A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

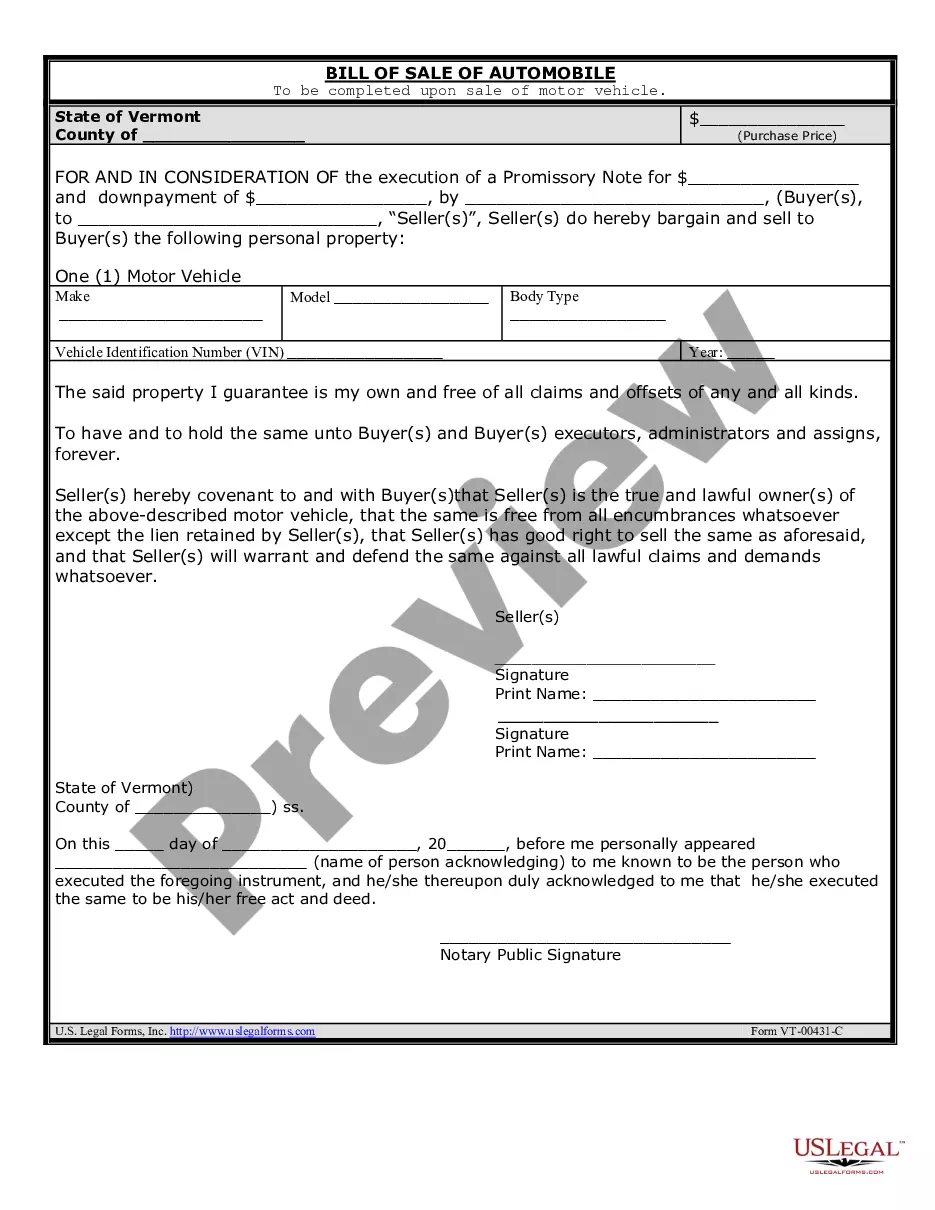

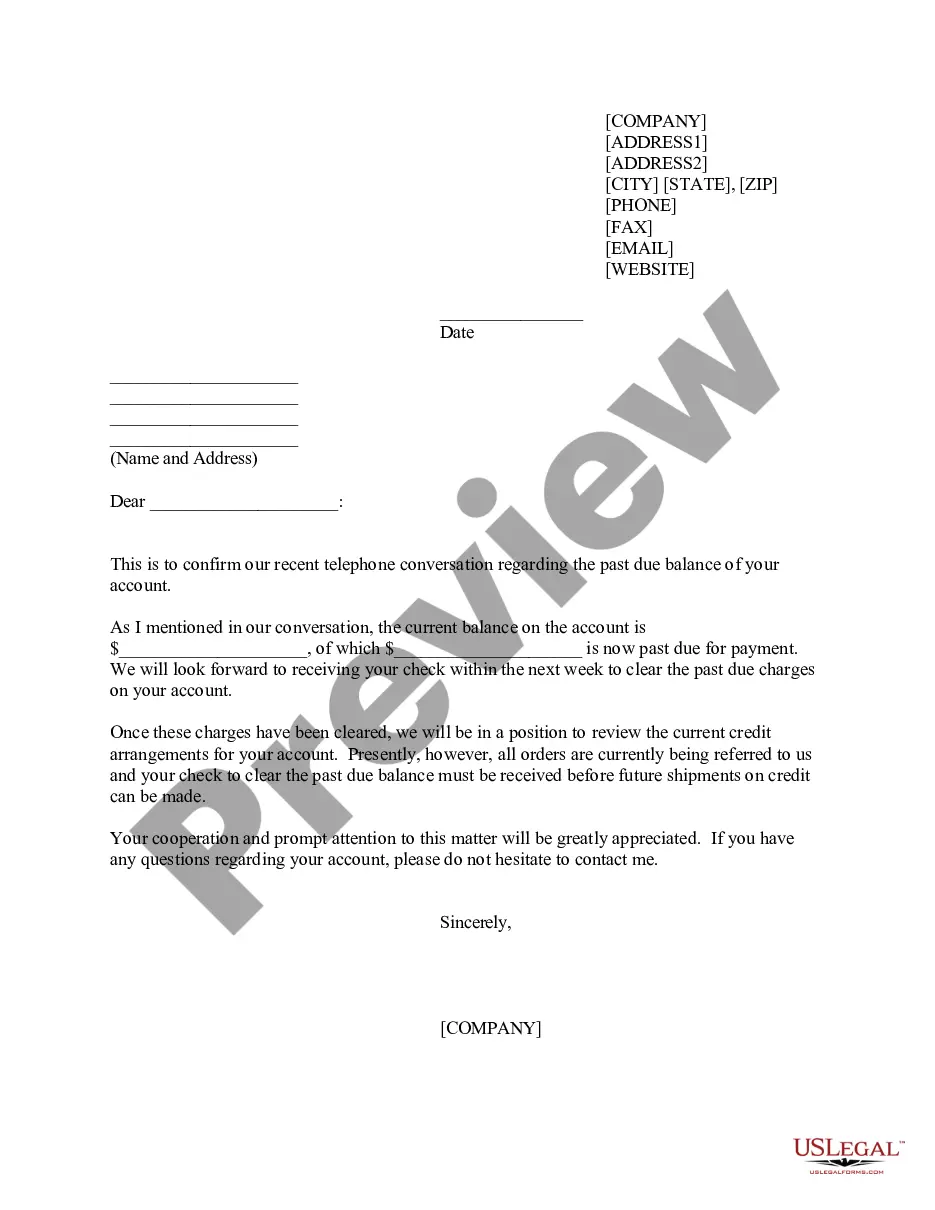

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

In the event that you desire to be thorough, procure, or create legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's straightforward and user-friendly search functionality to locate the documents you require.

A variety of templates for business and personal uses are organized by categories and states, or keywords.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

Every legal document template you download is yours forever. You will have access to every form you saved within your account. Go to the My documents section and select a form to print or download again.

Act decisively and download, as well as print the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to find the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

- You can also access forms you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to examine the form's contents. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

While limited partners usually enjoy liability protection, certain circumstances can lead to personal liability. If a limited partner engages in management activities, they may risk losing this protection. Moreover, the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership provides important guidelines on these matters. It is best to consult legal insights to navigate this landscape effectively and safeguard your interests.

In a general partnership, each partner is typically liable for debts incurred by the business, making the concept of shared liability crucial to understand. However, in a limited partnership, this responsibility differs greatly with general partners bearing more risk. The Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership clarifies the extent of each partner's liability, ensuring all parties are aware of their financial exposure. This clarity helps in making informed business decisions.

Yes, general partners are indeed subject to liability for partnership debts and obligations. This liability is unlimited, meaning that personal assets can be at risk if the partnership fails to meet its obligations. The Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership reinforces the importance of general partners understanding their legal responsibilities. Knowing these risks allows partners to strategize effectively.

