Arizona Agreement to Compromise Debt by Returning Secured Property

Description

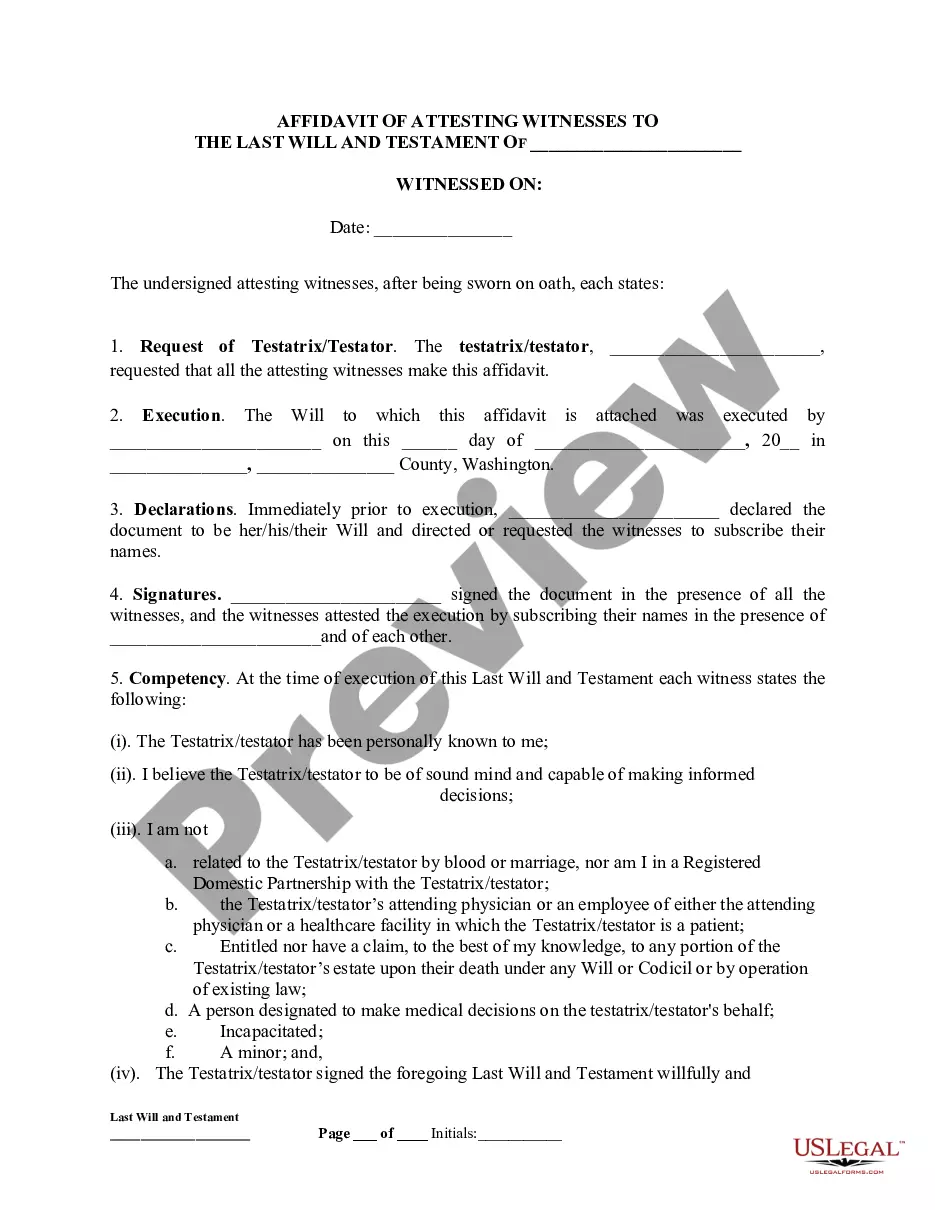

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Selecting the ideal legal document template can be challenging.

Certainly, there is a multitude of templates available online, but how do you secure the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Arizona Agreement to Compromise Debt by Returning Secured Property, suitable for business and personal purposes.

You can browse the form using the Review button and read the form description to confirm it meets your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Arizona Agreement to Compromise Debt by Returning Secured Property.

- Use your account to navigate through the legal templates you have previously purchased.

- Go to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, Arizona is a community property state, meaning that most debts incurred during a marriage are regarded as joint responsibilities, regardless of the individual whose name is on the account. Both spouses are generally responsible for repaying these debts, which can complicate financial situations during a separation or divorce. Exploring options like the Arizona Agreement to Compromise Debt by Returning Secured Property might help couples manage community debts effectively.

The predatory debt collection act in Arizona is legislation aimed at protecting consumers from abusive debt collection practices. This law prohibits harassment, misleading actions, and excessive fees by debt collectors. It is essential for individuals dealing with debts to understand their rights under this act. Utilizing strategies like the Arizona Agreement to Compromise Debt by Returning Secured Property may provide you with a pathway to address your financial obligations.

Yes, the US government offers various debt relief programs designed to aid citizens in financial distress. These programs include options for student loans, housing assistance, and bankruptcy assistance. However, navigating these programs can be challenging. You may find it beneficial to explore an Arizona Agreement to Compromise Debt by Returning Secured Property as a viable alternative.

In Arizona, a debt collector can pursue old debt typically for six years after the last payment was made. This timeframe is defined by the statute of limitations on most consumer debts. However, once this deadline passes, collectors lose their legal right to sue for payment. If you are facing old debt issues, consider an Arizona Agreement to Compromise Debt by Returning Secured Property to resolve the situation.

Filing an offer in compromise involves completing IRS Form 656 and submitting it along with the required documentation and fees. Ensure you follow all guidelines for your Arizona Agreement to Compromise Debt by Returning Secured Property to maximize your chances for approval. Utilizing platforms like USLegalForms can offer you the structure and support to file correctly.

While hiring an attorney is not mandatory, it can be very helpful for navigating the complexities of an offer in compromise. They can guide you in preparing your Arizona Agreement to Compromise Debt by Returning Secured Property and ensure all documentation is accurate. Consider using USLegalForms to access legal resources and templates that simplify the process.

Compromising a debt means negotiating with a creditor to settle for less than what you owe. In the context of the Arizona Agreement to Compromise Debt by Returning Secured Property, it often involves returning secured items in exchange for the creditor forgiving the remaining balance. This approach can help ease your financial burden while resolving obligations.

The primary form used for an offer to compromise is IRS Form 656. This form details your offer and assists in the evaluation of your Arizona Agreement to Compromise Debt by Returning Secured Property. It’s crucial to complete this form accurately, as errors may delay your application, so consider utilizing resources offered by USLegalForms for assistance.

When preparing an offer in compromise, you need certain documents to support your claim. Essential documents include your financial statements, tax returns, and proof of income. For your Arizona Agreement to Compromise Debt by Returning Secured Property, gathering these documents can streamline your submission, and platforms like USLegalForms can help you identify everything you need.

Yes, you can file an offer in compromise by yourself, but it's essential to understand the complexities involved. Preparing your Arizona Agreement to Compromise Debt by Returning Secured Property requires attention to detail. Many individuals find it beneficial to use resources from platforms like USLegalForms for clear guidance throughout the process.