Arizona Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a broad range of legal document templates that you can download or print.

On the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Arizona Assignment of Accounts Receivable in just moments.

If you possess a membership, Log In and retrieve the Arizona Assignment of Accounts Receivable from the US Legal Forms database. The Acquire button will show up on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finish the transaction.

Choose the format and download the form onto your device. Edit it. Fill it out, modify, print, and sign the downloaded Arizona Assignment of Accounts Receivable. Each template you have added to your account does not expire and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/region.

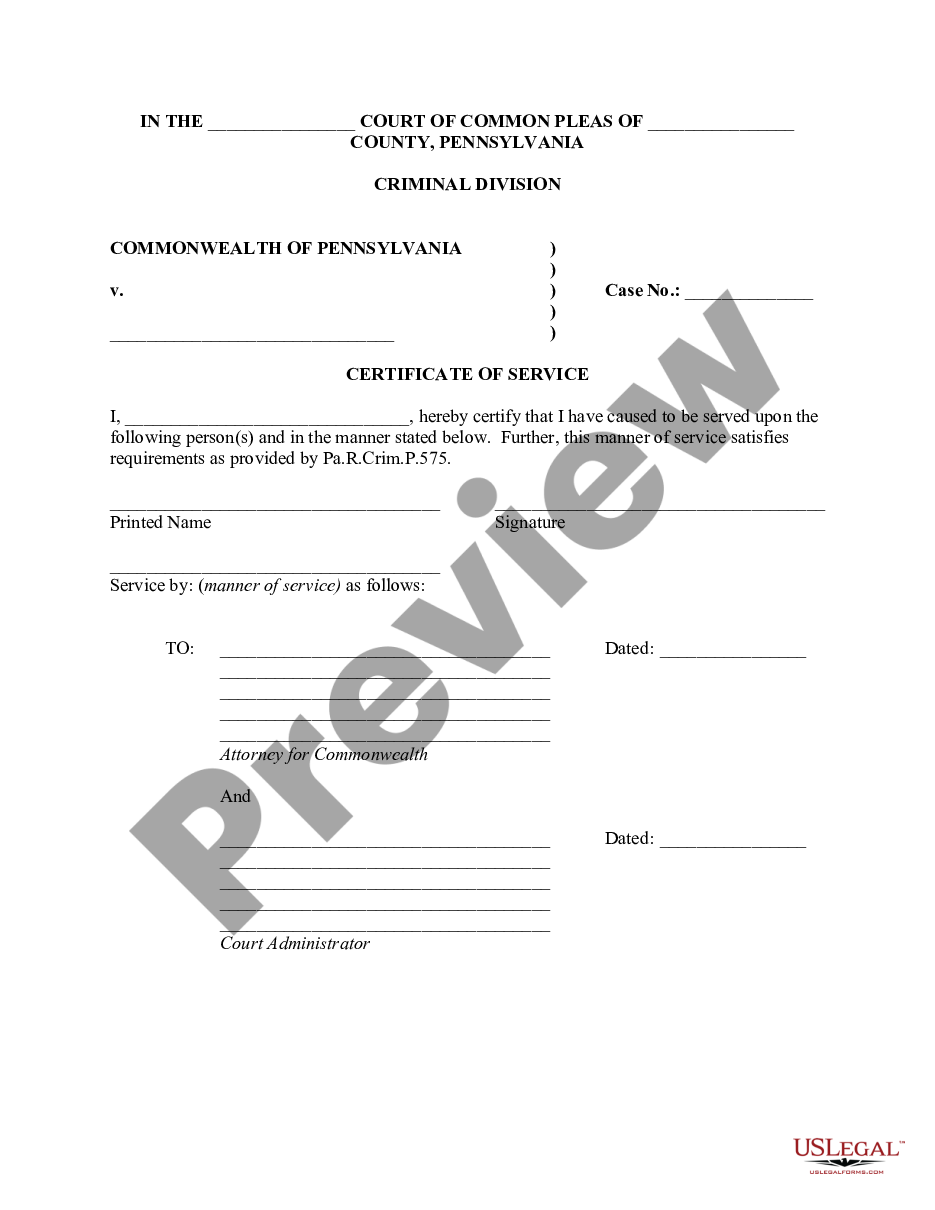

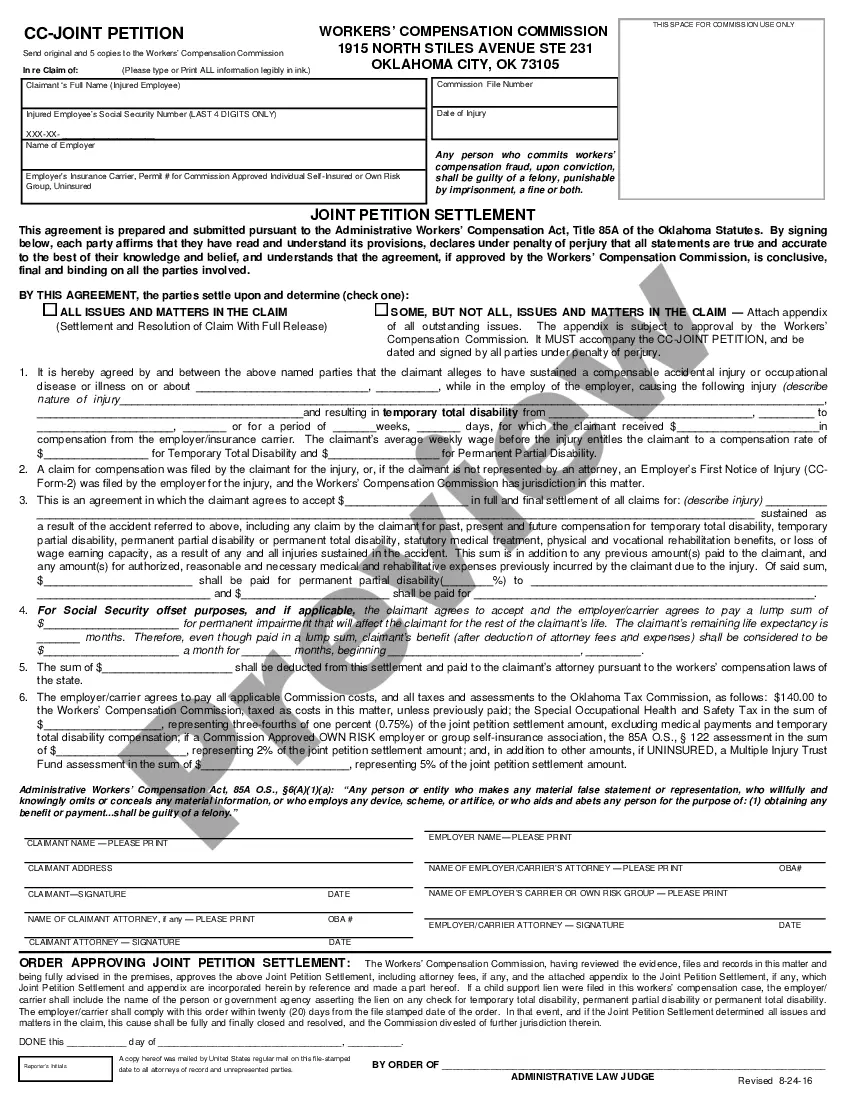

- Click the Preview button to examine the form's content.

- Read the form description to confirm you have chosen the appropriate form.

- If the form doesn’t meet your needs, utilize the Search box at the top of the page to find one that does.

- Once satisfied with the form, verify your choice by clicking the Acquire now button.

- Then, select the payment plan you desire and provide your details to register for the account.

Form popularity

FAQ

A right to assign agreement is a legal contract that permits one party to transfer its rights or interests in an asset, such as accounts receivable, to another party. This agreement specifies the conditions and terms under which the assignment occurs, providing legal clarity and protection for both parties involved. When engaging in the Arizona Assignment of Accounts Receivable, having a well-drafted right to assign agreement can help safeguard your business interests and ensure smooth transactions.

Locating accounts receivable typically involves reviewing financial statements, aging reports, and customer records. You can also assess your billing system for outstanding invoices and payments due. Using an efficient accounting software solution, such as those offered by US Legal Forms, can streamline this process and simplify the management of accounts receivable in the context of Arizona Assignment of Accounts Receivable.

