Arkansas Tutoring Agreement - Self-Employed Independent Contractor

Description

Form popularity

FAQ

In most cases, you do not need a specific license for private tutoring in Arkansas. However, it is essential to check local regulations, as some school districts may have guidelines to follow. Implementing an Arkansas Tutoring Agreement - Self-Employed Independent Contractor can help outline your qualifications and the nature of your services, ensuring you stay compliant while protecting your tutoring business.

Yes, private tutoring is categorized as self-employed work. As a private tutor, you directly offer your services to clients without being under an employer's control. Consequently, formalizing your arrangements with an Arkansas Tutoring Agreement - Self-Employed Independent Contractor is beneficial for establishing the terms of engagement and protecting your interests.

Yes, tutoring is often considered self-employed. When you provide tutoring services independently, you manage your own schedule, clients, and practices. This independent status allows you the flexibility to operate your business in a way that suits your needs. An Arkansas Tutoring Agreement - Self-Employed Independent Contractor could provide clarity around your responsibilities and benefits.

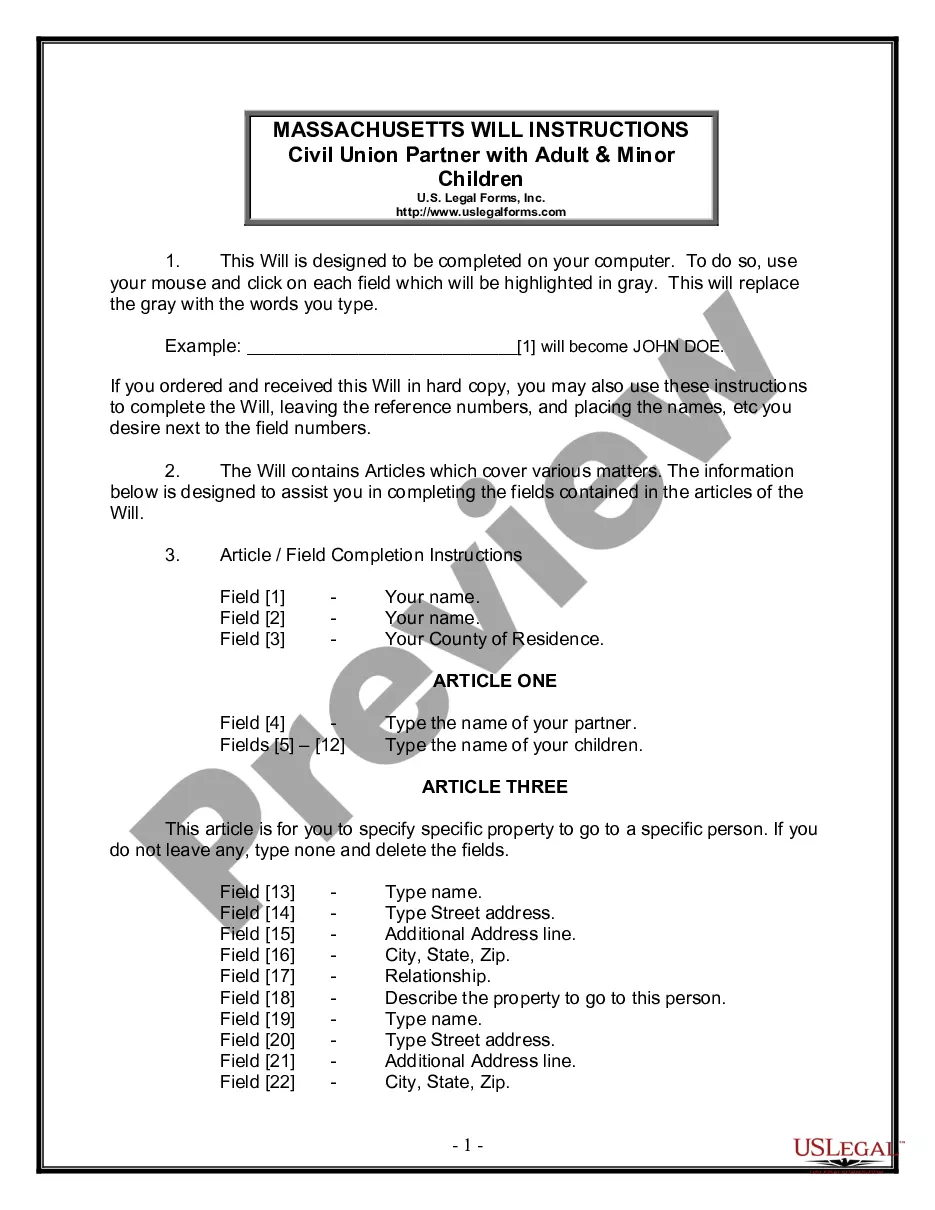

To make a tutoring contract, outline the specific tutoring services, schedule, payment details, and any other important conditions. Be sure to include terms that protect both you and the tutor, like cancellation policies and modification of terms. Consider using a standardized format offered by platforms such as USLegalForms that focuses on the Arkansas Tutoring Agreement - Self-Employed Independent Contractor, which provides you with a clear structure for your contract and makes the process efficient.

Creating an independent contractor agreement involves clearly defining the scope of work, payment terms, and responsibilities of both parties. Start by specifying the services to be provided and include terms regarding confidentiality, termination, and any necessary legal disclaimers. Using a platform like USLegalForms can simplify this process by providing customizable templates like the Arkansas Tutoring Agreement - Self-Employed Independent Contractor, ensuring all critical details are included.

Yes, a tutor can be classified as an independent contractor, particularly if they work on a freelance basis. This means they have the freedom to set their schedules, determine their rates, and choose their clients. When drafting an Arkansas Tutoring Agreement - Self-Employed Independent Contractor, make sure it clearly outlines these independent terms to keep both parties informed and protected. This classification also simplifies tax responsibilities for both parties.

Tutors are generally not considered employees but are often categorized as independent contractors, receiving a 1099 form for tax purposes. This classification helps both tutors and clients, allowing tutors to manage their own business affairs and tax responsibilities. If you have an Arkansas Tutoring Agreement - Self-Employed Independent Contractor, it’s essential to understand these implications for financial reporting. Therefore, ensure all agreements reflect this relationship.

An independent contractor is someone who provides services to clients under a contract instead of as an employee. They maintain control over how they perform their work, offer their expertise, and manage their own business taxes. For those creating an Arkansas Tutoring Agreement - Self-Employed Independent Contractor, it is vital to clarify that you are not under the direct supervision of an employer. This distinction allows tutors to enjoy greater flexibility in their work.

Yes, having a contract as an independent contractor is essential for establishing clear terms and protecting both parties involved. The Arkansas Tutoring Agreement - Self-Employed Independent Contractor outlines responsibilities, payment details, and work scope, which helps prevent misunderstandings. Without this documentation, you may encounter disputes that could have been easily avoided. Utilizing U.S. Legal Forms can provide you with a customizable Arkansas Tutoring Agreement that meets your specific needs.

Filling out an independent contractor form involves providing personal and business information, including tax details. Clearly state the work to be performed and any necessary timelines. Review the terms carefully to ensure compliance with applicable laws. The Arkansas Tutoring Agreement - Self-Employed Independent Contractor from uslegalforms makes this task easier, ensuring you cover all essential aspects.