A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Arizona Notice to Creditors in Probate

Description

How to fill out Arizona Notice To Creditors In Probate?

If you are looking for precise Arizona Notice to Creditors in Probate templates, US Legal Forms is what you require; discover documents crafted and verified by state-authorized lawyers.

Utilizing US Legal Forms not only helps prevent stress related to legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional template is significantly less expensive than hiring an attorney to do it for you.

And that's it. With just a few simple clicks, you will have an editable Arizona Notice to Creditors in Probate. Once you create your account, future orders will be processed even more effortlessly. When you have a subscription to US Legal Forms, simply Log In to your account and hit the Download button available on the form’s page. Then, when you need to access this document again, it will always be available in the My documents section. Don't expend your time and effort sifting through countless forms on various websites. Obtain precise documents from a single secure platform!

- Start by completing your registration process by entering your email address and creating a password.

- Follow the instructions below to set up your account and obtain the Arizona Notice to Creditors in Probate template to address your concerns.

- Use the Preview feature or check the document description (if provided) to confirm that the template meets your needs.

- Verify its compliance with the state you reside in.

- Click Buy Now to finalize your purchase.

- Choose a suggested pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Select a suitable format and save the file.

Form popularity

FAQ

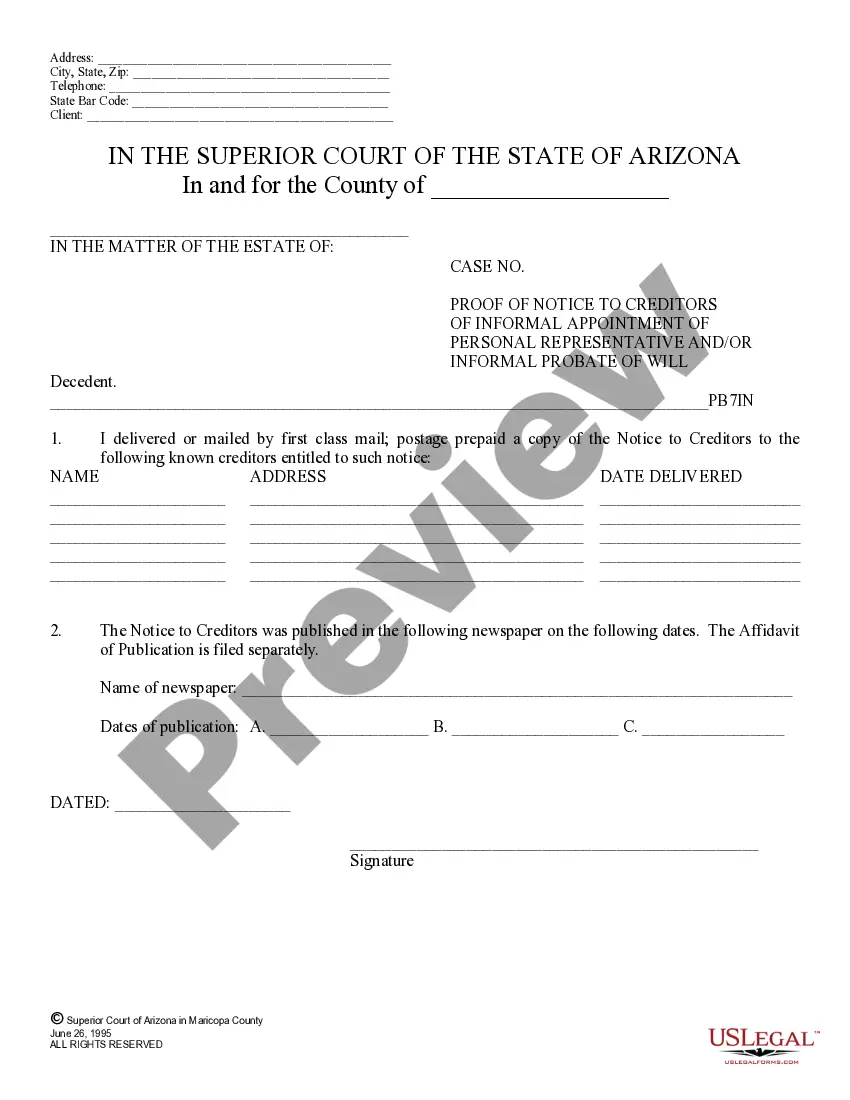

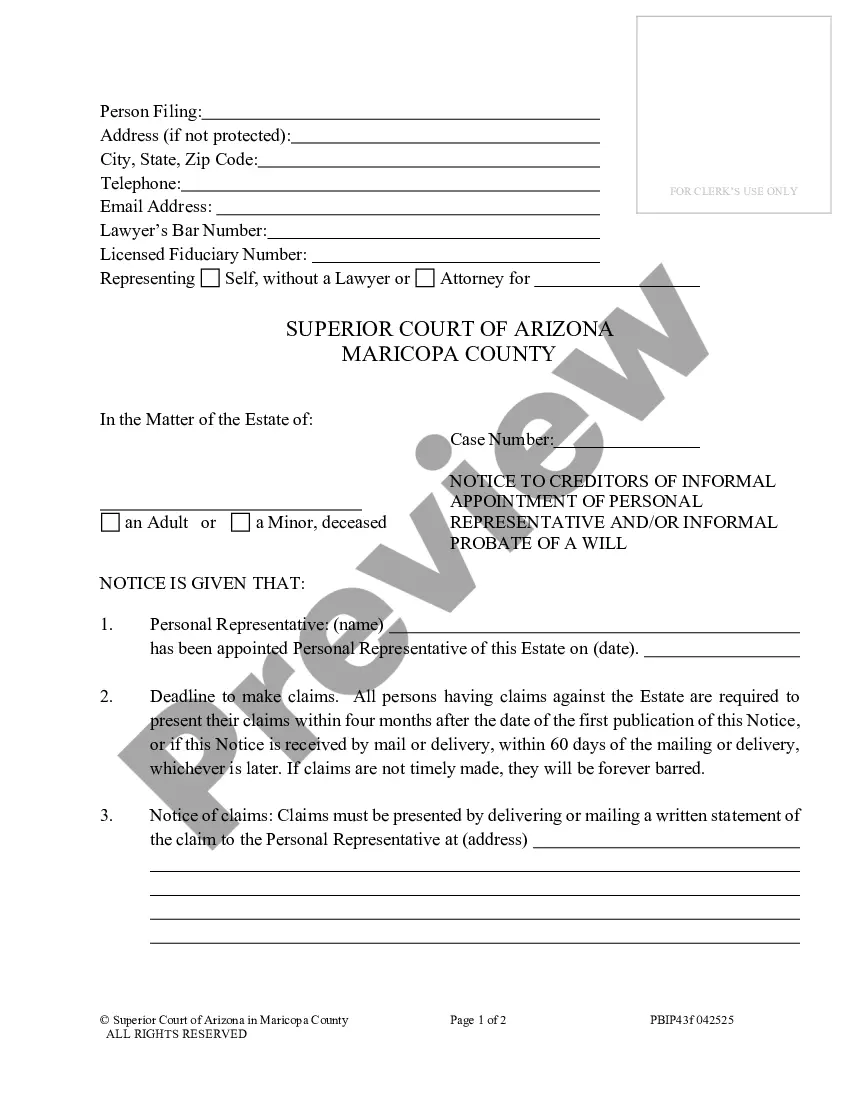

Creditors typically have four months to file their claims against a deceased estate after the publication of the Arizona Notice to Creditors in Probate. This period allows creditors to assess their claims and submit necessary documentation. If unknown creditors are not notified through personal means, they are generally bound by this four-month window after publication. It is critical to manage this timeline efficiently through reliable resources such as USLegalForms to ensure compliance with legal requirements.

A deceased estates notice is a formal announcement made to inform creditors, beneficiaries, and the public that an individual has passed away, and the estate is being administered. This notice typically includes details such as the decedent's name, date of death, and instructions on how creditors can file their claims, emphasizing the Arizona Notice to Creditors in Probate. It helps in managing estate claims and ensuring a fair distribution of the decedent's assets. Utilizing platforms like USLegalForms can simplify the creation and distribution of these notices.

