This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Key Concepts & Definitions

Arizona Installments Fixed Rate Promissory Note: A legal document detailing a loan agreement in Arizona where payments are made in installments under a fixed interest rate. Secured Personal Loan: A loan backed by collateral, decreasing the risk for lenders. Unsecured Personal Loan: A loan not backed by collateral, posing a higher risk for lenders. Promissory Note Template: A document format used to craft a legally binding agreement between a borrower and a lender. Fixed Rate Mortgage: A mortgage with a fixed interest rate for the entire term. Personal Property Agreement: A legal document for the terms of sale or transfer of movable personal items.

Step-by-Step Guide to Creating an Arizona Installments Fixed Rate Promissory Note

- Determine the Loan Details: Specify the loan amount, fixed interest rate, installment schedule, and total duration.

- Choose Collateral (if secured): Decide on personal property that will secure the loan.

- Draft the Note: Use a promissory note template to ensure all crucial details are legally documented.

- Sign Legally Binding Agreements: Both borrower and lender must sign the note to validate it legally.

- Keep Records: Maintain copies of the signed document for both parties' records.

Risk Analysis

- Default Risk: Risk that the borrower fails to meet the terms of the note.

- Interest Rate Risk: Potential losses due to fixed interest rates becoming unfavourable in a varying economic environment.

- Legal Enforcement: Challenges in the enforceability of a promissory note if not properly signed or documented.

Best Practices

- Use Clear Terms: Clearly state all loan terms to avoid future disputes.

- Verify Signatures: Ensure that all parties legally sign the document and verify identities.

- Securing the Loan: Secure the loan with collateral where possible, as it provides legal and financial safety.

- Legal Consultation: Consult a lawyer to ensure that all local Arizona laws are followed and the document is legally valid.

Common Mistakes & How to Avoid Them

- Incomplete Terms: Errors, such as not defining the payment schedule clearly, can make enforcement difficult. Always review the document meticulously.

- Failing to Record Collateral: In secured loans, failing to properly record information about collateral can lead to challenges in claiming it in case of default.

- Neglecting Legal Validation: Not having the promissory note validated or witnessed can lead to questions of legitimacy.

