Arizona Instructions are a set of documents produced by the Arizona Supreme Court that provide guidance to attorneys, judges, and court staff on how to apply Arizona statutes, court rules, and local court rules in legal proceedings. There are three main types of Arizona Instructions: Civil Jury Instructions (CGI), Criminal Jury Instructions (CICR), and Civil Bench Instructions (CBI). The CGI provide standard instructions for civil jury trials, while the CICR provide standard instructions for criminal jury trials. The CBI provide guidance on how to apply the law in civil non-jury proceedings. The instructions contain information on the elements of a particular offense or action, the applicable statutes, the applicable jury instructions or bench instructions, and the applicable court rules. The instructions also contain explanations and additional information to help attorneys, judges, and court staff understand the law and apply it in legal proceedings.

Arizona Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

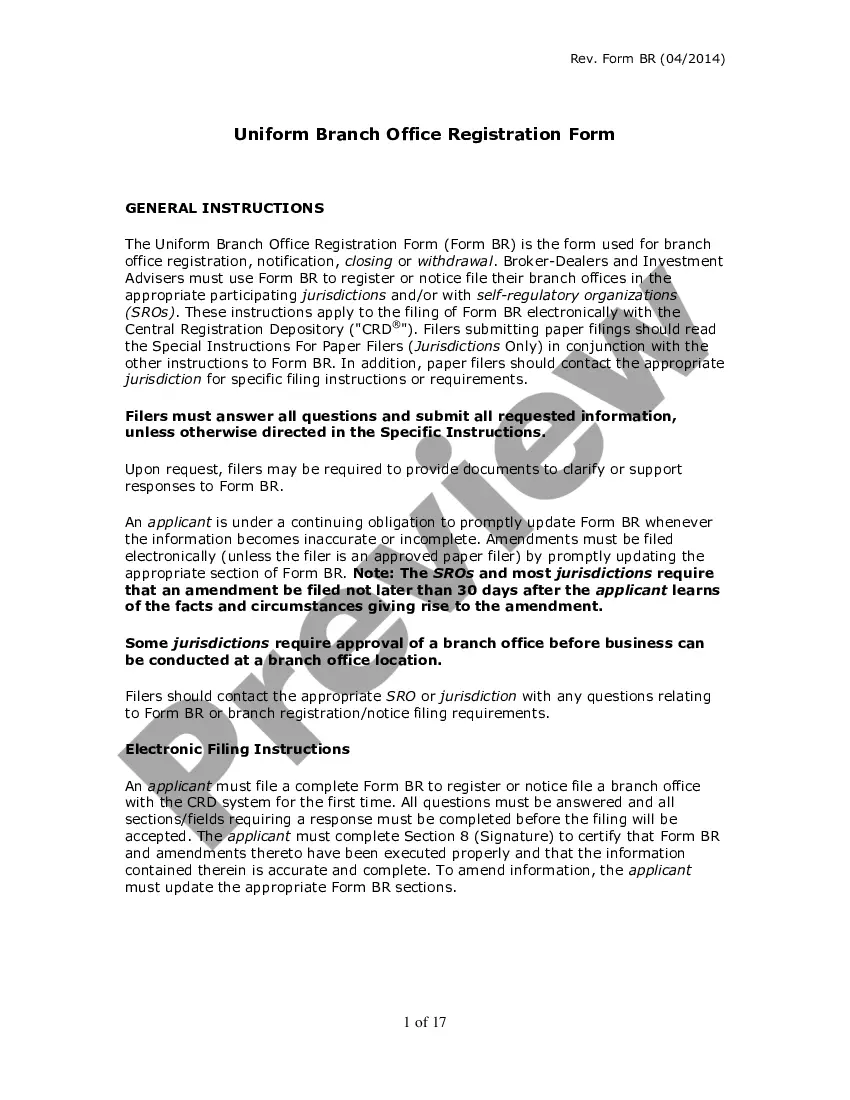

How to fill out Arizona Instructions?

Completing official documentation can be quite a challenge unless you have access to pre-designed fillable forms. With the US Legal Forms online repository of formal documents, you can trust the blanks you encounter, as they all align with federal and state regulations and have been verified by our experts.

Acquiring your Arizona Instructions from our platform is as simple as one, two, three. Previously permitted users with a valid subscription only need to Log In and click the Download button once they find the correct template. Subsequently, if desired, users can select the same form from the My documents section of their profile.

Haven’t you explored US Legal Forms yet? Sign up for our service today to obtain any official document swiftly and easily whenever you need to, and maintain your paperwork in order!

- Document compliance verification. You should carefully evaluate the content of the form you wish to use and confirm whether it meets your requirements and adheres to your state regulations. Reviewing your document and examining its general description will assist you in this process.

- Alternative search (optional). If there are any discrepancies, navigate the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now once you identify the one you need.

- Account registration and form acquisition. Create an account with US Legal Forms. After verifying your account, Log In and select the subscription plan that best fits your needs. Make a payment to continue (PayPal and credit card options are available).

