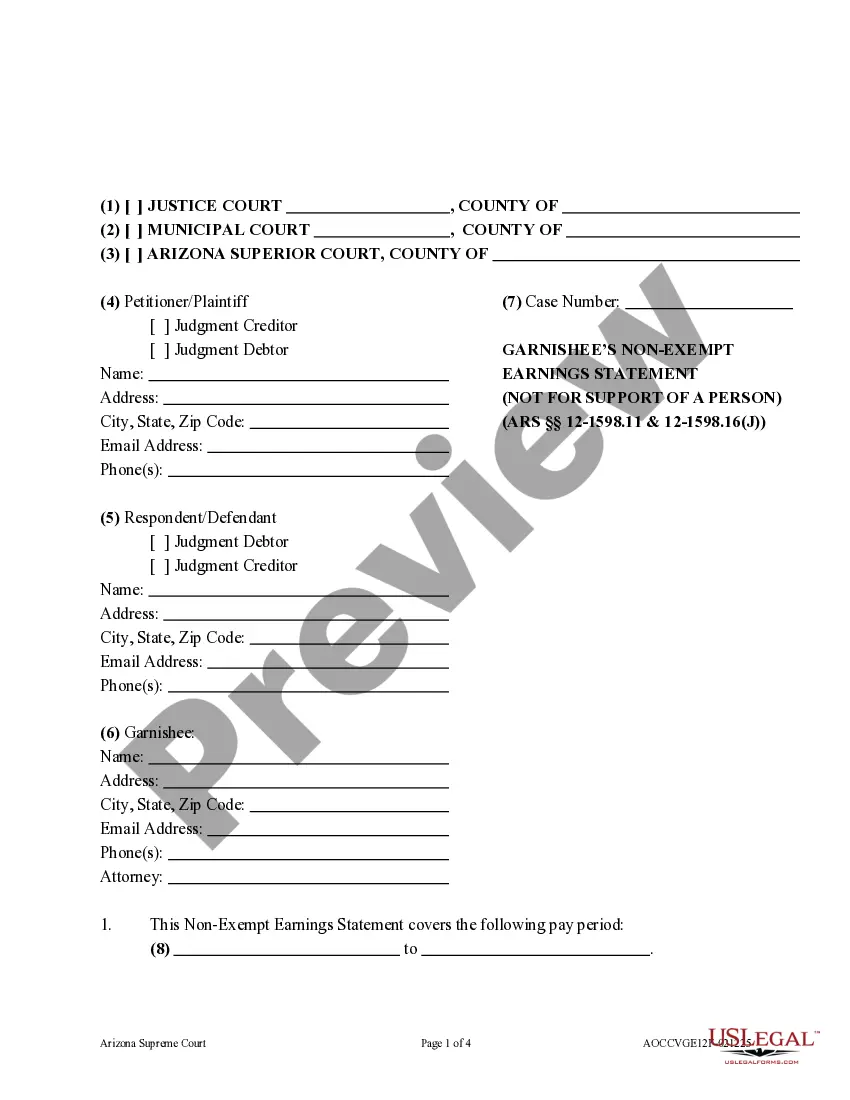

Arizona All Non-Earnings Garnishment Forms in one file is a set of documents designed for wage garnishment of non-earnings in Arizona. The file includes three different forms: an Employer's Answer, an Order for Garnishment of Non-Earnings, and a Garnishment of Non-Earnings Summons. The Employer's Answer form allows the employer to respond to the garnishment summons. The Order for Garnishment of Non-Earnings form allows the creditor to request the garnishment of the debtor's non-earnings. The Garnishment of Non-Earnings Summons form is the notice sent to the employer informing them of the garnishment and their obligation to comply with the order. The forms are all fully compliant with Arizona law and are designed to ensure a smooth and efficient garnishment process.

Arizona All Non-Earnings Garnishment Forms in one file

Description

How to fill out Arizona All Non-Earnings Garnishment Forms In One File?

