Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

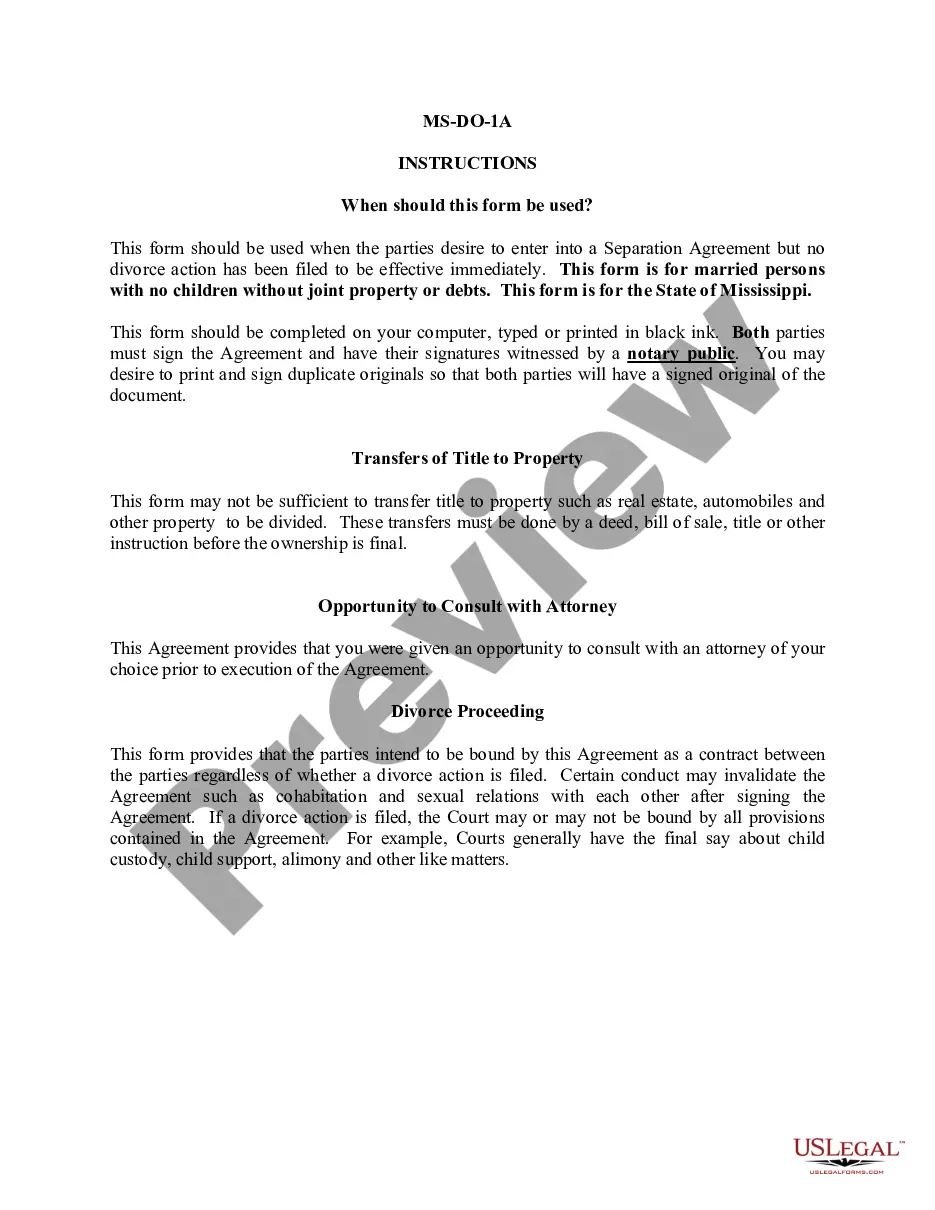

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor within minutes.

If you already have a monthly subscription, Log In and download the Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor. Each document you add to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have chosen the right form for your city/state.

- Click the Review button to examine the form's content.

- Check the form information to ensure you have selected the correct form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, choose your preferred payment plan and enter your details to register for an account.

Form popularity

FAQ

Filling out a 1099 form is a crucial process for independent contractors in Illinois, including X-Ray Technicians. You will need to provide your name, address, and taxpayer identification number, as well as the total payments you received during the tax year. The form is essential for reporting your income to the IRS and ensuring compliance with tax regulations. If you need guidance on completing this form correctly, consider utilizing US Legal Forms, which offers templates and instructions tailored for Illinois Self-Employed Independent Contractors.

As an Illinois Self-Employed X-Ray Technician or any independent contractor, you can show income by maintaining accurate records of your earnings through invoices and payment receipts. It is essential to document all transactions and keep a detailed account of your work hours and services provided. This will not only help you when filing taxes but also provide a clear picture of your business performance. Using a service like US Legal Forms can assist you in creating professional invoices and managing your financial documentation effectively.

In Illinois, an independent contractor is someone who provides services or performs tasks for others while maintaining control over how those tasks are completed. This includes Illinois Self-Employed X-Ray Technicians who manage their own business operations, set their own hours, and work without direct supervision. Being classified as an independent contractor means you are responsible for your own taxes and business expenses, which can be beneficial for your financial management. If you're navigating this landscape, consider using platforms like US Legal Forms to access resources specifically tailored for Illinois Self-Employed Independent Contractors.

Yes, receiving a 1099 form typically indicates that you are considered self-employed. This form is issued to independent contractors and reflects the income you earned during the tax year. As an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor, this income is subject to self-employment taxes. It is essential to maintain accurate records of your earnings and expenses to ensure compliance with tax regulations.

An independent contractor is indeed considered self-employed. This classification indicates that you operate your own business and are responsible for your income and expenses. As an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor, you enjoy the benefits of autonomy while navigating the complexities of self-employment. It's important to stay informed about your responsibilities and options available to you.

Yes, if you are an independent contractor, you are considered self-employed. This means you manage your own business operations and are not directly controlled by an employer. As an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor, you have the flexibility to determine how and when you work. This independence can lead to greater job satisfaction and opportunities for growth.

Yes, independent contractors and self-employed individuals are essentially the same. Both terms refer to individuals who work for themselves rather than being employed by someone else. As an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor, you operate your own business and take on the risks and rewards associated with it. This distinction is important for understanding your rights and obligations in the workforce.

The legal requirements for independent contractors in Illinois include obtaining any necessary licenses or permits to operate your business. Additionally, you must ensure compliance with tax laws and maintain accurate records of your income and expenses. As an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor, it's essential to understand your rights and responsibilities. Resources like USLegalForms can provide valuable information about the legal landscape for independent contractors.

You are classified as self-employed if you run your own business or earn income as an independent contractor. This means you are responsible for managing your own work, expenses, and taxes. Being an Illinois Self-Employed X-Ray Technician Self-Employed Independent Contractor signifies that you are not under the control of an employer. This classification gives you the freedom to operate your business as you see fit.

In Illinois, independent contractors are generally not eligible for workers' compensation benefits. This is because workers' compensation laws typically cover employees rather than independent contractors. However, some independent contractors may qualify for coverage under specific circumstances. It is essential to review your situation carefully and consider consulting with a legal expert or using resources like USLegalForms for guidance.