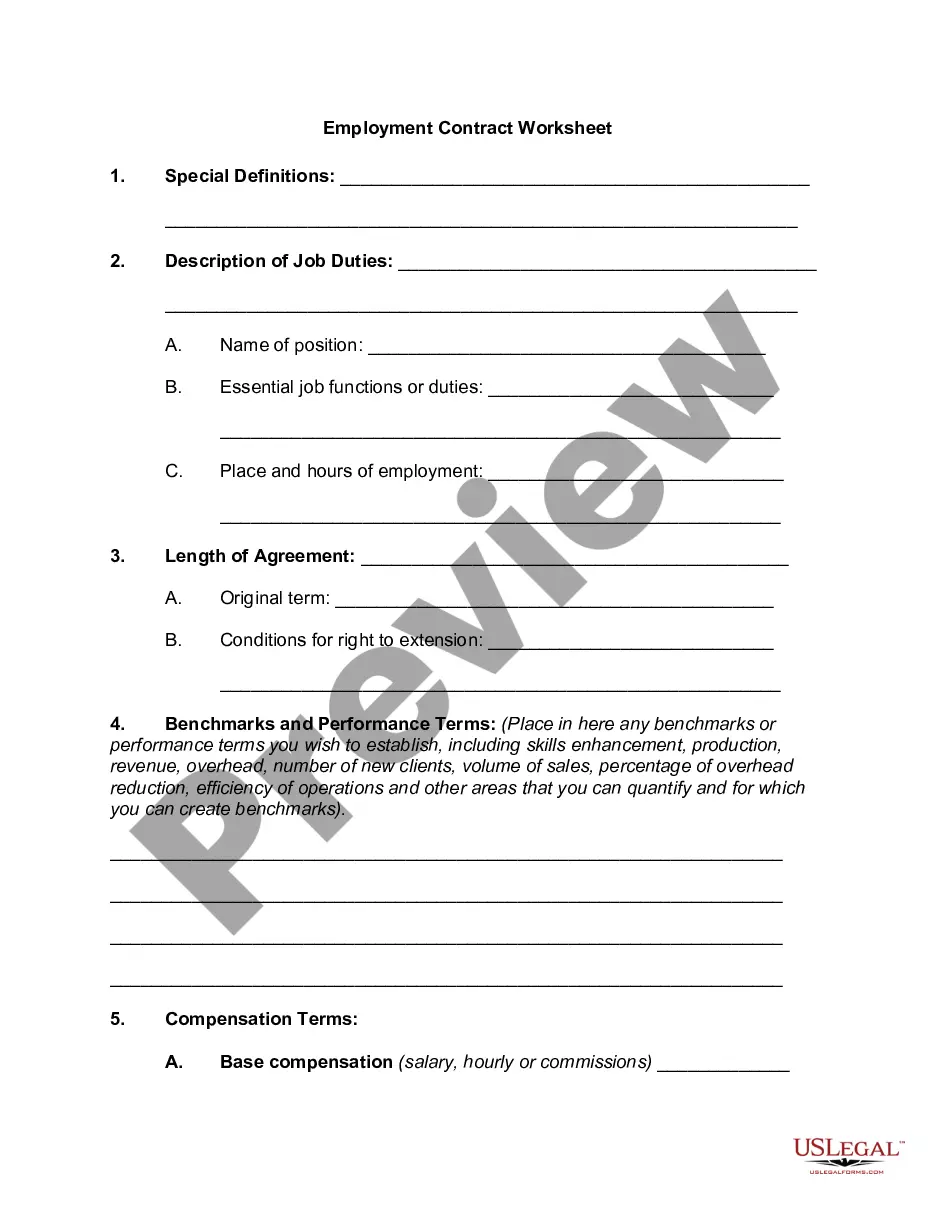

Arizona Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

Are you in a situation where you require documents for either business or personal purposes almost every day.

There are numerous authentic document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a wide range of form templates, including the Arizona Worksheet for Job Requirements, designed to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Choose your preferred pricing plan, complete the required details to create your account, and pay for your order with PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the Arizona Worksheet for Job Requirements template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to examine the document.

- Review the description to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search field to find the form that suits you and your requirements.

Form popularity

FAQ

Your weekly Unemployment Insurance Benefit Amount (WBA) is calculated on wages you earned from employers who paid Unemployment Tax to the State of Arizona. The WBA is 4% of the wages paid in the highest quarter of your base period. The current maximum WBA is $240.

Retroactive claims can be filed by calling 877-600-2722 or by completing a Weekly Claim form for each week.

If you are eligible to receive unemployment, your weekly benefit in Arizona will be 4% of the wages you earned in the highest paid quarter of the base period. The most you can receive per week is currently $240; the least you can receive is $122.

2 as the state and nation see an unprecedented number of people applying for jobless benefits because of COVID-19. DES spokesman Brett Bezio told Arizona Mirror those denied claims were deemed monetarily ineligible, meaning the people applying didn't meet the earnings eligibility requirement.

If you are returning to part-time work, you may continue to file weekly certifications and report your earnings for each week. If you earn less than your weekly benefit amount, you may still be entitled to partial unemployment benefits.

To be considered eligible to receive benefits with respect to any week, claimants must engage in a systematic and sustained effort to search for work:On at least 4 different days each week, AND.Making at least 4 work search contacts each week.

If you are eligible to receive unemployment, your weekly benefit in Arizona will be 4% of the wages you earned in the highest paid quarter of the base period. The most you can receive per week is currently $240; the least you can receive is $122.

Line C2 on the quarterly Unemployment Tax and Wage Report is the total amount of wages you paid to all your employees during the quarter being reported that exceeds the first $7,000 you paid to each of them in the calendar year-to-date.

If you are returning to part-time work, you may continue to file weekly certifications and report your earnings for each week. If you earn less than your weekly benefit amount, you may still be entitled to partial unemployment benefits.

To qualify for benefits in Arizona, you must have worked for an employer who paid unemployment tax and you must have earned: At least 390 times the Arizona minimum wage in your highest earning quarter and the total of the other three quarters must equal at least one half of the amount in your high quarter.