Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

Have you ever been in a situation where you require documentation for potentially organizational or individual reasons almost every day.

There is a multitude of legal document templates available on the internet, but finding forms you can trust is not simple.

US Legal Forms offers thousands of template forms, including the Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, which are designed to comply with federal and state regulations.

Once you find the correct form, simply click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

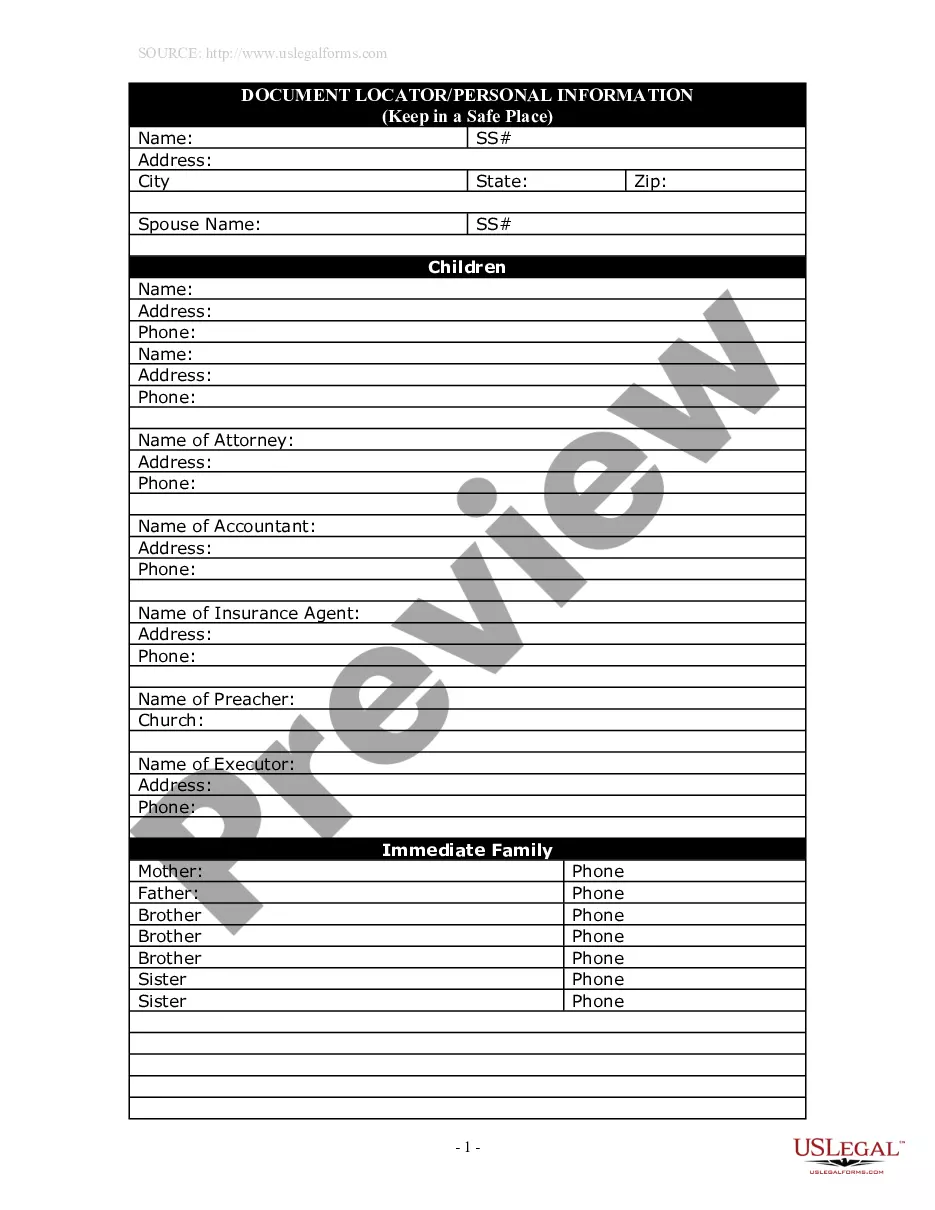

- Use the Review button to examine the form.

- Read the summary to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

As an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, it is generally advisable to set aside around 25-30% of your income for taxes. This amount includes federal income tax and self-employment tax. By planning ahead and saving this percentage, you can avoid surprises when tax season arrives. Using tools or platforms like uslegalforms can help you calculate and manage your tax obligations more effectively.

To show income as an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can provide invoices to clients for the services rendered. Additionally, you should maintain a record of all payments received, including bank statements and any 1099 forms from clients. These documents serve as proof of your income when filing taxes or applying for loans. Keeping accurate records helps you manage your finances more easily.

As an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, you typically need to complete various forms, including the 1099 for income reporting. Additionally, you may need to fill out a W-9 form to provide your taxpayer identification number to clients. Keeping your paperwork organized is vital for tax season and helps demonstrate your professional status to clients and regulatory agencies.

If you are an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, you will need to file a 1099 form if you earned $600 or more from a single client. This form reports the income the contractor received for services. Filing this form accurately is crucial for both you and your clients to ensure proper tax reporting. Make sure to keep detailed records of your earnings to simplify the process.

In Idaho, the key difference between an independent contractor and an employee lies in the level of control and independence. As an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor, you operate your own business, set your own hours, and determine how to deliver your services. In contrast, employees typically work under the direction of an employer and have less flexibility in their roles. Understanding these distinctions is crucial for your career and financial planning.

Yes, independent contractors, including Idaho Self-Employed X-Ray Technicians, generally need a business license in Idaho. This requirement varies by locality, so it is crucial to check the specific regulations in your area. Obtaining a license can enhance your professional reputation and make you more attractive to potential clients.

The self-employment tax in Idaho is the same as the federal self-employment tax, which is currently 15.3%. This tax covers Social Security and Medicare contributions. As an Idaho Self-Employed X-Ray Technician, it's essential to factor this tax into your income projections and budgeting.

Yes, in Idaho, you need a license to operate as a contractor, including Idaho Self-Employed X-Ray Technicians. This requirement helps maintain industry standards and ensures that contractors adhere to safety and quality regulations. Check with local authorities to understand the specific licensing requirements for your area.

While it's possible to work as an Idaho Self-Employed X-Ray Technician without a license, it is not advisable. Many clients require proof of licensure before hiring independent contractors. Additionally, operating without a license may expose you to legal risks and potential fines.

Filing taxes as an Idaho Self-Employed X-Ray Technician Self-Employed Independent Contractor involves several steps. Start by keeping accurate records of your income and expenses throughout the year. You will typically file a Schedule C with your personal tax return, detailing your business income and expenses.