Arkansas Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

US Legal Forms - one of many greatest libraries of legal forms in America - provides a variety of legal document web templates you are able to acquire or produce. Utilizing the site, you can get a large number of forms for business and person reasons, categorized by groups, suggests, or search phrases.You will find the most recent models of forms like the Arkansas Gift Deed of Nonparticipating Royalty Interest with No Warranty in seconds.

If you have a membership, log in and acquire Arkansas Gift Deed of Nonparticipating Royalty Interest with No Warranty in the US Legal Forms library. The Obtain button can look on each and every develop you view. You gain access to all previously acquired forms inside the My Forms tab of your respective account.

If you would like use US Legal Forms the very first time, allow me to share basic directions to help you get began:

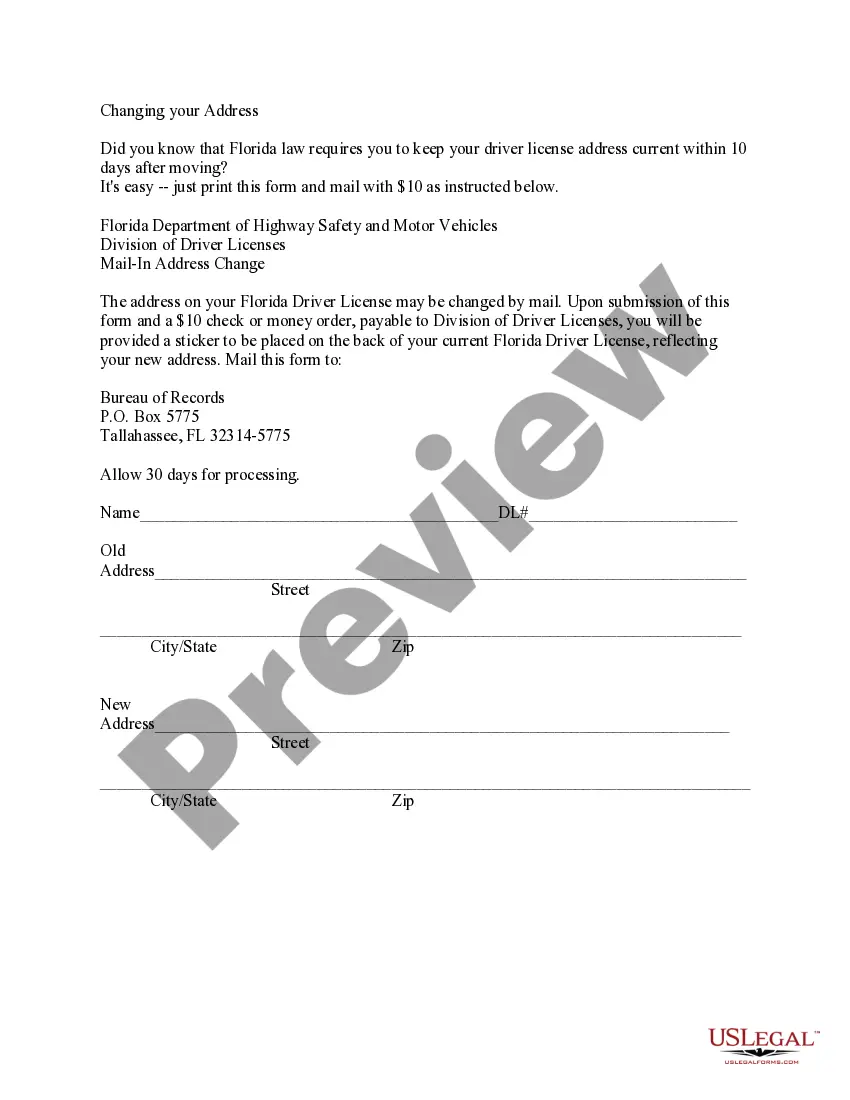

- Be sure to have chosen the proper develop for the metropolis/area. Click the Preview button to review the form`s information. See the develop description to actually have selected the right develop.

- In the event the develop does not match your specifications, utilize the Research area on top of the screen to get the one that does.

- If you are pleased with the form, verify your option by visiting the Purchase now button. Then, select the costs program you prefer and supply your references to register for the account.

- Process the deal. Use your Visa or Mastercard or PayPal account to perform the deal.

- Pick the file format and acquire the form in your gadget.

- Make modifications. Fill out, modify and produce and indicator the acquired Arkansas Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Every format you included in your bank account lacks an expiry time which is the one you have forever. So, if you would like acquire or produce one more copy, just proceed to the My Forms area and click around the develop you need.

Obtain access to the Arkansas Gift Deed of Nonparticipating Royalty Interest with No Warranty with US Legal Forms, the most substantial library of legal document web templates. Use a large number of expert and condition-particular web templates that meet your company or person needs and specifications.

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

The rule followed is generally known as the Strohacker Doctrine, named for the case of Missouri Pacific Railroad Co. v. Strohacker,s in which the Arkansas Supreme Court affirmed a chan- cery court decision that reservations of "coal and mineral deposits" in 1892 and 1893 deeds did not reserve the oil and gas.

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

A mineral interest is an economic interest in subsurface minerals. This interest gives the owner the right to mine the minerals situated beneath the surface of a property. For the purposes of this definition, minerals are assumed to include hydrocarbons.