Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

Are you in a location where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can rely on isn't simple.

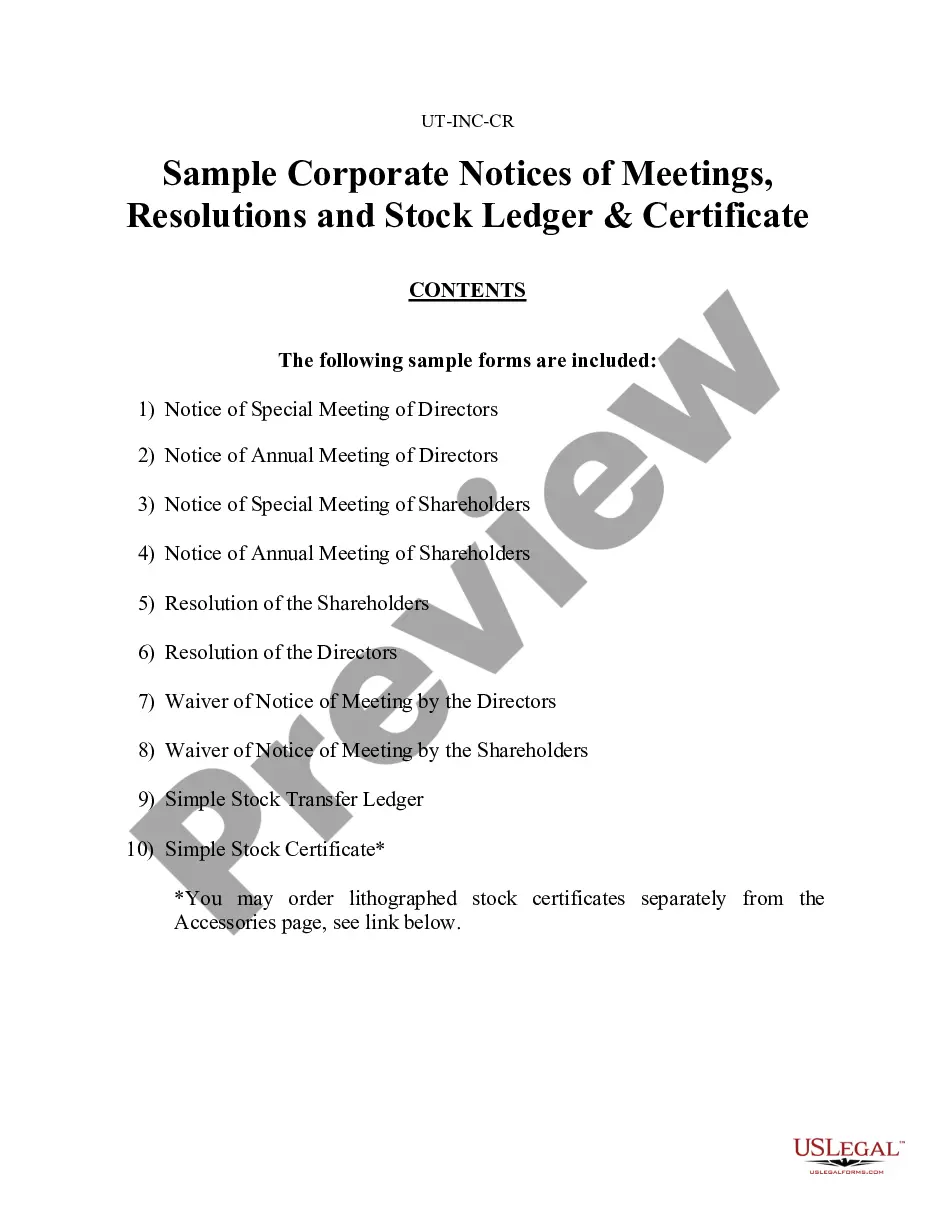

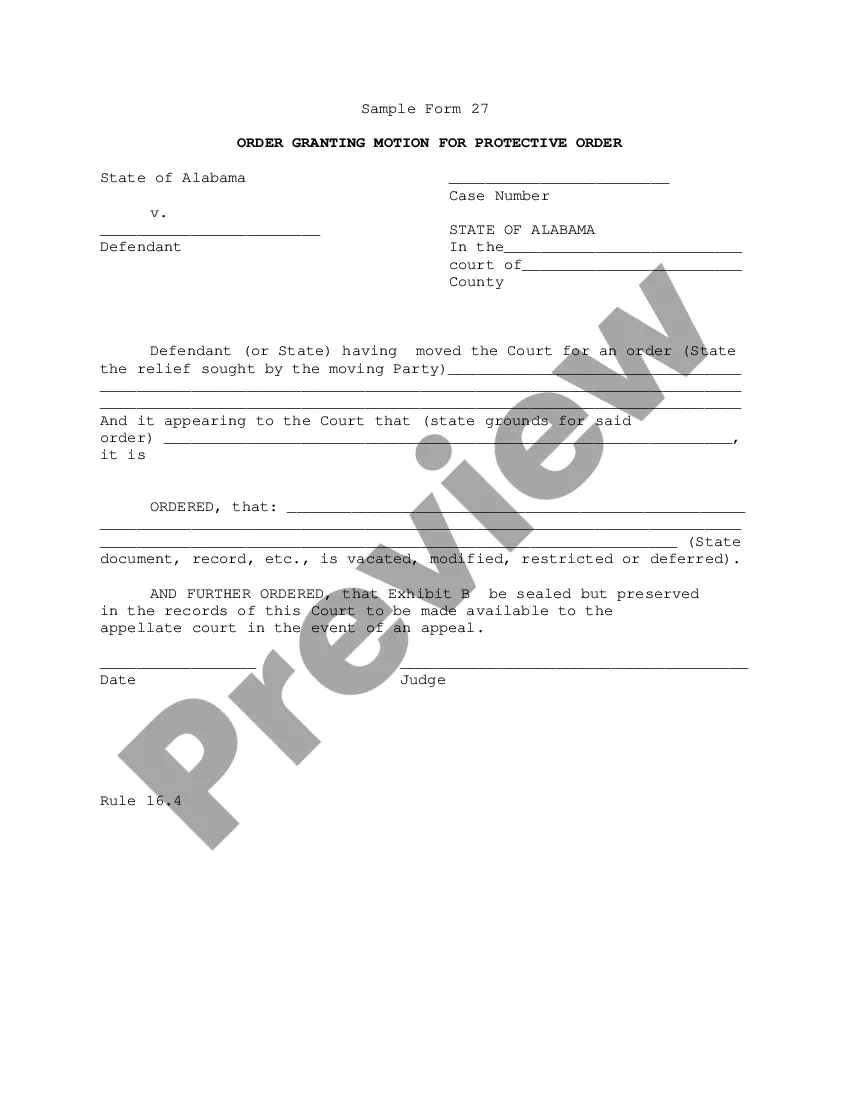

US Legal Forms offers thousands of form templates, such as the Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy. Retrieve all of the document templates you have purchased in the My documents section. You can obtain another copy of the Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor at any time if necessary. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Review button to evaluate the form.

- Check the details to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that satisfies your needs and requirements.

- If you find the correct form, click Purchase now.

Form popularity

FAQ

In Hawaii, the self-employment tax rate is currently set at 15.3%, which includes Social Security and Medicare taxes. As a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, understanding this tax responsibility is crucial for effective financial planning. It’s advisable to consult a tax professional to navigate these obligations accurately.

Filing taxes as an independent contractor involves reporting your income and expenses on Schedule C of your tax return. You will also be responsible for paying self-employment taxes. As a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, utilizing platforms like uslegalforms can simplify the process and ensure compliance with tax regulations.

Yes, independent contractors are a subset of self-employed individuals. While all independent contractors are self-employed, not all self-employed individuals work as independent contractors. Understanding this distinction can help you better navigate your role as a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor.

Independent contractors must adhere to specific legal requirements, such as obtaining necessary licenses and permits for their profession. As a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, you must ensure compliance with state regulations and tax obligations. Familiarizing yourself with these requirements can help you operate your business smoothly.

