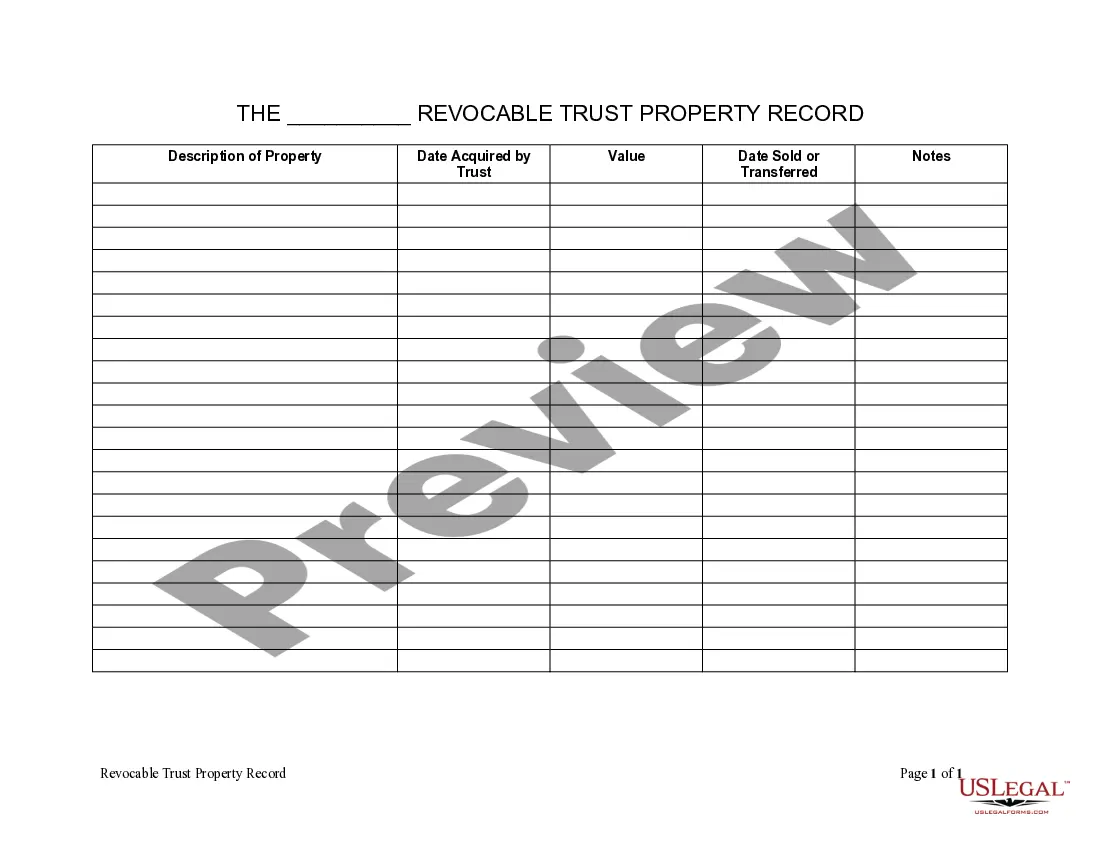

Florida Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Florida Living Trust Property Record?

Obtain entry to one of the most comprehensive collections of sanctioned forms.

US Legal Forms serves as a resource to locate any state-specific document in just a few clicks, including Florida Living Trust Property Record templates.

There’s no need to squander hours searching for a court-admissible example.

If everything is satisfactory, click on the Buy Now button. After selecting a pricing plan, create your account. Pay via card or PayPal. Download the document by clicking on Download. That's it! You need to submit the Florida Living Trust Property Record form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly browse approximately 85,000 useful samples.

- To benefit from the documents library, select a subscription and register your account.

- If you have registered, just Log In and then click Download.

- The Florida Living Trust Property Record template will be saved instantly in the My documents section (a section for each form you store on US Legal Forms).

- To establish a new profile, refer to the brief instructions outlined below.

- If you're planning to use a state-specific document, make sure you specify the correct state.

- If possible, review the description to comprehend all of the details of the form.

- Utilize the Preview feature if it's available to examine the document's content.

Form popularity

FAQ

You typically do not need to record a living trust, as recording is not required in Florida. By keeping the trust private, you can avoid additional costs and protect sensitive information. However, if your trust holds real estate, you may need to prepare a deed for that property to reflect the trust's ownership. Consider using uslegalforms to guide you through the necessary steps.

In Florida, living trusts are not recorded with the court. Instead, they act as private documents, which means they remain confidential and do not become part of the public Florida Living Trust Property Record. This privacy allows you to manage your assets without worrying about public disclosure. If you need help managing your living trust, uslegalforms offers resources to simplify the process.

To get a copy of a trust document in Florida, you should contact the trustee directly, as they are responsible for providing copies to beneficiaries or interested parties. The trustee can guide you through the steps needed to officially request this document. If you run into issues, consulting an attorney may help you navigate your options. Remember, maintaining your Florida Living Trust Property Record is crucial for ensuring your estate planning wishes are honored.

While putting your house in a trust offers benefits, there are some disadvantages to consider. You may face initial costs associated with creating the trust and transferring property. Additionally, there are potential complications in managing the trust over time. It’s essential to weigh these factors against the benefits when dealing with your Florida Living Trust Property Record.

As mentioned earlier, trust documents are not public records in Florida. This privacy allows you to maintain control over your assets without unwanted scrutiny. Knowing this, you can make informed decisions about your estate planning. For more insights on managing your Florida Living Trust Property Record, USLegalForms offers supportive resources.

To obtain a certificate of trust, the trust's trustee must prepare it, which outlines basic details of the trust without revealing its contents. This document can help in various transactions or dealings when the full trust document is not necessary. Engaging with a legal professional may streamline this process, ensuring your Florida Living Trust Property Record is properly handled and documented.

To obtain a copy of a trust document in Florida, you need to contact the trustee listed in the document. The trustee has the authority to provide you with copies as required, typically for beneficiaries or interested parties. If no documents are available, you might want to consider contacting legal professionals for assistance. Managing your Florida Living Trust Property Record effectively often involves clear communication with your trustee.

Trust documents are generally private and not considered public records in Florida. This means that others can’t freely access or review the details contained within your trust. If you are establishing a living trust, understanding this privacy can help you plan your estate more securely. For assistance with your Florida Living Trust Property Record, consider seeking help from professionals who specialize in estate planning.

You cannot typically access trust documents online as they are not filed with the county recorder's office. Trusts are private documents, meaning their contents are not publicly available. However, some services, like USLegalForms, can guide you through the process of managing these records and understanding their implications. It's important to know your options when looking for specific information related to your Florida Living Trust Property Record.

In Florida, putting property in a living trust generally does not trigger a reassessment. The property continues to receive the same tax treatment as before, provided the ownership remains unchanged. This means that you can manage your assets without facing property tax spikes. For more detailed information, consult with an estate planning professional to ensure your Florida Living Trust Property Record stays intact.