Arizona Assignment of Debt

Description

How to fill out Assignment Of Debt?

In case you need thorough, obtain, or printing legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's simple and convenient search to discover the documents you require.

Different templates for business and personal purposes are categorized by types and claims, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select your preferred pricing plan and enter your information to create an account.

Step 5. Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to finish the transaction.

- Utilize US Legal Forms to locate the Arizona Assignment of Debt with just a few mouse clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Arizona Assignment of Debt.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the following steps.

- Step 1. Ensure you have selected the form suitable for your city/state.

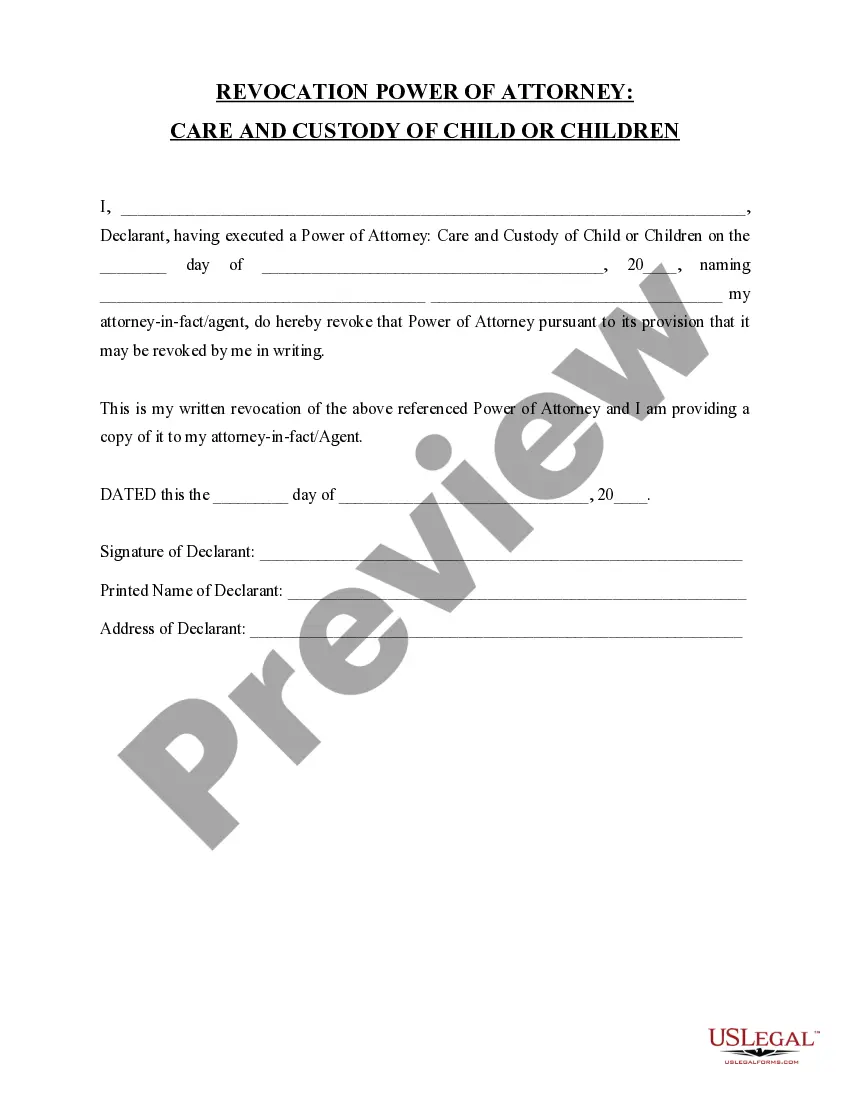

- Step 2. Use the Preview option to review the form's details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

An example of an assignment of benefits would be when a patient assigns their medical insurance benefits to a healthcare provider to cover outstanding medical bills. This process allows the provider to receive payment directly from the insurance company. Understanding such examples can be crucial when considering an Arizona Assignment of Debt in healthcare or other sectors.

The assignment of benefits form serves to formalize the transfer of rights from a debtor to another party, ensuring clear understanding of benefits and obligations. This document specifies what is assigned and can help clarify responsibilities when dealing with debts. If you're considering the Arizona Assignment of Debt process, a well-completed form can enhance your standing.

In Arizona, the statute of limitations for most debts ranges from three to six years, depending on the type of debt. After this period, collectors can no longer legally pursue the debt in court. It's essential to be aware of these limits when dealing with any Arizona Assignment of Debt matters to ensure your rights are protected.

The assignment of benefits can be a beneficial strategy, but it depends on your circumstances. It allows you to hand over your claims to a third party, potentially simplifying your debt management. Consider consulting with professionals to see how the Arizona Assignment of Debt could work best for you in your specific situation.

Arizona follows the Fair Debt Collection Practices Act, which protects consumers from abusive debt collection practices. Debt collectors must adhere to specific rules regarding communication, providing you with certain rights. Understanding these laws is essential when navigating your own Arizona Assignment of Debt situation.

Debt collectors can visit your home in Arizona, but they must follow strict guidelines. They can only contact you during reasonable hours and cannot harass you in any way. Remember, if you feel uncomfortable, you can request that they cease contact, or seek guidance on the Arizona Assignment of Debt process to protect your rights.

In Arizona, most debts become uncollectible after a six-year period due to the statute of limitations. This means that creditors cannot pursue legal action after this timeframe. Understanding Arizona Assignment of Debt can empower you to effectively handle debt and make informed decisions about your financial matters. Staying educated about your rights is crucial for effective debt management.

Assigning debt involves transferring the responsibility of the debt from one party to another. This process often requires a written agreement that outlines the terms of the transfer. Utilizing resources like Arizona Assignment of Debt can streamline the assignment process and ensure proper documentation. It helps create a clear path for managing financial responsibilities.

In Arizona, the law allows creditors to initiate legal action to collect debts for up to six years. This period starts from the date the payment was due, not when the creditor first tries to collect. Keeping track of your debts and understanding the implications of Arizona Assignment of Debt can help you navigate your financial landscape. If you're facing debt issues, consider reviewing your options.

Debts generally become uncollectible in Arizona after the statute of limitations expires, which is six years for most debts. Once the time frame passes, creditors can no longer legally sue you for the debt. Understanding Arizona Assignment of Debt can help you manage financial obligations more effectively and avoid potential collection issues. Staying proactive can help protect your financial future.