Nebraska Material Return Record

Description

How to fill out Material Return Record?

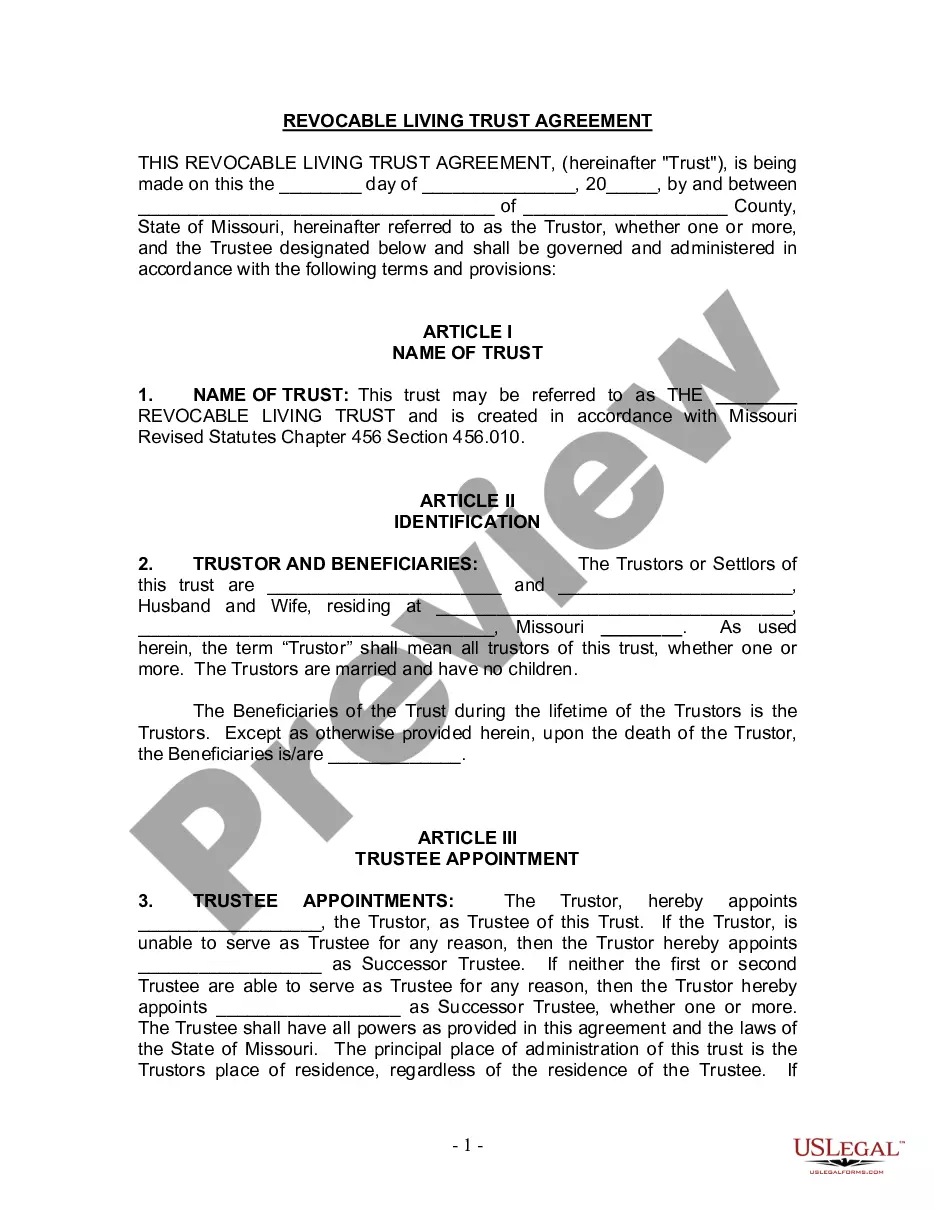

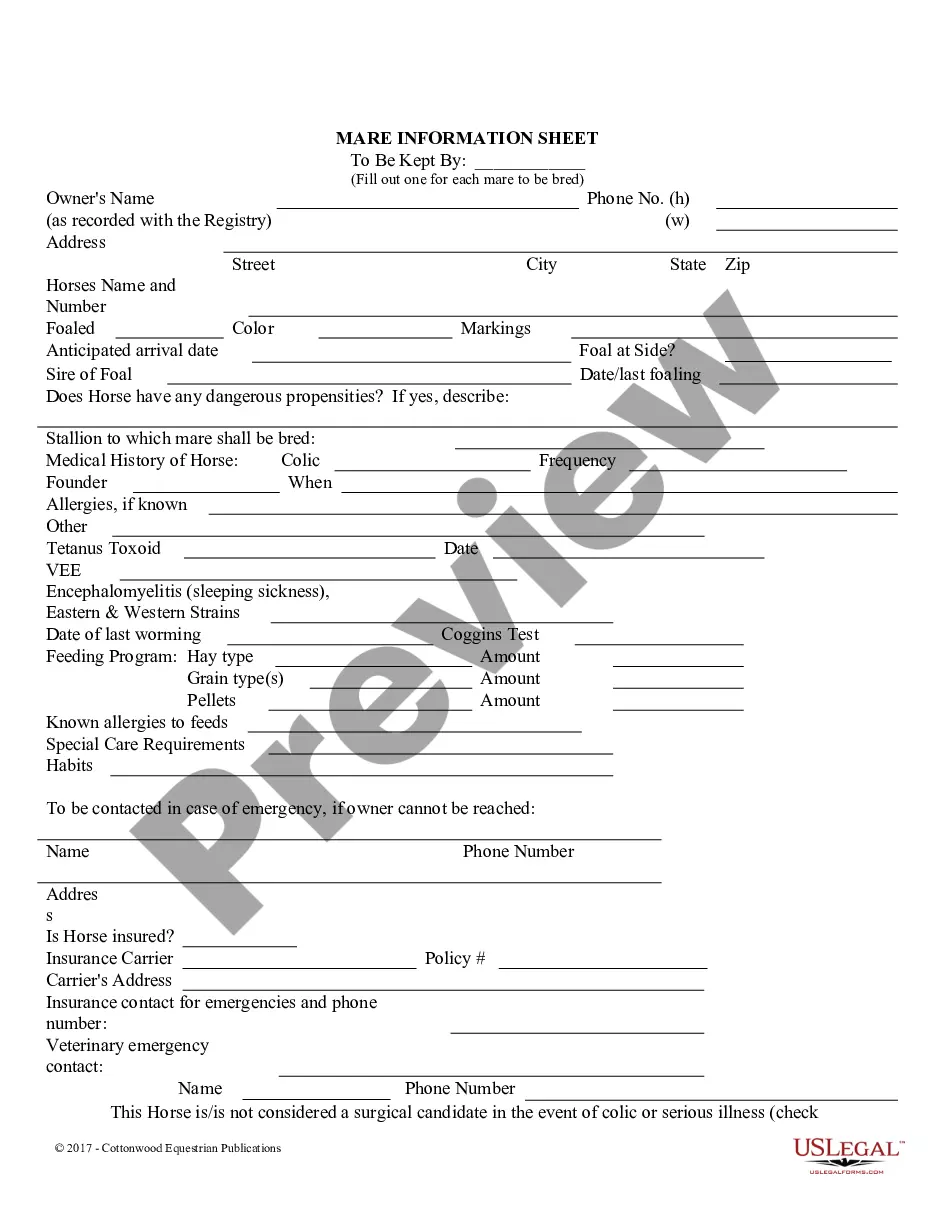

US Legal Forms - one of the largest collections of legal forms in the country - provides a selection of legal document templates that you can obtain or create.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Nebraska Material Return Record in mere seconds.

If you already have an account, Log In and download the Nebraska Material Return Record from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nebraska Material Return Record. All templates you add to your account have no expiration date and are yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Material Return Record with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- Ensure you have selected the correct form for your locality.

- Click the Preview button to review the form's content.

- Check the form details to make sure you have chosen the right one.

- If the form does not fit your needs, use the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your details to sign up for an account.

Form popularity

FAQ

FORM. 17. Section A Purchasing Agent Appointment. Name and Address of Contractor. Name and Address of Exempt Governmental Unit or Exempt Organization.

Nonresident individuals, partnerships, S corporations, regular corporations, estates (filing a Federal Form 1041) and trusts can be included on the composite income tax form.

States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.

Nebraska has both a corporation income tax and a franchise tax known as the corporation occupation tax. Your business may be subject to one, both, or neither of these taxes depending on its legal form.

A composite return is an individual return filed by the passthrough entity that reports the state income of all the nonresident owners or, in some cases, the electing members, as one group.

When a business purchases inventory to resell, they can do so without paying sales tax. In order to do so, the retailer will need to provide a Nebraska Resale Certificate to their vendor.

6. Form. Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the

No Composite Filing. The Department does not provide for the filing of composite income tax returns.

The state of Nebraska follows what is known as an origin-based sales tax policy. This means that long-distance sales within Nebraska are taxed according to the address of the seller.