Arizona Assignment of Partnership Interest

Description

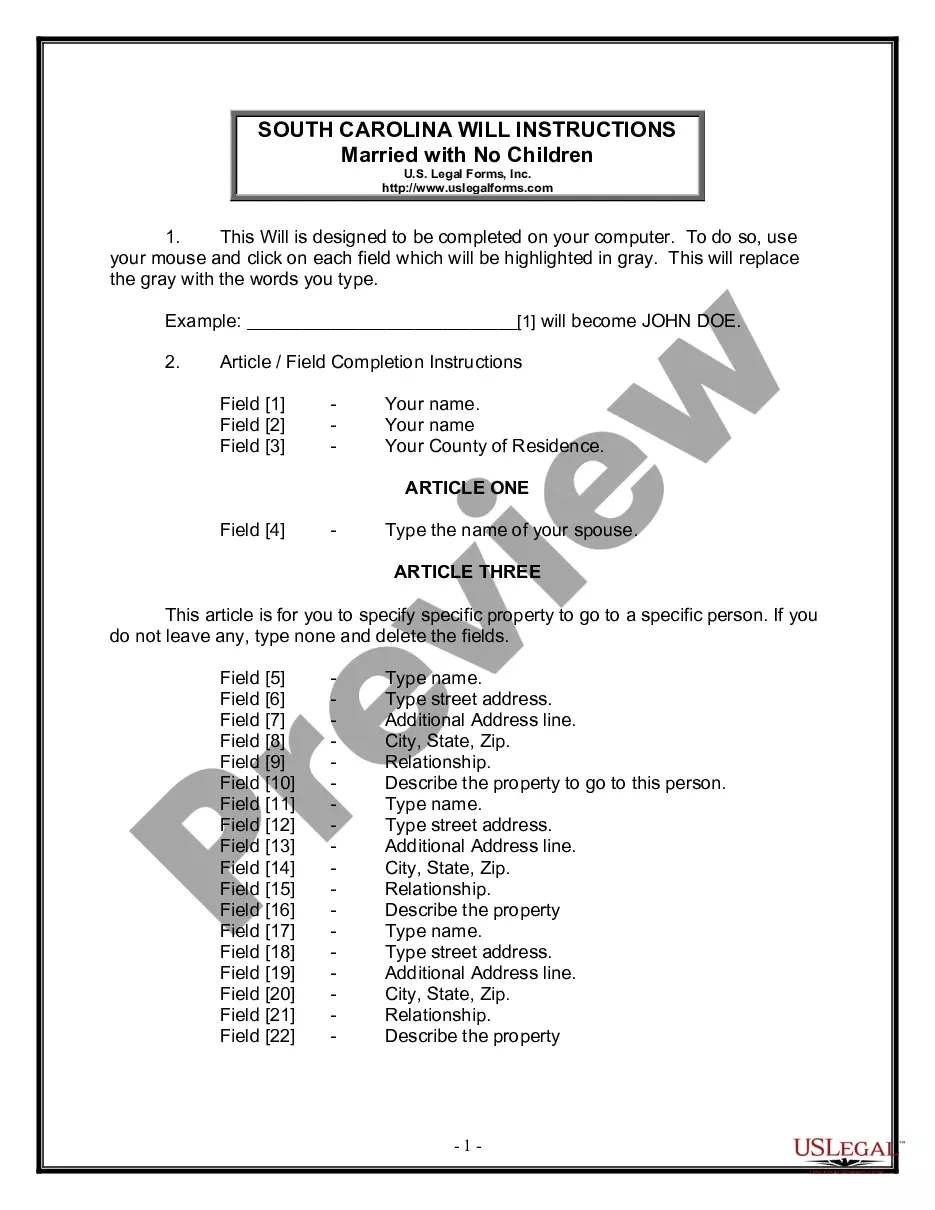

How to fill out Assignment Of Partnership Interest?

Have you ever been in a scenario where you require documents for either professional or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Arizona Assignment of Partnership Interest, that are designed to comply with state and federal regulations.

You can view all the document templates you have purchased in the My documents section. You can download an additional copy of the Arizona Assignment of Partnership Interest at any time if needed. Just click on the specific form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Arizona Assignment of Partnership Interest template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Search for the document you need and confirm it is for the correct locality/county.

- Utilize the Review button to evaluate the form.

- Check the details to ensure you have selected the right document.

- If the form isn’t what you need, use the Lookup field to find the document that matches you and your requirements.

- Once you locate the right form, click Get now.

- Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The form for transferring partnership interest is a legal document that facilitates the assignment of ownership from one partner to another. In Arizona, this document must clearly outline the terms of the transfer and be signed by all parties involved. Completing an Arizona Assignment of Partnership Interest form ensures that the rights and obligations are clearly defined and legally binding. You can find templates and guidance on this process through uslegalforms, which offers reliable resources for legal documentation.

In Arizona, the assignment of rights pertains to the act of transferring the legal rights of a partner to another individual or entity. This is a crucial aspect of the Arizona Assignment of Partnership Interest, as it lays the groundwork for how partnership assets and obligations can be handled. Assigning rights in Arizona requires adherence to both state laws and the partnership agreement. Utilizing platforms like uslegalforms can simplify the necessary paperwork for this process.

The assignment in partnership refers to the transfer of a partner's interest in the partnership to another party. This process allows the partner to assign their share of profits, losses, and management rights to someone else. In Arizona, executing an Arizona Assignment of Partnership Interest involves following specific legal requirements to ensure the transfer is valid and enforceable. It's essential to consult with legal professionals to navigate this process smoothly.

An assignment of partnership interest is a formal agreement where a partner relinquishes their ownership stake to another party. This process typically requires adherence to specific legal protocols to ensure validity. If you’re navigating this process, utilizing uslegalforms can help simplify the steps involved in creating a valid Arizona Assignment of Partnership Interest.

The assignment of interest involves the transfer of ownership rights within a partnership or LLC. This allows the assignee to step into the shoes of the assignor regarding profits, losses, and decision-making. This concept is crucial in the framework of an Arizona Assignment of Partnership Interest, as it sets clear expectations for all participants.

An assignment of a member's interest refers to the transfer of a member's rights to financial benefits and responsibilities from one party to another. In the context of a partnership, this means that a member can assign their share of profits or losses to someone else. Understanding the implications of an Arizona Assignment of Partnership Interest can help facilitate smoother transitions and protect all parties involved.

In the absence of a partnership deed, interest on drawing by a partner may not be explicitly defined. However, under Arizona law, partners typically can draw funds as per mutual agreement. It's important to consult with a legal expert to understand how the Arizona Assignment of Partnership Interest might affect such arrangements.

Yes, typically a transfer of partnership interest is taxable. This means that any gain realized on the transfer must be reported, often resulting in a tax liability. Understanding the tax implications is crucial when engaging in an Arizona Assignment of Partnership Interest, and consulting with a tax adviser might be beneficial.

Transferring ownership interest in a partnership generally requires following specific procedures outlined in the partnership agreement. This usually involves drafting a written agreement that details the terms and conditions of the transfer. Utilizing resources like uslegalforms can simplify the process and ensure all necessary documentation is completed for your Arizona Assignment of Partnership Interest.

If your partnership does business in Arizona or earns income from Arizona sources, you typically need to file an Arizona partnership return. Filing ensures compliance with state tax regulations and properly reflects your Arizona Assignment of Partnership Interest. You can use platforms like uslegalforms for guidance on filing your partnership return.