A general partner holds personal liability for the debts and obligations of the limited partnership. They are responsible for managing the day-to-day operations and, under the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, they must ensure financial obligations are met. Unlike limited partners, general partners are fully accountable for the partnership’s liabilities. Understanding this difference can help partners make informed decisions.

Generally, a limited partner is not personally liable for the debts of the business beyond their investment in the partnership. This is central to the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership. However, if a limited partner takes part in managing the partnership, they may lose this liability protection. It's crucial to understand these dynamics fully to protect your investment.

Guaranteed payments to general partners are compensations that ensure the partner receives a specified amount, regardless of the partnership's profit or loss. These payments can be beneficial for providing stability and encouraging active management. Understanding these payments is essential within the context of the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

In essence, there is no entity specifically termed 'general limited partner.' However, the general partner holds significant authority and liability, while limited partners contribute capital but have limited involvement in management. Clarifying these roles helps all parties ensure compliance with the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

A limited company can act as a general partner within a limited partnership structure, thus allowing it to take on management and operational responsibilities. This approach can provide stability and efficiency, as the company operates under a familiar corporate structure. It is crucial for parties to understand their rights and obligations under the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

Yes, a general partner can be a limited company, which can limit its own liability in the limited partnership. This structure allows for more strategic flexibility, enabling the company to engage in multiple limited partnerships while maintaining protections for its owners. It’s essential to consider how this fits into the broader framework of the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

In a limited liability partnership (LLP), there is no general partner as typically defined in a limited partnership. All partners generally share responsibility and liability proportionately. Understanding the distinctions in structure can clarify how the Arizona Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership applies to various partnership forms.