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

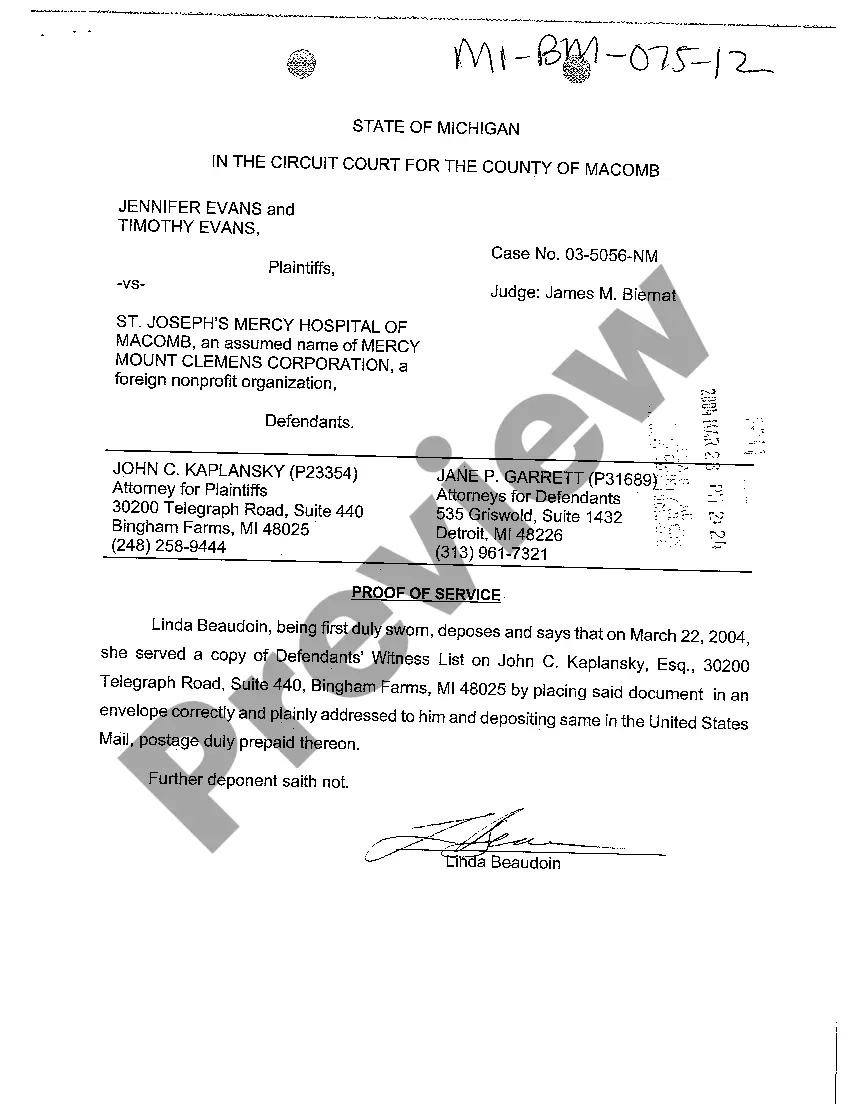

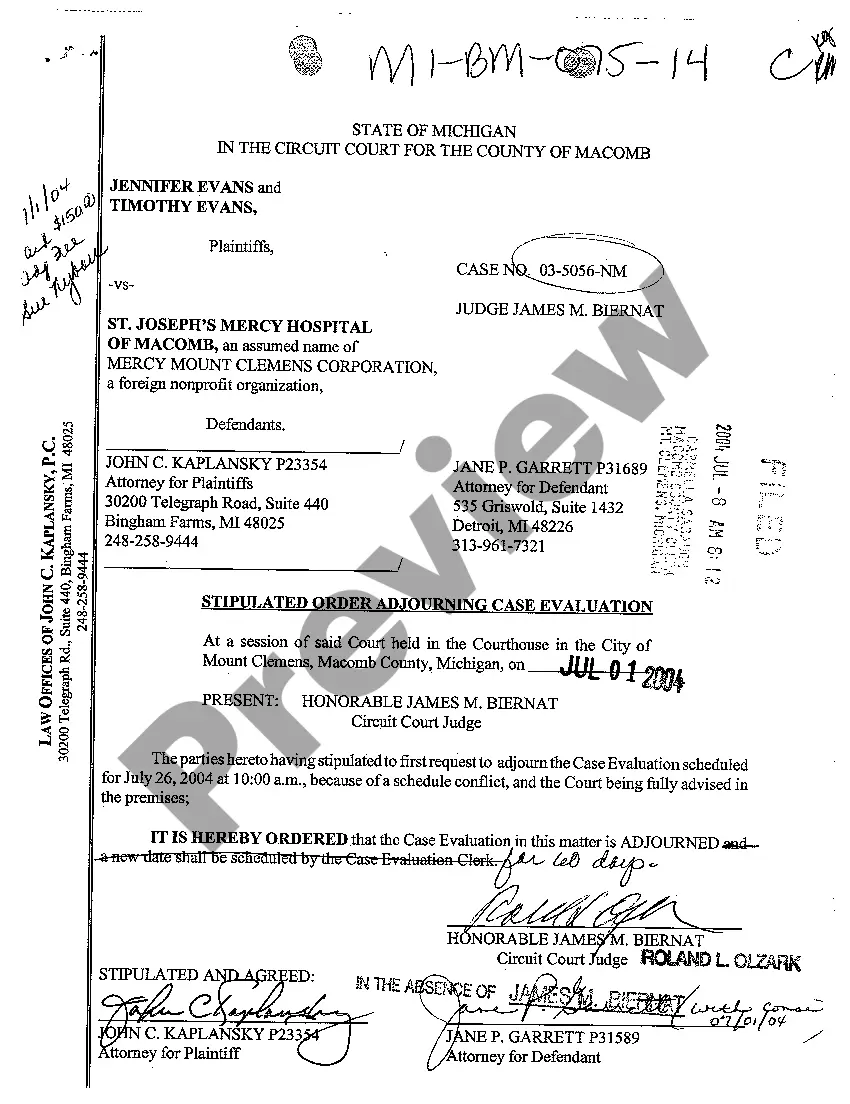

If you are looking for accurate Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate templates, US Legal Forms is precisely what you require; obtain documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only spares you from concerns about legal documents; it also saves you time, effort, and money! Downloading, printing, and submitting a professional template is significantly less expensive than hiring an attorney to draft it for you.

Select a convenient format and download the document. And that's it! In just a few simple steps, you have an editable Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Once you create an account, all future orders will be processed much more easily. If you have a US Legal Forms membership, just Log In to your account and click the Download button available on the form's page. Then, whenever you need to use this template again, you can always find it in the My documents section. Don't waste your time comparing numerous forms across different sites. Purchase accurate copies from a single secure platform!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to establish an account and locate the Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate sample to address your needs.

- Utilize the Preview option or review the document description (if available) to ensure that the form is the one you require.

- Verify its compliance with regulations in your area.

- Click Buy Now to place an order.

- Choose a recommended pricing plan.

- Create an account and pay with your credit card or PayPal.

Form popularity

FAQ

A promissory note can be secured or unsecured, depending on the agreement between the parties involved. An Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate specifically provides security by tying the note to a tangible asset, reducing the lender's risk. This type of security is often more favorable for lenders, ensuring they have a claim on the property in the event of default. Thus, knowing whether your note is secured can influence your lending experience.

The main disadvantages of a promissory note include the risk of default by the borrower, which can lead to financial loss. Additionally, collecting on a promissory note may require legal action, which can be time-consuming and expensive. When considering an Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's important to weigh these risks against the potential benefits. Understanding these factors can help you make an informed decision.