To assign accounts receivable, you start by identifying the specific invoices or payments you wish to transfer to another party. Next, you both create a written agreement that outlines the terms of the assignment. This process involves notifying the debtor about the assignment to ensure proper payment to the new party. By using Arizona Assignment of Accounts Receivable, you can streamline this process effectively.

In the assignment of receivables, the agreement details the rights and obligations of each party regarding the outstanding accounts. This documentation outlines payment terms, amounts, and any specific conditions tied to the assignment. With the Arizona Assignment of Accounts Receivable, you receive a structured approach that helps manage collections efficiently.

To file accounts receivable in Arizona, start by organizing your invoices and outstanding payments. You’ll need to document the details of each receivable clearly. After that, using a reliable platform like USLegalForms can simplify the filing process, helping you manage your Arizona Assignment of Accounts Receivable effectively.

A notice of assignment of receivables is a document informing your customers that their payments should be directed to a designated third party. This notice ensures clarity and helps prevent confusion during the collection process. By providing this notice, you protect your interests in the Arizona Assignment of Accounts Receivable and facilitate smoother transitions between accounts. It is vital for ensuring your customers are aware of the change in payment arrangements.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

Follow these tips to ensure efficient and effective accounts receivable management.Use Electronic Billing & Payment.Outline Clear Billing Procedures.Set Credit & Collection Policies and Stick to Them.Be Proactive.Set up Automations.Make It Easy for Customers.Use the Right KPIs.Involve All Teams in the Process.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Accounts receivable pledging occurs when a business uses its accounts receivable asset as collateral on a loan, usually a line of credit. When accounts receivable are used in this manner, the lender typically limits the amount of the loan to either: 70% to 80% of the total amount of accounts receivable outstanding; or.