- Template retrieval and additional usage. Choose the file format for your Arizona Instructions and click Download to save it onto your device. Print it to fill out your paperwork by hand, or utilize a feature-rich online editor to prepare an electronic version swiftly and more effectively.

Form popularity

FAQ

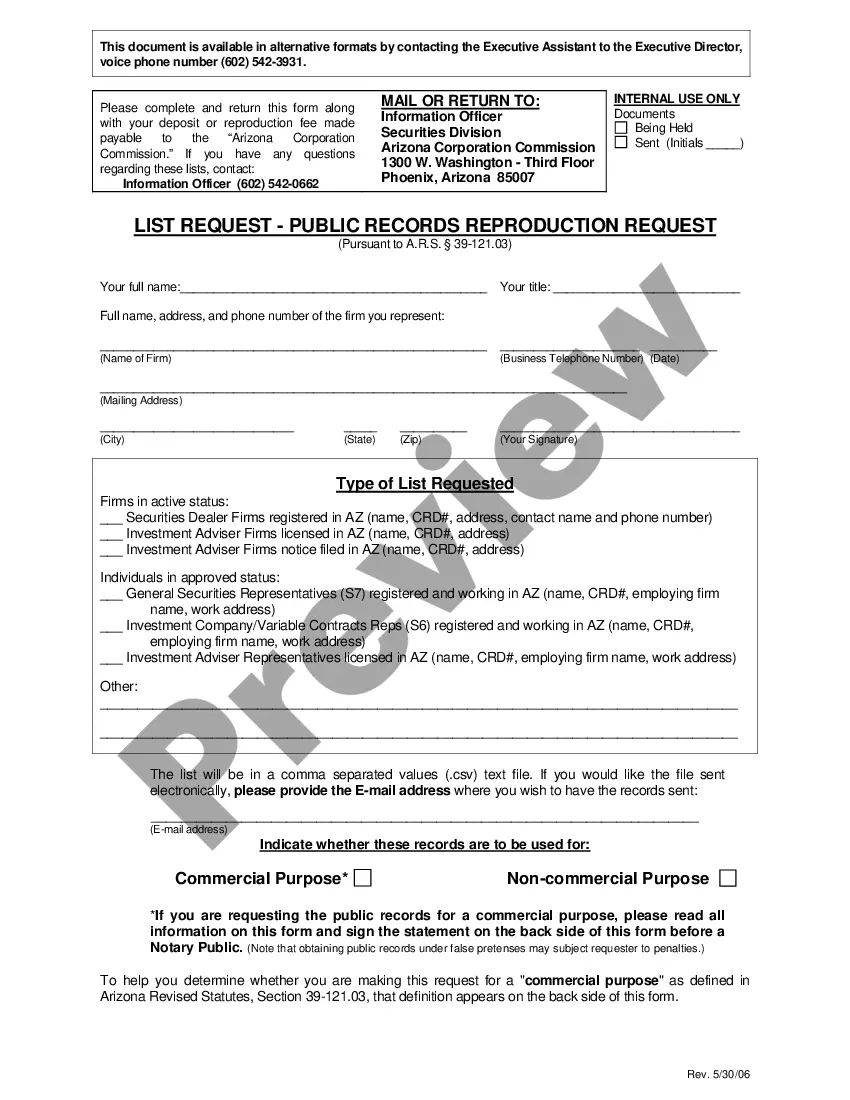

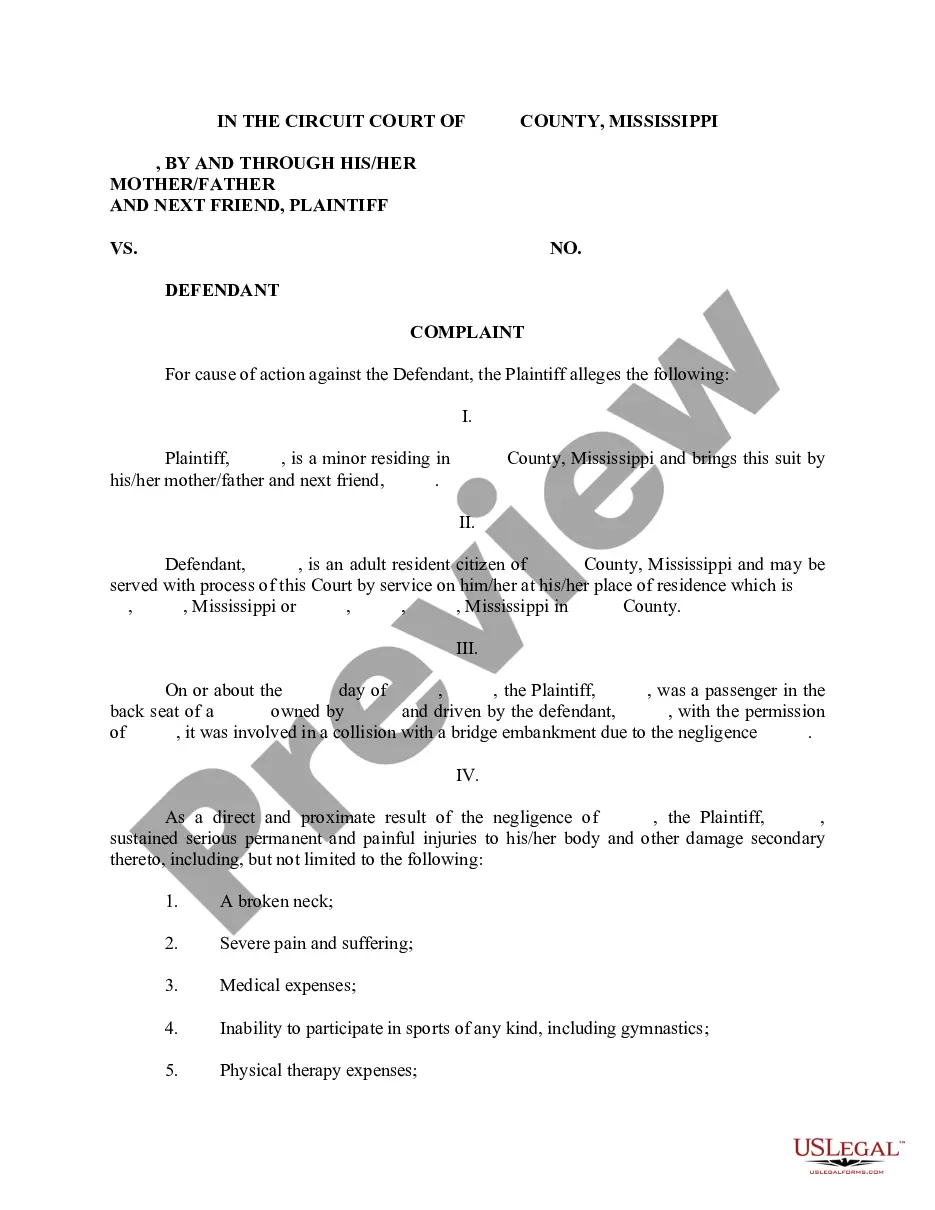

Nonresidents must file Arizona state taxes if they earn income sourced from Arizona. This includes wages, rental income, and business income. Properly filing is crucial to comply with state tax laws. For clear instructions and assistance on nonresident filing, Arizona Instructions serve as a valuable tool.

The 183 day rule in Arizona helps determine residency status for tax purposes. If you spend more than 183 days in Arizona during the tax year, you are likely considered a resident. This can affect your tax obligations and filing requirements. It's beneficial to refer to Arizona Instructions for clarity on how this rule may impact your tax situation.

In Arizona, you typically must file a tax return if you earn above the standard deduction amount. For single filers, this amount generally falls around $12,550. Staying informed about current exemptions and tax rates is crucial. For a deeper understanding, consult Arizona Instructions to determine your specific situation and requirements.

Anyone earning income in Arizona must file a tax return if their income surpasses specific thresholds. This includes residents, nonresidents, and part-year residents who had income from Arizona sources. Understanding your filing obligations through Arizona Instructions can ensure compliance and may highlight potential tax benefits. Don't overlook the importance of this step to avoid penalties.