The promissory rule refers to a legal principle that holds parties accountable to the terms they agreed upon in a promissory note. This means that for an Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, both the borrower and lender must adhere to the stipulated repayment and conditions outlined in the document. Violating this rule may lead to legal implications such as default. Understanding this rule helps both parties navigate their financial agreements confidently.

Yes, a promissory note is a legally binding document that outlines the borrower's promise to repay a specified amount to the lender. In the situation of an Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, both parties are bound by the agreed-upon terms, which provide legal recourse in case of default. It is essential to ensure that the note is properly drafted to hold up in court if necessary. This legal assurance plays a crucial role in financial transactions.

The promissory note policy outlines the protocols and regulations governing the creation, execution, and enforcement of promissory notes. For an Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial to adhere to state laws which dictate how these documents should be structured. This policy helps in establishing clarity and preventing any legal issues that may arise. Understanding this policy will give you confidence in your financial transactions.

The rules for promissory notes include requirements such as clarity in the terms, acknowledgment of the amount being borrowed, and defined repayment conditions. In the context of an Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, these rules need to ensure both parties understand their obligations. It is essential to have accurate documentation to prevent disputes. Implementing these rules will enhance the reliability of your financial agreements.

In Arizona, a promissory note does not require notarization to be legally binding, although having it notarized may help avoid disputes later. Notarization adds a layer of authenticity and can facilitate enforcement if necessary. For your Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you might find that notarization provides additional peace of mind.

A secured promissory note is backed by collateral, such as commercial real estate, while a standard promissory note is an unsecured agreement between the borrower and lender. If the borrower defaults on a secured promissory note, the lender can claim the collateral to recover losses. This added security makes Arizona Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate a safer investment option.