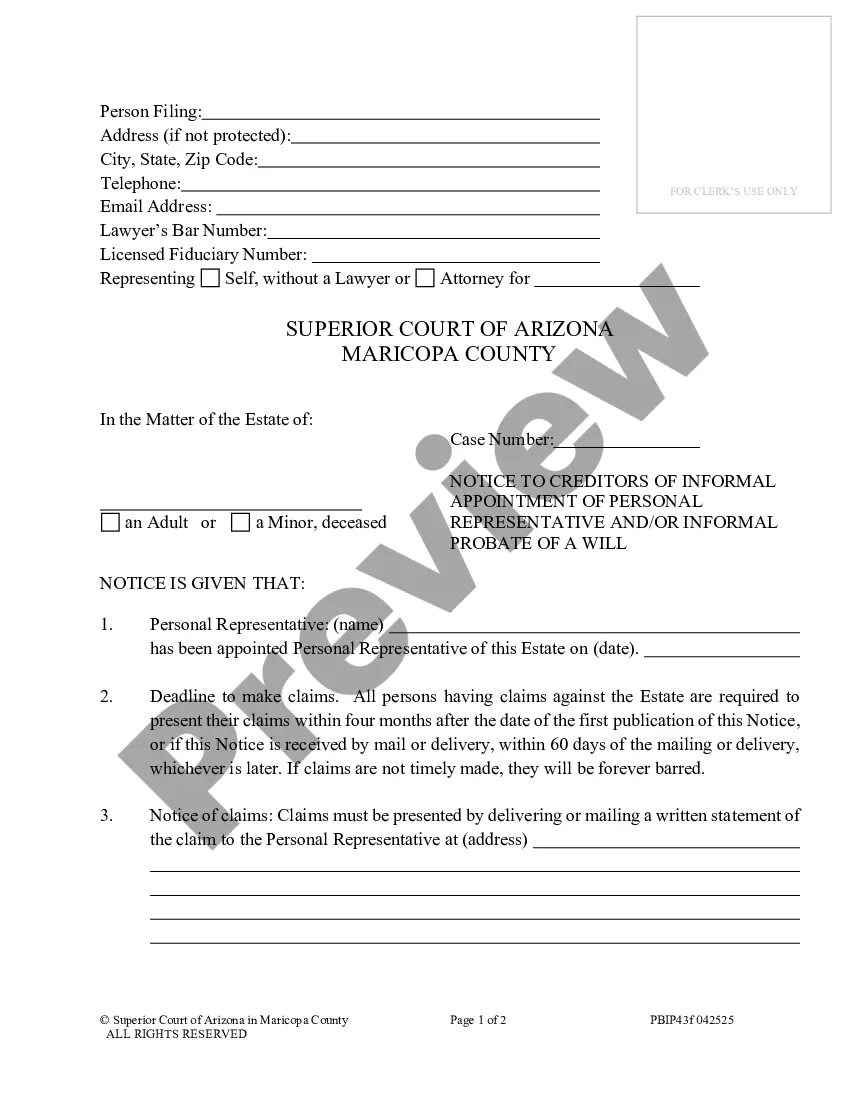

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Informal Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Arizona Notice to Creditors in Informal Probate

Description

How to fill out Arizona Notice To Creditors In Informal Probate?

If you are looking for accurate Arizona Notice to Creditors in Informal Probate examples, US Legal Forms is exactly what you need; find documents crafted and endorsed by state-certified legal professionals.

Using US Legal Forms not only alleviates concerns related to legal documentation; it also saves you time, effort, and money! Downloading, printing, and submitting a professional template is significantly more affordable than hiring an attorney to create it for you.

