Arizona Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

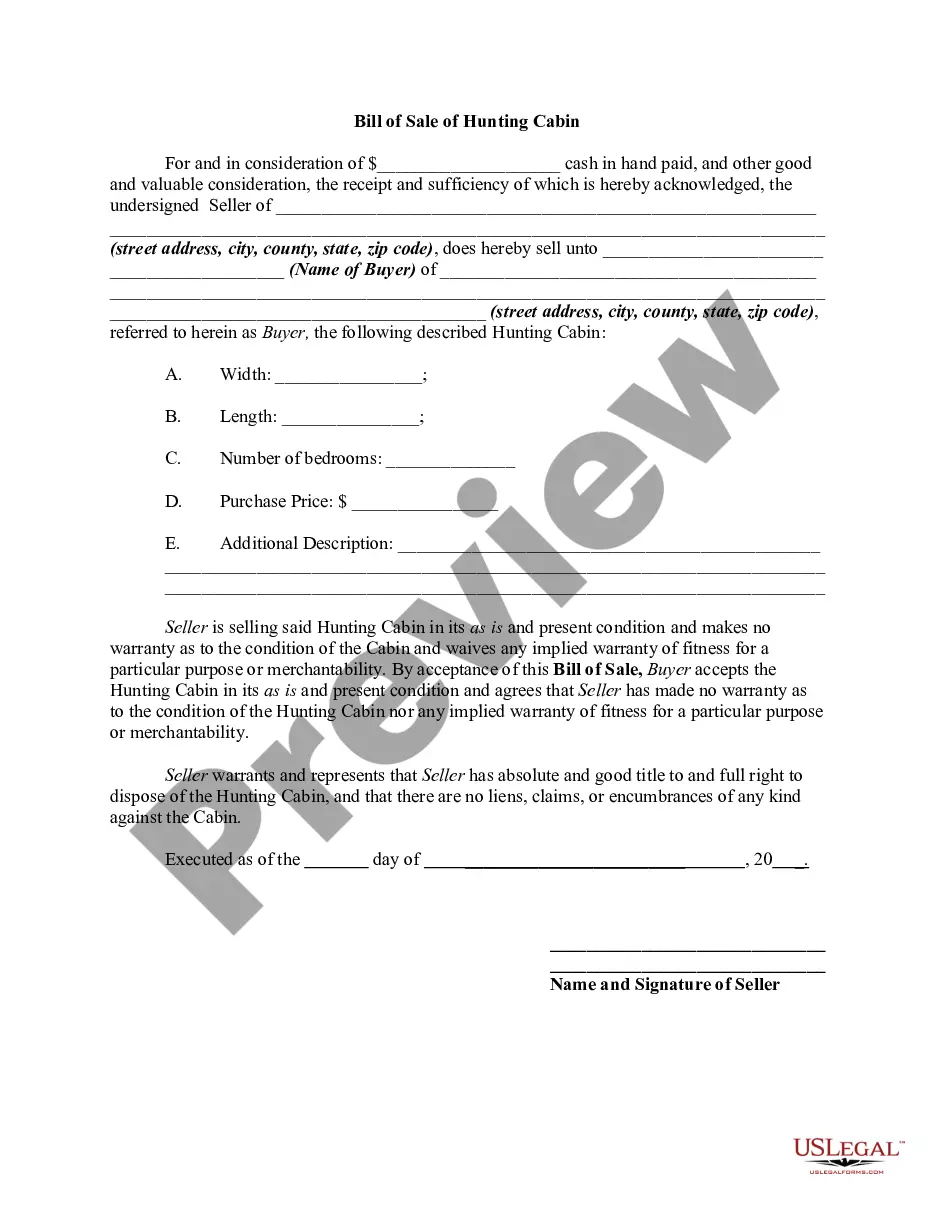

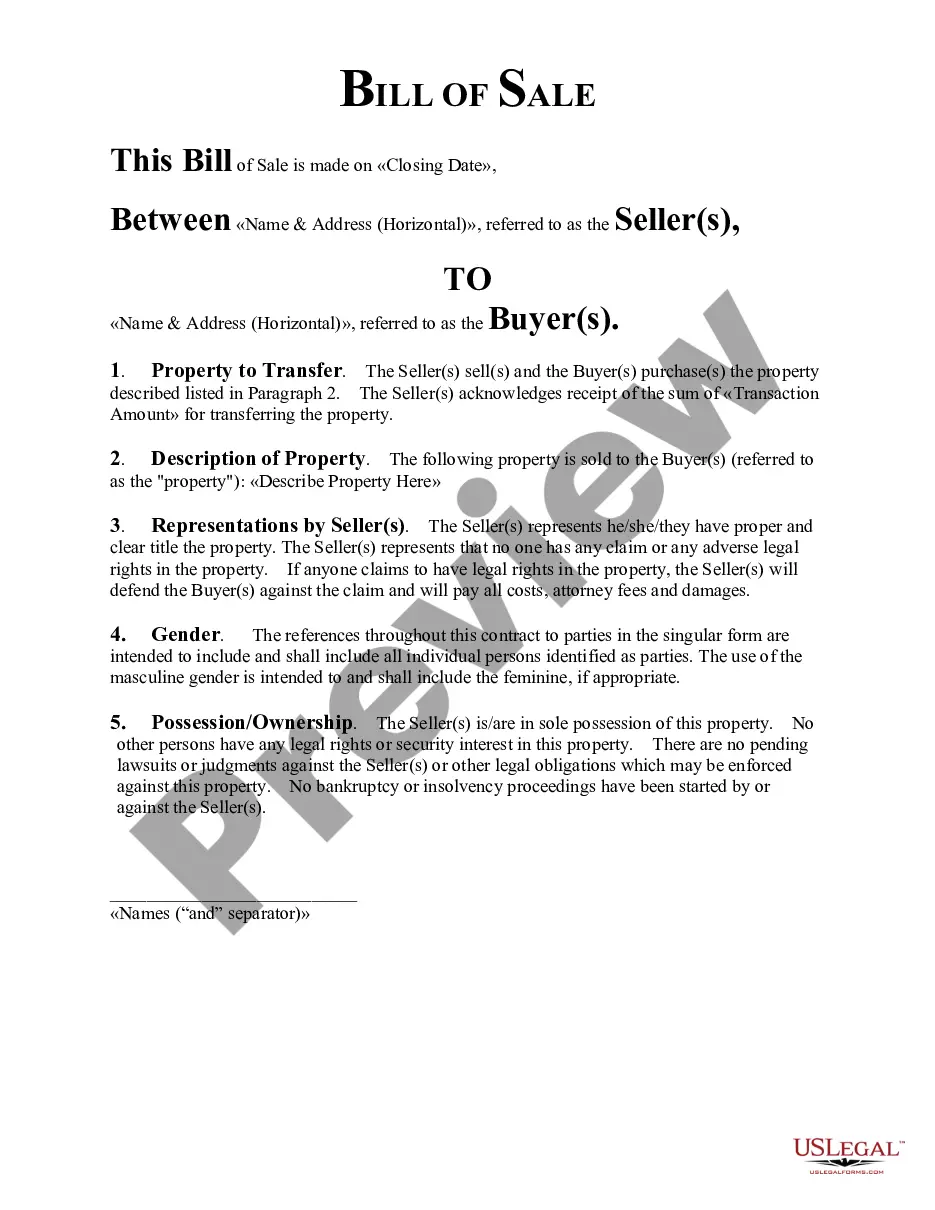

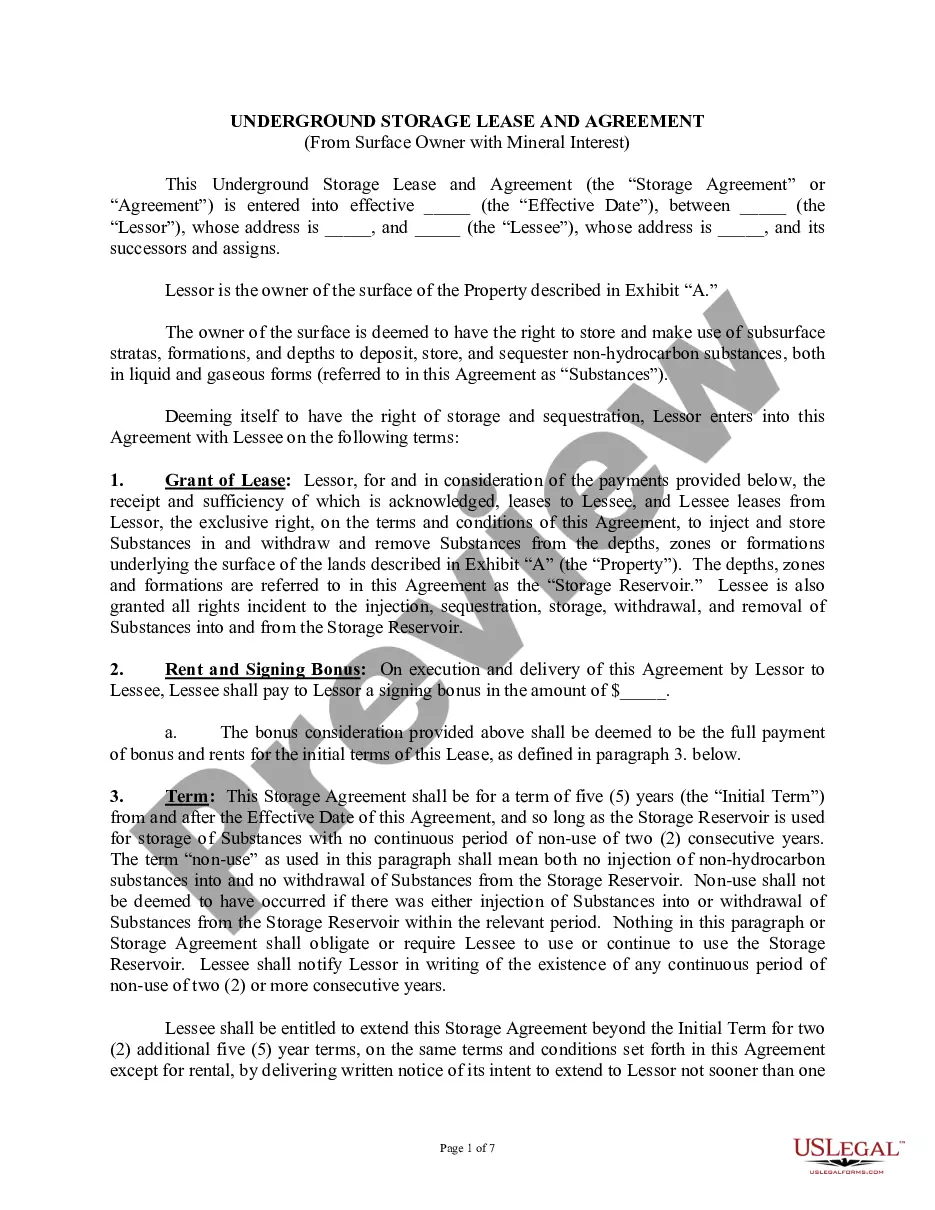

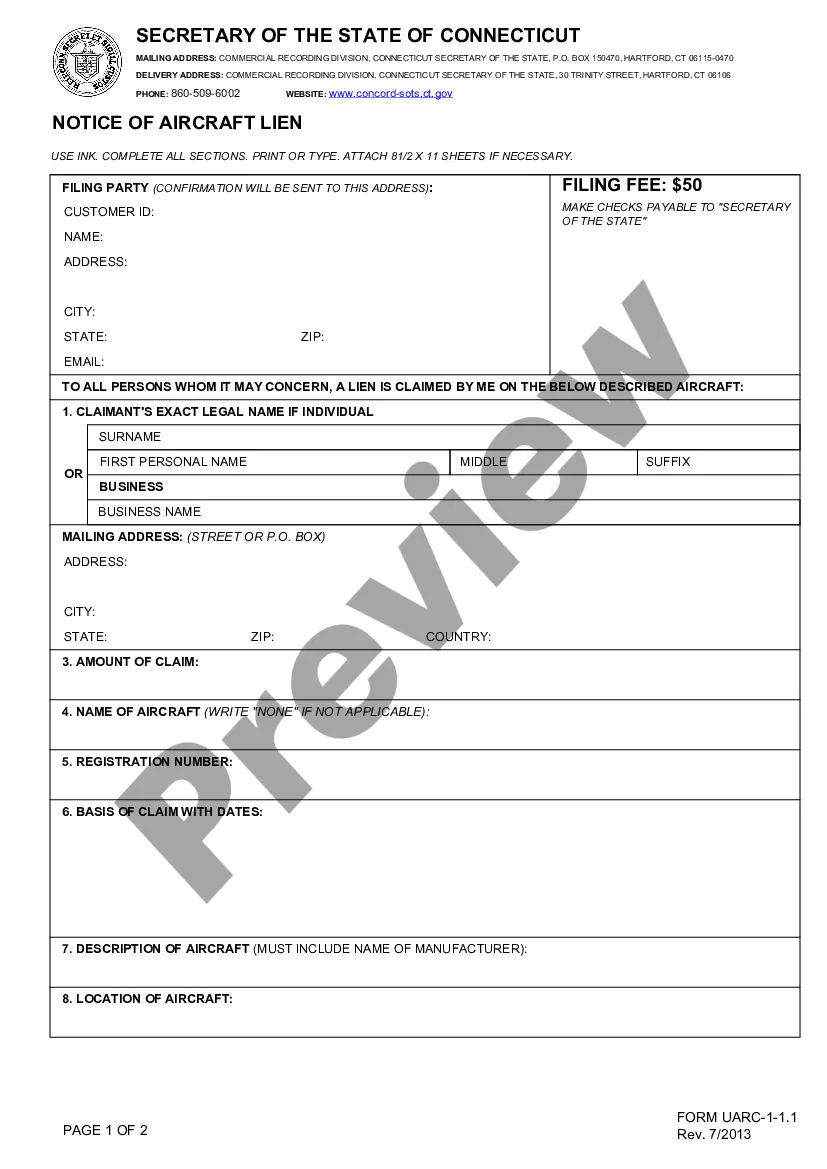

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost all the time.

There are many legal document templates available online, but locating trustworthy ones is not simple.

US Legal Forms offers a vast array of form templates, including the Arizona Bill of Sale of Personal Property - Reservation of Life Estate in Seller, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Arizona Bill of Sale of Personal Property - Reservation of Life Estate in Seller at any time if needed. Just click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Arizona Bill of Sale of Personal Property - Reservation of Life Estate in Seller template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Find the form you need and ensure it is for the correct city/county.