You are classified as self-employed if you operate your own business or provide services independently, receiving income directly rather than through an employer. This classification often includes professionals like a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, who manage their own business operations. Understanding this classification is vital for tax purposes and benefits.

Yes, if you are an independent contractor, you are classified as self-employed. This status brings specific tax implications and responsibilities, including the need to file taxes as a self-employed individual. As a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, it's crucial to grasp these concepts for effective financial management.

Indeed, an independent contractor is considered self-employed. This classification applies to professionals who provide services under a contract, like a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, without the typical employer-employee relationship. Understanding this distinction can help you navigate your tax responsibilities.

Yes, receiving a 1099 form often indicates that you are classified as a self-employed individual. This form is typically issued to independent contractors, such as a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor, to report income earned. However, it's essential to ensure that you meet other criteria for self-employment as well.

Yes, you need to fill out a W9 form as a Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractor. This form provides your clients with the necessary information to report payments to the IRS accurately. Completing the W9 correctly is essential to ensure smooth transactions and compliance with tax laws.

Typically, independent contractors, including Hawaii Self-Employed X-Ray Technician Self-Employed Independent Contractors, do not need to fill out an I-9 form. The I-9 is primarily for employees to verify their identity and employment eligibility. Since independent contractors are self-employed, this requirement does not apply to you.