.

The advantage of incentive stock options is the favorable tax treatment for employees (generally employees' favorite variety of equity compensation). The disadvantages are the statutory requirements (quite constrictive) and the lack of any deduction for the Company.

Incentive stock options are one type of deferred compensation used to motivate and retain key employees. Since you need to hold on to your ISOs for a period of time, the only way to capitalize on these benefits is to stay with your firm for the long haul.

A qualified stock option confers special tax benefits on the employees of a corporation. This stock option is not reportable as taxable income to the employee at the time of grant, nor when the employee later exercises the option to buy stock.

A qualified stock option is a type of company share option granted exclusively to employees. It confers an income tax benefit when exercised. Qualified stock options are also referred to as 'incentive stock options' or 'incentive share options. '

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

If your employer grants you a statutory stock option, you generally don't include any amount in your gross income when you receive or exercise the option. However, you may be subject to alternative minimum tax in the year you exercise an ISO.

Qualified stock options is another name for incentive stock options. When a qualified stock option is exercised and results in a profit, this profit will be taxed at 15 percent, which is the standard rate for the capital gains tax. This is also considerably lower than the income tax rate.

What are the pros of offering employee stock options? They offer employees an opportunity to have ownership in the company they work for and feel more connected to the business as well as to their co-workers. They are a cost-effective company benefit that can help make employment packages more attractive.