- 2. Use the Preview option to look over the form.

- 3. Check the details to confirm you have selected the right form.

- 4. If the form is not what you're looking for, use the Research field to discover the form that meets your needs.

- 5. If you find the right form, click on Acquire now.

- 6. Choose the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Indeed, recent changes in Arizona law stipulate that notarization is no longer required for certain titles. However, for various transactions, including the Arizona Bill of Sale of Personal Property - Reservation of Life Estate in Seller, it is advisable to obtain a notarized document for added security and legitimacy. A notary can help validate the identities of the parties involved and provide an extra layer of protection against fraud.

Pur autre vie (per o-truh vee) is a French legal phrase which means for another's life. This phrase is durational in meaning as it is another's life, not that of the possessor, that is used to measure the amount of time someone has a right to possess real property.

Filters. Latin/French. For the life of another, term often used in bequeathing a right (but not title) in property.

If you have created a life estate and are looking to remove someone from it, you cannot do so without consent from all parties unless you have a clause or document known as a power of appointment. These powers may be written within the deed or attached to it.

In property law of countries with a common law background, including the United States and some Canadian provinces, pur autre vie (Law French for "for another's life") is a duration of a proprietary freehold interest in the form of a variant of a life estate.

Advantages of a Life Estate No probate proceeding will be required to transfer title. The transfer/gift of the property to the persons who are deeded the property is a completed gift/transfer.

If the life estate is based on the life tenant's life, it is known as an ordinary life estate. Once the owner dies, the estate terminates. If the estate is based on a life other than the life tenant, it is known as a pur autre vie life estate, which means for another's life.

Under a life estate deed, however, the remainder owner's tax basis is the value of the home at the time of the life tenant's death (a stepped-up basis), greatly reducing or even eliminating any capital gains tax consequences of future sale of the property. Medicaid Exemption After Five Years.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

Measuring life means the period over which a jackpot or second-level annuitized prize is paid out. For each winning ticket, the measuring life shall be the natural life of the individual determined by the commission to be a valid prize winner.