If you’re searching for a method to accurately prepare the Arizona All Non-Earnings Garnishment Forms in a single file without hiring an attorney, then you are in the perfect spot. US Legal Forms has established itself as the most comprehensive and esteemed library of official templates for every personal and business circumstance. Every document you find on our platform is crafted in compliance with national and state regulations, ensuring that your records are in good order.

Follow these straightforward instructions on how to obtain the ready-to-use Arizona All Non-Earnings Garnishment Forms in one file.

Another excellent feature of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you need it.

- Confirm that the document displayed on the page aligns with your legal needs and state regulations by reviewing its text description or checking the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown menu to locate another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are satisfied with the document's compliance with all the requirements.

- Log In to your account and click Download. Create an account with the service and choose the subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format in which you wish to receive your Arizona All Non-Earnings Garnishment Forms in one file and download it by clicking the appropriate button.

- Upload your template to an online editor to fill it out and sign it quickly or print it to prepare a hard copy manually.

Form popularity

FAQ

To stop wage garnishment in Arizona, you can file a motion to contest the garnishment or negotiate a settlement with your creditor. It’s essential to act quickly and understand your rights in this process. Utilizing resources like Arizona All Non-Earnings Garnishment Forms in one file can equip you with the necessary forms and information to effectively manage and halt wage garnishments.

The most your wages can be garnished in Arizona is determined by the same guidelines that limit garnishments to 25% of your disposable income or 30 times the minimum wage. This ensures you retain enough income for living expenses. For more clarity and guidance, accessing Arizona All Non-Earnings Garnishment Forms in one file will provide the necessary information for managing your situation.

In Arizona, the maximum amount that creditors can garnish is typically 25% of your disposable income, or the amount by which your weekly earnings exceed 30 times the minimum wage. This means understanding your income and any deductions you have is crucial. Using Arizona All Non-Earnings Garnishment Forms in one file can help you understand your limits and protect your finances.

To calculate Arizona garnishment, you need to determine your disposable income, which is what remains after deductions like taxes and Social Security. Generally, Arizona law allows creditors to garnish a portion of your wages based on this disposable income. Ensure you have the right resources, such as Arizona All Non-Earnings Garnishment Forms in one file, to simplify the calculation and reporting process.

To obtain a copy of a garnishment, you can start by contacting the court that issued the garnishment order. They typically keep records of such documents. Alternatively, you can use the Arizona All Non-Earnings Garnishment Forms in one file available on the uslegalforms platform. This file streamlines the process, making it easier for you to retrieve the necessary documentation efficiently.

To stop a garnishment in Arizona, you generally need to file a motion with the court that issued the garnishment. This may involve demonstrating your financial difficulties or proving that the garnishment was improperly applied. For comprehensive and clear guidance, consider using Arizona All Non-Earnings Garnishment Forms in one file to ensure you're following the legal procedures correctly.

Yes, you can face multiple garnishments simultaneously in Arizona, depending on your financial obligations. However, this could significantly reduce your disposable income. Keeping organized and having access to Arizona All Non-Earnings Garnishment Forms in one file can help you manage these situations better and protect your rights.

Proposition 209 in Arizona deals with limitations on the garnishment of wages and provides protections for consumers. Specifically, it aims to make garnishment fairer and more transparent. Understanding this proposition can empower you as a debtor, and having access to Arizona All Non-Earnings Garnishment Forms in one file can further simplify your situation.

Yes, a creditor can garnish your bank account in Arizona. This type of garnishment is conducted through a writ, but it requires specific legal procedures. To protect yourself and prepare the right documents, utilizing Arizona All Non-Earnings Garnishment Forms in one file can be a practical solution.

A writ of garnishment for non-earnings in Arizona is a legal order that allows creditors to collect payments from your non-wage income, such as bank accounts or rental income. This process is initiated through the court, and it is crucial to follow the legal guidelines. To manage this effectively, you can access Arizona All Non-Earnings Garnishment Forms in one file, ensuring you have the necessary documentation.