All corporations doing business in Arizona must file a corporate income tax return. This requirement applies regardless of whether the corporation is organized in Arizona or another state. It's essential to keep up to date with annual filing deadlines. For detailed guidance, Arizona Instructions can provide insights and assist with the filing process effectively.

When filing in Arizona, you need to submit your taxes by April 15 each year, unless it falls on a weekend or holiday. Residents must file a state return if they earn a specific amount of income, according to Arizona Instructions. It's essential to keep track of any tax credits or deductions that may reduce your tax burden. A reliable resource for navigating Arizona's filing requirements is uslegalforms.

To obtain an Arizona Emergency Substitute Teaching Certificate, you must complete an application through the Arizona Department of Education’s website. You'll need to provide proof of your higher education degree and pass a background check. Following your application, expect to receive specific Arizona Instructions on completing further requirements.

After you apply for a new driver’s license in Arizona, you typically receive your temporary license immediately. The physical card will be mailed to you within 15 days, though processing may vary. To ensure a smooth experience, follow all instructions and provide complete documentation during your application.

Currently, Arizona does not offer an option to take the driving skills test online. You must schedule an appointment to take the test in person at an Arizona Department of Transportation location. However, you can complete other parts of the licensing process online, making it easier to prepare for your visit.

To acquire a driver's license in Arizona, you must be at least 16 years old and provide proof of identity, residency, and lawful presence in the United States. Additionally, passing both a written knowledge test and a driving skills test is necessary. Be sure to gather all required documents before visiting the Arizona Department of Transportation.