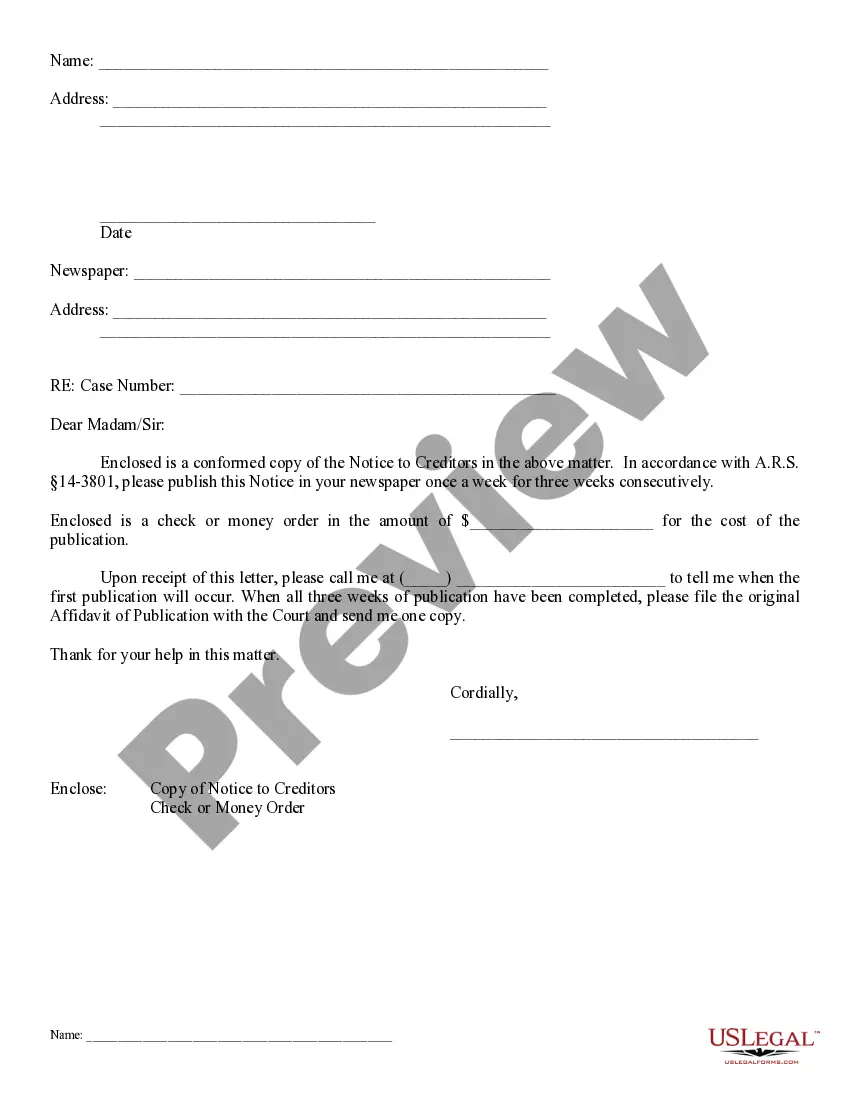

The best way to notify creditors of death is to publish a notice in local newspapers and the Government Gazette, as required by Arizona law. This public announcement serves as an Arizona Notice to Creditors in Probate, alerting all potential creditors to file claims within a designated time frame. Additionally, sending personalized letters to known creditors can further ensure they receive proper notification. Using a legal service like USLegalForms can guide you through the notification process seamlessly.

To write a letter to creditors for a deceased, you should start by clearly stating the decedent's name, date of death, and your relationship to them. Include the probate case number and specify that it is in accordance with the Arizona Notice to Creditors in Probate. Ensure you list all known creditors and mention that they should submit their claims promptly to facilitate the probate process. Lastly, provide your contact information for any further communication.

In Arizona, bank accounts may go through probate depending on how they are titled. If an account is solely in the deceased’s name, it will likely need to go through the probate process. However, accounts with designated beneficiaries or held jointly may bypass probate entirely. Understanding the implications of the Arizona Notice to Creditors in Probate can help clarify your responsibilities regarding these accounts.

In Arizona, an executor typically has a reasonable period, often within one year, to settle the estate and distribute assets. However, the complexity of the estate and any outstanding debts may affect this timeline. Executors should be mindful of the Arizona Notice to Creditors in Probate to ensure all creditor claims are addressed before making distributions.

A creditor in Arizona has five years to collect on a judgment. This timeframe can be extended for an additional five years if the creditor renews the judgment before it expires. It’s beneficial to understand your rights and obligations under the Arizona Notice to Creditors in Probate, as well, to ensure you manage any potential claims effectively.

A notice to creditors in a deceased estate informs creditors of the death and invites them to submit claims against the estate. This legal notice provides a timeframe for creditors to act. In Arizona, the executor must ensure that all creditors are properly notified to settle debts before distributing assets. Understanding the role of the Arizona Notice to Creditors in Probate can be crucial for managing this process.

In Arizona, the statute of limitations on most debts is typically six years. After this period, a creditor cannot legally enforce the debt collection. Therefore, if you owe a debt and it has not been collected for six years, it generally becomes uncollectible. It's important to stay updated about the Arizona Notice to Creditors in Probate to understand your obligations.

In Arizona, certain properties are typically exempt from creditors, including primary residences and personal belongings up to a specific value. The exemptions serve to protect the essential assets of individuals and families. Understanding these exemptions can provide peace of mind during probate, particularly with the Arizona Notice to Creditors in Probate in mind.