And that’s it. In just a few simple steps, you obtain an editable Arizona Notice to Creditors in Informal Probate. Once your account is created, all future requests will be processed even more smoothly. With a US Legal Forms subscription, simply Log In to your account and click the Download option available on the form’s webpage. Then, when you need to use this sample again, you will always find it in the My documents section. Don’t waste your time and effort sorting through numerous forms on various websites. Purchase accurate templates from a single reliable source!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the steps below to set up your account and obtain the Arizona Notice to Creditors in Informal Probate template for your situation.

- Utilize the Preview tool or review the file description (if available) to ensure that the sample is what you require.

- Verify its legitimacy in your residing state.

- Click on Buy Now to place your order.

- Select a recommended pricing plan.

- Create your account and make the payment using your credit card or PayPal.

- Choose a suitable format and save the form.

Form popularity

FAQ

A notice to creditors is a formal notification sent to inform creditors of a deceased person's estate. This announcement allows them to present their claims for payment of debts owed. In the context of the Arizona Notice to Creditors in Informal Probate, this procedure is vital for ensuring an orderly and lawful settlement of debts before any distribution of assets occurs. By using US Legal Forms, you can ensure that your notice meets all legal requirements.

When notifying creditors after a death, you should provide essential information about the deceased and the estate. Include details such as the deceased's name, date of death, and a request for any claims against the estate, under the framework of the Arizona Notice to Creditors in Informal Probate. This communication should also encourage creditors to submit their claims within a specified timeframe. Resources like US Legal Forms can help you craft the necessary documents.

Issuing a notice to a creditor is an important step in the probate process. It informs creditors of a deceased person's passing and provides them with details on how to submit claims for debts owed. In Arizona, this process is part of the Arizona Notice to Creditors in Informal Probate, which ensures all creditors have a fair opportunity to present their claims. Utilizing resources like US Legal Forms can streamline this process for you.

To publish a notice to creditors in Arizona, you must first prepare the notice according to state specifications. This notice should then be published in a local newspaper that meets legal requirements for notification. It's a straightforward process, but accuracy is key to ensure all creditors are informed. Utilizing the Arizona Notice to Creditors in Informal Probate can provide you with the necessary guidance to accomplish this effectively.

In Arizona, certain types of property are exempt from creditors' claims, including homestead exemptions and personal property up to specific value limits. This means that some assets may be protected from liquidation to satisfy debts. Understanding these exemptions helps individuals navigate the probate process effectively. Knowledge of the Arizona Notice to Creditors in Informal Probate can equip you with essential insights for protecting estate assets.

Creditors in Arizona have 4 months from the date they receive notice of the informal probate to file a claim against the estate. This filing period is crucial for creditors to secure their rights to any debts owed. Missing this window can prevent them from recovering owed funds. Utilizing the Arizona Notice to Creditors in Informal Probate is vital to ensure all creditors are informed and can act promptly.

The informal probate process in Arizona is designed to be less complicated and time-consuming than formal probate. It allows families to settle an estate without a court hearing, provided there are no disputes among heirs. This process involves filing necessary documents and publishing the Arizona Notice to Creditors in Informal Probate, which is essential for notifying creditors. By keeping the process straightforward, it helps ease the burden during difficult times.

Bank accounts that have beneficiaries listed do not have to undergo probate in Arizona. These accounts transfer directly to the designated beneficiaries outside of the probate process. This feature simplifies the transfer of assets, allowing beneficiaries to access funds quickly. Understanding this can streamline estate management and may alleviate unnecessary probate complications.

In Arizona, creditors typically have one year from the date of the notice to creditors publication to collect their debts. This timeline underscores the importance of timely action in the informal probate process. If creditors do not pursue their claims within this period, they risk being barred from future collection efforts. Utilizing the Arizona Notice to Creditors in Informal Probate can facilitate this process.

Creditors receive a formal notice informing them of the probate proceedings. This notice is part of the Arizona Notice to Creditors in Informal Probate, which ensures that all interested parties are aware of the estate's potential claims. This step is essential for the resolution of debts owed by the deceased. Accurately publishing this notice helps protect the estate and fulfill legal obligations.